How to Set Up a College Savings Plan: Your Easy-to-Understand Guide to Funding Future Education

The cost of a college education can seem daunting. With tuition fees, room and board, books, and living expenses constantly on the rise, many parents and students wonder how they’ll ever afford it. But here’s the good news: with a little planning and the right strategy, setting up a college savings plan is entirely achievable.

This comprehensive guide will walk you through everything you need to know about setting up a college savings plan, breaking down complex financial jargon into simple, actionable steps. Whether your child is a toddler or already in high school, it’s never too early or too late to start thinking about their educational future.

Why Saving for College is a Smart Move

Before we dive into the "how-to," let’s quickly touch on the "why." Understanding the benefits of a dedicated college savings plan can provide the motivation you need to get started:

- Reduce Student Loan Debt: The most significant benefit. Less debt means your child can start their post-college life with more financial freedom, whether it’s buying a home, starting a business, or saving for retirement.

- More College Choices: With a solid savings foundation, your child won’t be limited by the sticker price of a school. They’ll have the flexibility to choose the best fit for their academic and personal goals.

- Potential Tax Benefits: Many college savings plans offer significant tax advantages, allowing your money to grow faster.

- Peace of Mind: Knowing you’re actively working towards funding your child’s education can alleviate a lot of financial stress for the whole family.

- Teaches Financial Responsibility: Involving your child in the savings process, even in a small way, can teach them valuable lessons about money, budgeting, and long-term goals.

How Much Do You Really Need to Save?

This is often the first question people ask, and it’s a crucial one. There’s no single magic number, as costs vary widely based on the type of school (in-state public, out-of-state public, private), degree program, and location.

Here’s how to approach estimating your goal:

- Research Current Costs: Look up the average costs for different types of colleges today. Websites like College Board (BigFuture), College Navigator (from NCES), and individual university websites are great resources.

- Factor in Inflation: College costs typically rise faster than general inflation. A good rule of thumb is to assume an annual increase of 3-5%. If college costs $20,000 today and your child is 10 years away from enrollment, it could be closer to $30,000 per year by then.

- Consider Financial Aid: Keep in mind that the "sticker price" isn’t always what families pay. Many students receive some form of financial aid (grants, scholarships, loans). However, relying solely on aid is risky, as it’s not guaranteed, and loans still need to be repaid. Your savings can supplement aid, reducing loan dependency.

- Use a College Savings Calculator: Many financial institutions and educational websites offer free calculators that can help you estimate your goal and how much you need to save periodically to reach it. Just search for "college savings calculator" online.

- Determine Your Contribution Level: Decide how much of the total cost you realistically aim to cover. Is it 100%? 50%? Even saving a portion can make a huge difference.

Example: If you estimate college will cost $25,000 per year (adjusted for inflation) for four years, your target savings could be $100,000. Don’t let a large number discourage you; remember, every dollar saved is a dollar your child won’t have to borrow.

Understanding Your College Savings Options

Now for the core of setting up your plan: choosing the right savings vehicle. Each option has its own rules, benefits, and drawbacks. We’ll focus on the most popular and beneficial choices for college savings.

