How to Dispute Errors on Your Credit Report: A Beginner’s Guide to Fixing Your Credit

Your credit report is more than just a document; it’s a financial snapshot that can open or close doors to loans, housing, insurance, and even job opportunities. Imagine a report card for your financial responsibility. Now imagine that report card has a failing grade because of someone else’s mistake, or an error that simply shouldn’t be there. That’s what an error on your credit report can feel like – unfair and damaging.

The good news is that you have rights, and you have the power to fix these inaccuracies. Disputing errors on your credit report might sound daunting, but it’s a straightforward process when you know the steps. This comprehensive guide will walk you through everything you need to know, from identifying mistakes to getting them removed, in language even a beginner can understand.

Why an Accurate Credit Report Matters So Much

Before we dive into the "how," let’s understand the "why." Your credit report directly influences your credit score, which is a three-digit number lenders use to assess your creditworthiness. A higher score means you’re considered less risky, leading to better interest rates on:

- Mortgages: Saving you thousands over the life of a loan.

- Car Loans: Lower monthly payments.

- Credit Cards: Better rewards and lower APRs.

- Personal Loans: Easier approval and more favorable terms.

Beyond loans, an accurate credit report can impact:

- Renting an Apartment: Landlords often check credit.

- Insurance Premiums: Some insurers use credit-based scores.

- Utility Services: Getting connected without a large deposit.

- Employment: Some employers review credit reports for certain positions.

An error, even a small one, can drag down your score, costing you money and opportunities. That’s why being proactive about checking and correcting your report is crucial.

What Kinds of Errors Should You Look For?

Credit report errors aren’t always obvious. They can range from simple typos to complex issues. Here are the most common types of mistakes to watch out for:

- Identity Errors:

- Incorrect name, address, or phone number.

- Accounts belonging to someone else with a similar name.

- Accounts that are the result of identity theft (someone opening credit in your name).

- Incorrect date of birth or Social Security number.

- Account Errors:

- Incorrect Account Status: An account reported as "late" or "charged off" when it was paid on time, or an account you closed still showing as open.

- Incorrect Payment History: Payments you made on time are reported as late.

- Duplicate Accounts: The same account listed multiple times.

- Incorrect Account Balance or Credit Limit: Shows you owe more than you do, or have less available credit.

- Accounts You Don’t Recognize: This could be an error or a sign of identity theft.

- Public Record Errors:

- Incorrect Bankruptcies, Liens, or Civil Judgments: These should be accurate and removed after their reporting period ends (e.g., bankruptcies typically stay for 7-10 years).

- Misreported Child Support or Alimony: While these can appear, they must be accurate.

Key Takeaway: Be a detective. Scrutinize every detail, no matter how small it seems.

How to Get Your Credit Reports (For Free!)

The first step to disputing errors is knowing what’s on your report. You are entitled to a free copy of your credit report from each of the three major credit bureaus once every 12 months.

The three major credit bureaus are:

- Experian

- Equifax

- TransUnion

The ONLY official, government-authorized website for free credit reports is:

- AnnualCreditReport.com

Important Tips:

- Do NOT use other "free credit report" sites. Many of these are marketing ploys that sign you up for paid services or bombard you with ads.

- Check all three bureaus. Information can vary between Experian, Equifax, and TransUnion because not all lenders report to all three. An error might appear on one report but not another.

- Consider staggering your requests. Instead of getting all three at once, you could get one every four months (e.g., Experian in January, Equifax in May, TransUnion in September) to monitor your credit throughout the year. However, if you suspect errors or are planning a major purchase, get all three at once.

Once you have your reports, download or print them and go through them with a fine-tooth comb, highlighting any information that looks incorrect or unfamiliar.

