Coverdell ESA vs. 529 Plan: The Ultimate Guide to Choosing Your College Savings Strategy

Saving for college is a noble and important goal for many families. However, navigating the world of education savings accounts can feel like learning a new language. Among the most popular options, the Coverdell Education Savings Account (ESA) and the 529 Plan stand out as powerful tools for tax-advantaged growth. But which one is right for you? Can you use both?

This comprehensive guide will break down the key differences and similarities between Coverdell ESAs and 529 Plans in plain language, helping you make an informed decision for your family’s future.

Understanding the Basics: What Are They?

Before diving into the comparisons, let’s establish a foundational understanding of each account type. Both are designed to help you save for education expenses with significant tax benefits, but they operate under different rules and structures.

What is a 529 Plan?

A 529 Plan is a tax-advantaged savings plan designed to encourage saving for future education costs. They are sponsored by states, state agencies, or educational institutions.

- Key Features:

- Tax-Free Growth: Your investments grow free from federal income tax.

- Tax-Free Withdrawals: Qualified withdrawals for eligible education expenses are also federal income tax-free. Many states also offer state income tax benefits.

- Account Owner Control: The account owner (usually a parent or grandparent) maintains control of the funds, even after the beneficiary turns 18.

- Broad Eligibility: Generally, there are no income limitations for contributing to a 529 Plan.

What is a Coverdell ESA?

A Coverdell Education Savings Account (ESA), sometimes simply called an "educational IRA," is a trust or custodial account set up specifically to pay for qualified education expenses for a designated beneficiary. It’s named after Senator Paul Coverdell, who championed its creation.

- Key Features:

- Tax-Free Growth: Like a 529, investments grow free from federal income tax.

- Tax-Free Withdrawals: Qualified withdrawals for eligible education expenses are also federal income tax-free.

- Custodian Control: A designated custodian (often a financial institution) manages the account.

- Broader Education Expenses: One of its standout features is that it covers a wider range of K-12 expenses in addition to higher education.

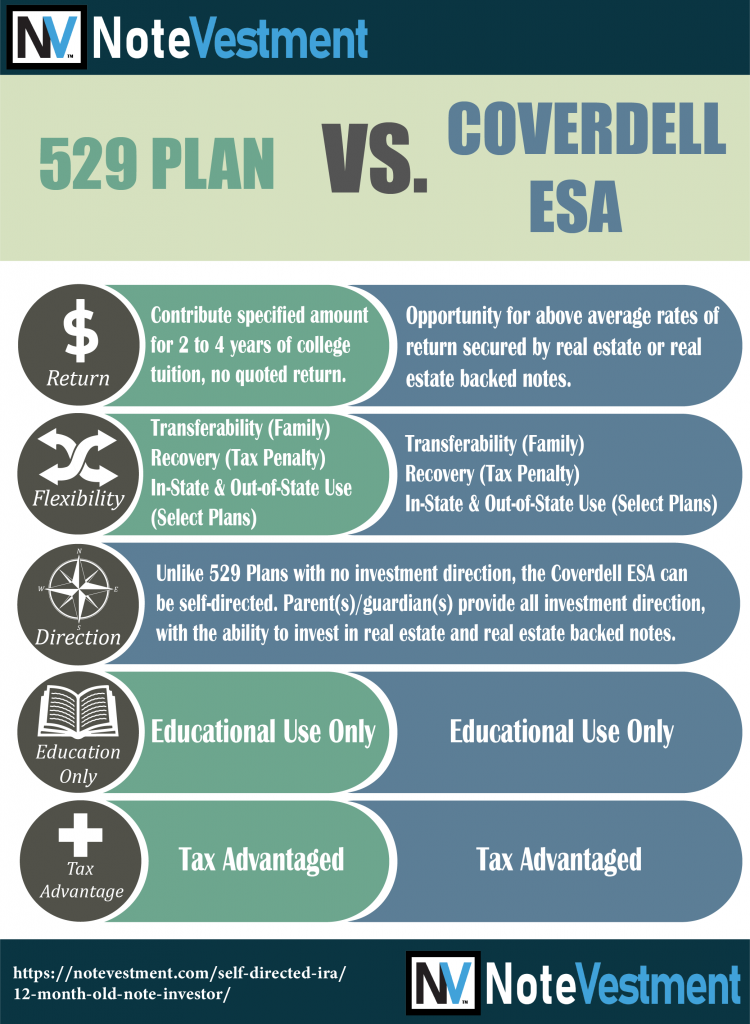

Coverdell ESA vs. 529 Plan: A Head-to-Head Comparison

While both plans offer excellent tax advantages, their rules and flexibility differ significantly. Let’s compare them across key categories:

1. Contribution Limits

This is one of the most significant differences between the two plans.

