The Power of Compound Interest Explained: Your Ultimate Guide to Building Wealth

Imagine having a secret financial superpower, a force that can turn small sums of money into substantial wealth over time, seemingly by magic. This isn’t a fantasy; it’s the undeniable reality of compound interest. Often called the "eighth wonder of the world" by Albert Einstein, understanding and harnessing this principle is one of the most crucial steps you can take on your journey to financial freedom.

For many beginners, financial concepts can feel overwhelming. But compound interest is surprisingly simple once you grasp its core idea. It’s not about complex stock market strategies or risky investments; it’s about the relentless, exponential growth of your money.

In this comprehensive guide, we’ll demystify compound interest, explain how it works, explore its incredible power, and show you actionable strategies to make it work for you.

What is Interest, Anyway? A Quick Primer

Before we dive into compounding, let’s quickly define "interest."

In simple terms, interest is the cost of borrowing money or the reward for lending money.

- When you borrow money (like a loan or credit card), you pay interest to the lender.

- When you save or invest money, a bank or investment vehicle pays you interest for the use of your funds.

There are two main types of interest: simple and compound.

Simple Interest: The Basic Calculation

Simple interest is calculated only on the original principal amount (the initial sum of money deposited or borrowed). It’s straightforward and doesn’t change over time unless the principal changes.

How it works: You earn (or pay) interest only on the initial amount.

Example:

Let’s say you deposit $1,000 into a savings account that pays 5% simple interest per year.

- Year 1: $1,000 (principal) x 0.05 (interest rate) = $50 interest

- Year 2: $1,000 (principal) x 0.05 (interest rate) = $50 interest

- Year 3: $1,000 (principal) x 0.05 (interest rate) = $50 interest

After three years, you would have earned $150 in total interest ($50 x 3). Your total balance would be $1,150. While nice, this growth is linear and relatively slow.

