Unlocking Your Financial Future: Open Banking Regulations, Data Sharing, and the New Era of Competition

Imagine a world where managing your money isn’t a fragmented mess of logging into multiple bank accounts, but a seamless, integrated experience. A world where innovative tools can instantly analyze your spending across all your cards, find you better deals on loans, or even predict your future financial needs with remarkable accuracy. This isn’t science fiction; it’s the promise of Open Banking, and it’s being made a reality by crucial Open Banking Regulations.

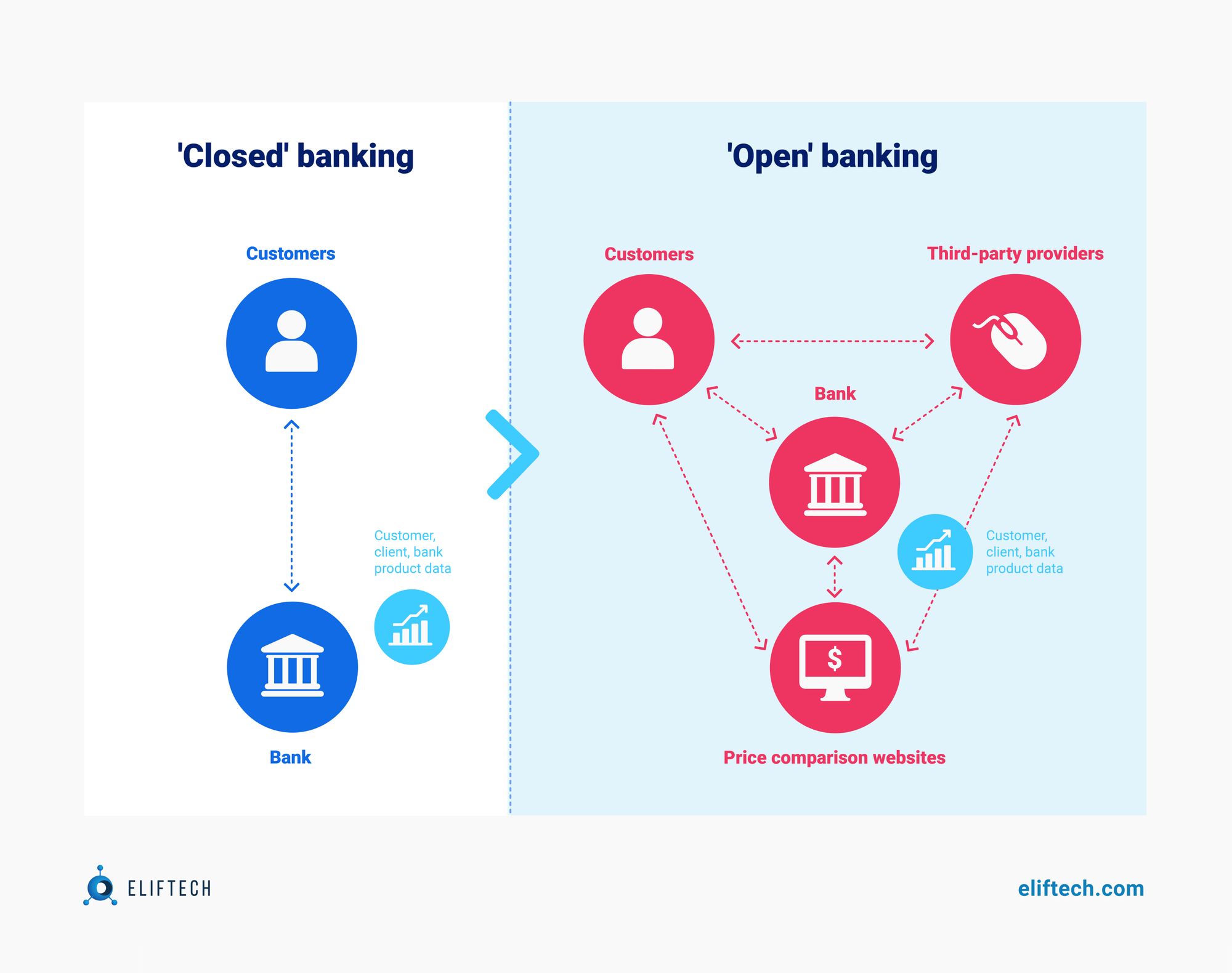

For beginners, the terms "Open Banking," "data sharing," and "competition" in the financial sector might sound complex or even a little intimidating. But at its heart, Open Banking is about giving you, the customer, more control over your own financial data and using that control to foster a vibrant, competitive financial landscape.

