Debt Consolidation: The Pros and Cons Explained for Beginners

Feeling overwhelmed by multiple debts, high-interest rates, and juggling different due dates? You’re not alone. Millions of people struggle with debt, and for many, the idea of debt consolidation sounds like a dream come true – one simple payment, potentially lower interest, and a clearer path to financial freedom.

But is debt consolidation truly the magic bullet it seems to be? Like any financial strategy, it comes with both significant advantages and potential pitfalls. This comprehensive guide will break down the pros and cons of debt consolidation in easy-to-understand language, helping you decide if it’s the right move for your unique financial situation.

What Exactly Is Debt Consolidation?

At its core, debt consolidation means combining multiple smaller debts into one larger, single debt. Imagine you have several small streams (credit card debt, personal loans, medical bills) all flowing in different directions. Debt consolidation is like building a dam to merge all those streams into one larger, more manageable river.

The goal is often to:

- Simplify payments: Instead of paying five different creditors, you pay just one.

- Lower your interest rate: Potentially reduce the total amount you pay over time.

- Reduce your monthly payment: Free up cash flow (though this can sometimes mean a longer repayment period).

Common ways to consolidate debt include:

- Personal Loans: Taking out a new, larger loan (often unsecured) to pay off your existing smaller debts.

- Balance Transfer Credit Cards: Moving balances from high-interest credit cards to a new card with a 0% introductory APR.

- Home Equity Loan or Line of Credit (HELOC): Using the equity in your home as collateral for a loan.

- Debt Management Plan (DMP): Working with a credit counseling agency that negotiates with your creditors on your behalf to lower interest rates and create a single payment plan.

