529 Plans Explained: Your Ultimate Guide to College Savings Pros and Cons

The dream of a higher education for your children, grandchildren, or even yourself often comes with a hefty price tag. College costs have been steadily rising, making financial planning for the future more critical than ever. This is where 529 plans step in – a popular, tax-advantaged way to save for education expenses.

But what exactly is a 529 plan, and is it the right choice for your family? This comprehensive guide will break down everything you need to know about 529 plans, exploring their benefits and drawbacks in simple, easy-to-understand language.

What Exactly is a 529 Plan?

At its core, a 529 plan is an education savings plan sponsored by states, state agencies, or educational institutions. It’s designed to help families set aside money for future college costs or other qualified education expenses, while enjoying significant tax benefits.

Think of it like a special investment account, but specifically for education. While your contributions are made with after-tax money (meaning you’ve already paid income tax on it), the real magic happens next:

- Tax-Free Growth: The money you invest in a 529 plan grows tax-free. This means you won’t pay taxes year after year on the investment earnings.

- Tax-Free Withdrawals: When it’s time to pay for college, qualified withdrawals (used for eligible education expenses) are also tax-free. This is a huge advantage, as it means all your investment gains can go directly towards education costs, not to the taxman.

There are two main types of 529 plans:

- Education Savings Plans (Investment-Based): These are the most common type. You contribute money, and it’s invested in a portfolio of mutual funds or other investments, similar to a 401(k) or IRA. The value of your account will fluctuate based on the performance of these investments.

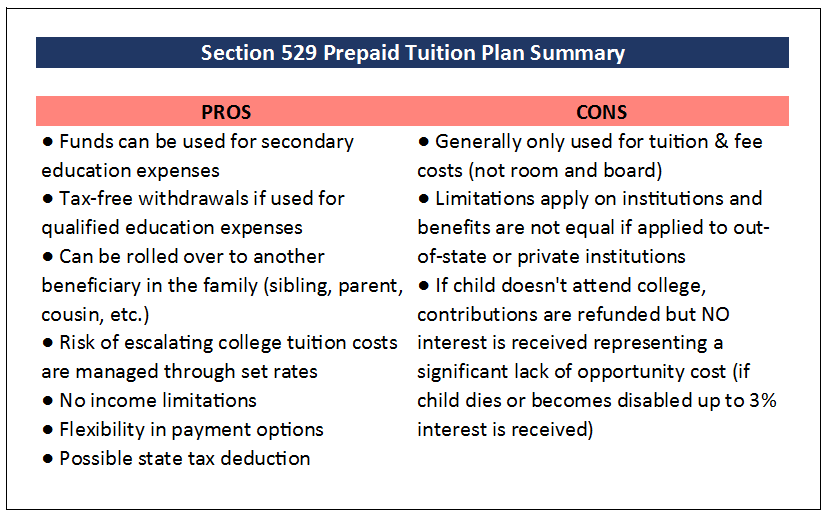

- Prepaid Tuition Plans: These plans allow you to purchase future tuition credits at today’s prices, locking in tuition rates for specific in-state public colleges. They typically don’t cover room and board or other expenses, and their flexibility can be more limited. For the purpose of this article, we’ll primarily focus on the more popular education savings plans.

How Does a 529 Plan Work? (The Simple Steps)

Understanding the mechanics of a 529 plan is straightforward:

- Open an Account: You, as the "account owner" (usually a parent or grandparent), open a 529 account with a state’s plan. You don’t have to live in the state whose plan you choose, though your home state might offer extra tax benefits for using its plan (more on this later).

- Name a Beneficiary: You designate a "beneficiary" – the student who will eventually use the funds (e.g., your child, grandchild, niece, nephew, or even yourself!).

- Contribute Funds: You contribute money to the account. There are often high contribution limits (hundreds of thousands of dollars, varying by state) and no income restrictions. You can contribute a lump sum or make regular contributions.

- Invest the Money: Your contributions are invested within the plan’s available options. These typically include age-based portfolios (which automatically adjust risk as the beneficiary gets older) or static portfolios.

- Money Grows Tax-Free: As your investments perform, the earnings accumulate without being taxed. This compounding growth is a powerful benefit over many years.