This long-form article will break down Open Banking regulations, explain the pivotal role of data sharing, and show how it’s sparking a revolution in financial services, all in easy-to-understand language.

What Exactly is Open Banking? A Simple Explanation

Before diving into regulations, let’s clarify what Open Banking means.

Open Banking is a secure way for you to share your financial data (like bank account transactions, balances, and credit card spending) with trusted third-party providers (TPPs) – but only with your explicit permission.

Think of it like giving an app permission to access your photos or contacts on your smartphone. You decide what data is shared and with whom.

Key components of Open Banking:

- APIs (Application Programming Interfaces): These are like digital translators that allow different computer systems (e.g., your bank’s system and a budgeting app’s system) to talk to each other securely and efficiently.

- Customer Consent: This is paramount. No data can be shared without your clear, informed, and explicit permission. You are in control.

- Third-Party Providers (TPPs): These are the companies, often tech-savvy FinTechs (financial technology companies), that use the shared data to offer new services. Examples include:

- Account Information Service Providers (AISPs): Apps that give you a consolidated view of all your bank accounts in one place.

- Payment Initiation Service Providers (PISPs): Services that allow you to make payments directly from your bank account to a merchant, bypassing traditional card networks.

In essence, Open Banking moves financial data from being locked away in individual banks to being accessible by other authorized services, with your permission, to benefit you.

Why Do We Need Regulations for Open Banking? The Rules of the Game

While the idea of better financial services sounds great, simply letting anyone access financial data would be chaotic and dangerous. This is where Open Banking Regulations come in.

These regulations are the rulebooks that ensure Open Banking operates safely, fairly, and with the customer’s best interests at heart. They establish:

- Trust and Security: They mandate strict security protocols for data sharing, protecting your sensitive financial information from fraud and misuse. This includes requirements for encryption, strong authentication, and secure communication channels.

- Fair Play and Competition: Historically, traditional banks held a near-monopoly on customer data. Regulations level the playing field, forcing banks to open up their data (securely) to new players. This encourages competition and innovation.

- Consumer Protection: Regulations define your rights as a consumer, including your right to consent, to revoke consent at any time, and to know exactly what data is being shared and for what purpose. They also establish mechanisms for resolving disputes.

- Standardization: They create common standards for how data is shared (e.g., using specific API formats). This makes it easier for different financial institutions and FinTechs to connect and work together.

- Driving Adoption: By setting clear rules and building trust, regulations encourage both financial institutions to participate and consumers to embrace Open Banking services.

Without these regulations, Open Banking would be a wild west, lacking the security, fairness, and trust necessary for widespread adoption.

Key Open Banking Regulations Around the World

Different regions and countries have adopted their own frameworks for Open Banking, reflecting their unique market conditions and regulatory philosophies. Here are some of the most prominent:

1. The European Union & United Kingdom: PSD2 and CMA

The Revised Payment Services Directive (PSD2) is arguably the most influential Open Banking regulation globally. Implemented across the European Union (EU) and the UK (even after Brexit, the UK has largely retained its principles), PSD2 mandates that banks must:

- Allow customers to securely share their account data with third-party providers.

- Allow third-party providers to initiate payments directly from a customer’s bank account.

Key aspects of PSD2:

- Strong Customer Authentication (SCA): Requires multi-factor authentication for online payments and accessing financial data, significantly enhancing security.

- Access to Account (XS2A): This is the core principle that forces banks to provide secure interfaces (APIs) for TPPs to access customer data with consent.

In the UK, the Competition and Markets Authority (CMA) also played a significant role. Its investigation into the retail banking market led to a specific Open Banking Initiative that went beyond PSD2 in some aspects, particularly in creating standardized APIs and fostering a central "Open Banking Implementation Entity" (OBIE) to oversee the rollout. This proactive approach has made the UK a global leader in Open Banking adoption.