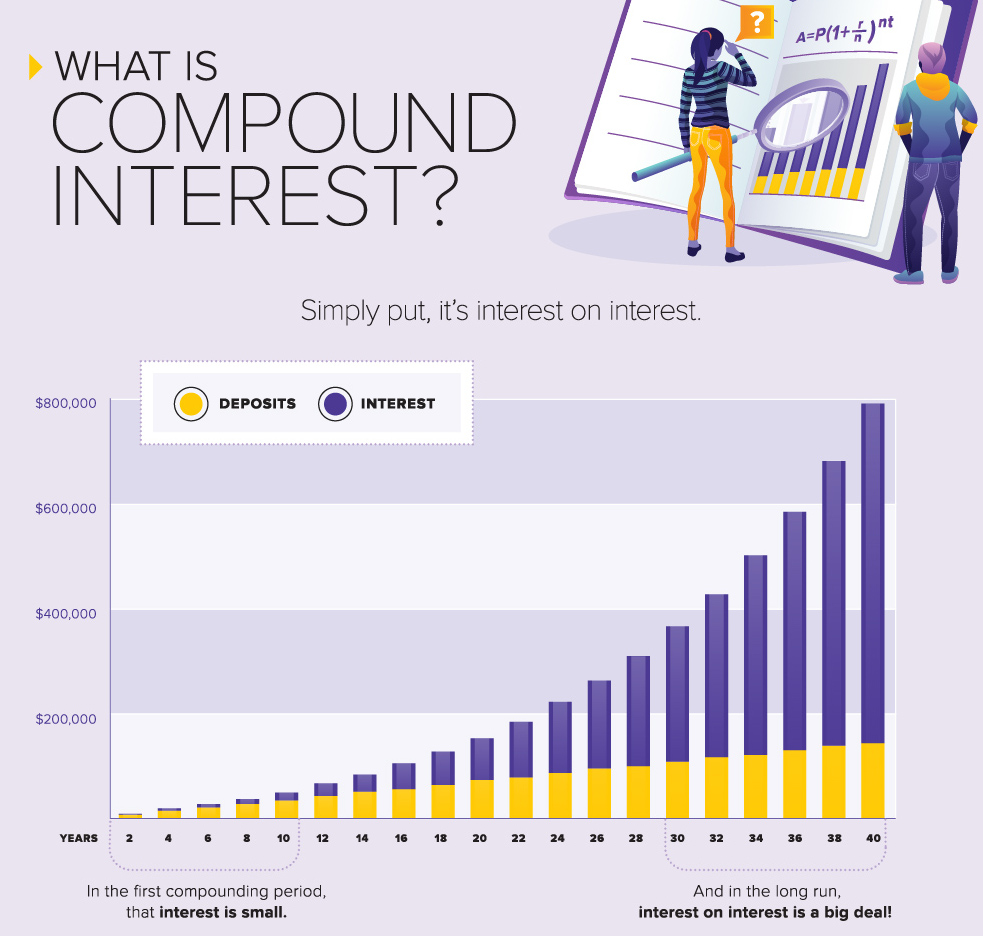

What is Compound Interest? The "Interest on Interest" Phenomenon

Now, for the game-changer: compound interest.

Compound interest is when you earn interest not only on your initial principal but also on the accumulated interest from previous periods. In essence, your interest starts earning its own interest. This is why it’s often referred to as "interest on interest."

Think of it like a snowball rolling down a hill:

- You start with a small snowball (your initial principal).

- As it rolls, it picks up more snow (it earns interest).

- The bigger the snowball gets, the more snow it can pick up with each rotation (the more interest it earns, the more rapidly it grows).

How it works:

The interest earned is added back to the principal, and then the next interest calculation is based on this new, larger total. This creates an accelerating growth pattern.

Let’s revisit our example with compound interest:

You deposit $1,000 into an account that pays 5% interest per year, compounded annually.

-

Year 1:

- Starting Balance: $1,000

- Interest Earned: $1,000 x 0.05 = $50

- New Balance: $1,000 + $50 = $1,050

-

Year 2:

- Starting Balance: $1,050 (your original principal + last year’s interest)

- Interest Earned: $1,050 x 0.05 = $52.50

- New Balance: $1,050 + $52.50 = $1,102.50

-

Year 3:

- Starting Balance: $1,102.50

- Interest Earned: $1,102.50 x 0.05 = $55.13

- New Balance: $1,102.50 + $55.13 = $1,157.63

Notice the difference? After three years, with simple interest, you had $1,150. With compound interest, you have $1,157.63. While the difference seems small initially, imagine this over 10, 20, or even 40 years! The gap widens dramatically.

Why is Compound Interest So Powerful? The Exponential Effect

The true power of compound interest lies in its exponential growth. Unlike linear growth (simple interest), where growth is steady, exponential growth starts slow but then accelerates rapidly, like a hockey stick curve.

Here’s why it’s a financial game-changer:

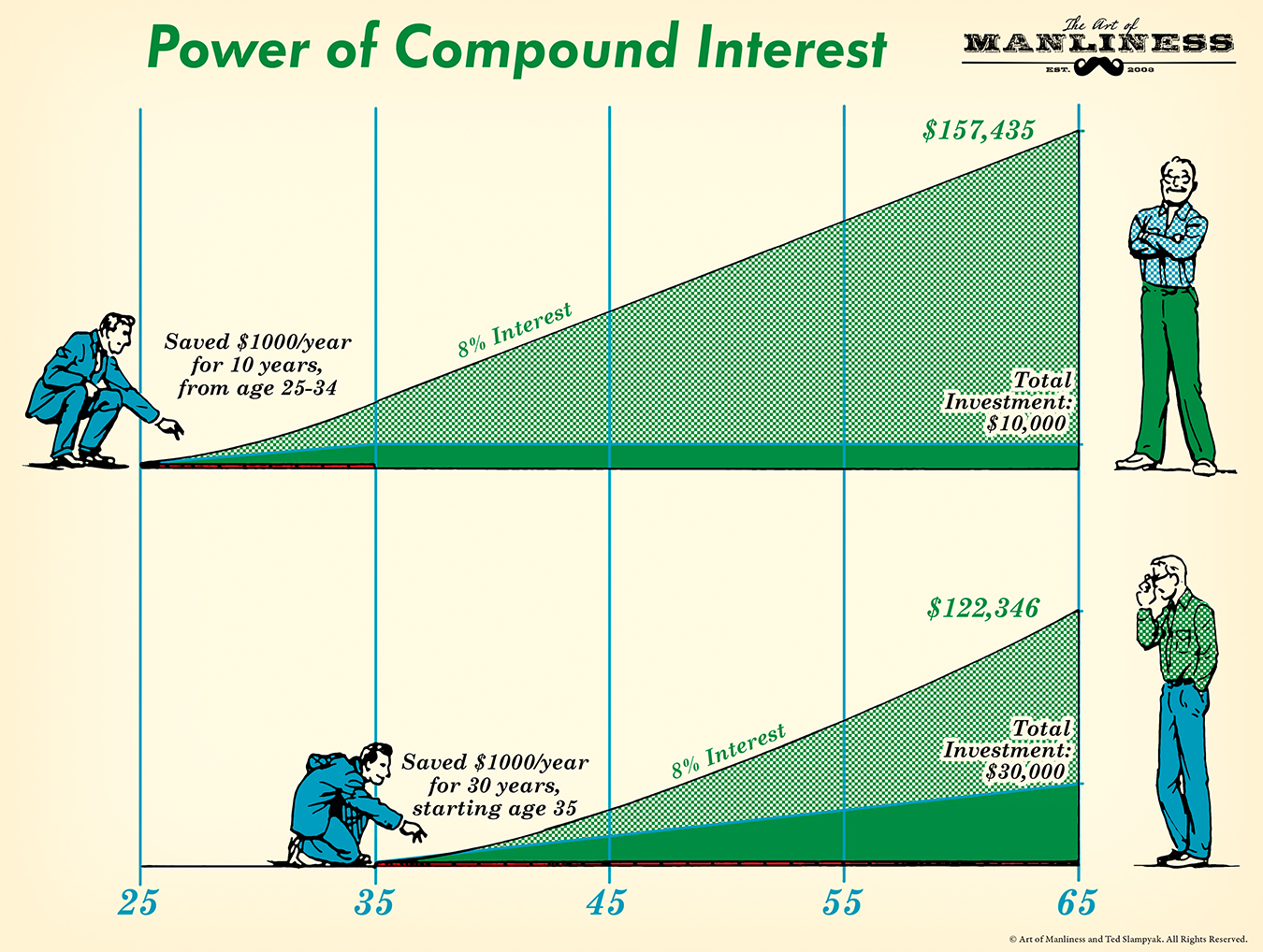

- Time is Your Ally: The longer your money has to compound, the more significant the effect. Early starters have a massive advantage because their money has more time to "work" for them.

- The Snowball Effect: As your balance grows, the amount of interest earned in each period also grows. This creates a powerful positive feedback loop.

- Small Sums Become Large: You don’t need to be rich to start. Consistent, even modest, contributions combined with the power of compounding can lead to substantial wealth over decades.

- Battles Inflation: While not directly inflation-fighting, earning compound interest helps your money grow faster than the rate of inflation, preserving and increasing your purchasing power over time.

Key Factors Influencing Compound Interest Growth

Several elements play a crucial role in determining how quickly your money grows through compounding:

- Initial Principal: The amount of money you start with. A larger initial sum will naturally earn more interest from the outset.

- Interest Rate: The percentage rate at which your money grows. A higher interest rate means faster growth, assuming all other factors are equal.

- Compounding Frequency: How often the interest is calculated and added to the principal.

- Annually: Once a year.

- Semi-annually: Twice a year.

- Quarterly: Four times a year.

- Monthly: Twelve times a year.

- Daily: Every day.

The more frequently interest is compounded, the faster your money grows, as interest starts earning interest sooner. Daily compounding is generally the most beneficial for savers.

- Time Horizon: This is arguably the most critical factor. The longer your money has to compound, the more powerful the effect. Starting early is far more impactful than trying to catch up later, even with larger contributions.

- Regular Contributions: While not strictly part of the compound interest formula itself, consistently adding to your principal balance significantly supercharges the compounding effect. Each new contribution immediately starts earning interest and compounding.

Real-World Applications of Compound Interest

Compound interest isn’t just a theoretical concept; it’s the engine behind many everyday financial products and strategies:

- Savings Accounts: While typically offering low interest rates, even a basic savings account demonstrates compounding, usually monthly or daily.

