How to Create a Realistic Monthly Budget: Your Beginner’s Guide to Financial Freedom

Feeling overwhelmed by your finances? Do you watch your money disappear each month without knowing where it all went? You’re not alone. Many people struggle with managing their money, leading to stress, missed goals, and a constant feeling of being behind.

The good news? Creating a realistic monthly budget is your superpower for taking control. It’s not about deprivation; it’s about clarity, intentionality, and building a foundation for financial peace and freedom. This comprehensive guide will walk you through the process, step by step, in a way that’s easy for any beginner to understand and implement.

Why Do You Need a Realistic Monthly Budget?

Before we dive into the "how," let’s understand the "why." A budget isn’t a straitjacket; it’s a map that shows you where your money is going and helps you direct it where you want it to go.

Here’s why it’s essential:

- Gain Control: You’ll know exactly how much you earn and spend, giving you power over your financial situation.

- Reduce Stress: Money worries are a leading cause of stress. A budget brings predictability and peace of mind.

- Achieve Financial Goals: Whether it’s saving for a down payment, a dream vacation, retirement, or paying off debt, a budget helps you allocate funds towards your aspirations.

- Identify Waste: You might be surprised where your money is truly going. A budget helps you spot unnecessary spending.

- Avoid Debt: By understanding your limits, you can avoid overspending and accumulating high-interest debt.

- Build Savings: A budget makes saving a deliberate act, not just what’s left over (which is often nothing!).

What Makes a Budget "Realistic"?

This is the crucial part. Many people try budgeting, fail, and then give up because their budget was too strict or didn’t account for real life. A realistic budget is:

- Honest: It reflects your actual income and spending, not what you wish they were.

- Flexible: Life happens! A realistic budget has some wiggle room for unexpected expenses or occasional treats.

- Sustainable: It allows for "fun money" and doesn’t make you feel deprived. If it’s too restrictive, you’ll ditch it.

- Regularly Reviewed: Your income and expenses change, so your budget needs to adapt.

Step-by-Step: How to Create Your Realistic Monthly Budget

Ready to take charge? Let’s break down the process into simple, actionable steps.

Step 1: Gather Your Financial Data

Before you can build your budget, you need to know what you’re working with. This step is about honest self-assessment, not judgment.

What you’ll need:

- Bank statements (checking and savings) for the last 1-3 months

- Credit card statements for the last 1-3 months

- Pay stubs

- Bills (utility, internet, phone, rent/mortgage, loan statements)

- Receipts (if you pay cash for many things)

- A notebook, spreadsheet, or budgeting app

Step 2: Calculate Your Total Monthly Income

This is the money coming in. It’s important to use your net income (take-home pay after taxes, deductions, and benefits), not your gross income.

How to calculate:

- Salaried Employees: Look at your pay stubs. If you’re paid bi-weekly, multiply your bi-weekly net pay by 26 (weeks in a year), then divide by 12 (months in a year) to get an accurate monthly average.

- (Example: $2,000 bi-weekly net pay x 26 weeks = $52,000/year. $52,000 / 12 months = $4,333.33 average monthly net income.)

- Hourly Employees/Variable Income: This can be trickier.

- If your hours are consistent, use the average of your last 2-3 months’ net pay.

- If your income fluctuates significantly, use the lowest amount you typically earn in a month. This creates a "buffer" and ensures you don’t overspend when income is lower. You can always adjust later if you consistently earn more.

- Other Income: Include any regular income sources like child support, alimony, side hustle income (after expenses), rental income, or government benefits.

Write down your total estimated monthly net income. This is your budget’s starting point.

Step 3: List & Categorize Your Monthly Expenses

This is where you figure out where your money is currently going. Be thorough and honest. It’s helpful to break expenses into two main categories: Fixed and Variable.

A. Fixed Expenses (Non-Negotiable & Consistent)

These are expenses that are generally the same amount each month and are difficult to change quickly.

- Housing: Rent/Mortgage, Renter’s/Homeowner’s Insurance

- Loans: Car payments, student loan payments, personal loan payments

- Insurance: Health, car, life insurance (if paid monthly)

- Subscriptions: Streaming services (Netflix, Spotify), gym memberships, software subscriptions

- Childcare: Regular daycare or nanny costs

B. Variable Expenses (Fluctuating & More Flexible)

These expenses change from month to month and often offer the most opportunity for adjustment.

- Food: Groceries, dining out, coffee runs

- Utilities: Electricity, gas, water, trash, internet, cell phone (some of these can be somewhat fixed, but often fluctuate based on usage)

- Transportation: Gas, public transport fares, car maintenance, ride-sharing

- Personal Care: Haircuts, toiletries, cosmetics

- Entertainment: Movies, concerts, hobbies, nights out

- Shopping: Clothing, electronics, home goods

- Medical: Prescriptions, co-pays (if regular)

- Miscellaneous/Buffer: This is important! A small amount for unexpected small costs or "just in case" money.

