Financial Scams Targeting Seniors: A Comprehensive Guide to Safeguarding Against Elder Fraud

The golden years should be a time of peace, enjoyment, and security. Unfortunately, a sinister threat lurks for many seniors: financial scams. These predatory schemes, often sophisticated and emotionally manipulative, cost older adults billions of dollars annually, leading to devastating financial losses, emotional distress, and a profound loss of trust.

Protecting our loved ones from financial scams is not just about safeguarding their money; it’s about preserving their dignity, independence, and peace of mind. This comprehensive guide will illuminate the common types of scams targeting seniors, highlight the warning signs, and provide actionable steps you can take to protect those you care about most.

Why Are Seniors Often Targets for Financial Scams?

Scammers specifically target older adults for several reasons, exploiting vulnerabilities that may develop with age:

- Accumulated Wealth: Many seniors have savings, pensions, and home equity, making them attractive targets for fraudsters seeking significant payouts.

- Trusting Nature: Older generations were often raised in a time when people were generally more trusting, making them less likely to question authority or the intentions of others.

- Loneliness and Isolation: Seniors who live alone or are isolated may be more susceptible to scams that offer companionship or a sense of connection, such as romance scams.

- Less Tech-Savvy: While many seniors are proficient with technology, some may be less familiar with the nuances of online security, phishing attempts, or sophisticated digital scams.

- Cognitive Decline: Early stages of cognitive impairment can make it difficult for seniors to identify red flags, understand complex financial transactions, or recall details of a scam.

- Reluctance to Report: Victims often feel shame or embarrassment, making them hesitant to report the crime to family or authorities, which only emboldens the scammers.