- 529 Plan:

- High Contribution Limits: There are no federal annual contribution limits for 529 plans. Instead, states set their own limits, which are often very high (e.g., $300,000 to over $500,000) to ensure the account balance doesn’t exceed the anticipated cost of higher education.

- Gift Tax Exclusion: Contributions are considered gifts and qualify for the annual gift tax exclusion (e.g., $18,000 per donor per beneficiary in 2024). You can even "superfund" a 529 by contributing up to five years’ worth of gifts at once ($90,000 in 2024) without incurring gift tax.

- Coverdell ESA:

- Low Annual Contribution Limit: You can contribute a maximum of $2,000 per year, per beneficiary. This limit is across all Coverdell ESAs for that specific beneficiary, not per account. For example, if a child has two Coverdell ESAs, the combined contributions to both cannot exceed $2,000 in a single year.

2. Income Restrictions for Contributors

This is a crucial differentiator for the Coverdell ESA.

- 529 Plan:

- No Income Restrictions: Anyone, regardless of their income, can contribute to a 529 Plan. This makes it accessible to a wide range of families.

- Coverdell ESA:

- Income Limitations: Eligibility to contribute to a Coverdell ESA is phased out for higher-income taxpayers.

- For single filers, the ability to contribute phases out for modified adjusted gross income (MAGI) between $95,000 and $110,000.

- For those married filing jointly, the phase-out occurs for MAGI between $190,000 and $220,000.

- If your income is above these limits, you cannot contribute to a Coverdell ESA for that year.

- Income Limitations: Eligibility to contribute to a Coverdell ESA is phased out for higher-income taxpayers.

3. Qualified Education Expenses

What you can use the funds for without penalty and taxes is another key difference.

- 529 Plan:

- Higher Education Focused: Primarily designed for qualified higher education expenses. This includes:

- Tuition and fees

- Books, supplies, and equipment required for enrollment

- Room and board (if the student is enrolled at least half-time)

- Computers, internet access, and related services

- Special needs services for special needs students

- Apprenticeship program expenses (registered and certified with the Department of Labor)

- Student loan repayment (up to $10,000 lifetime per beneficiary and $10,000 for each of the beneficiary’s siblings)

- K-12 tuition (up to $10,000 per year per beneficiary) – Important note: This is a federal rule, but some states may not allow it for state tax benefits.

- Higher Education Focused: Primarily designed for qualified higher education expenses. This includes:

- Coverdell ESA:

- Broader K-12 and Higher Education Coverage: Offers a much broader definition of "qualified education expenses," making it highly versatile, especially for K-12. This includes:

- K-12 Expenses: Tuition, fees, books, supplies, equipment, academic tutoring, special needs services, room and board, uniforms, transportation, and supplementary items and services (like extended day programs).

- Higher Education Expenses: Same as 529 plans (tuition, fees, books, supplies, equipment, room and board, etc.).

- Broader K-12 and Higher Education Coverage: Offers a much broader definition of "qualified education expenses," making it highly versatile, especially for K-12. This includes:

4. Investment Control and Options

How much say you have over the investments within the account varies.

- 529 Plan:

- Limited Investment Options: Account owners typically choose from a pre-selected menu of investment options offered by the plan, such as age-based portfolios, static portfolios, or individual mutual funds. You can usually change investment options only twice per calendar year.

- Professional Management: The underlying investments are professionally managed, which can be a pro for those who prefer a hands-off approach.

- Coverdell ESA:

- Broader Investment Control: Because they function more like an IRA, Coverdell ESAs often offer a wider range of investment choices, including individual stocks, bonds, mutual funds, and exchange-traded funds (ETFs).

