Creating a Family Budget That Works: Your Easy Guide to Financial Freedom

Feeling overwhelmed by money? Do you ever wonder where your paycheck goes, or dream of saving for that big family vacation, a new home, or even just a less stressful financial future? You’re not alone. The idea of "budgeting" can sound intimidating, like a financial straitjacket designed to suck all the fun out of life.

But what if we told you that creating a family budget isn’t about restriction, but about freedom? It’s about gaining control, making informed choices, and aligning your spending with your values and goals. A well-crafted family budget is a powerful tool that empowers you to achieve financial peace and stability.

This comprehensive guide is designed specifically for beginners. We’ll break down the process of creating a family budget into simple, actionable steps, making it easy to understand and implement. Get ready to transform your financial life!

Why Creating a Family Budget Matters More Than You Think

Before we dive into the "how," let’s talk about the "why." Understanding the benefits will motivate you to stick with your new financial plan.

- Gain Financial Clarity: No more guessing games! A budget shows you exactly where your money comes from and where every single dollar goes. This transparency is the first step towards control.

- Achieve Your Financial Goals: Whether it’s saving for a down payment, paying off debt, building an emergency fund, or planning for retirement, a budget is your roadmap to getting there. Without one, goals often remain just dreams.

- Reduce Financial Stress: Money worries are a leading cause of stress for many families. When you know you have a plan, and you’re actively working towards your goals, that anxiety significantly decreases.

- Identify and Plug Money Leaks: You might be surprised where your money is actually going. Daily coffees, unused subscriptions, impulse buys – a budget helps you identify these "leaks" and redirect that money towards what truly matters.

- Improve Communication About Money: Budgeting is a team sport. It encourages open and honest conversations with your partner and even your children about financial priorities, fostering a shared understanding and common goals.

- Make Smarter Financial Decisions: When you have a clear picture of your finances, you can make informed decisions about large purchases, investments, or even career changes.

Getting Started: The Mindset Shift

Before you even touch a calculator, take a moment for a mindset shift.

- No Judgment Zone: This isn’t about shaming yourself for past spending habits. It’s about looking forward and creating a healthier relationship with money.

- It’s a Tool, Not a Punishment: Think of your budget as a helpful guide, not a restrictive rulebook. It’s there to serve you.

- Patience is Key: You won’t become a budgeting wizard overnight. There will be bumps in the road, but persistence pays off.

- Involve Your Partner (If Applicable): Budgeting works best when both partners are on board. Schedule a time to discuss your finances openly and honestly.

Step-by-Step: Creating Your Family Budget That Works

Now, let’s roll up our sleeves and get into the practical steps.

Step 1: Calculate Your Total Net Income

Your net income is the amount of money you actually take home after taxes, deductions, and contributions (like 401k or health insurance premiums) are removed from your gross pay.

-

Gather all income sources:

- Paychecks (your and your partner’s)

- Freelance or side hustle income

- Child support or alimony

- Rental income

- Social Security or disability benefits

- Any other regular income streams

-

Total it up: Add all these sources together to get your total monthly net income. This is the foundation of your budget.

Step 2: Track Your Expenses (The Real Eye-Opener!)

This is arguably the most crucial step. Most people underestimate how much they spend. For at least one month (and ideally two or three), you need to meticulously track every single dollar that leaves your hands.

-

How to Track:

- Budgeting Apps: Apps like Mint, YNAB (You Need A Budget), Personal Capital, or Simplifi can link to your bank accounts and credit cards, automatically categorizing transactions.