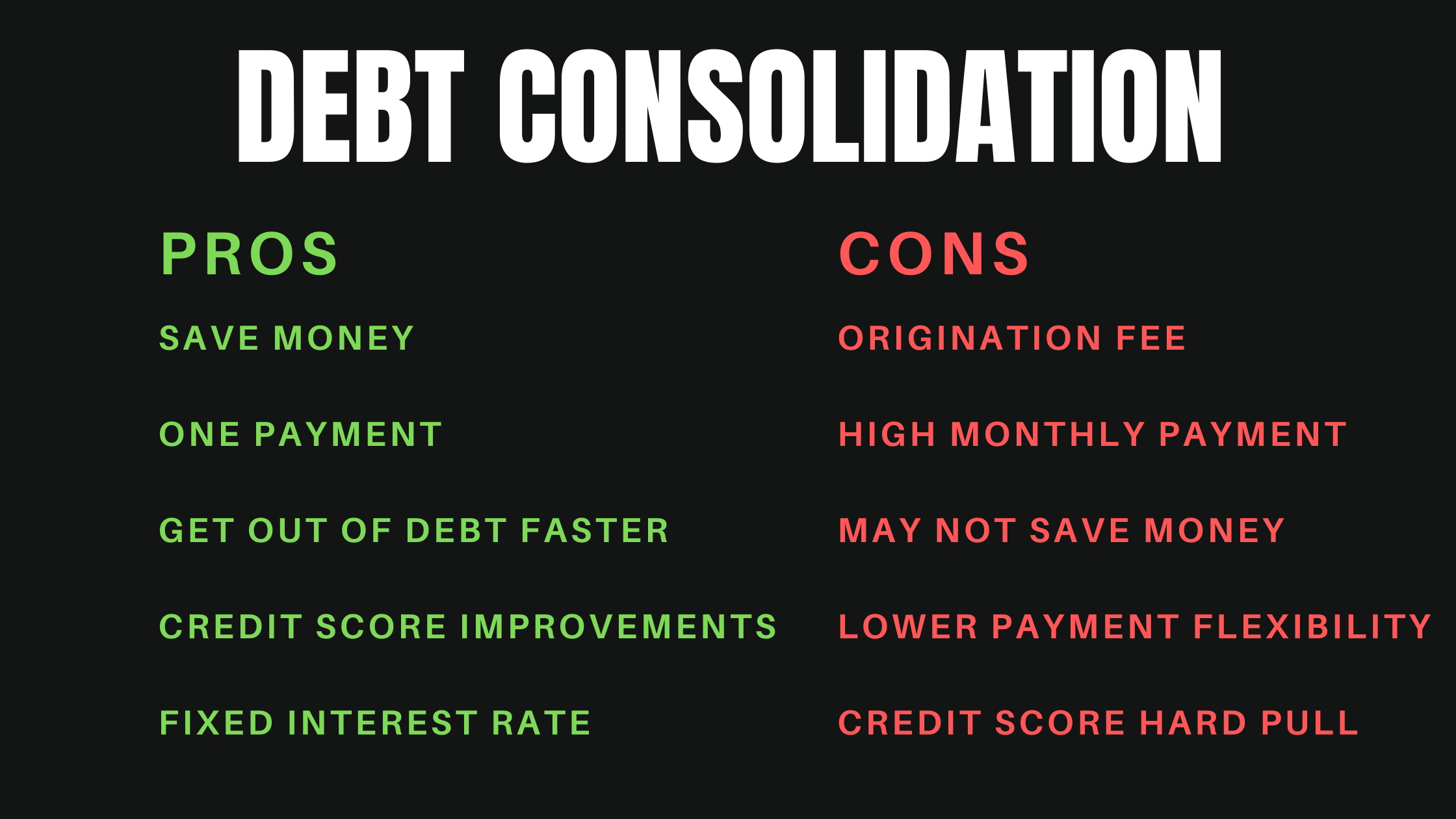

The Bright Side: Pros of Debt Consolidation

Let’s start with the advantages that make debt consolidation an appealing option for many.

1. Simplify Your Financial Life

- One Payment, One Due Date: This is arguably the biggest benefit. Instead of remembering multiple due dates and minimum payments, you have just one. This dramatically reduces the chances of missing payments, which can lead to late fees and damage your credit score.

- Less Mental Clutter: Managing multiple debts can be stressful and time-consuming. Consolidating frees up mental space, allowing you to focus on other financial goals or simply enjoy life more.

- Clearer Picture of Your Debt: With one consolidated loan, you have a much clearer understanding of your total debt amount and your progress towards paying it off.

2. Potential for Significant Savings

- Lower Interest Rates: This is the Holy Grail of debt consolidation. If you can qualify for a new loan with a lower interest rate than the average rate on your current debts, you’ll pay less interest over the life of the loan. This can save you hundreds or even thousands of dollars.

- Example: If you have credit card debt at 20% APR and consolidate it into a personal loan at 10% APR, you’ll save a lot!

- Reduced Monthly Payments: A lower interest rate and/or a longer repayment term can result in a smaller monthly payment. This can free up cash flow in your budget, making it easier to meet your other financial obligations or even start saving.

- Faster Debt Payoff (Potentially): If your new loan has a lower interest rate and you stick to your payment plan (or even pay more than the minimum), you can pay off your debt faster than if you were making minimum payments on multiple high-interest debts.

3. Pathway to Financial Freedom

- Structured Repayment Plan: Most consolidation loans come with a fixed repayment schedule, giving you a clear end date for your debt. This provides a sense of direction and motivation.

- Reduced Stress and Anxiety: The psychological relief of seeing a clear path out of debt can’t be overstated. Less stress often leads to better decision-making and overall well-being.

- Improved Credit Score (Over Time): While there might be a temporary dip (more on that later), successfully managing a consolidated loan by making on-time payments can significantly improve your payment history, which is a major factor in your credit score. Paying off old, high-balance credit cards can also lower your credit utilization, further boosting your score.

The Other Side of the Coin: Cons and Risks of Debt Consolidation

While the benefits are attractive, it’s crucial to understand the downsides and potential risks involved. Debt consolidation is not a one-size-fits-all solution.

1. Hidden Costs and Longer Terms

- Fees Can Eat Into Savings: Consolidation loans often come with fees.

- Origination Fees: A percentage of the loan amount charged by the lender for processing your loan.

- Balance Transfer Fees: For 0% APR credit cards, you’ll typically pay a fee (e.g., 3-5%) of the amount you transfer.

- These fees can sometimes negate the interest savings, especially on smaller loan amounts.

- Higher Overall Cost (If Terms Are Longer): While a lower monthly payment sounds great, it often comes with a longer repayment period. This means you’re paying interest for a longer time, which can result in paying more in total interest over the life of the loan, even if the interest rate is lower.