- Withdraw for Qualified Expenses: When your beneficiary enrolls in an eligible educational institution, you can withdraw funds tax-free to cover qualified expenses.

- Flexibility: If your initial beneficiary doesn’t go to college, or if there’s money left over, you can change the beneficiary to another qualified family member without penalty.

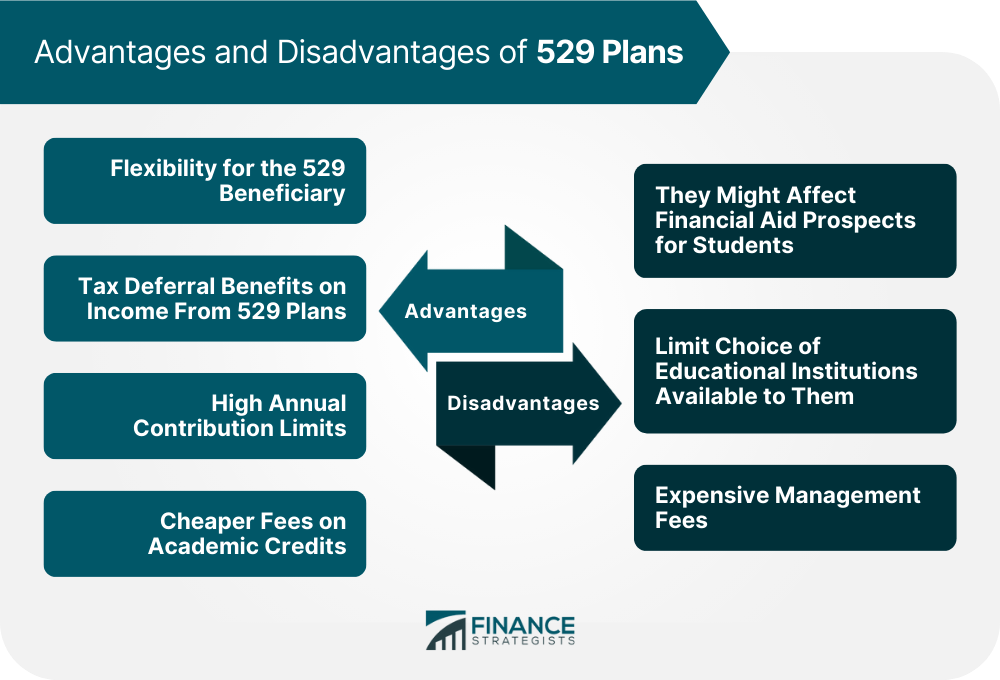

The Big Advantages: Pros of a 529 Plan

529 plans offer a compelling list of benefits, making them a cornerstone of many families’ education savings strategies.

- 1. Powerful Tax-Free Growth and Withdrawals:

- This is the biggest perk! Your money grows free from federal income tax, and as long as withdrawals are used for qualified education expenses, they are also federal income tax-free. This means more of your money goes directly towards education.

- 2. Potential State Income Tax Benefits:

- Many states offer an income tax deduction or credit for contributions made to their specific 529 plan. For example, if you contribute $5,000 to your home state’s 529 plan, you might be able to deduct that $5,000 from your state taxable income, saving you money each year. Some states even offer deductions for contributions to any state’s 529 plan.

- 3. Account Owner Retains Control:

- Unlike custodial accounts (like UTMAs or UGMAs), where the money becomes the child’s property at a certain age, you, as the account owner, maintain control over the funds in a 529 plan. You decide when and how the money is spent, and you can even change the beneficiary.

- 4. High Contribution Limits:

- 529 plans generally have very high lifetime contribution limits, often exceeding $300,000 or even $500,000 per beneficiary, depending on the state. This allows for significant savings, especially for families with multiple children or ambitious savings goals.

- 5. Minimal Impact on Financial Aid (FAFSA):

- Assets held in a 529 plan are considered an asset of the account owner (usually the parent), not the student. For FAFSA (Free Application for Federal Student Aid) purposes, parent assets are assessed at a maximum of 5.64% of their value. This is a much lower percentage than student assets, which are assessed at 20%. This means a 529 plan will have a relatively small impact on your child’s eligibility for need-based financial aid.