- Savings/Debt Repayment: While a goal, you should budget for these as expenses if you’re serious about them (e.g., a specific amount for an emergency fund, or extra debt payments).

How to get the numbers for variable expenses:

- Look at your bank and credit card statements! This is the best way to see your actual spending habits. Categorize every transaction for the past 1-3 months.

- Average it out: If you spent $400 on groceries one month, $500 the next, and $450 the third, average it to ($400+$500+$450)/3 = $450.

- Don’t forget irregular expenses: Things that don’t happen every month (car registration, annual subscriptions, holiday gifts). Estimate these by dividing the annual cost by 12 and setting aside that amount each month into a separate savings bucket.

Create a detailed list of all your estimated monthly expenses, categorized.

Step 4: Track Your Spending (The Most Important Step for Realism!)

You’ve estimated your expenses based on past behavior, but now it’s time to see if those estimates hold true in real-time. This is where many budgets fall apart if not done consistently.

Methods for tracking:

- Budgeting Apps:

- Mint: Free, links to your accounts, automatically categorizes transactions. Great for beginners.

- YNAB (You Need A Budget): Paid, but very powerful for "zero-based budgeting" (giving every dollar a job).

- Rocket Money, Simplifi, Personal Capital: Other popular options with varying features.

- Spreadsheets (Excel/Google Sheets):

- You can create your own or download free templates. Offers maximum customization.

- Pen and Paper:

- Simple and effective for some. Just write down every expense as it happens.

- Notebook/Journal: Keep it in your pocket and jot down every purchase.

Consistency is key. Track every single dollar you spend for at least one full month, ideally two or three. This will reveal your true spending habits and highlight areas where your estimates might be off.

Step 5: Compare Your Income vs. Your Expenses

Now for the moment of truth.

- Total Monthly Income – Total Monthly Expenses = Balance

What does your balance tell you?

- Positive Balance (Income > Expenses): Congratulations! You have a surplus. This means you have money left over after all your expenses are paid. You can now direct this surplus towards savings, debt repayment, or specific financial goals.

- Negative Balance (Expenses > Income): Don’t panic, this is common! It means you’re spending more than you earn. This is precisely why you’re budgeting, and now you have the information to make changes.

- Zero Balance (Income = Expenses): This is the goal of "zero-based budgeting," where every dollar has a job (including savings).

Step 6: Make Adjustments to Create a Realistic Budget

If your balance is negative, or if you want to free up more money for your goals, it’s time to make strategic adjustments. This is where your budget becomes truly realistic and sustainable.

How to adjust:

- Start with Variable Expenses: These are the easiest to cut or reduce without major lifestyle changes.

- Dining Out/Takeaway: Can you cook more meals at home? Pack your lunch?

- Groceries: Meal plan, shop with a list, avoid impulse buys, look for sales.

- Entertainment: Look for free or low-cost activities. Reduce streaming services you don’t use often.

- Shopping: Implement a "30-day rule" for non-essential purchases.

- Transportation: Carpool, use public transport, walk/bike more.

- Examine Fixed Expenses: These are harder to change but can offer significant savings.

- Subscriptions: Cancel unused memberships (gym, streaming, apps).

- Insurance: Shop around for better rates annually.

- Utilities: Be mindful of energy consumption (turn off lights, adjust thermostat). Negotiate with your internet or phone provider.

- Loans: Refinance high-interest loans if possible (student loans, personal loans).

- Housing: This is a big one. If rent/mortgage is too high, consider downsizing or finding a roommate in the long term.

- Increase Your Income (If Possible):

- Ask for a raise.

- Take on a side hustle (freelancing, gig work).

- Sell unused items.