2. Australia: The Consumer Data Right (CDR)

Australia’s Consumer Data Right (CDR) takes Open Banking a step further. It’s a broader economy-wide data sharing framework, starting with banking (called "Open Banking") but extending to energy, telecommunications, and potentially other sectors.

Key features of CDR:

- Data Portability: Gives consumers the right to access and transfer their data from one service provider to another.

- Broader Scope: While initially focused on banking, its ambition is to cover all consumer data, allowing for a more holistic view of a customer’s interactions with various industries.

- Consent-Driven: Like PSD2, customer consent is central and must be explicit and revocable.

3. Other Notable Regions and Initiatives

- Canada: Has a phased approach towards a made-in-Canada Open Banking system, focusing on consumer-driven finance.

- Singapore: While not having a single overarching regulation like PSD2, the Monetary Authority of Singapore (MAS) has strongly encouraged API adoption and data sharing through various initiatives and guidelines.

- Brazil: Implemented its own comprehensive Open Banking framework, aiming to boost competition and financial inclusion.

- India: While not strictly "Open Banking," the Unified Payments Interface (UPI) has created a robust real-time payment infrastructure that facilitates many similar functionalities, enabling innovation.

The global trend is clear: governments and regulators increasingly recognize the benefits of data sharing for consumers and the economy, leading to a patchwork of similar yet distinct regulatory frameworks worldwide.

Data Sharing: The Heartbeat of Open Banking

At the core of Open Banking is the secure and consented sharing of your financial data. But what exactly does that mean, and how does it work in practice?

How Data Sharing Works (Simplified)

- You Decide: You want to use a new budgeting app that consolidates all your accounts.

- Consent is Key: The app asks for your permission to access your bank account data. It will clearly state what data it wants (e.g., account balances, transaction history) and for how long.

- Secure Authentication: If you agree, the app redirects you to your bank’s secure portal. You log in using your usual bank credentials (the app never sees these!).

- Authorization: Your bank then asks you to confirm what data you’re authorizing the app to access.

- API Connection: Once authorized, your bank uses its secure API to share the agreed-upon data directly with the app. This is not like giving the app your login details; it’s a direct, machine-to-machine transfer.

- Real-Time Insights: The app receives the data and uses it to provide you with the service you requested (e.g., show all your balances in one place, categorize your spending).

What Kinds of Data Are Shared?

Open Banking typically allows for the sharing of read-only financial data. This means the third-party provider can see your data, but cannot move money or make changes to your account without further explicit instructions (like initiating a payment, which requires a separate consent process).

Common types of data shared include:

- Account Information: Account numbers, names, balances.

- Transaction History: Details of past transactions (date, amount, merchant, description).

- Product Information: Details about your financial products (e.g., loan terms, credit card limits).

- Standing Orders & Direct Debits: Information about recurring payments.

Crucially, Open Banking regulations never allow a third-party app to access your bank login credentials (username, password). Your bank handles the authentication process directly with you, keeping your sensitive login information secure.

The Role of Consent and Security Measures

- Granular Consent: You can often choose exactly what data you want to share (e.g., just current account data, not savings).

- Time-Limited Consent: Consent is usually granted for a specific period (e.g., 90 days), after which the app must ask for your permission again. You can revoke consent at any time.

- Revocability: If you change your mind, you can easily revoke an app’s access to your data through your bank’s online portal or the app itself.

- Encryption: Data is encrypted both when it’s stored and when it’s transmitted between your bank and the third-party provider.

- Regulatory Oversight: TPPs must be regulated and authorized by financial authorities (e.g., the Financial Conduct Authority in the UK) to ensure they meet strict security and data protection standards.

Boosting Competition and Innovation in Financial Services

This secure, consented data sharing is the engine driving a massive wave of competition and innovation in the financial industry. Here’s how:

1. New Players (FinTechs) Enter the Arena

Historically, starting a bank was incredibly difficult due to high capital requirements and regulatory hurdles. Open Banking lowers the barrier to entry for FinTech companies. They don’t need to build a full banking infrastructure; instead, they can focus on specific, innovative services by leveraging existing bank data.

This has led to a boom in:

- Budgeting and Financial Management Apps: Tools that pull data from all your accounts to give you a holistic view of your finances, categorize spending, and help you save.

- Personalized Lending: Apps that can quickly assess your financial health across multiple accounts to offer more tailored and potentially cheaper loan products.

