Producer Sentiment Surveys: What They Tell Us About Global Manufacturing – Your Guide to Economic Insight

Unlocking Global Manufacturing Trends with Business Confidence

Ever wondered how economists, investors, and policymakers get a pulse on the global economy before the official numbers are even out? The answer often lies in something called Producer Sentiment Surveys. These aren’t just dry statistical reports; they are crucial economic indicators that act like a crystal ball, offering invaluable insights into the health and future direction of global manufacturing and the broader economy.

In a world where supply chains are increasingly interconnected and economic shifts can happen rapidly, understanding the mood and expectations of businesses themselves is more vital than ever. This comprehensive guide will demystify producer sentiment surveys, explain why they are so important, and reveal what they truly tell us about the intricate world of global manufacturing.

What Exactly Are Producer Sentiment Surveys?

At their core, Producer Sentiment Surveys are systematic questionnaires sent to a wide range of businesses, typically within the manufacturing, services, construction, and retail sectors. The goal is to gauge their current business confidence and their expectations for the near future.

Think of it like taking the collective "temperature" of the business world. Instead of just looking at past sales figures (which are lagging indicators), these surveys ask businesses directly about their feelings and plans regarding:

- Production levels: Are they increasing or decreasing output?

- New orders: Are customers placing more or fewer orders?

- Employment: Are they hiring or laying off staff?

- Inventories: Are stockpiles growing or shrinking?

- Prices: Are they experiencing rising costs or planning to increase their own prices?

- Investment: Are they planning to invest in new equipment or expansion?

The responses are then compiled into an index, often presented as a single number that reflects the overall optimism or pessimism of the business community.

Why Are They So Important for Global Manufacturing?

Producer sentiment surveys are not just interesting trivia; they are powerful tools for several key reasons, especially when it comes to understanding global manufacturing:

- Early Warning System: Unlike "hard data" like GDP or industrial production, which are reported weeks or months after the fact, sentiment surveys offer a near real-time snapshot. Businesses are often the first to feel shifts in demand, supply, and costs. This makes these surveys excellent leading indicators of economic change.

- Future-Oriented Insights: The surveys primarily focus on expectations. What do manufacturers plan to do in the next 3-6 months regarding production, investment, and hiring? This forward-looking perspective is crucial for forecasting future economic activity.

- Qualitative Depth: While hard data tells us what happened, sentiment surveys often reveal why it happened or how businesses are reacting. For instance, a drop in sentiment might be attributed to rising energy costs or declining export orders, providing deeper context.

- Complements Hard Data: Sentiment data doesn’t replace official statistics but rather complements them. When both sentiment and hard data align, it strengthens the conviction about a particular economic trend. When they diverge, it signals an interesting point for further investigation.

- Global Reach: Major surveys are conducted across key manufacturing hubs worldwide, offering a comparative view of economic health and trends in different regions and their potential ripple effects.

How Do Producer Sentiment Surveys Work?

While the specifics vary by survey, the general methodology is similar:

- Sampling: A representative sample of businesses (ranging from small firms to large corporations) across various manufacturing sub-sectors (e.g., automotive, electronics, textiles, machinery) are selected.

- Questionnaires: Businesses receive questionnaires, usually monthly or quarterly. The questions are typically qualitative, asking respondents to indicate if conditions are "better," "worse," or "unchanged" compared to the previous period, or if they expect conditions to "improve," "deteriorate," or "stay the same."

- Data Compilation: Responses are aggregated and weighted (e.g., by company size or sector contribution to GDP) to create a composite index.

- Index Creation: Most surveys convert responses into an index number. For many surveys, particularly the widely followed Purchasing Managers’ Index (PMI), a reading of 50 is the crucial threshold:

- Above 50: Indicates expansion or improvement in the manufacturing sector.

- Below 50: Indicates contraction or deterioration.

- At 50: Suggests no change.

- The further away from 50, the stronger the expansion or contraction.

Key Indicators Within the Surveys

Beyond the headline index number, producer sentiment surveys break down responses into several sub-indices that provide granular detail about different aspects of manufacturing:

- New Orders: A key forward-looking indicator, showing customer demand. Rising new orders suggest future production increases.

- Production Volume: Reflects the actual output of goods.

- Employment Levels: Indicates whether manufacturers are hiring or reducing their workforce.

- Inventories: Tracks whether companies are building up or drawing down their stock of finished goods and raw materials. High inventories can signal weak demand, while low inventories might mean future production increases.

- Supplier Delivery Times: A critical supply chain indicator. Longer delivery times often signal increased demand or bottlenecks in the supply chain.

- Input Prices: Measures the cost pressures manufacturers face for raw materials, energy, and components. This is a crucial gauge of inflationary pressures.

- Output Prices: Indicates the prices manufacturers are charging for their finished goods, showing how much cost increases are being passed on to consumers or other businesses.

- Export Orders: Specifically tracks demand from international markets, reflecting the global trade environment.

Major Global Producer Sentiment Surveys to Watch

Several key surveys are closely watched by economists and financial markets worldwide:

- Purchasing Managers’ Index (PMI): This is arguably the most influential. Conducted in over 40 countries, including the US (ISM PMI), Eurozone (S&P Global PMI), UK, China (Caixin PMI), and Japan. The PMI surveys purchasing managers, who are often the first to see changes in supply, demand, and prices.

- Ifo Business Climate Index (Germany): A highly respected monthly survey that gauges business confidence in Germany, Europe’s largest economy. It surveys around 9,000 businesses across manufacturing, services, trade, and construction.