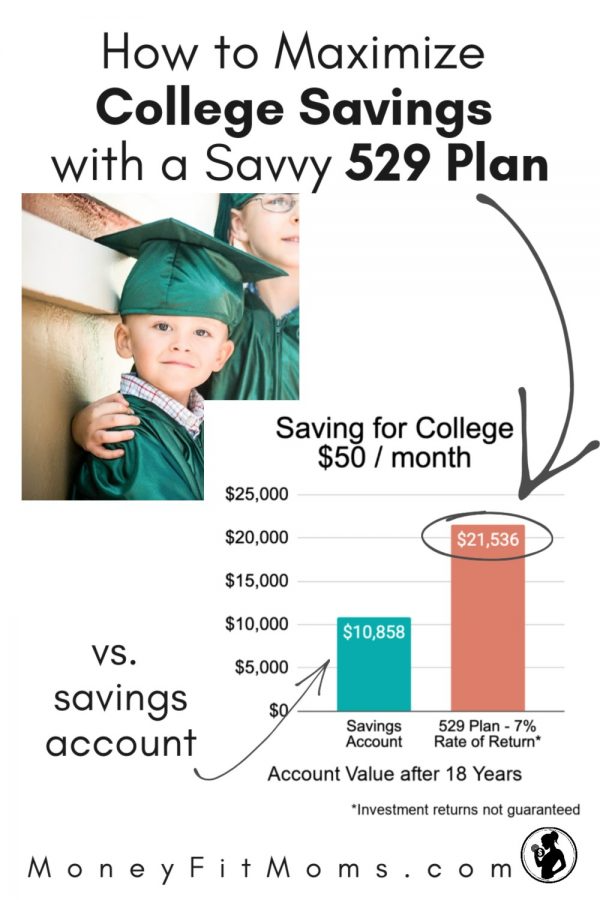

1. 529 Plans (The Most Popular Choice)

529 plans are tax-advantaged savings plans designed specifically to encourage saving for future education costs. They are sponsored by states, state agencies, or educational institutions.

How They Work:

You contribute money to an investment account (similar to a 401(k) or IRA). The money grows tax-deferred, and qualified withdrawals for education expenses are completely tax-free.

Two Main Types of 529 Plans:

-

a) 529 College Savings Plans:

- What it is: This is an investment account where your contributions are invested in mutual funds, exchange-traded funds (ETFs), or other professionally managed portfolios. Your returns depend on the market performance of your chosen investments.

- Pros:

- Tax-Free Growth & Withdrawals: Your investments grow tax-free, and qualified withdrawals (for tuition, fees, books, supplies, equipment, room and board for students enrolled at least half-time, and even K-12 tuition up to $10,000 per year) are also tax-free.

- High Contribution Limits: Most plans have very high lifetime contribution limits, often over $300,000 per beneficiary.

- Flexibility: You can use the funds at almost any accredited college or university in the U.S. and even some abroad.

- No Income Restrictions: Anyone can contribute, regardless of income level.

- Beneficiary Changes: If the original beneficiary doesn’t go to college, you can change the beneficiary to another qualified family member (another child, grandchild, niece/nephew, or even yourself) without penalty.

- Account Owner Control: You maintain control over the account, not the beneficiary.

- Gift Tax Exclusion: Contributions up to the annual gift tax exclusion limit ($18,000 in 2024) are generally excluded from gift tax. You can even "superfund" with five years’ worth of contributions at once ($90,000 in 2024) without gift tax implications.

- Minimal Financial Aid Impact: Generally treated favorably in financial aid calculations (as an asset of the parent, with a low impact on aid eligibility).

- Cons:

- Non-Qualified Withdrawals: If you withdraw money for non-educational expenses, the earnings portion is subject to income tax and a 10% penalty.

- Investment Risk: Like any investment, there’s a risk your investments could lose value.

- Limited Investment Options: You’re typically limited to the investment options offered by the plan, which may be fewer than a standard brokerage account.

- Fees: Plans may have administrative fees, investment management fees, and sometimes sales charges.

-

b) 529 Prepaid Tuition Plans:

- What it is: These plans allow you to purchase future tuition credits at today’s prices, locking in tuition costs. They typically only cover tuition and mandatory fees at in-state public colleges. Some private college plans exist.

- Pros:

- Guaranteed Tuition: The biggest advantage is that you lock in tuition prices, protecting against inflation.

- Risk-Free: Your principal is usually guaranteed by the state.

- Cons:

- Limited Scope: Usually only covers tuition and fees, not room, board, or books.

- Limited Schools: Primarily for in-state public universities. If your child attends a private or out-of-state school, the value of the plan might be limited to the average in-state tuition.

- Less Flexibility: If your child doesn’t attend college, or attends a school not covered by the plan, you might receive a refund with minimal or no earnings.

- No K-12 Expenses: Cannot be used for K-12 tuition.

Choosing a 529 Plan:

You don’t have to choose your state’s 529 plan, but many states offer additional tax deductions or credits for residents who contribute to their in-state plan. Research various plans at websites like SavingforCollege.com or the College Savings Plans Network to compare fees, investment options, and state tax benefits.

2. Coverdell Education Savings Accounts (ESAs)

What it is: A tax-advantaged investment account that allows contributions up to $2,000 per year per beneficiary. Like 529 plans, earnings grow tax-free, and qualified withdrawals are tax-free.