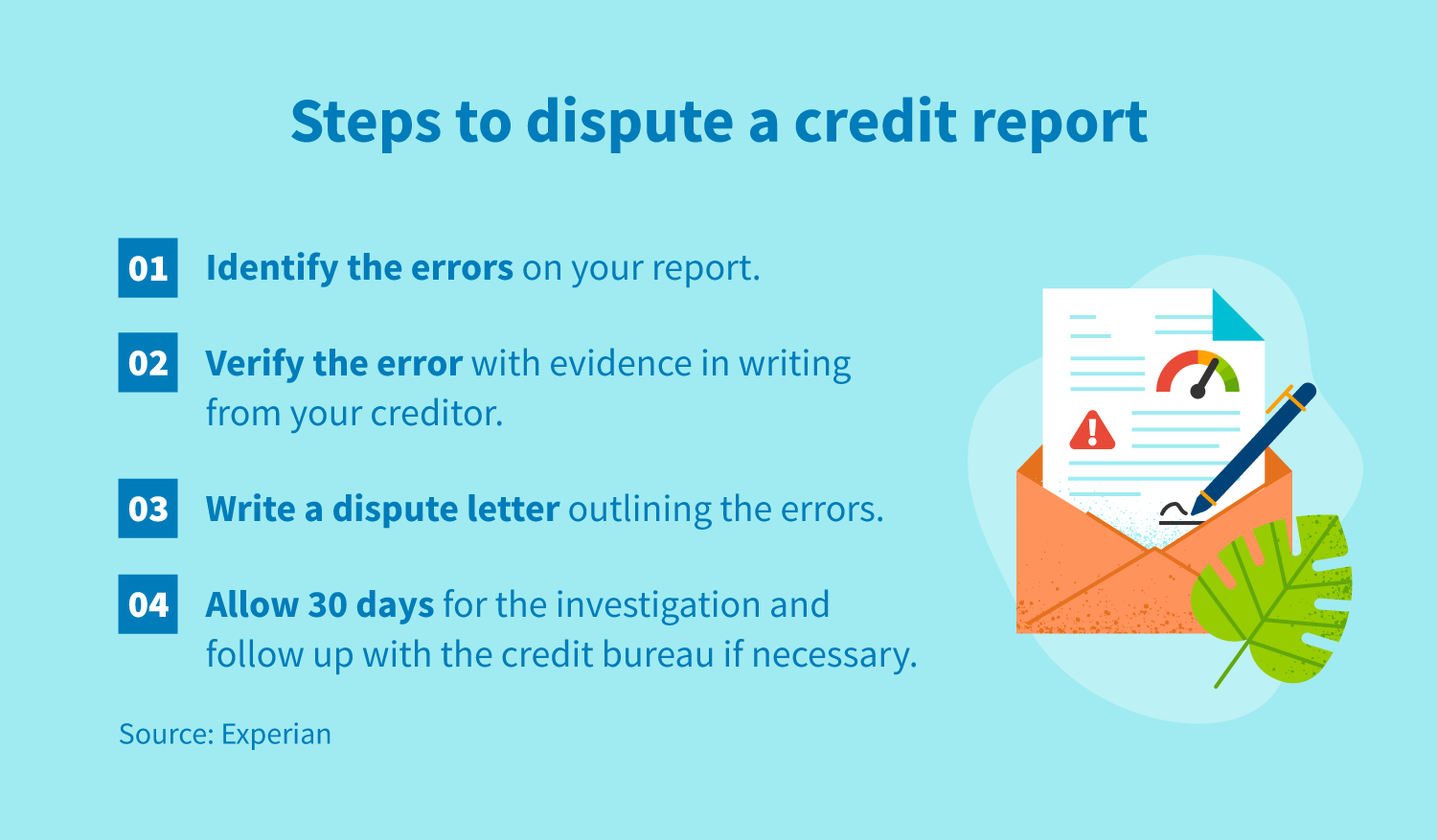

Step-by-Step Guide to Disputing Errors

You’ve found an error. Now it’s time to take action! Here’s the most effective way to dispute inaccurate information:

Step 1: Gather Your Evidence

Documentation is your best friend in a dispute. The more proof you have, the stronger your case.

What to collect:

- Your Credit Report(s): Highlight the specific error(s).

- Proof of Identity: Copy of a government-issued ID (driver’s license, passport) and a utility bill showing your current address.

- Supporting Documents:

- Cancelled checks or bank statements: To prove a payment was made.

- Account statements: To show correct balances or payment history.

- Letters or emails from the creditor: Confirming account closure, payment arrangements, or corrections.

- Court documents: If disputing public record information.

- Police report: If you’re a victim of identity theft.

- A log of all communications: Keep track of who you spoke to, when, and what was discussed.

Tip: Never send original documents. Always send copies.

Step 2: Choose Your Dispute Method (Online or Mail)

You generally have two ways to dispute an error: online or via mail.

- Online Dispute (Faster):

- Each credit bureau has an online dispute portal on their website.

- This is often the quickest way to initiate a dispute.

- You can usually upload supporting documents digitally.

- You’ll receive a confirmation number and can often track the dispute’s progress online.

- Mail Dispute (Recommended for Documentation):

- While slower, sending a dispute letter via certified mail with return receipt requested provides a physical paper trail, which can be invaluable if further action is needed.

- This method ensures you have proof that the credit bureau received your dispute.

It’s often a good idea to start online for speed, but if you have complex evidence or want a strong paper trail, mail is the way to go.

Step 3: Contact the Credit Bureaus

You need to contact each credit bureau that is reporting the error. Remember, they don’t share information with each other.

What to include in your dispute (if mailing a letter):

- Your full name, current address, and phone number.

- Your date of birth and Social Security number.

- A clear statement that you are disputing information on your credit report.

- Identify the specific item(s) you are disputing: Include the account number, the creditor’s name, and why you believe the information is inaccurate (e.g., "Account XYZ is reported as late, but I made all payments on time. See attached bank statements.").

- Request that the inaccurate information be removed or corrected.

- List all attached supporting documents.

- A copy of your credit report with the error highlighted.

- Sign and date the letter.

Sample Dispute Letter Template (adapt as needed):

[Your Name]

[Your Address]

[Your City, State, ZIP Code]

[Your Phone Number]

[Your Email Address]

[Date]

[Credit Bureau Name]

[Credit Bureau Address - See below for specific addresses]

**Subject: Dispute of Inaccurate Information on My Credit Report – [Your Full Name] – SSN: [Your Social Security Number]**

Dear [Credit Bureau Name] Consumer Relations,

I am writing to formally dispute inaccurate information on my credit report. I have attached a copy of my credit report with the disputed item(s) highlighted.

