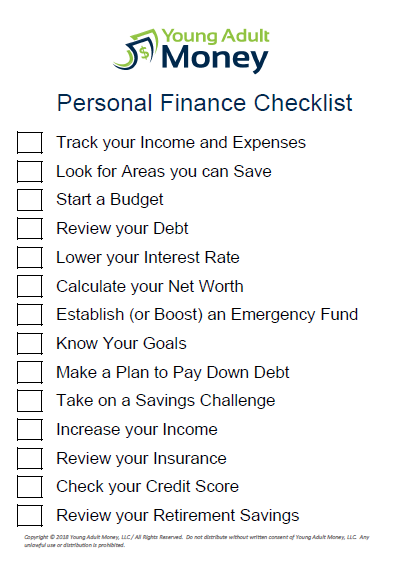

Your Ultimate Financial Planning Checklist for Young Adults: Master Your Money Early!

Are you a young adult standing at the threshold of financial independence, feeling a mix of excitement and overwhelm? You’re not alone! The world of personal finance can seem like a dense jungle, filled with jargon and confusing paths. But here’s the secret: it doesn’t have to be. Starting early with a clear, actionable financial plan is one of the smartest decisions you can make.

This comprehensive financial planning checklist for young adults is designed to demystify money management, breaking it down into simple, actionable steps. We’ll guide you through everything from understanding your cash flow to smart investing, helping you build a solid foundation for lifelong financial well-being.

Let’s dive in and transform your financial future!

Why Financial Planning Matters for Young Adults

You might think financial planning is something only older adults or high-earners need to worry about. Think again! For young adults, getting a handle on your finances early offers incredible advantages:

- Compound Interest is Your Best Friend: The earlier you start saving and investing, the more time your money has to grow, thanks to the magic of compound interest. Even small amounts can turn into significant wealth over decades.

- Avoid Costly Mistakes: Learning about debt, credit, and budgeting now can save you from financial pitfalls that take years to recover from.

- Reduce Stress: Money worries are a leading cause of stress. A solid plan gives you peace of mind and confidence.

- Achieve Your Dreams Faster: Whether it’s buying a home, starting a business, or traveling the world, clear financial goals and a plan to reach them make your dreams tangible.

- Build Independence: Financial literacy empowers you to make informed decisions and stand on your own two feet.

The Essential Financial Planning Checklist for Young Adults

Here’s your step-by-step guide to financial freedom. Take your time, tackle one item at a time, and celebrate every small victory!

1. Understand Your Current Financial Landscape

Before you can plan where you’re going, you need to know where you are. This foundational step is crucial for any successful financial journey.

- Track Your Income:

- List all sources: Salary, side hustle income, freelance work, allowances, etc.

- Calculate your net income: This is your "take-home pay" after taxes and deductions.

- Identify Your Expenses:

- Fixed Expenses: These are costs that generally stay the same each month (e.g., rent, loan payments, subscriptions, insurance premiums).

- Variable Expenses: These fluctuate month-to-month (e.g., groceries, entertainment, dining out, utilities that vary).

- The "Why": Knowing where your money goes is the first step to controlling it. You might be surprised at how much those small, daily purchases add up!

2. Define Your Financial Goals (Short-Term & Long-Term)

What do you want your money to do for you? Setting clear, measurable financial goals gives your planning a purpose and direction.

- Short-Term Goals (1-3 years):

- Building an emergency fund (we’ll cover this next!)

- Saving for a down payment on a car

- Paying off a specific credit card debt

- Saving for a vacation or a new gadget

- Long-Term Goals (5+ years):

- Saving for a down payment on a home

- Retirement planning (yes, start now!)

- Funding further education

- Starting a business

- Make Them SMART:

- Specific: "Save for a car" vs. "Save $5,000 for a car down payment."

- Measurable: You can track your progress.

- Achievable: Is it realistic given your income and expenses?

- Relevant: Does it align with your values and life plans?