- 6. Broad Definition of "Qualified Expenses":

- The definition of qualified expenses is quite broad (we’ll detail this below), covering more than just tuition. This flexibility ensures you can use the funds for many essential college-related costs.

- 7. Flexibility with Beneficiary Changes:

- If your original beneficiary decides not to pursue higher education, or if there’s money left over, you can change the beneficiary to another eligible family member without tax penalty. This includes siblings, first cousins, parents, or even yourself!

- 8. New Uses Beyond Traditional College:

- Recent legislation has expanded the uses for 529 funds:

- K-12 Tuition: Up to $10,000 per year per beneficiary can be used for tuition expenses at elementary or secondary public, private, or religious schools.

- Apprenticeship Programs: Funds can be used for fees, books, supplies, and equipment required for an apprenticeship program registered with the Department of Labor.

- Student Loan Repayment: Up to $10,000 in total (lifetime limit per beneficiary and their siblings) can be used to pay off qualified student loans.

- Recent legislation has expanded the uses for 529 funds:

- 9. Wide Range of Investment Options:

- Most plans offer a variety of investment options, from conservative money market funds to more aggressive stock portfolios. Many also offer age-based portfolios that automatically become more conservative as the beneficiary approaches college age.

- 10. No Age or Income Restrictions:

- Anyone can open a 529 plan, regardless of their income level or age. There are no age limits for the beneficiary either, making them suitable for adult learners or lifelong learning.

The Downsides: Cons of a 529 Plan

While 529 plans offer many advantages, they aren’t without their drawbacks. It’s important to understand these potential limitations.

- 1. Penalties for Non-Qualified Withdrawals:

- This is the biggest downside. If you withdraw money for expenses that are not considered qualified education expenses, the earnings portion of that withdrawal will be subject to federal income tax (at your ordinary income tax rate) plus a 10% federal penalty tax. This penalty can be a significant deterrent if plans change drastically.

- 2. Limited Investment Control:

- Unlike a standard brokerage account where you have complete control over individual stock or fund choices, 529 plans offer a more limited menu of investment options. You typically choose from a selection of pre-set portfolios managed by the plan provider. You’re usually only allowed to change your investment options twice per calendar year.

- 3. State-Specific Benefits Can Be Confusing:

- While many states offer tax benefits for using their plan, this can be confusing. If your state offers a deduction only for its own plan, but another state’s plan has lower fees or better investment options, you might have to weigh the trade-off. Researching plans across different states is necessary.

- 4. Not Always Best for Students Seeking Maximum Financial Aid:

- While 529 plans have a minimal impact on FAFSA compared to student-owned assets, they do still count as an asset. For families in extreme financial need, alternative savings vehicles that are entirely excluded from financial aid calculations might be preferable (though these are rare and have their own limitations).

- 5. Investment Losses Are Not Tax-Deductible:

- If your 529 investments lose money, you cannot deduct those losses on your tax return, unlike losses in a taxable brokerage account.

- 6. Fees and Expenses:

- Like any investment vehicle, 529 plans come with various fees, including administrative fees, underlying mutual fund expense ratios, and potentially advisor fees if you open an advisor-sold plan. These fees can eat into your returns over time, so it’s crucial to compare fee structures across different plans.

- 7. Not for Every Education Goal:

- While expanded, the definition of qualified expenses might not cover every single education-related cost (e.g., transportation to/from campus for daily commuters, non-required extracurricular activities).

Qualified vs. Non-Qualified Expenses: What Counts?

Understanding what qualifies as an "eligible education expense" is crucial to avoid penalties.

What Counts as a ‘Qualified Expense’ (Tax-Free Withdrawals):

- Tuition and Fees: For eligible educational institutions (colleges, universities, vocational schools, and other post-secondary institutions eligible to participate in federal student aid programs).

- Books, Supplies, and Equipment: Required for enrollment or attendance.

- Room and Board: For students enrolled at least half-time. This includes on-campus housing and off-campus housing costs (up to the allowance for room and board determined by the school for federal financial aid purposes).

- Computers, Software, and Internet Access: If used primarily by the beneficiary during enrollment.

- Special Needs Services: Required for a special needs beneficiary to enroll or attend.

- K-12 Tuition: Up to $10,000 per beneficiary per year (federal tax-free).

- Apprenticeship Program Expenses: Fees, books, supplies, and equipment.