- Self-Directed Potential: You have more control over specific investment decisions, which can be appealing to experienced investors.

5. Impact on Financial Aid

Both types of accounts are generally treated similarly in financial aid calculations.

- 529 Plan:

- Parental Asset: Funds held in a 529 plan owned by a parent (or dependent student) are generally considered a parental asset on the Free Application for Federal Student Aid (FAFSA). Parental assets are assessed at a maximum of 5.64% of their value.

- Grandparent-Owned 529s: Historically, withdrawals from grandparent-owned 529s counted as untaxed student income, which could significantly reduce aid eligibility. However, with the implementation of the FAFSA Simplification Act, this is changing for the 2024-2025 FAFSA cycle and beyond. Grandparent-owned 529s will no longer be reported as assets on the FAFSA, nor will distributions be counted as student income.

- Coverdell ESA:

- Parental Asset: Funds in a Coverdell ESA are also typically considered a parental asset for FAFSA purposes, similar to a parent-owned 529.

6. Changing Beneficiaries

Life happens, and sometimes the original beneficiary doesn’t pursue higher education.

- 529 Plan:

- Flexible Beneficiary Changes: You can change the beneficiary to another eligible family member without tax penalty. An "eligible family member" is broadly defined and includes siblings, parents, grandparents, aunts, uncles, first cousins, nieces, nephews, and even the spouse of the original beneficiary.

- Coverdell ESA:

- Flexible Beneficiary Changes: You can also change the beneficiary to another eligible family member without tax penalty, similar to a 529 plan. The definition of "eligible family member" is generally the same.

7. Rollovers

What happens if you want to switch plans or have leftover funds?

- 529 Plan:

- 529 to 529: You can roll over funds from one 529 plan to another 529 plan for the same beneficiary (once every 12 months) or to a new eligible family member beneficiary without tax penalty.

- 529 to Roth IRA: Starting in 2024, unused 529 funds can be rolled over to a Roth IRA for the beneficiary, subject to certain limits and conditions (e.g., the 529 must have been open for 15+ years, contributions/earnings must have been in the account for 5+ years, annual Roth IRA contribution limits apply, and a lifetime maximum of $35,000 can be rolled over).

- Coverdell ESA:

- Coverdell to Coverdell: Funds can be rolled over from one Coverdell ESA to another for the same beneficiary or a new eligible family member beneficiary.

- Coverdell to 529: You can roll over Coverdell ESA funds into a 529 plan for the same beneficiary or a new eligible family member beneficiary without tax penalty. This can be a useful strategy if you hit the Coverdell contribution limits but want to continue saving in a tax-advantaged way.

8. Account Control and Age Limitations

- 529 Plan:

- Account Owner Control: The account owner (e.g., parent) retains control of the account throughout its life. The beneficiary does not gain control of the funds upon reaching adulthood.

- No Age Limit for Use: Funds can be used at any age. There’s no requirement for the beneficiary to use the funds by a certain age.

- Coverdell ESA:

- Beneficiary Control at Majority: The beneficiary typically gains control of the account upon reaching the age of majority (usually 18 or 21, depending on state law). This means they can decide how the funds are used (though they must still be for qualified education expenses to be tax-free).

- Age Limit for Use: Funds must be used by the time the beneficiary turns 30 years old. If not, the earnings become taxable and subject to a 10% penalty. This can be avoided by rolling over the funds to another eligible family member’s Coverdell ESA or 529 plan.

Pros and Cons: A Quick Overview

To help you quickly grasp the strengths and weaknesses of each, here’s a summary:

529 Plan Pros:

- High Contribution Limits: Save a substantial amount for college.

- No Income Restrictions: Accessible to all income levels.

- Account Owner Control: You maintain control over the funds.

- State Tax Benefits: Many states offer tax deductions or credits for contributions.

- Flexibility with Beneficiary: Easy to change beneficiaries.

- New Roth IRA Rollover Option: Added flexibility for unused funds.

529 Plan Cons:

- Limited Investment Control: Less choice in specific investments.

- Primarily Higher Education: While K-12 tuition is allowed federally, state benefits might not apply, and it doesn’t cover other K-12 expenses like books or supplies.

