Understanding Two-Factor Authentication (2FA) for Finance Apps: Your Essential Guide to Digital Money Security

In today’s digital age, managing your finances online has become incredibly convenient. From banking and investing to budgeting and peer-to-peer payments, finance apps put powerful tools right at your fingertips. But with great convenience comes great responsibility – particularly when it comes to securing your hard-earned money.

One of the most critical steps you can take to protect your financial accounts from cybercriminals is enabling Two-Factor Authentication (2FA), also sometimes called Multi-Factor Authentication (MFA). If the term sounds technical or intimidating, don’t worry! This comprehensive guide will break down 2FA for finance apps in simple, easy-to-understand language, helping you fortify your digital money defenses.

Why Your Passwords Aren’t Enough Anymore

Think about it: your password is the primary lock on your digital vault. But what if someone steals it? Phishing scams, data breaches, keyloggers, and even simple guessing can compromise your password, giving unauthorized individuals direct access to your sensitive financial information and funds.

This is where 2FA steps in as your digital bodyguard, adding a crucial second layer of security. It’s like having a second, completely different lock on your vault door that even if a thief picks the first lock, they still can’t get in.

What Exactly is Two-Factor Authentication (2FA)?

At its core, Two-Factor Authentication requires two different "factors" to verify your identity before granting access to your account. These factors typically fall into three categories:

- Something You Know: This is your traditional password or PIN.

- Something You Have: This is usually a device in your possession, like your smartphone.

- Something You Are: This refers to your unique biological traits, such as a fingerprint or face scan (biometrics).

When you enable 2FA, even if a hacker manages to steal your password (something you know), they still won’t be able to log in because they don’t have your second factor (something you have or are). This significantly reduces the risk of unauthorized access to your finance apps.

Why is 2FA Crucial for Your Finance Apps?

Enabling 2FA for your banking, investment, and payment apps isn’t just a good idea; it’s an essential security measure in our increasingly digital world. Here’s why:

- Protects Against Password Theft: The most common way accounts are hacked is through stolen passwords. 2FA renders these stolen passwords useless without the second verification step.

- Prevents Unauthorized Transactions: With 2FA, even if someone gains access to your login credentials, they can’t initiate transfers, payments, or other financial activities without the second factor.

- Safeguards Your Money: Your financial well-being is directly tied to the security of your accounts. 2FA is your primary defense against fraudsters emptying your accounts.

- Reduces Identity Theft Risk: Financial accounts often contain personal information that can be used for identity theft. 2FA helps keep that information locked down.

- Peace of Mind: Knowing your money is better protected allows you to use your finance apps with greater confidence and less worry.

- Industry Standard: Most reputable financial institutions and fintech companies now offer and strongly recommend 2FA as a baseline security feature.

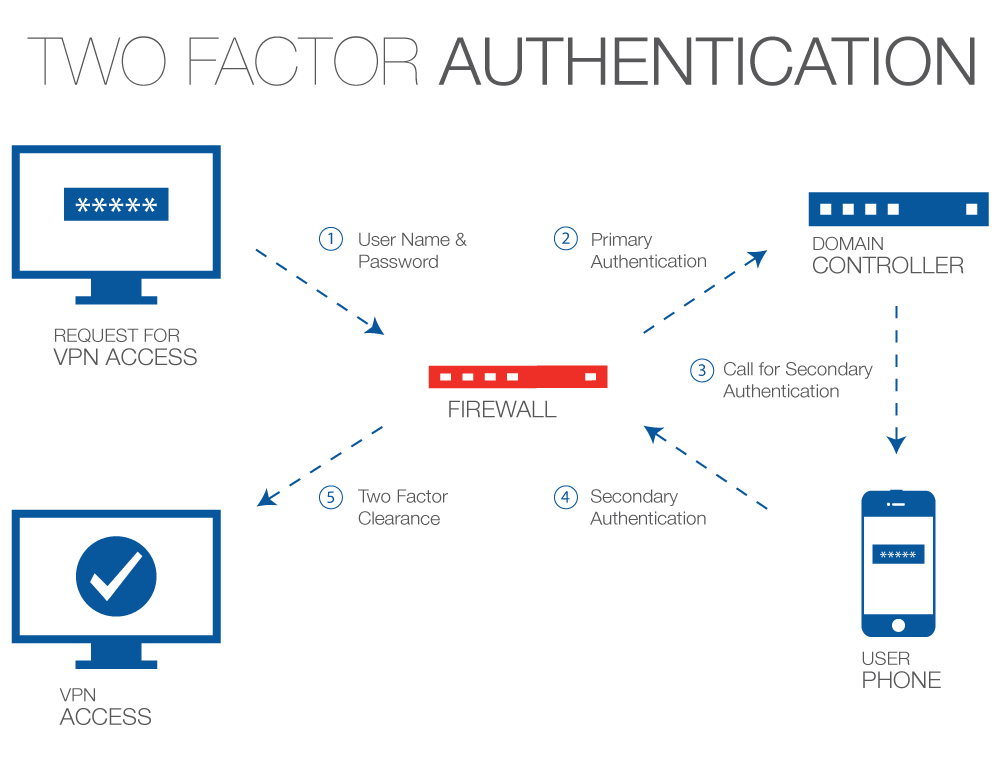

How Does Two-Factor Authentication Work? Understanding the "Two Factors"