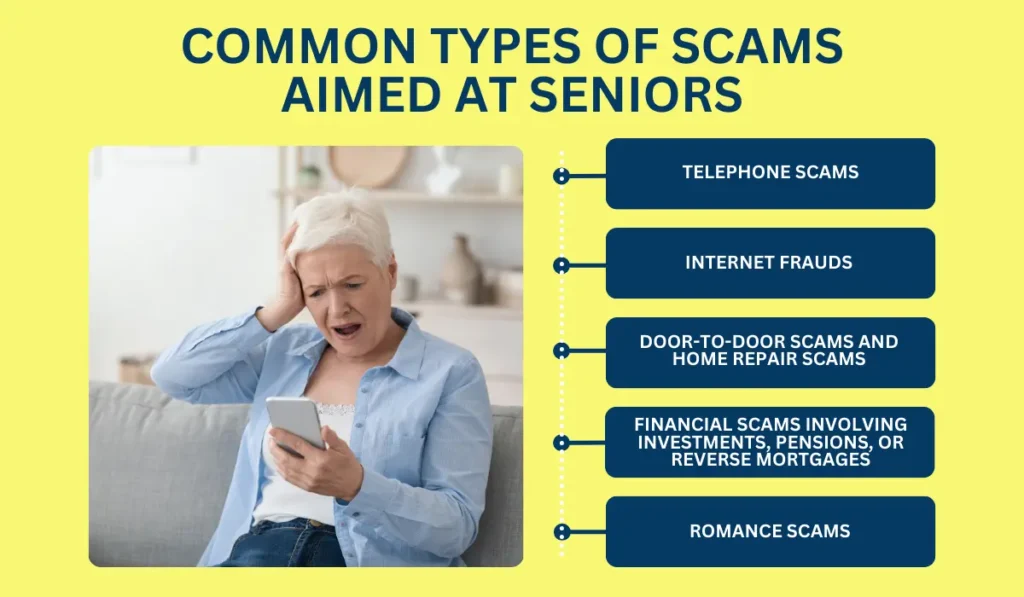

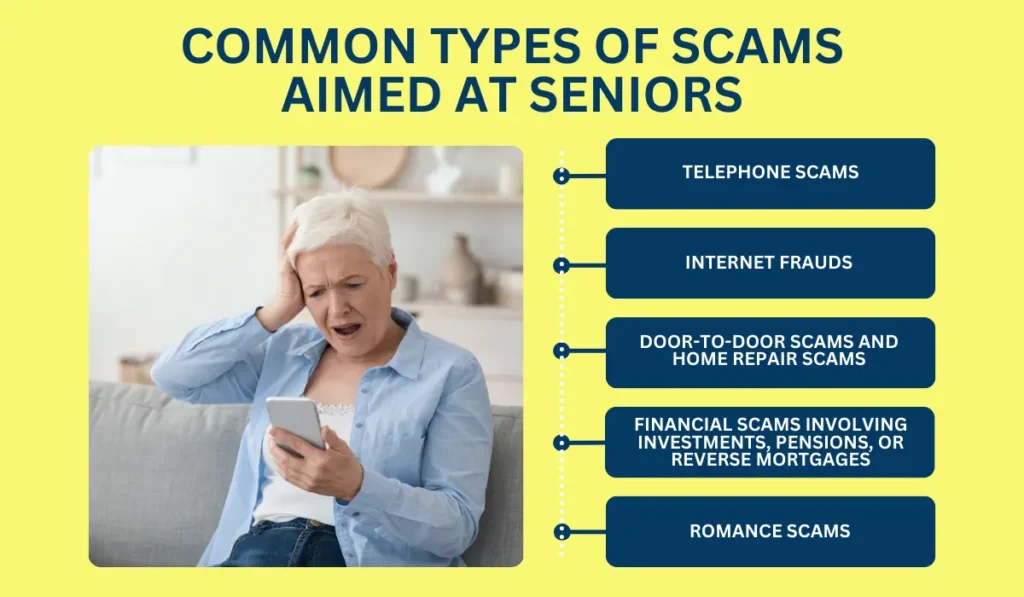

Common Types of Financial Scams Targeting Seniors

Scammers are constantly evolving their tactics, but many schemes fall into predictable categories. Knowing these can help you and your loved ones spot them early:

1. The Grandparent Scam

- How it Works: You receive an urgent call or message from someone pretending to be your grandchild. They claim to be in immediate trouble (e.g., arrested, in an accident, stranded in a foreign country) and desperately need money wired or gift cards purchased for bail, medical expenses, or travel. They often plead with you not to tell their parents.

- Red Flags: Extreme urgency, secrecy ("don’t tell anyone"), requests for unusual payment methods (wire transfers, gift cards, cryptocurrency), and a voice that might sound "different" due to a bad connection.

2. Tech Support Scams

- How it Works: A pop-up message appears on your computer screen (often fake) claiming your device is infected with a virus, or you receive an unsolicited call from someone claiming to be from a well-known tech company (like Microsoft or Apple). They trick you into giving them remote access to your computer, then "fix" a non-existent problem and charge exorbitant fees, often installing malware or stealing personal information.

- Red Flags: Unsolicited calls or pop-ups about computer problems, demands for remote access, pressure to pay immediately, and claims that your computer is severely compromised.

3. Government Imposter Scams (IRS, Social Security, Medicare)

- How it Works: Scammers pose as government officials, threatening arrest, legal action, or loss of benefits if you don’t immediately pay "back taxes," "fines," or "fees" using specific payment methods. They might also claim there’s an issue with your Social Security number or that you’re eligible for a new Medicare card, trying to extract personal information.

- Red Flags: Threats of arrest or legal action, demands for payment via gift cards, wire transfers, or cryptocurrency, requests for personal information over the phone, and calls from government agencies (they typically contact you by mail first).

4. Romance Scams

- How it Works: Scammers create fake online profiles on dating sites or social media, befriending and developing a relationship with lonely individuals. After building trust and an emotional connection, they invent a crisis (e.g., medical emergency, business failure, travel expenses) and ask for money, promising to repay it or to finally meet in person, which never happens.

- Red Flags: Rapid declarations of love, refusal to meet in person or via video call, requests for money for "emergencies," stories that seem too good to be true, and pressure to keep the relationship secret.