The following information is inaccurate and I request that you investigate and remove or correct it immediately:

1. **Account Name:** [Creditor Name, e.g., "XYZ Bank"]

**Account Number:** [Account Number]

**Reason for Dispute:** [Clearly explain why it's inaccurate. E.g., "This account is reported as '30 days late' on [Date], but I made the payment on time. Please see the attached bank statement showing payment on [Date]."]

**Desired Resolution:** Remove the late payment notation.

2. **[Add more items if necessary, following the same format]**

I have attached copies of supporting documentation to verify my claim, including:

* [List each attached document, e.g., "Copy of bank statement for [Month/Year]"]

* [Copy of [Your ID] and a utility bill for address verification]

Under the Fair Credit Reporting Act (FCRA), I have the right to have inaccurate information removed from my credit report. Please investigate this matter promptly and notify me of the results.

Thank you for your time and attention to this matter.

Sincerely,

[Your Signature]

[Your Typed Name]Credit Bureau Dispute Addresses:

- Experian:

Experian

P.O. Box 4500

Allen, TX 75013 - Equifax:

Equifax Information Services LLC

P.O. Box 740256

Atlanta, GA 30374 - TransUnion:

TransUnion LLC

P.O. Box 2000

Chester, PA 19016

Step 4: Contact the Furnisher (Optional, but Recommended)

A "furnisher" is the company that reported the information to the credit bureau – typically a lender, bank, or collection agency. While the credit bureaus are legally obligated to investigate your dispute, contacting the furnisher directly can sometimes speed up the process.

Why contact the furnisher?

- They have direct access to your account records.

- They can correct the error at its source, which then gets reported to all three bureaus.

How to contact the furnisher:

- Send a dispute letter directly to the furnisher, similar to the one you sent to the credit bureau.

- Clearly state the error and provide supporting documentation.

- Request that they correct the information with all three credit bureaus.

- Send via certified mail with return receipt requested.

Important: Even if you contact the furnisher, always dispute the error with the credit bureaus as well. This ensures your rights under the FCRA are protected.

Step 5: Follow Up and Monitor

Once you’ve sent your dispute, the credit bureaus have a legal timeframe to investigate.

- Investigation Period: Under the FCRA, credit bureaus typically have 30 days to investigate your dispute once they receive it. This period can extend to 45 days if you submit additional information during the initial 30-day window.

- What to Expect:

- The credit bureau will contact the furnisher of the information and ask them to verify it.

- If the furnisher confirms the information is inaccurate or cannot verify it, the credit bureau must remove it from your report.

- If the furnisher verifies the information, it will remain on your report.

- Results: The credit bureau will send you the results of their investigation, usually within a few days of completing it.

- If the information is removed or corrected, you should also receive an updated copy of your credit report.

- What if the error isn’t removed?

- Re-dispute: If you have new information or feel the investigation was inadequate, you can dispute it again.

- Add a Consumer Statement: You have the right to add a brief statement (100 words or less) to your credit report explaining your side of the dispute. While this won’t remove the item, it can provide context to future lenders.

- File a Complaint: If you believe your rights under the FCRA have been violated, you can file a complaint with:

- The Consumer Financial Protection Bureau (CFPB): consumerfinance.gov/complaint/

- Your State Attorney General’s Office.

Important Tips for a Successful Dispute

- Be Meticulous: Accuracy in your dispute letter and documentation is key.

- Keep Excellent Records: Create a dedicated folder (physical or digital) for all correspondence, documents, tracking numbers, and notes. This is your paper trail!

- Be Patient, But Persistent: The process can take a few weeks. Don’t get discouraged if it’s not resolved instantly.

- Check All Three Reports Regularly: Make it a habit to review your reports annually (or more often if you suspect issues).

- Beware of "Credit Repair" Scams: While legitimate credit counseling services exist, many "credit repair" companies charge high fees for doing things you can easily do yourself. Be skeptical of anyone promising to "magically" remove negative items.

What Happens After You Dispute?

Once an error is successfully removed from your credit report, you might see a positive impact on your credit score. The exact impact depends on the severity of the error and your overall credit profile. For instance, removing a late payment or collection account will likely have a more significant positive effect than correcting a misspelled name.

Monitor your credit score regularly using free services offered by many banks or credit card companies, or sites like Credit Karma or Credit Sesame. While these may not show your official FICO score, they can give you a good indication of progress.

Conclusion

Taking control of your credit report and disputing errors is a powerful step towards financial well-being. It might seem like a chore, but the long-term benefits of an accurate credit report – better interest rates, easier approvals, and peace of mind – are well worth the effort.

By understanding what to look for, how to gather your evidence, and following the clear steps outlined above, you can effectively challenge inaccurate information and protect your financial future. Don’t let someone else’s mistake hold you back. Take action today: get your free credit reports from AnnualCreditReport.com and review them carefully!

Post Comment