- Smart Savings Tools: Services that analyze your spending patterns and automatically transfer small amounts to savings accounts when you can afford it.

- Faster Payments: Direct bank-to-bank payments that can be quicker and cheaper than traditional card payments.

- Account Switching Services: Tools that make it easier to compare and switch bank accounts based on your specific needs and spending habits.

2. Improved Customer Experience

With more competition, the focus shifts to the customer. Banks and FinTechs are compelled to offer:

- Seamless Integration: No more logging into multiple portals.

- Personalized Services: Offers and advice tailored to your actual financial behavior.

- Convenience: Managing all your finances from a single dashboard or app.

3. Fairer Pricing and Better Products

When banks know their customers can easily compare and switch to competitors offering better rates or services, they are incentivized to:

- Offer more competitive interest rates on savings and loans.

- Reduce fees for various services.

- Develop new and improved products that genuinely meet customer needs.

This ultimately leads to a more efficient and customer-centric financial market.

4. Financial Inclusion

Open Banking can also play a vital role in financial inclusion. For individuals or small businesses with limited credit history, traditional lending models often fall short. By allowing them to securely share their transaction data, FinTechs can gain a clearer picture of their financial behavior, potentially enabling access to credit or other financial services they were previously excluded from.

Benefits for You, The Consumer

So, what does all this mean for the average person? Here are some tangible benefits:

- Better Budgeting: Get a complete picture of your spending across all accounts and cards in one place, making it easier to track where your money goes.

- Smarter Savings: Tools that analyze your income and spending to suggest optimal savings amounts or even automate transfers.

- Quicker and Easier Loan Applications: Share your financial data directly and securely with lenders, potentially speeding up approval times and getting you better rates.

- Personalized Financial Advice: Receive tailored recommendations based on your actual financial situation, not just generic advice.

- Effortless Account Switching: Find and switch to a new bank that offers better terms, with less paperwork and hassle.

- Enhanced Payment Options: Make direct payments from your bank account for online purchases, potentially offering more security or lower fees than traditional methods.

- Access to Innovative Services: Explore a growing marketplace of apps and services designed to help you manage, save, invest, and borrow money more effectively.

Open Banking puts you firmly in the driver’s seat of your financial life.

Challenges and the Road Ahead

While the promise of Open Banking is immense, there are still challenges to address:

- Public Awareness and Trust: Many consumers are still unaware of Open Banking or have concerns about data privacy and security. Education is key to building trust and encouraging adoption.

- Data Privacy Concerns: While regulations are strict, some consumers worry about how their data might be used or if it could fall into the wrong hands. Clear communication about data handling is crucial.

- Standardization Across Borders: While many countries have Open Banking, the specific standards and regulations can differ, making it challenging for global FinTechs to operate seamlessly across multiple markets.

- API Quality and Consistency: Not all bank APIs are created equal. Ensuring high-quality, reliable, and consistent API performance across all financial institutions is an ongoing effort.

- Monetization Models for FinTechs: Finding sustainable business models for FinTechs that rely on Open Banking data, without resorting to excessive fees or data exploitation, is a continuous challenge.

- "Open Finance" and Beyond: The next evolution is "Open Finance," which extends the principles of Open Banking to include other financial products like pensions, investments, and insurance. This will bring even more opportunities but also greater regulatory complexity.

Despite these challenges, the trajectory for Open Banking is overwhelmingly positive. As regulations mature, technology advances, and consumer trust grows, Open Banking is set to become the standard for how we interact with our money.

Conclusion: A Brighter, More Competitive Financial Future

Open Banking regulations are not just about complex rules; they are about fundamentally transforming the financial industry for the better. By mandating secure data sharing with customer consent, these regulations have unlocked unprecedented levels of competition and innovation.

For you, the consumer, this means:

- More choice: A wider array of financial products and services.

- Better value: More competitive pricing and improved terms.

- Greater control: You decide who sees your data and for what purpose.

- Enhanced convenience: Managing your money becomes simpler and more integrated.

The era of traditional banks holding exclusive rights to your financial data is fading. In its place, a dynamic, customer-centric financial ecosystem is emerging, powered by Open Banking and its forward-thinking regulations. Embrace it, understand your rights, and get ready for a future where managing your money is truly in your hands.

Post Comment