5. Lottery, Sweepstakes, or Prize Scams

- How it Works: You receive a call, email, or letter congratulating you on winning a large sum of money or a fantastic prize. To "claim" your winnings, however, you’re told you must first pay taxes, processing fees, or customs duties. The prize, of course, never materializes.

- Red Flags: You’re asked to pay money to receive winnings, the notification is unsolicited, and you don’t remember entering any such contest. Legitimate lotteries don’t ask for money upfront.

6. Investment Scams

- How it Works: Scammers promote "too good to be true" investment opportunities with promises of high, guaranteed returns with little to no risk. These can involve fake precious metals, real estate, cryptocurrencies, or exotic ventures. They often pressure you to act quickly before the "opportunity" disappears.

- Red Flags: Unsolicited investment offers, promises of unusually high returns with "guaranteed" safety, pressure to invest quickly, lack of proper documentation, and difficulty verifying the promoter’s credentials.

7. Home Repair Scams

- How it Works: Unscrupulous contractors go door-to-door, often after a storm, offering unsolicited home repair services (roofing, driveway paving, tree removal). They pressure seniors into immediate work, charge exorbitant fees for shoddy or unnecessary repairs, or demand cash upfront and then disappear.

- Red Flags: Unsolicited offers, pressure for immediate decisions, demands for cash payment, contractors without local references or proper licensing, and vague or non-existent written contracts.

Warning Signs Your Loved One Might Be Targeted or Victim of a Scam

Beyond knowing the types of scams, it’s crucial to recognize the behavioral and financial red flags:

- Sudden Secrecy or Defensiveness about Finances: They become withdrawn or cagey when asked about money matters.

- Unusual or Large Withdrawals/Transfers: Frequent or uncharacteristic transactions from their bank accounts.

- New "Friends" or "Admirers": A new, often younger, person has entered their life and seems to exert undue influence.

- Receipt of Excessive Junk Mail or Spam Calls: A sudden increase in unsolicited offers, particularly for sweepstakes or investments.

- Isolation from Family and Friends: They stop engaging in activities they once enjoyed or pull away from their support network.

- Unexplained Purchases of Gift Cards: Large quantities of gift cards for unfamiliar reasons.

- Requests for Wire Transfers or Cryptocurrency: These payment methods are nearly impossible to trace once sent.

- Emotional Distress: Increased anxiety, fear, shame, or depression related to money.

- Talk of "Secret" Investments or "Special" Deals: Believing they are part of an exclusive opportunity.

- Unpaid Bills or Utilities: A sudden inability to pay for regular expenses despite having funds.

How to Protect Your Loved Ones: Proactive Steps and Open Communication

Protecting seniors from financial scams requires a combination of vigilance, education, and open, empathetic communication.

1. Foster Open Communication

- Start the Conversation Early: Don’t wait until a problem arises. Talk openly and regularly about scams. Share news stories about recent scams.

- Listen Without Judgment: If your loved one mentions a suspicious call or email, or seems to be falling for a scam, approach them with empathy, not accusation. Shame can make them less likely to confide in you.

- Establish a "Safe Word" or "Code Phrase": For grandparent scams, agree on a word only true family members would know to verify identity during an emergency call.

- Encourage Them to Ask Questions: Remind them it’s okay to hang up on suspicious calls or delete questionable emails. Their money and personal information are theirs to protect.

2. Educate and Inform

- Regularly Share Scam Alerts: Forward legitimate warnings from organizations like the FTC or AARP.

- Teach Them the Golden Rules:

- "If it sounds too good to be true, it probably is."

- "Never give personal information (Social Security number, bank account, credit card details) over the phone or email unless you initiated the contact and trust the source."

- "Government agencies will NEVER demand immediate payment via gift cards, wire transfers, or cryptocurrency."

- "Never send money to someone you haven’t met in person."

- "Hang up on unsolicited calls demanding immediate action or payment."