Let’s break down the most common methods financial apps use for the second factor:

1. Something You Have: SMS Text Message Codes (OTP)

- How it Works: After entering your password, the finance app sends a unique, one-time passcode (OTP) via SMS to your registered phone number. You then enter this code into the app to complete the login.

- Pros:

- Convenient: Most people have their phones with them.

- Easy to Understand: Simple and widely familiar.

- Cons:

- Vulnerable to SIM Swapping: A sophisticated attack where criminals trick your phone carrier into transferring your number to their SIM card, allowing them to receive your SMS codes.

- Reliability Issues: Dependent on cell signal, and texts can sometimes be delayed or not arrive.

- Less Secure: While better than nothing, it’s generally considered less secure than authenticator apps.

2. Something You Have: Authenticator Apps

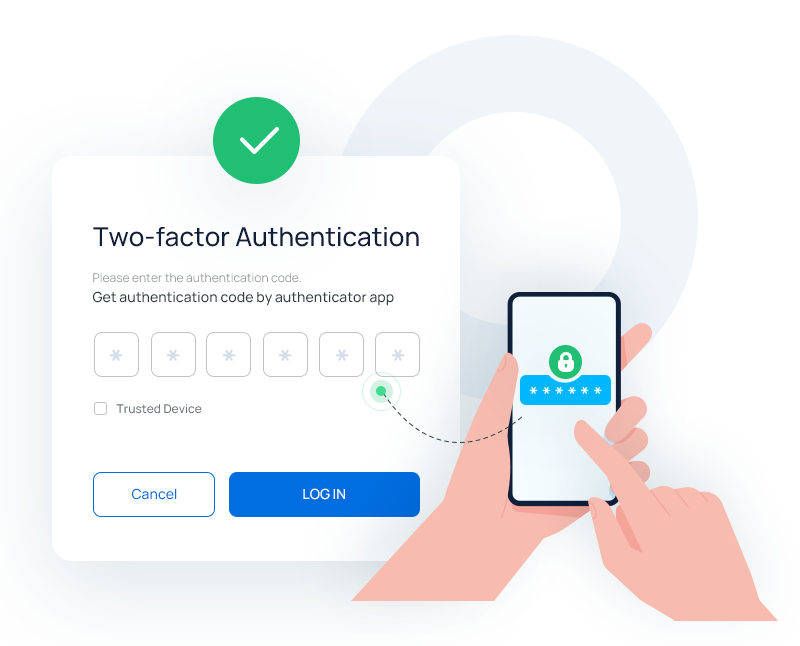

- How it Works: You install a dedicated authenticator app (like Google Authenticator, Microsoft Authenticator, Authy, or Duo Mobile) on your smartphone. When setting up 2FA, you link your finance app to the authenticator app, usually by scanning a QR code. From then on, the authenticator app generates a new, time-sensitive 6-digit code every 30-60 seconds. You enter this code after your password.

- Pros:

- Highly Secure: Codes are generated directly on your device and aren’t sent over cellular networks, making them immune to SIM swapping.

- Works Offline: Codes are generated even without an internet connection.

- Can Manage Multiple Accounts: One authenticator app can store codes for many different services.

- Cons:

- Requires a Separate App: An extra app on your phone.

- Device Loss/Damage: If you lose or damage your phone, you’ll need to have a backup plan (see "Backup Codes" below).

3. Something You Are: Biometrics (Fingerprint or Face Scan)

- How it Works: Many modern smartphones have built-in fingerprint scanners (Touch ID) or facial recognition (Face ID). Once enabled in your finance app’s settings, you can often use these biometrics as a second factor (or even as your primary login in some cases, though 2FA is still recommended for maximum security).

- Pros:

- Extremely Convenient: Just a touch or a glance.

- Very Fast: Quickest way to authenticate.

- Highly Secure: Your biometrics are unique to you.

- Cons:

- Device Dependent: Only works on devices with the necessary hardware.