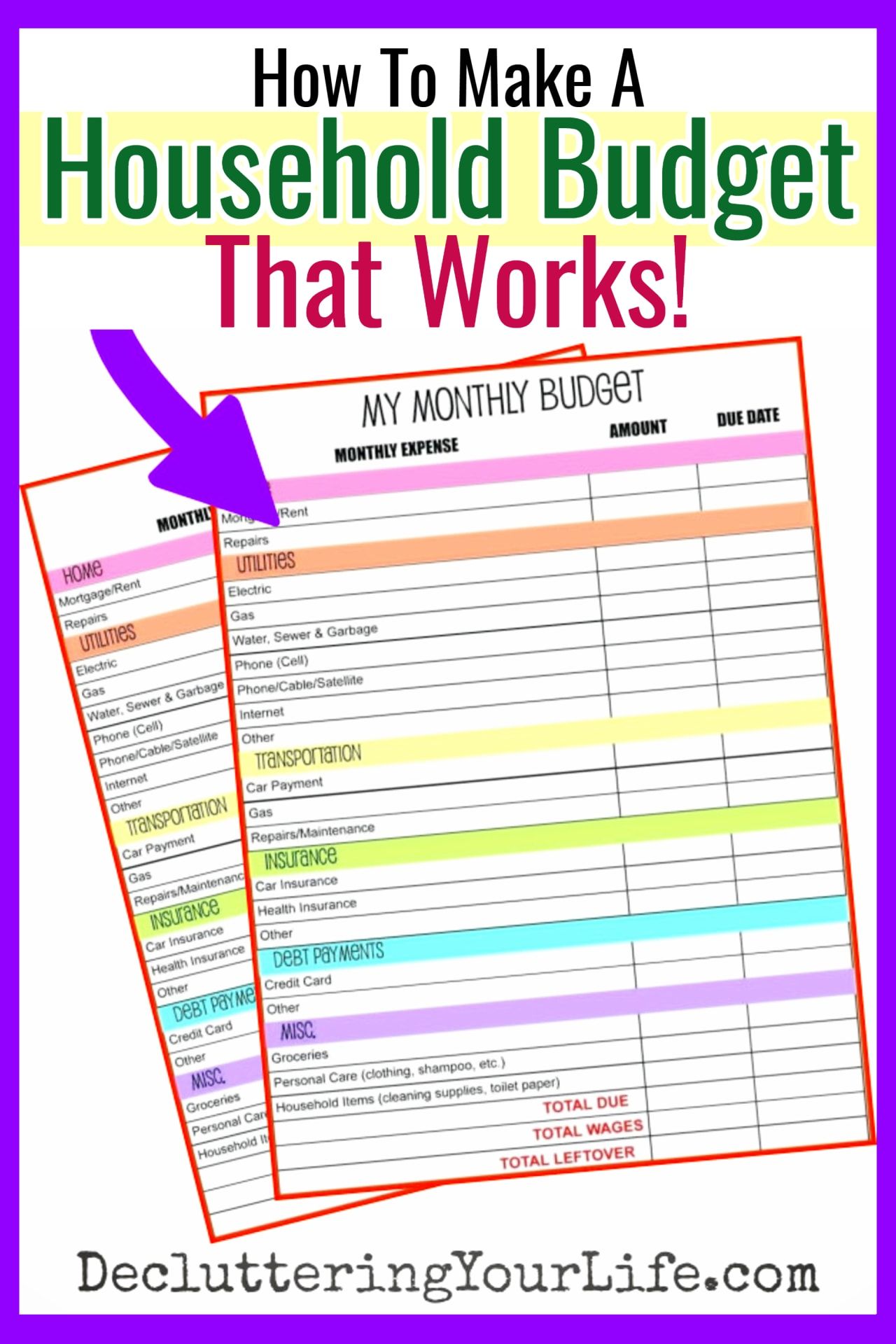

- Spreadsheet: Create a simple spreadsheet (Excel, Google Sheets) and manually input every transaction.

- Notebook/Journal: Old-school but effective! Write down every purchase.

- Bank Statements & Credit Card Bills: Review these at the end of the month to catch anything you missed.

-

Categorize Your Expenses: As you track, start to group your spending. This will make Step 3 much easier.

Step 3: Categorize Your Spending – Needs, Wants, and Savings/Debt

Once you have a clear picture of your income and spending, it’s time to categorize your expenses into three main buckets. A popular and easy-to-understand method is the 50/30/20 Rule.

-

50% for Needs: These are the essential expenses you can’t live without.

- Housing (rent/mortgage)

- Utilities (electricity, water, gas)

- Groceries (food for home cooking)

- Transportation (car payment, gas, public transit, car insurance)

- Minimum debt payments (student loans, credit cards)

- Healthcare (insurance premiums, essential medical costs)

- Basic clothing

-

30% for Wants: These are the non-essential items that improve your quality of life but aren’t strictly necessary.

- Dining out/takeaway

- Entertainment (movies, concerts, streaming services)

- Hobbies

- Vacations

- Shopping (non-essential clothing, electronics)

- Gym memberships (if not medically necessary)

- Subscriptions you rarely use

-

20% for Savings & Debt Repayment: This is the money you allocate to building your future and getting out of debt.

- Emergency fund contributions

- Retirement savings (401k, IRA contributions beyond employer match)

- Investments

- Extra debt payments (beyond the minimums)

- Specific savings goals (down payment, college fund, vacation fund)

Action: Go through your tracked expenses and assign each one to a "Need," "Want," or "Savings/Debt" category. Then, total up how much you spent in each category.

Step 4: Create Your Budget Plan (Income – Expenses = Zero or Surplus!)

Now comes the actual budgeting part! Your goal is to allocate every dollar of your income, ensuring that Income – Expenses = Zero (or a surplus for extra savings/debt payments). This is often called a "Zero-Based Budget."

-

Compare your actual spending to your ideal categories:

- Example: If your net income is $4,000, ideally you’d aim for:

- Needs: $2,000 (50%)

- Wants: $1,200 (30%)

- Savings/Debt: $800 (20%)

- Example: If your net income is $4,000, ideally you’d aim for:

-

Adjust and Allocate:

- Are your "Needs" too high? Look for ways to reduce them (e.g., refinancing mortgage, cheaper car, cutting down on food waste). This is often the hardest area to change quickly.

- Are your "Wants" too high? This is usually where you have the most flexibility. Can you cook more at home? Cut down on streaming services? Find free entertainment?

- Are you saving enough? If not, identify areas in your "Wants" (or even "Needs" if possible) where you can cut back to free up money for savings and debt repayment.

