Understanding the Debt Avalanche Method: Your Fastest Path to Financial Freedom

Debt can feel like a heavy, suffocating blanket, making it hard to breathe financially. For many, the sheer volume of outstanding balances and the seemingly endless minimum payments can be overwhelming. But what if there was a strategic, mathematically sound way to pay off your debt faster, save money on interest, and finally achieve financial freedom?

Enter the Debt Avalanche Method. This powerful debt reduction strategy is favored by financial experts for its efficiency and cost-saving benefits. If you’re tired of just treading water with your debt and want to make real progress, the Debt Avalanche could be your most effective weapon.

In this comprehensive guide, we’ll break down the Debt Avalanche Method in easy-to-understand terms, show you how to implement it, and explain why it’s a smart choice for serious debt elimination.

What is the Debt Avalanche Method?

The Debt Avalanche Method is a debt repayment strategy that focuses on paying down your debts in order of their interest rates, from highest to lowest.

Here’s the core idea:

- You make the minimum payment on all your debts.

- You then take any extra money you have available and apply it to the debt with the highest interest rate.

- Once that highest-interest debt is completely paid off, you take the money you were paying on that debt (both the minimum and the extra) and add it to the minimum payment of the next highest interest rate debt.

- You continue this "avalanche" effect until all your debts are gone.

Why does this work? Because interest is the "cost" of borrowing money. By targeting the debts with the highest interest rates first, you’re attacking the most expensive parts of your debt load. This strategy minimizes the total interest you pay over time, saving you significant money and ultimately leading to a faster overall debt payoff.

How to Implement the Debt Avalanche Method: A Step-by-Step Guide

Ready to unleash your own debt avalanche? Follow these simple steps:

Step 1: List All Your Debts

Gather all your debt information. This includes:

- Credit cards

- Personal loans

- Student loans

- Car loans

- Medical bills

- Any other outstanding balances

For each debt, note down:

- The creditor (e.g., Visa, Sallie Mae)

- The current balance

- The minimum monthly payment

- The interest rate (APR) – this is the most crucial piece of information for the Avalanche method!

Step 2: Order Your Debts by Interest Rate (Highest to Lowest)

This is the cornerstone of the Debt Avalanche. Once you have all your debts listed, rearrange them so that the debt with the absolute highest interest rate is at the top, followed by the next highest, and so on, until the debt with the lowest interest rate is at the bottom.

Example Ordering:

- Credit Card A (24% APR)

- Personal Loan (15% APR)

- Car Loan (7% APR)

- Student Loan (4% APR)

Step 3: Make Minimum Payments on All Debts

Commit to making at least the minimum payment on every single one of your debts, without fail, and always on time. Missing payments can incur late fees and negatively impact your credit score, undermining your efforts.

Step 4: Apply All Extra Money to the Top Debt

This is where the magic happens. After making all your minimum payments, take any extra money you can find in your budget (from cutting expenses, a bonus, a side hustle, etc.) and apply all of it to the debt at the top of your prioritized list – the one with the highest interest rate.

Example: If your highest interest debt is Credit Card A, and you have an extra $100 this month, pay your minimum on Credit Card A plus that $100.

Step 5: "Roll Over" Payments When a Debt is Paid Off

Once you completely pay off the debt at the top of your list (the one you’ve been aggressively attacking), celebrate that win! Now, here’s the "avalanche" part:

- Take the entire payment amount you were making on that now-paid-off debt (its minimum payment + any extra money you were adding to it).

- Add that total amount to the minimum payment of the next debt on your list (the new highest interest rate debt).

You are essentially "snowballing" the money you were paying on the previous debt into the next one, creating a larger and larger payment amount as you go down your list.

Step 6: Repeat Until Debt-Free!

Continue this process. Once the second debt is paid off, take all the money you were paying on it and add it to the minimum payment of the third debt, and so on. Each time you eliminate a debt, your payment towards the next one grows, accelerating your progress and making the process feel increasingly rewarding.