- Time-bound: Set a deadline (e.g., "by December 2025").

3. Create a Realistic Budget & Stick to It

A budget isn’t about restricting yourself; it’s about giving yourself permission to spend on what matters while ensuring you’re saving for your goals. It’s your financial roadmap.

- Choose a Budgeting Method:

- The 50/30/20 Rule:

- 50% Needs: Housing, utilities, groceries, transportation, insurance.

- 30% Wants: Dining out, entertainment, hobbies, shopping, vacations.

- 20% Savings & Debt Repayment: Emergency fund, retirement, extra debt payments.

- Zero-Based Budgeting: Every dollar is assigned a job (e.g., "every penny goes somewhere").

- Envelope System: For cash spenders, allocating physical cash into envelopes for different categories.

- The 50/30/20 Rule:

- Track Your Spending: Use apps (Mint, YNAB, Rocket Money), spreadsheets, or even a simple notebook. The key is consistency.

- Review & Adjust Monthly: Your life changes, and so should your budget. Don’t be afraid to tweak it until it works for you.

4. Build a Robust Emergency Fund

This is your financial safety net, designed to catch you when unexpected expenses hit (think job loss, medical emergency, car repair). Without one, you might be forced into debt.

- The Goal: Aim for 3 to 6 months’ worth of essential living expenses. If you have unstable income or dependents, aim for 6-12 months.

- Where to Keep It: In a separate, easily accessible, high-yield savings account. It needs to be liquid (easy to get to) but separate from your everyday spending account so you’re not tempted to dip into it.

- How to Build It:

- Treat it like a bill and automate transfers from your checking account.

- Direct deposit a portion of your paycheck.

- Put windfalls (bonuses, tax refunds) directly into it.

- Start small! Even $25 a week adds up quickly.

5. Tackle Debt Strategically (Especially Student Loans!)

Debt can feel like a heavy anchor. Learning how to manage and reduce it is critical for financial freedom.

- Prioritize High-Interest Debt: Credit card debt often carries very high interest rates (15-25%+). Focus on paying this off first.

- Debt Snowball Method: Pay minimums on all debts, but put any extra money towards the smallest debt first. Once it’s paid off, roll that payment into the next smallest debt. This builds momentum and motivation.

- Debt Avalanche Method: Pay minimums on all debts, but put any extra money towards the debt with the highest interest rate first. This saves you the most money on interest over time.

- Manage Student Loans:

- Understand Your Loans: Know your loan servicer, interest rates, and repayment terms.

- Explore Repayment Options: Income-driven repayment plans, deferment, forbearance.

- Consider Refinancing: If you have good credit and stable income, you might qualify for a lower interest rate, which can save you a lot of money.

- Make Extra Payments: Even small extra payments can significantly reduce your total interest paid and the life of your loan.

6. Master Your Credit Score

Your credit score is a three-digit number that represents your creditworthiness. It impacts your ability to get loans, rent an apartment, and sometimes even get a job.

- What Builds Good Credit:

- Payment History (35%): Pay all your bills on time, every time. This is the most important factor.

- Credit Utilization (30%): How much of your available credit you’re using. Keep it below 30% (e.g., if you have a $1,000 limit, don’t owe more than $300).

- Length of Credit History (15%): The longer you’ve had accounts open and in good standing, the better.

- New Credit (10%): Don’t open too many new accounts at once.

- Credit Mix (10%): Having a mix of credit types (credit cards, loans) can be helpful.

- How to Build It (If You Have None):

- Secured Credit Card: Requires a deposit, acts like a regular credit card.

- Authorized User: Get added to a parent’s well-managed credit card (they use it, you benefit from their good history).

- Small Loan: A small personal loan or credit-builder loan.

- Monitor Your Credit: Get your free credit report annually from AnnualCreditReport.com to check for errors. Use free credit monitoring services (like Credit Karma) to track your score.

7. Start Investing Early & Consistently

This is where the magic of compound interest truly shines! Investing isn’t just for the wealthy; it’s how you build wealth over time.