- Potential for Fees: Can have varying administrative and investment fees depending on the plan.

Coverdell ESA Pros:

- Broad K-12 Expense Coverage: Excellent for private school, tutoring, uniforms, etc.

- More Investment Control: Often offers a wider range of investment options.

- Can be Rolled to a 529: Provides a potential pathway to a 529 for larger savings.

Coverdell ESA Cons:

- Low Annual Contribution Limit: Maximum of $2,000 per year per child.

- Income Restrictions: Not available to high-income earners.

- Age 30 Rule: Funds must be used by age 30 or face penalties.

- Beneficiary Control at Majority: Loss of control for the account owner once the child reaches adulthood.

Who Should Choose Which?

The "best" plan depends entirely on your specific financial situation, income, and educational goals for your child.

When a 529 Plan is Best:

- You want to save a significant amount for college. If your goal is to cover a large portion of future college costs, the 529’s high contribution limits are essential.

- You are a high-income earner. If your income exceeds the Coverdell ESA phase-out limits, the 529 is your primary tax-advantaged option.

- You prefer a hands-off investment approach. The pre-selected investment options are ideal if you don’t want to actively manage specific stocks or funds.

- You want to maintain control over the funds. The account owner retains control indefinitely.

- You are primarily focused on higher education expenses.

When a Coverdell ESA is Best:

- You anticipate significant K-12 private school, tutoring, or special needs expenses. The broad definition of qualified expenses for K-12 is the Coverdell’s superpower.

- You prefer more control over your investments. If you’re an experienced investor who wants to pick individual stocks or specific funds, a Coverdell might appeal to you.

- Your income is within the eligible limits.

- You’re comfortable with a lower annual contribution limit. This might be a good fit if you’re just starting to save or have modest savings goals.

Can You Use Both a Coverdell ESA and a 529 Plan?

Yes, absolutely! For many families, using both a Coverdell ESA and a 529 Plan can be a powerful strategy, especially if you have K-12 education costs and also plan for higher education.

- You can contribute to both for the same beneficiary in the same year, provided you meet the respective income and contribution limits.

- The key is that you cannot use tax-free distributions from both accounts for the same qualified education expenses. For example, you can’t pay for the same college tuition bill with tax-free money from both a 529 and a Coverdell in the same year.

- However, you can use a Coverdell for K-12 expenses (like private school tuition, uniforms, or tutoring) and a 529 for future college tuition and room and board. This allows you to maximize the benefits of each account.

Important Considerations for Your College Savings Journey

Regardless of which plan you choose, or if you choose both, keep these tips in mind:

- Start Early: Time is your greatest asset when it comes to investing. The longer your money has to grow, the more powerful compounding becomes.

- Research State Benefits: Many states offer additional tax benefits for 529 plan contributions (e.g., tax deductions, credits). Research your state’s specific 529 plan and its benefits, as these can significantly enhance your savings.

- Understand Qualified Expenses: Be clear on what constitutes a "qualified education expense" for your chosen plan to avoid taxes and penalties on withdrawals. Keep meticulous records of all education-related expenses.

- Review Regularly: Life circumstances change, as do education costs and financial aid rules. Review your savings strategy annually to ensure it still aligns with your goals.

- Seek Professional Advice: For complex financial situations or personalized guidance, consider consulting a qualified financial advisor. They can help you create a comprehensive education savings plan tailored to your family’s needs.

Conclusion

Both Coverdell ESAs and 529 Plans are excellent vehicles for saving for education, each with its unique strengths. The 529 Plan offers higher contribution limits and broad accessibility, making it ideal for substantial college savings. The Coverdell ESA, with its lower contribution limit and income restrictions, shines for its versatility in covering a wider array of K-12 education expenses and offering more investment control.

By understanding their differences and how they complement each other, you can strategically choose the best path—or even a combination of paths—to fund your child’s educational journey from kindergarten through college and beyond. The most important step is to start saving today!

Disclaimer: This article provides general information and is not intended as financial, tax, or legal advice. Tax laws and regulations can change. Consult with a qualified financial advisor, tax professional, or legal expert for advice tailored to your specific situation.

Post Comment