Debt Avalanche Example in Action

Let’s illustrate with a simple example:

Your Debts:

- Credit Card 1: $2,000 balance, 20% APR, $50 minimum payment

- Personal Loan: $5,000 balance, 12% APR, $100 minimum payment

- Student Loan: $10,000 balance, 6% APR, $120 minimum payment

Total Minimum Payments: $50 + $100 + $120 = $270/month

You find an extra $100 in your budget each month to put towards debt.

Month 1:

- Prioritize:

- Credit Card 1 (20% APR) – Target Debt

- Personal Loan (12% APR)

- Student Loan (6% APR)

- Payments:

- Credit Card 1: $50 (minimum) + $100 (extra) = $150

- Personal Loan: $100 (minimum)

- Student Loan: $120 (minimum)

- Total Paid This Month: $150 + $100 + $120 = $370

A Few Months Later (Credit Card 1 is Paid Off!):

You’ve been diligently paying $150/month to Credit Card 1, and it’s finally gone! Congratulations!

Now, the Avalanche Effect:

- You were paying $150 on Credit Card 1.

- Your new highest-interest debt is the Personal Loan.

- New Payment to Personal Loan: $100 (minimum) + $150 (from CC1) = $250

- Student Loan: Continues at $120 (minimum)

Now, you’re paying $250/month to the Personal Loan. This significantly accelerates its payoff. Once the Personal Loan is gone, you’ll take that $250 (plus its original minimum of $100, totaling $350) and add it to your Student Loan payment, making it $120 + $350 = $470/month!

This snowballing of payments is what makes the Avalanche method so powerful and fast.

Debt Avalanche vs. Debt Snowball: Which is Right for You?

The Debt Avalanche is often compared to its cousin, the Debt Snowball Method. While both are effective debt reduction strategies, they differ in their approach and psychological impact.

-

Debt Avalanche (Highest Interest First):

- Focus: Math and saving money.

- How it works: Pay off debts from highest interest rate to lowest.

- Pros: Saves the most money on interest, pays off debt fastest overall.

- Cons: Can take longer to see the first debt eliminated, which might be demotivating for some.

-

Debt Snowball (Smallest Balance First):

- Focus: Psychology and quick wins.

- How it works: Pay off debts from smallest balance to largest.

- Pros: Provides rapid "wins" as small debts are eliminated quickly, building motivation and momentum.

- Cons: You may pay more in total interest over time, as you might be ignoring higher-interest debts in favor of smaller ones.

Which should you choose?

- Choose the Debt Avalanche if you are disciplined, motivated by saving money, and comfortable with a slightly longer wait for your first debt to be eliminated. You are prioritizing financial efficiency.

- Choose the Debt Snowball if you need quick wins to stay motivated, feel overwhelmed by your debt, and value psychological momentum over absolute financial savings.

Many people start with a Snowball to build confidence and then switch to an Avalanche once they’ve gained momentum. Both are vastly better than just making minimum payments!

Why Choose the Debt Avalanche Method? Key Benefits

The Debt Avalanche isn’t just a strategy; it’s a smart financial decision. Here’s why:

- Saves You the Most Money: This is the #1 benefit. By targeting high-interest debt first, you reduce the amount of interest you accrue over the life of your loans, potentially saving you thousands of dollars.

- Faster Overall Debt Payoff: Because you’re chipping away at the most expensive debt first, your total debt balance decreases more rapidly than if you were just making minimum payments or using a less optimized strategy.

- Clear, Logical Path: The system is straightforward: list, prioritize, attack. There’s no guesswork involved, making it easy to stick to.

- Builds Financial Savvy: Understanding how interest works and actively managing it empowers you to make smarter financial decisions in the future.

- Motivation Through Progress: While the first payoff might take a little longer than with the Snowball, seeing your highest interest rates vanish is incredibly motivating. As payments roll over, the speed at which subsequent debts disappear will be exhilarating.

Tips for Success with the Debt Avalanche Method

Implementing the Debt Avalanche is only half the battle; sticking with it is key. Here are some tips to maximize your success:

- Create a Detailed Budget: You can’t find extra money to apply to your debts if you don’t know where your money is going. A budget is non-negotiable for finding those extra dollars.