- Example: A $10,000 debt at 15% over 3 years vs. 10% over 7 years. The 10% loan has a lower monthly payment, but you’ll pay significantly more overall.

- Not Always a Lower Interest Rate: You might not qualify for an interest rate lower than your current debts, especially if your credit score isn’t strong. In some cases, you might even end up with a higher rate.

2. The Danger of More Debt

- Addressing the Symptom, Not the Cause: Debt consolidation deals with the result of your spending habits, not the habits themselves. If you don’t address why you got into debt in the first place (e.g., overspending, lack of budget, emergency fund), you might find yourself accumulating new debt on the old, now-empty credit cards.

- False Sense of Security: With credit cards paid off and available credit again, it can be tempting to start spending. This is a common trap, leading to an even worse financial situation than before.

- "Consolidation Cycle": Some people get into a pattern of consolidating debt, accumulating more, and then consolidating again. This is a dangerous cycle that makes true financial freedom elusive.

3. Impact on Your Credit Score

- Initial Dip from Hard Inquiry: When you apply for a new loan or credit card, the lender performs a "hard inquiry" on your credit report. This can temporarily lower your credit score by a few points.

- Closing Old Accounts: While paying off old credit cards is good, immediately closing those accounts can sometimes negatively impact your credit utilization ratio (the amount of credit you’re using vs. your total available credit) and the length of your credit history. It’s often better to keep them open (if they don’t have annual fees) and use them sparingly.

- Collateral Risk (for Home Equity Loans/HELOCs): If you use your home as collateral (via a home equity loan or HELOC), you’re putting your most valuable asset at risk. If you default on the consolidated loan, your lender could foreclose on your home. This is a significant risk that should not be taken lightly.

4. Eligibility Challenges

- Credit Score Requirements: Lenders typically offer the best consolidation loan rates to borrowers with excellent credit. If your credit score is already low due to past payment issues or high debt, you might not qualify for favorable terms – or even for a loan at all.

- Income Requirements: Lenders also assess your income and debt-to-income ratio to ensure you can afford the new monthly payments.

Is Debt Consolidation Right For You? Key Considerations

Before jumping into debt consolidation, ask yourself these critical questions:

- What is my primary goal? Is it to lower my interest rate, reduce my monthly payment, simplify payments, or all of the above?

- Have I addressed my spending habits? Do I have a budget? Can I commit to not accumulating new debt?

- What is my credit score? Will I qualify for a better interest rate than my current debts?

- What are the total costs (including fees and total interest over the life of the loan)? Don’t just look at the monthly payment.

- Am I disciplined enough to stick to the new payment plan?

- Am I comfortable using my home as collateral (if considering a HELOC)?

Before You Decide: Important Tips

If you’re considering debt consolidation, keep these tips in mind:

- Shop Around: Don’t just take the first offer. Compare interest rates, fees, and terms from multiple lenders (banks, credit unions, online lenders).

- Read the Fine Print: Understand all the terms and conditions, including any prepayment penalties or hidden fees.

- Create a Strict Budget: This is non-negotiable. Before consolidating, you must have a clear budget that accounts for your new consolidated payment and prevents you from accumulating new debt.

- Build an Emergency Fund: Having a small emergency fund (even $1,000) can prevent you from relying on credit cards for unexpected expenses.

- Consider Credit Counseling: If you’re unsure or feel overwhelmed, a non-profit credit counseling agency can provide free or low-cost advice, help you explore options (including Debt Management Plans), and create a personalized plan.

- Address the Root Cause: Debt consolidation is a tool, not a cure. If you don’t change the behaviors that led to debt, you’ll likely find yourself in the same situation again.

Conclusion: A Tool, Not a Magic Wand

Debt consolidation can be an incredibly powerful tool for getting your finances back on track. It offers the potential for simpler payments, lower interest costs, and a clearer path to becoming debt-free.

However, it’s not a magic wand. It requires careful consideration, thorough research, and most importantly, a commitment to changing the financial habits that led to debt in the first place. By understanding both the pros and cons, you can make an informed decision that truly sets you on the path to financial freedom.

Post Comment