- The Power of Compounding: Money earns interest, and then that interest earns interest. The earlier you start, the more time your money has to grow exponentially.

- Automate Your Investments: Set up automatic transfers from your checking account to your investment accounts, even if it’s a small amount.

- Explore Retirement Accounts:

- 401(k) / 403(b): If your employer offers one, contribute at least enough to get the full "employer match" – it’s free money! Contributions are often pre-tax, reducing your taxable income now.

- Roth IRA: Contributions are made with after-tax money, but qualified withdrawals in retirement are tax-free. Great for young adults who expect to be in a higher tax bracket later.

- Traditional IRA: Contributions might be tax-deductible now, but withdrawals in retirement are taxed.

- Consider Low-Cost Index Funds/ETFs: These are diversified investments that hold a basket of stocks or bonds, providing broad market exposure without picking individual stocks. They’re great for beginners.

- Don’t Overthink It: The most important step is just starting. You can always learn more and adjust later.

8. Protect Your Future with Smart Insurance

Insurance might seem like an extra expense, but it’s a vital safety net that protects your financial health from unexpected catastrophes.

- Health Insurance: Crucial for covering medical emergencies, doctor visits, and prescriptions. You may be able to stay on a parent’s plan until age 26, or explore options through your employer or the Health Insurance Marketplace.

- Auto Insurance: If you own a car, it’s legally required in most places and protects you financially in case of an accident.

- Renters/Homeowners Insurance: Protects your belongings from theft, fire, or other damage. If you rent, your landlord’s insurance won’t cover your personal items.

- Disability Insurance: Replaces a portion of your income if you become unable to work due to illness or injury. Your most valuable asset is your ability to earn an income!

- Life Insurance (Potentially): If you have dependents (e.g., a spouse, children, or even parents who rely on your income for student loans), life insurance provides financial support for them if something happens to you.

9. Consider Basic Estate Planning (Yes, Even Now!)

Estate planning isn’t just for the elderly or the super-rich. For young adults, it’s about making sure your wishes are known and loved ones aren’t left in a difficult position.

- Create a Simple Will: Designate who inherits your assets (even if it’s just a few thousand dollars in a bank account or sentimental items) and who cares for any future dependents.

- Designate Beneficiaries: For your bank accounts, retirement accounts (401k, IRA), and life insurance policies, make sure you’ve named beneficiaries. This ensures the money goes directly to them without needing to go through probate.

- Power of Attorney: Appoint someone you trust to make financial and medical decisions for you if you become incapacitated.

- The "Why": These steps can save your family a lot of stress, time, and money during an already difficult time.

10. Commit to Continuous Financial Learning

The financial world is always evolving, and so should your knowledge. Financial literacy is a lifelong journey.

- Read Books: Start with classics like "The Total Money Makeover" by Dave Ramsey or "The Simple Path to Wealth" by J.L. Collins.

- Listen to Podcasts: "BiggerPockets Money," "Stacking Benjamins," "Planet Money" are great starting points.

- Follow Reputable Financial Blogs/Websites: Look for sources that provide unbiased, evidence-based advice.

- Stay Curious: Don’t be afraid to ask questions, research new concepts, and adapt your plan as your life circumstances change.

Getting Started: Don’t Let Perfection Be the Enemy of Progress

This checklist might seem like a lot, but remember, financial planning is a marathon, not a sprint. The most important thing is to just start.

- Pick one item from this checklist that feels most achievable right now. Maybe it’s tracking your expenses for a month, or setting up an automatic transfer to your emergency fund.

- Celebrate small wins. Every step forward, no matter how tiny, builds momentum and confidence.

- Be patient with yourself. You’ll make mistakes, and that’s okay. Learn from them and keep moving forward.

By taking control of your financial planning now, you’re not just managing money; you’re building a foundation for a future filled with choice, security, and the freedom to pursue your biggest dreams. You’ve got this!

Post Comment