- Allocate specific amounts: For each category (e.g., Groceries: $600, Dining Out: $200, Gas: $150, Emergency Fund: $300), assign a specific dollar amount that you plan to spend.

-

Make sure it balances: Your total planned expenses (Needs + Wants + Savings/Debt) should equal your total net income. If you have a surplus, great! Allocate it to extra savings or debt. If you have a deficit, you must go back and find areas to cut until it balances.

Step 5: Choose a Budgeting Method That Works for You

The best budgeting method is the one you’ll actually stick with!

- Spreadsheet (Excel/Google Sheets):

- Pros: Highly customizable, free (Google Sheets), great for detailed tracking.

- Cons: Requires manual input, can be intimidating for some.

- Budgeting Apps (Mint, YNAB, Simplifi, Personal Capital):

- Pros: Automate tracking, categorize transactions, offer insights and reports, accessible on mobile.

- Cons: Can have a learning curve, some are paid subscriptions, security concerns for some.

- Envelope System:

- Pros: Tangible, great for controlling cash spending, simple.

- Cons: Less practical for online payments, not ideal for all expenses.

- How it works: Withdraw cash for your variable expenses (groceries, entertainment, dining out) and put it into labeled envelopes. Once an envelope is empty, you stop spending in that category until the next budgeting period.

- Pen and Paper:

- Pros: Simple, no technology needed, good for visual learners.

- Cons: Can be cumbersome for tracking many transactions, no automated calculations.

Recommendation: Start simple. If you’re tech-savvy, try an app. If you prefer hands-on, a spreadsheet or even the envelope system for variable expenses can be a great start.

Making Your Family Budget Work (Sustainability & Success)

Creating the budget is just the beginning. The real magic happens when you make it a consistent part of your life.

-

Review and Adjust Regularly: Life changes! Your income might fluctuate, unexpected expenses arise, or your goals might shift.

- Weekly Check-ins: Briefly review your spending for the week to ensure you’re on track.

- Monthly Review: At the end of each month, compare your actual spending to your budget. Where did you overspend? Where did you underspend? What can you learn for next month? Adjust your budget as needed.

- Quarterly/Annual Review: Do a deeper dive. Are your financial goals still relevant? Are there better ways to manage your money?

-

Be Realistic, Not Restrictive: Don’t cut everything you enjoy out of your budget. A budget that’s too restrictive is a budget you won’t stick to. Allow for some "fun money" in your "Wants" category. It’s about balance, not deprivation.

-

Involve the Whole Family: Even young children can understand basic money concepts. Talk about saving, making choices, and the value of things. For older children, involve them in discussions about family goals and how their choices impact the budget. This teaches valuable life skills.

-

Build an Emergency Fund (Non-Negotiable!): This is money set aside for unexpected events like job loss, medical emergencies, or car repairs. Aim for 3-6 months of essential living expenses. This fund prevents you from going into debt when life throws a curveball. Make it a priority in your "Savings" category.

-

Automate Your Savings: "Pay yourself first." Set up automatic transfers from your checking account to your savings, investment, or debt repayment accounts immediately after you get paid. If you don’t see the money, you’re less likely to spend it.

-

Celebrate Small Wins: Did you stick to your grocery budget? Did you pay off a small debt? Acknowledge your progress! Positive reinforcement makes the process more enjoyable and sustainable.

-

Don’t Give Up After a Slip-Up: You will likely overspend in a category occasionally. That’s okay! Don’t throw in the towel. Learn from it, adjust, and get back on track. Budgeting is a journey, not a perfect destination.

Common Budgeting Myths Debunked

Let’s address some common misconceptions that might be holding you back:

- Myth 1: Budgeting is Restrictive and Takes All the Fun Out of Life.

- Reality: Quite the opposite! A budget gives you permission to spend within your means without guilt. It allows you to prioritize what truly brings you joy and say "yes" to those things, while consciously saying "no" to things that don’t align with your values.

- Myth 2: Budgeting is Only for People Who Are Struggling Financially.

- Reality: Everyone, regardless of income level, benefits from budgeting. Wealthy individuals budget to grow their wealth and manage complex finances. Budgeting is a tool for financial optimization, not just survival.

- Myth 3: Budgeting is Too Complicated and Time-Consuming.

- Reality: It takes effort to set up initially, but once you have a system in place, it becomes much quicker. Modern apps and simple methods make it accessible for everyone. Even 15-30 minutes a week can make a huge difference.

- Myth 4: Once I Set My Budget, I Never Have to Touch It Again.

- Reality: A budget is a living document. Your life, income, and expenses are constantly changing. Regularly reviewing and adjusting your budget is key to its long-term success.

Your Journey to Financial Empowerment Starts Today!

Creating a family budget that works is one of the most powerful steps you can take towards financial freedom. It might feel like a big undertaking at first, but remember to take it one step at a time. Start with tracking your spending, then categorize, plan, and adjust.

The benefits – reduced stress, achieving your dreams, and gaining true control over your money – are immeasurable. You have the power to transform your family’s financial future.

Don’t wait another day. Start your budgeting journey today and watch your financial confidence soar!

Post Comment