- Build a Small Emergency Fund First: Before aggressively paying down debt, aim for a small emergency fund (e.g., $1,000 or one month’s expenses). This prevents new debt from accumulating if an unexpected expense arises.

- Stop Incurring New Debt: This sounds obvious, but it’s crucial. Don’t add new debt while trying to pay off old debt. Cut up credit cards if necessary, or put them in a safe place.

- Find Ways to Increase Income or Decrease Expenses: Every extra dollar you can free up goes directly to accelerating your debt payoff. Consider a side hustle, selling unused items, or aggressively cutting discretionary spending.

- Automate Payments: Set up automatic minimum payments for all your debts to ensure you never miss a due date.

- Track Your Progress: Use a spreadsheet, an app, or even a simple chart on your wall to visualize your debt decreasing. Seeing the numbers go down can be incredibly motivating.

- Celebrate Milestones: Acknowledge your progress! Pay off a credit card? Treat yourself to something small and free, like a walk in the park or a movie night at home.

- Stay Persistent: Debt payoff is a marathon, not a sprint. There will be good months and challenging months. Don’t get discouraged by setbacks; just get back on track.

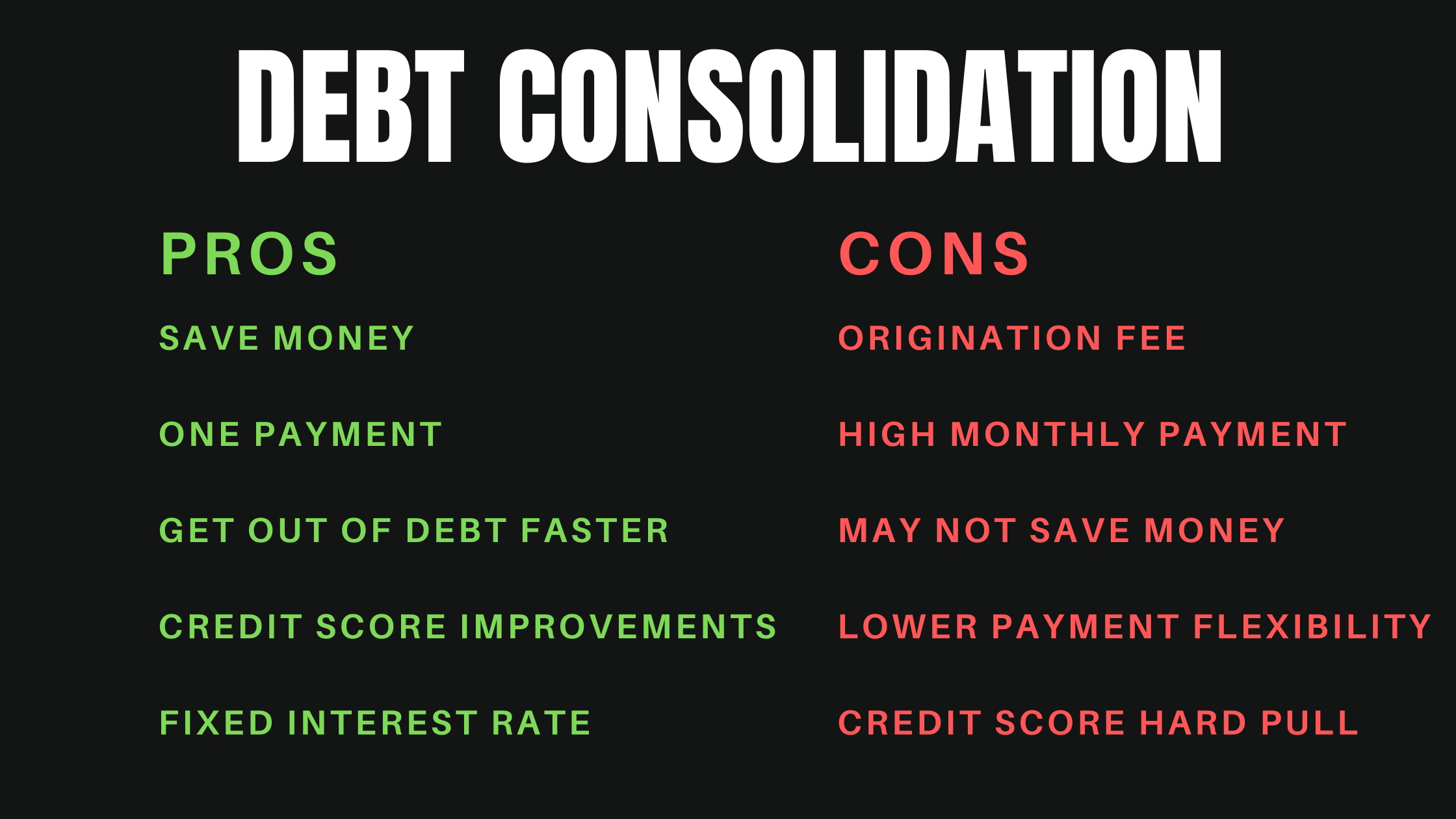

- Consider Debt Consolidation or Refinancing (Carefully): For very high-interest debts, consolidating them into a lower-interest personal loan or doing a balance transfer (if you have excellent credit) can accelerate your Avalanche. Always compare the new interest rate and fees carefully.

Common Mistakes to Avoid

- Not Having a Budget: Without one, you’re guessing how much extra you can pay, and often, you’ll pay nothing extra.

- Not Listing All Debts: You need a full picture to prioritize correctly.

- Getting New Debt: This is like trying to empty a bathtub with the faucet still running.

- Giving Up Too Soon: The beginning can feel slow. Trust the process, and the momentum will build.

- Focusing Only on Interest: While interest is key, ensure you’re still making all minimum payments to avoid fees and credit score damage.

Frequently Asked Questions (FAQs) About the Debt Avalanche Method

Q1: Is the Debt Avalanche Method right for everyone?