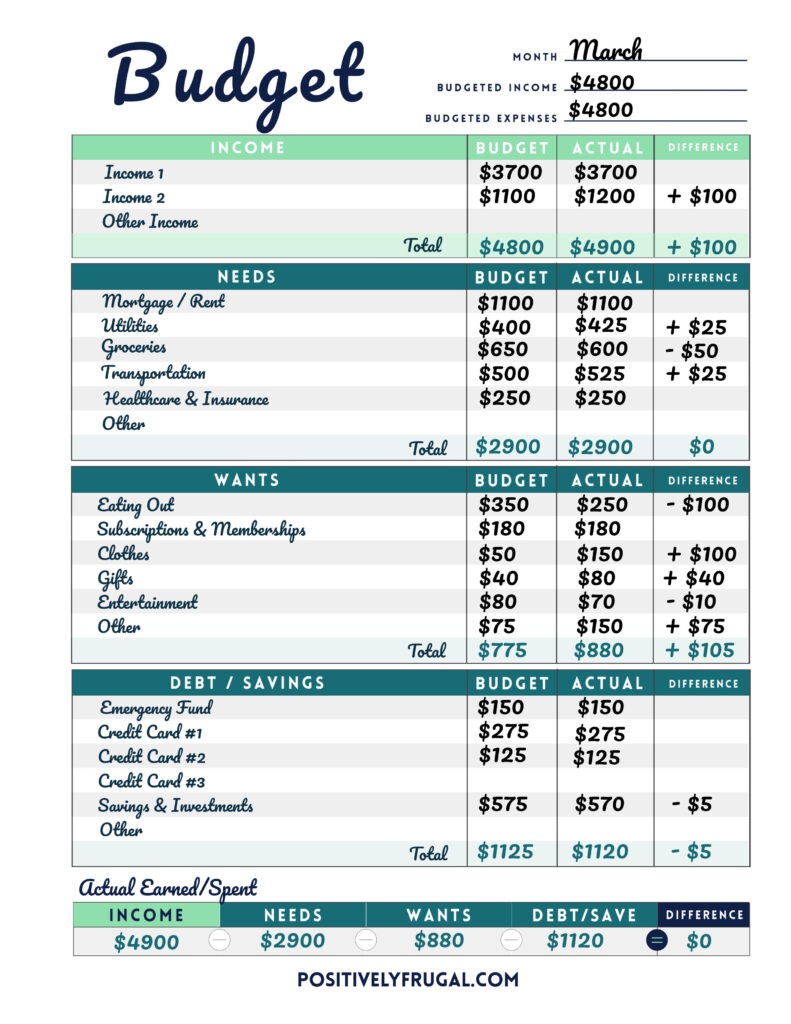

The 50/30/20 Rule (A Popular Guideline):

This is a great starting point for beginners, though not a strict rule. It suggests allocating your after-tax income as follows:

- 50% for Needs: Housing, utilities, groceries, transportation, insurance, minimum loan payments.

- 30% for Wants: Dining out, entertainment, hobbies, shopping, vacations, subscriptions you could live without.

- 20% for Savings & Debt Repayment: Emergency fund, retirement, investments, extra debt payments (above minimums).

Use this as a framework to see if your current spending aligns. If your "wants" are eating into your "needs" or "savings," you know where to focus your adjustments.

Step 7: Automate Your Savings & Bills

Once you’ve made your adjustments and have a positive balance, automate as much as possible. This makes your budget work for you and reduces the chance of "forgetting" to save.

- Automate Savings: Set up automatic transfers from your checking to your savings account (emergency fund, specific goals) on payday. Even small amounts add up.

- Automate Bills: Set up auto-pay for your fixed expenses (rent, loans, subscriptions) so you never miss a payment.

Step 8: Review and Adjust Regularly

Your budget isn’t a "set it and forget it" tool. Life changes, and so should your budget.

- Monthly Review: At the end of each month, review your actual spending against your budgeted amounts.

- Where did you overspend? Why?

- Where did you underspend?

- Are your income or expenses likely to change next month?

- Quarterly/Annual Review: Do a more in-depth review. Are your goals still the same? Do you need to adjust major categories?

- Be Patient and Forgiving: You won’t get it perfect the first month. There will be surprises. Don’t beat yourself up; just learn from it and adjust for next time. That’s what makes it realistic!

Tools and Resources to Help You Budget

You don’t have to do this alone. There are many tools available:

- Budgeting Apps: (As mentioned above) Mint, YNAB, Rocket Money, Simplifi.

- Spreadsheet Templates: Google Sheets and Microsoft Excel offer many free budgeting templates. Search online for "free monthly budget template."

- Pen and Paper: Sometimes the simplest method is the best for getting started.

- Online Banking Tools: Many banks now offer built-in budgeting and spending analysis tools within their online platforms.

- Financial Advisors/Coaches: For more complex situations or if you need personalized guidance, consider consulting a professional.

Common Budgeting Mistakes to Avoid

- Being Too Restrictive: Don’t cut out all your "wants." A sustainable budget includes money for fun and enjoyment.

- Forgetting Categories: Account for all your money, including irregular expenses like car maintenance, annual memberships, or gifts.

- Not Tracking Consistently: This is the biggest pitfall. If you don’t track, you won’t know if your budget is working.

- Giving Up Too Soon: The first few months are the hardest. Stick with it! It gets easier and more rewarding.

- Budgeting with Gross Income: Always use your net (take-home) pay.

- Ignoring "Miscellaneous" or "Buffer": Always leave a small buffer for unexpected small expenses.

- Not Involving Your Partner: If you share finances, budgeting needs to be a team effort.

Start Your Journey to Financial Freedom Today!

Creating a realistic monthly budget is one of the most powerful steps you can take toward financial stability and freedom. It transforms your relationship with money from one of fear and confusion to one of control and confidence.

It might feel daunting at first, but remember: every expert was once a beginner. Start small, be patient with yourself, track diligently, and adjust as you go. You’ll be amazed at how quickly you can gain clarity, reduce stress, and start building the financial future you’ve always dreamed of.

What’s your first step going to be? Gather your statements, download an app, or grab a notebook? The journey begins now!

Post Comment