- Help Them Understand Technology: Guide them on how to identify phishing emails, suspicious links, and secure websites (look for "https://" and a padlock symbol). Explain the dangers of pop-ups and unsolicited remote access.

3. Implement Financial Safeguards

- Monitor Financial Accounts (with Permission): If appropriate and with their consent, help them set up online banking and periodically review their statements for unusual activity. Many banks offer "view-only" access for trusted family members.

- Set Up Trusted Contacts at Financial Institutions: Many banks and brokerage firms allow clients to designate a "trusted contact person" who can be reached if there are concerns about the client’s financial exploitation or cognitive decline. This person cannot make transactions but can be contacted if suspicious activity occurs.

- Consider Power of Attorney (POA): Discuss establishing a durable power of attorney for finances with a trusted family member or professional. This allows someone to manage their finances if they become unable to do so themselves. This should be done before any signs of cognitive decline.

- Limit Access to Large Sums: Encourage direct deposit for benefits and consider keeping only a limited amount in checking accounts, with larger sums in savings that are harder to access quickly.

- Shred Sensitive Documents: Emphasize the importance of shredding documents with personal information before discarding them.

4. Practical Tips for Everyday Protection

- Filter Robocalls: Register their phone number on the National Do Not Call Registry (donotcall.gov). While it won’t stop all calls, it can reduce legitimate telemarketing. Consider call-blocking services or devices.

- Be Wary of Unsolicited Visitors: Advise them not to open the door to strangers or let anyone into their home who isn’t expected or properly identified.

- Verify Identity: If someone claims to be from a utility company or service provider, always call the company’s official number (found on a bill, not provided by the caller) to verify their identity.

- Check on Their Social Circle: Be aware of new "friends" or caregivers who seem overly interested in their finances.

- Install Antivirus Software: Ensure their computers and devices have up-to-date antivirus software and firewalls.

- Secure Mail: Encourage them to pick up mail promptly and consider a locked mailbox.

What to Do If a Scam Occurs

Even with the best precautions, a loved one might fall victim to a scam. Acting quickly is crucial to minimize damage and prevent further exploitation.

- Stop All Contact: Tell your loved one to immediately stop all communication with the scammer. Block their numbers and email addresses.

- Contact Financial Institutions:

- Notify their bank or credit card company immediately if money was sent or personal information was shared. They may be able to stop transactions or freeze accounts.

- If debit/credit card numbers were compromised, cancel the cards.

- Gather Evidence: Collect any emails, texts, transaction receipts, or call logs related to the scam.

- Report the Scam:

- Local Police: File a police report. While recovery of funds is often difficult, it creates a record and can aid investigations.

- Federal Trade Commission (FTC): Report the scam at ReportFraud.ftc.gov. The FTC collects reports to identify patterns and pursue legal action against scammers.

- FBI’s Internet Crime Complaint Center (IC3): For online scams, report to IC3.gov.

- Adult Protective Services (APS): If the elder is particularly vulnerable or isolated, contact your local APS.

- Social Security Administration (SSA): If the scam involved Medicare or Social Security, report it to the SSA Office of the Inspector General.

- Place a Fraud Alert or Credit Freeze: Contact the three major credit bureaus (Equifax, Experian, TransUnion) to place a fraud alert or, even better, a credit freeze on their credit files. This makes it harder for identity thieves to open new accounts in their name.

- Seek Emotional Support: Being a victim of a scam can be emotionally devastating. Encourage your loved one to talk about their feelings and consider seeking support from a therapist or support group. Reassure them that it’s not their fault.

Conclusion

Protecting our senior loved ones from financial scams is an ongoing effort that demands vigilance, education, and unwavering support. By understanding the common tactics of fraudsters, recognizing the warning signs, and taking proactive steps to safeguard their finances and personal information, we can significantly reduce their risk.

Remember, the most powerful tool against financial scams is open communication and trust within families. Empower your loved ones with knowledge, assure them they are not alone, and always be ready to step in and help. Their security and peace of mind are worth every effort.

Post Comment