A: The Debt Avalanche is mathematically the most efficient way to pay off debt, saving you the most money on interest. However, if you struggle with motivation and need quick wins to stay on track, the Debt Snowball Method (paying off smallest balances first) might be a better psychological fit for you initially.

Q2: What if I have debts with very similar interest rates?

A: If two debts have very similar interest rates (e.g., 18.9% and 19.1%), you can choose to attack the one with the slightly higher rate, or if you prefer, the one with the smaller balance to get a quicker win. The difference in interest saved will be minimal in such cases.

Q3: How long will it take to pay off my debt using the Debt Avalanche?

A: The exact time depends on the total amount of debt, your interest rates, and how much extra you can consistently pay each month. However, the Debt Avalanche will generally get you debt-free faster than just making minimum payments or using the Debt Snowball (because you save more on interest, allowing more money to go towards principal).

Q4: Can I combine the Debt Avalanche with other financial strategies?

A: Absolutely! The Debt Avalanche works best when combined with a solid budget, an emergency fund, and efforts to either increase your income or reduce your expenses. It’s a key component of a comprehensive financial plan.

Q5: Should I pay off my mortgage with the Debt Avalanche?

A: Generally, no. Mortgages usually have very low interest rates compared to other consumer debts. Focus on higher-interest debts (credit cards, personal loans, etc.) first. Once those are clear, you can decide if paying off your mortgage early aligns with your other financial goals.

Conclusion: Take Control with the Debt Avalanche

Understanding and implementing the Debt Avalanche Method is more than just a financial strategy; it’s a commitment to taking control of your financial future. By systematically attacking your highest-interest debts, you’re not just paying bills; you’re actively dismantling the chains of debt, saving money, and building momentum towards a life free from financial burden.

It requires discipline and consistency, but the rewards—a healthier financial life, peace of mind, and thousands of dollars saved—are well worth the effort. Start today, list your debts, and unleash your own powerful debt avalanche. Your future self will thank you.

Post Comment