- Less Common as a Sole Second Factor: Often used in conjunction with a PIN or password rather than replacing a true "something you have" factor like an authenticator app for initial setup.

4. Something You Have: Hardware Security Keys (FIDO/U2F)

- How it Works: These are small physical devices (like a USB stick) that you plug into your computer or tap against your phone. They generate cryptographic keys to confirm your identity. Examples include YubiKey or Google Titan Key.

- Pros:

- Most Secure: Virtually unphishable and highly resistant to sophisticated attacks.

- Physical Control: You must physically possess the key.

- Cons:

- Less Common for Finance Apps: While becoming more popular, not all finance apps support them yet.

- Requires Purchase: You need to buy the device.

- Can Be Lost: If you lose the key, you need backup options.

Setting Up 2FA on Your Finance Apps: A Step-by-Step Guide

The exact steps might vary slightly depending on the app or financial institution, but the general process is similar:

- Log In to Your Account: Use your regular username and password.

- Navigate to Security Settings: Look for sections like "Security," "Profile," "Login Settings," "Privacy," or "Authentication."

- Find 2FA/MFA Option: Locate the option for "Two-Factor Authentication," "Multi-Factor Authentication," "2-Step Verification," or "Login Verification."

- Choose Your Preferred Method: The app will usually give you choices like SMS, Authenticator App, or sometimes Biometrics. For finance apps, we highly recommend choosing an Authenticator App if available.

- Follow On-Screen Prompts:

- For Authenticator Apps: You’ll typically be shown a QR code to scan with your authenticator app. Once scanned, the app will start generating codes for your finance account.

- For SMS: You’ll confirm your phone number, and the app will send a test code to verify it works.

- Save Backup Codes: This is CRITICAL! Many services provide a list of one-time backup codes. Print these out or save them in a secure, offline location (like a password manager or encrypted drive, NOT a screenshot on your phone). These codes are your lifeline if you lose your phone or can’t access your authenticator app.

- Test It Out: Log out of your account and then try logging back in. Make sure the 2FA process works smoothly.

Best Practices for Using 2FA with Finance Apps

To maximize the security benefits of 2FA, keep these best practices in mind:

- Enable 2FA Everywhere Possible: Don’t limit 2FA to just your finance apps. Use it for email, social media, cloud storage, and any other critical online accounts.

- Prefer Authenticator Apps over SMS: As discussed, authenticator apps offer superior security against SIM swapping and other phone-related vulnerabilities.

- Protect Your Smartphone: Your phone is now a key to your financial security. Use a strong PIN/password to unlock it, and consider enabling remote wipe features in case it’s lost or stolen.

- Be Wary of Public Wi-Fi: Avoid logging into finance apps or performing sensitive transactions on unsecured public Wi-Fi networks.

- Beware of Phishing Scams: Always double-check the website address (URL) before entering your login details or 2FA codes. Scammers often create fake login pages.

- Never Share Your 2FA Codes: No legitimate financial institution will ever ask you for your 2FA code over the phone, email, or text message.

- Keep Your Software Updated: Ensure your phone’s operating system and all your finance apps are updated to the latest versions to benefit from the newest security patches.

- Regularly Review Account Activity: Even with 2FA, it’s wise to regularly check your bank statements and transaction history for any suspicious activity.

Common Myths and Misconceptions about 2FA

Let’s debunk some common misunderstandings that might stop people from using 2FA:

- Myth 1: "It’s too complicated or inconvenient."

- Reality: While there’s a quick setup process, the daily use of 2FA (especially with authenticator apps or biometrics) is usually just a few extra seconds. The security benefits far outweigh this minor inconvenience.

- Myth 2: "My password is strong enough."

- Reality: Even the strongest, most complex password can be stolen through phishing, data breaches, or malware. 2FA provides a critical second line of defense.

- Myth 3: "Only tech-savvy people need 2FA."

- Reality: Everyone who uses online financial services can benefit from and should use 2FA. Cybercriminals target everyone, not just "tech experts."

- Myth 4: "If I use 2FA, I’m 100% secure."

- Reality: 2FA is an incredibly powerful security tool, but no system is foolproof. It significantly reduces risk but doesn’t eliminate all threats. Good password hygiene, vigilance against scams, and up-to-date software are still essential.

Conclusion: Your Money, Your Security, Your Choice

Understanding and implementing Two-Factor Authentication for your finance apps is one of the most impactful steps you can take to protect your digital money. It’s a simple yet powerful barrier against unauthorized access, giving you greater control and peace of mind in managing your financial life online.

Don’t wait for a security incident to happen. Take control of your financial security today. If you haven’t already, take a few minutes to enable 2FA on all your banking, investment, and payment apps. Your future self (and your wallet) will thank you.

Post Comment