- Certificates of Deposit (CDs): These offer fixed interest rates for a set period, and the interest often compounds.

- Retirement Accounts (401(k)s, IRAs): This is where compound interest truly shines! Contributions to these accounts are invested, and the returns (interest, dividends, capital gains) compound over decades until retirement. This is the primary way most people build significant retirement wealth.

- Investment Accounts (Stocks, Mutual Funds, ETFs): When you invest in assets that pay dividends or reinvest earnings, those reinvested amounts start earning their own returns, leading to powerful compounding growth.

- Bonds: Interest earned on bonds can often be reinvested to compound.

The Dark Side of Compounding: Debt

It’s crucial to understand that compound interest works both ways. Just as it can build your wealth, it can also erode it if you’re on the wrong side of the equation.

- Credit Card Debt: This is the most notorious example. High-interest credit card balances compound rapidly, making it incredibly difficult to pay off debt if you’re only making minimum payments. The interest accrues on the original balance and the unpaid interest, quickly spiraling out of control.

- Loans (Mortgages, Student Loans): While these typically have lower rates than credit cards, the interest still compounds. Paying more than the minimum can significantly reduce the total interest paid over the life of the loan.

Strategies to Maximize the Power of Compound Interest

Ready to put this superpower to work for you? Here are actionable strategies:

- Start Early, Start Small: This is the golden rule of compounding. Even if you can only save a little, the earlier you begin, the more time your money has to grow exponentially.

- Example: Someone who invests $200/month from age 25 to 35 (10 years total) and then stops, could have more money by age 65 than someone who starts investing $200/month at age 35 and continues until age 65 (30 years total), assuming the same returns. Time beats larger contributions later on!

- Be Consistent with Contributions: Regularly adding to your investments (e.g., monthly contributions to your 401(k) or IRA) drastically accelerates the compounding process. Each new contribution becomes a new principal that starts earning interest immediately.

- Seek Higher Interest Rates (Wisely): While higher rates mean faster growth, they often come with higher risk. Balance your desire for returns with your comfort level for risk. For long-term goals like retirement, investing in diversified funds typically offers better returns than basic savings accounts.

- Let Your Money Grow (Don’t Withdraw): Resist the urge to dip into your compounded savings. Every withdrawal sets back the exponential growth. For long-term goals, "set it and forget it" is often the best approach.

- Understand the Rule of 72: This simple mental math trick helps you estimate how long it will take for your money to double.

- Formula: Divide 72 by the annual interest rate.

- Example: If you earn 6% interest, your money will roughly double in 72 / 6 = 12 years. If you earn 10%, it doubles in 7.2 years!

- Avoid High-Interest Debt: Make paying off credit card debt your top financial priority. The interest compounding against you on debt negates any positive compounding you might be trying to achieve with savings.

- Reinvest Earnings: If you receive dividends from stocks or interest from bonds, opt to reinvest them. This automatically adds them to your principal, allowing them to compound further.

Common Myths About Compound Interest

- "It only works if you have a lot of money to start with."

- False! The power comes from time and consistency, not just initial wealth. Even small, regular contributions can lead to significant sums over decades.

- "It’s too complicated for me to understand."

- False! As we’ve seen, the core concept is simple: interest earning interest. You don’t need to be a math genius to benefit from it.

- "You need to be an expert investor."

- False! You can harness compound interest through simple, low-cost investment vehicles like index funds or target-date retirement funds, which are managed for you.

Conclusion: Your Financial Superpower Awaits

Compound interest is not a trick or a secret reserved for the wealthy; it’s a fundamental principle of financial growth available to everyone. It’s the silent, relentless force that can transform modest savings into a substantial nest egg.

By understanding how "interest on interest" works, starting early, staying consistent, and avoiding the pitfalls of high-interest debt, you can leverage this incredible power to achieve your financial goals, whether it’s buying a home, funding your children’s education, or securing a comfortable retirement.

Don’t just save your money; let your money work for you. The sooner you start, the more profound the impact of compound interest will be on your financial future. Begin today, and watch your wealth grow exponentially!

Post Comment