Pros:

- Broader Expense Coverage: Can be used for qualified higher education expenses and qualified elementary and secondary education expenses (K-12 tuition, books, tutoring, computers).

- More Investment Choices: Often offers a wider range of investment options than 529 plans.

- Tax-Free Growth & Withdrawals: Similar to 529s for qualified expenses.

Cons:

- Low Contribution Limit: Max of $2,000 per year per child, which is often not enough to cover significant college costs.

- Income Restrictions: Contributions are phased out for higher-income individuals.

- Age Limit: Funds must be used by the time the beneficiary turns 30, or they are subject to taxes and penalties.

3. Custodial Accounts (UGMA/UTMA)

What it is: Uniform Gifts to Minors Act (UGMA) and Uniform Transfers to Minors Act (UTMA) accounts are brokerage accounts opened by an adult (the custodian) for the benefit of a minor.

Pros:

- Flexible Spending: Funds can be used for anything that benefits the minor, not just education.

- Simple to Set Up: Easy to open at most brokerage firms.

- No Contribution Limits or Income Restrictions: You can contribute as much as you want, regardless of income.

Cons:

- Irrevocable Gift: Once money is put into a UGMA/UTMA, it belongs to the child. They gain full control of the assets at the "age of majority" (usually 18 or 21, depending on the state).

- Tax Disadvantages: Earnings are taxed at the child’s tax rate (which can be subject to "kiddie tax" rules for higher amounts), but eventually, they are taxed annually. Not tax-free like 529s or Coverdells.

- Significant Financial Aid Impact: Funds in a UGMA/UTMA account are considered the child’s assets, which significantly reduces their eligibility for need-based financial aid. This is a major drawback.

4. Roth IRA (Retirement Account with a Twist)

What it is: Primarily a retirement savings account, but Roth IRAs offer a unique flexibility: you can withdraw contributions (not earnings) tax-free and penalty-free at any time for any reason. After 5 years, you can also withdraw earnings tax-free and penalty-free for qualified higher education expenses.

Pros:

- Dual Purpose: You save for retirement first, but have the option to use the funds for college if needed.

- Tax-Free Withdrawals in Retirement: All qualified withdrawals in retirement are tax-free.

- No Impact on Financial Aid (Usually): Retirement accounts generally aren’t counted as assets in financial aid calculations.

- Flexibility: If your child gets a scholarship or decides not to go to college, your retirement savings remain intact.

Cons:

- Lower Contribution Limits: Annual limits are much lower than 529 plans (e.g., $6,500 in 2023, $7,000 in 2024 for those under 50).

- Income Restrictions: Eligibility to contribute to a Roth IRA phases out for higher-income individuals.

- Prioritizing Retirement: While flexible, it’s generally advised to prioritize your own retirement savings before using a Roth IRA purely for college. You can borrow for college, but not for retirement.

5. Savings Bonds (Low Risk)

What it is: U.S. Series EE and I bonds are very low-risk investments backed by the U.S. government.

Pros:

- Tax Exclusion: If used for qualified higher education expenses, the interest earned on Series EE and I bonds can be tax-free (subject to income limitations).

- Extremely Safe: No investment risk.

Cons:

- Low Returns: Generally offer lower returns compared to market-based investments.

- Income Limitations: The tax exclusion for education is subject to adjusted gross income (AGI) limits.

- Limited Growth: Not designed for aggressive growth.

6. Traditional Savings/Investment Accounts

What it is: A regular bank savings account, certificate of deposit (CD), or a taxable brokerage account.

Pros:

- Ultimate Flexibility: No restrictions on how the money is used.

- Easy Access: Funds are readily available.

Cons:

- No Tax Benefits: Earnings are fully taxable each year.

- Low Returns: Savings accounts and CDs offer very low interest rates, often not keeping pace with college inflation.

- Financial Aid Impact: Counted as parental assets, impacting financial aid eligibility.

Step-by-Step: How to Set Up Your College Savings Plan

Once you’ve considered the options, follow these steps to get your plan in motion:

Step 1: Research and Compare Options

- Start with 529 Plans: For most families, a 529 college savings plan is the best starting point due to its tax advantages and flexibility.

- Compare State Plans: Look beyond your home state. While your state might offer a tax deduction for contributions to its 529 plan, another state’s plan might have lower fees, better investment options, or a stronger performance history. Websites like SavingforCollege.com are excellent for comparing plans side-by-side.