- Student Loan Repayment: Up to $10,000 lifetime per beneficiary (and their siblings).

What Doesn’t Count (and the Cost of Getting it Wrong):

If you withdraw money from a 529 plan for non-qualified expenses, the earnings portion of that withdrawal will be subject to:

- Federal Income Tax at your ordinary income tax rate.

- A 10% Federal Penalty Tax.

- Potentially State Income Tax if you received a state tax deduction for the contribution.

Examples of Non-Qualified Expenses:

- Transportation costs (gas, plane tickets to/from home).

- Health insurance premiums.

- Club sports fees or non-credit courses.

- Personal expenses (e.g., toiletries, clothing, entertainment).

- Dorm room decorations or furniture beyond basic necessities.

- Expenses for a gap year or non-enrollment periods.

Who Should Consider a 529 Plan?

A 529 plan is an excellent tool for a wide range of individuals and families:

- Parents of Young Children: The earlier you start, the more time your investments have to grow tax-free.

- Grandparents: Many grandparents open 529 plans for their grandchildren, offering a generous gift that also has tax advantages (e.g., it can be a way to reduce their taxable estate).

- Individuals Planning for Their Own Education: Whether you’re returning to school, pursuing a graduate degree, or looking to learn a new trade, you can be both the account owner and the beneficiary.

- Families Looking for Tax-Advantaged Savings: If you’ve maxed out other retirement accounts and are looking for another tax-efficient way to save, a 529 can be a great option.

- Those Who Value Control: If you want to maintain control over the funds until they are used for education, unlike custodial accounts.

Are There Alternatives to 529 Plans? (Briefly)

While 529 plans are highly recommended for education savings, other options exist, each with its own pros and cons:

- Coverdell Education Savings Accounts (ESAs): Similar tax benefits to 529s, but lower contribution limits ($2,000/year) and income restrictions. More flexible investment options.

- Custodial Accounts (UTMA/UGMA): No contribution limits, but money becomes the child’s property at age of majority, giving them full control. Earnings are taxed at the child’s (potentially lower) tax rate, but can impact financial aid more significantly.

- Roth IRA: Primarily a retirement account, but contributions (not earnings) can be withdrawn tax-free and penalty-free for qualified education expenses. Earnings can also be withdrawn tax-free and penalty-free if the account is open for 5+ years and the owner is 59.5 or older.

- Taxable Investment Accounts: No specific education benefits, but complete control and flexibility. All gains are subject to capital gains tax.

- U.S. Savings Bonds: Modest returns, but interest can be tax-free if used for qualified education expenses and certain income requirements are met.

Tips for Choosing and Managing a 529 Plan

If you decide a 529 plan is right for you, here are some tips:

- Research Different States’ Plans: You’re not limited to your own state’s plan. Some plans are considered "direct-sold" (you open directly with the plan administrator) and others are "advisor-sold" (you open through a financial advisor). Compare fees, investment options, and historical performance.

- Consider Your Home State’s Tax Benefits: If your state offers a significant income tax deduction for contributions to its plan, that might outweigh slightly higher fees or less diverse investment options compared to another state’s plan.

- Start Early, Contribute Regularly: The power of compound interest is immense. Even small, consistent contributions over many years can add up to a substantial sum.

- Automate Contributions: Set up automatic transfers from your bank account to your 529 plan. "Set it and forget it" is a powerful strategy.

- Review Your Investments Periodically: At least once a year, check your account’s performance and ensure your investment allocation still aligns with your risk tolerance and the beneficiary’s age.

- Understand the Fees: Be aware of administrative fees, underlying fund expenses, and any other charges that might eat into your returns.

Conclusion

529 plans are a powerful, tax-advantaged tool designed to help families tackle the rising costs of education. Their tax-free growth and withdrawals, combined with potential state tax benefits and flexibility, make them a top choice for college savings.

While the penalties for non-qualified withdrawals and limited investment control are important considerations, for most families committed to saving for higher education, the pros far outweigh the cons. By starting early, contributing consistently, and understanding the rules, a 529 plan can be a cornerstone of securing a brighter educational future.

As with any significant financial decision, it’s always a good idea to consult with a qualified financial advisor to determine if a 529 plan aligns with your specific financial goals and situation.

Post Comment