- Consider Other Options: If you have specific needs (e.g., lower income, desire for K-12 savings, or prioritizing retirement), explore Coverdell ESAs or Roth IRAs as supplementary or alternative options.

Step 2: Choose a Plan and an Investment Strategy

- Select Your 529 Plan (if applicable): Once you’ve identified a 529 plan that meets your needs (considering fees, investment options, and potential state tax benefits), you’re ready to proceed.

- Select Your Investment Strategy:

- Age-Based Portfolios: These are popular for their simplicity. The investments automatically become more conservative (less risky) as your child gets closer to college age. This is often the default and a good choice for most families.

- Individual Portfolios: If you’re comfortable with investing, you might choose specific mutual funds or ETFs within the plan’s offerings.

- Target-Risk Portfolios: Choose a portfolio based on your risk tolerance (e.g., aggressive, moderate, conservative).

- Understand the Fees: Pay attention to expense ratios, annual maintenance fees, and any sales charges. Lower fees mean more of your money goes towards saving.

Step 3: Open the Account

- Online Application: Most 529 plans and other investment accounts can be opened online. You’ll typically need to provide:

- Your Social Security Number (SSN) or Taxpayer Identification Number (TIN).

- Your beneficiary’s SSN.

- Your bank account information for initial funding and future contributions.

- Minimum Contribution: Some plans have a minimum initial contribution (e.g., $25 or $50), while others have none.

Step 4: Set Up Automatic Contributions

- Consistency is Key: The most powerful tool in college savings is consistent contributions, even small ones. Set up automatic transfers from your checking or savings account to your college savings plan.

- Budgeting: Determine an amount you can realistically afford each month, bi-weekly, or quarterly. Even $50 or $100 a month adds up significantly over time.

- Increase Over Time: As your income grows, consider increasing your contributions.

Step 5: Involve Family and Friends (Optional)

- Gift Contributions: Many 529 plans allow family and friends to contribute directly to the account. This can be a great idea for birthdays, holidays, or special occasions instead of traditional gifts.

- Gift Tax Rules: Remind contributors of the annual gift tax exclusion limit ($18,000 in 2024 per individual) if they plan large gifts.

Step 6: Review and Adjust Your Plan Regularly

- Annual Review: At least once a year, review your plan’s performance and your overall financial situation.

- Life Changes: Adjust your contributions or investment strategy if there are significant life changes (e.g., birth of another child, job change, inheritance).

- College Cost Updates: Keep an eye on rising college costs and adjust your savings goals accordingly.

- Performance Check: While you shouldn’t constantly tinker, ensure your investments are performing as expected relative to the market and your chosen strategy.

Important Tips for College Savers

- Start Early, Even Small: The power of compound interest is immense. Even small contributions made consistently over a long period can grow into a substantial sum.

- Don’t Forget Your Own Retirement: Financial advisors almost universally recommend prioritizing your retirement savings (e.g., 401(k), IRA) over college savings. You can borrow for college, but you can’t borrow for retirement. A financially secure parent is a greater asset to a child than one who sacrificed their future for college.

- Educate Yourself Continually: Financial planning is an ongoing process. Stay informed about changes in college costs, financial aid rules, and tax laws.

- Involve Your Child: As they get older, talk to your child about the cost of college and your savings efforts. This can foster appreciation and encourage them to contribute through scholarships, part-time jobs, or smart spending choices in college.

- Consider a Financial Advisor: If you find the options overwhelming or have a complex financial situation, a certified financial planner can provide personalized advice and help you create a comprehensive strategy.

Conclusion

Setting up a college savings plan is one of the most impactful financial decisions you can make for your child’s future. While the task might seem large, breaking it down into manageable steps and understanding the various options available makes it far less intimidating.

Remember, every dollar saved is a dollar your child won’t have to borrow. By starting early, staying consistent, and choosing the right plan for your family, you can build a strong foundation for their educational journey and set them up for a lifetime of success, free from the burden of excessive student loan debt.

Don’t wait. Take the first step today towards securing your child’s educational future.

Disclaimer: This article is for informational purposes only and does not constitute financial or tax advice. Please consult with a qualified financial advisor or tax professional to discuss your specific situation and make informed decisions. Tax laws and regulations are subject to change.

Post Comment