- ZEW Economic Sentiment Index (Germany): Another prominent German survey, this one focuses on the sentiment of financial market experts regarding the economic development in Germany and the Eurozone.

- Tankan Survey (Japan): Conducted quarterly by the Bank of Japan, the Tankan surveys a wide range of companies regarding their current business conditions and their forecasts for the future. It’s crucial for understanding the health of Japan’s export-oriented economy.

- National Surveys: Many other countries have their own national producer sentiment surveys (e.g., France’s INSEE Business Climate, Australia’s NAB Business Survey) that contribute to the global picture.

What Do They Tell Us About Global Manufacturing?

Now, let’s dive into the core of what these surveys reveal about the world of factories, production lines, and intricate global supply chains:

1. The Current Health of the Manufacturing Sector

The headline index (like the PMI) immediately tells us if manufacturing is expanding or contracting. A string of readings above 50 suggests a healthy, growing sector, while consistent readings below 50 point to a downturn. This is the first indicator of whether factories are busy or slowing down.

2. Future Trends and Expectations

The forward-looking components are paramount. If manufacturers expect new orders to increase and plan to boost production in the coming months, it signals future economic growth. Conversely, declining expectations for new orders and production foreshadows a potential slowdown or recession. This helps us anticipate:

- Investment cycles: Are businesses confident enough to invest in new machinery, technology, or factory expansions?

- Hiring trends: Will there be more manufacturing jobs or layoffs?

- Demand shifts: Are global consumers and businesses placing more orders for goods?

3. Supply Chain Insights and Disruptions

Sentiment surveys are incredibly valuable for understanding the state of global supply chains. Questions about supplier delivery times, backlogs, and inventory levels directly reflect supply chain efficiency and potential bottlenecks.

- Longer delivery times: Often indicate strong demand overwhelming supply, or real logistical issues (e.g., port congestion, labor shortages).

- Rising backlogs: Suggests that orders are coming in faster than they can be fulfilled, potentially leading to future production increases but also possible delays.

- Inventory levels: If businesses are reporting declining inventories of raw materials, it could signal strong future demand or difficulty sourcing inputs. Conversely, rising finished goods inventories might mean demand is weakening.

During periods of global disruption (like the COVID-19 pandemic or geopolitical conflicts), these indicators become even more critical for identifying where the pinch points are in the global manufacturing supply chain.

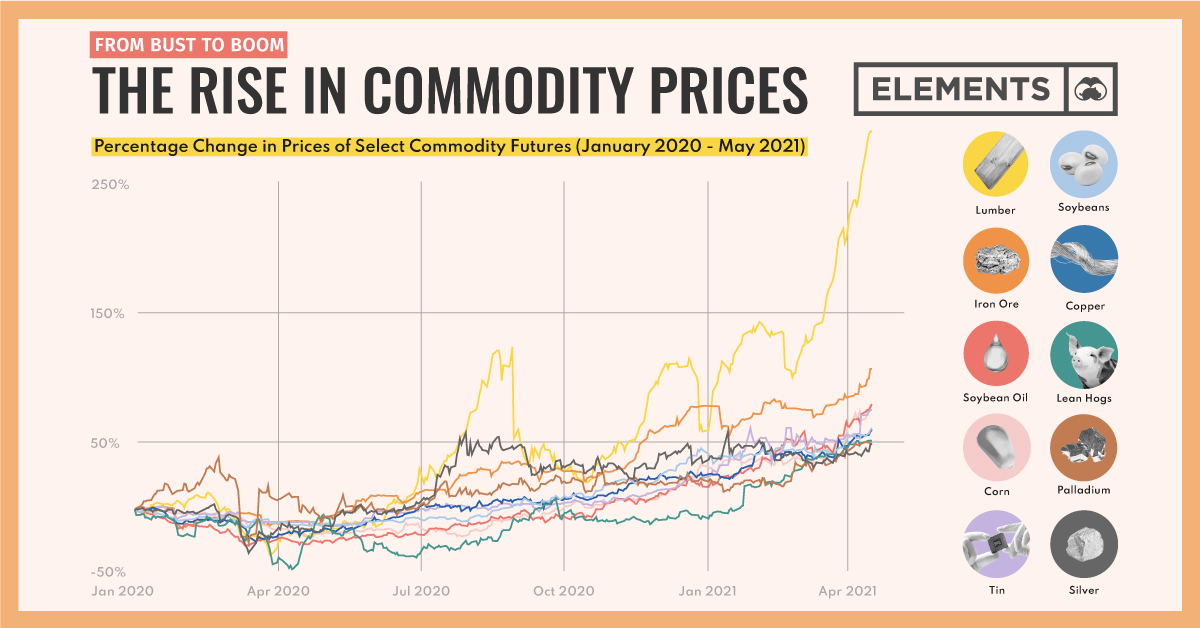

4. Inflationary Pressures

The sub-indices for "input prices" and "output prices" are direct gauges of inflation from the producer’s perspective.

- Rising Input Prices: When manufacturers report higher costs for raw materials, energy, and freight, it’s a strong signal of cost-push inflation. This tells us that consumer prices might rise soon as businesses pass on these higher costs.

- Rising Output Prices: If manufacturers are also reporting that they are raising the prices of their finished goods, it confirms that inflation is being felt by the end-consumer or downstream businesses. This information is vital for central banks deciding on interest rate policies.

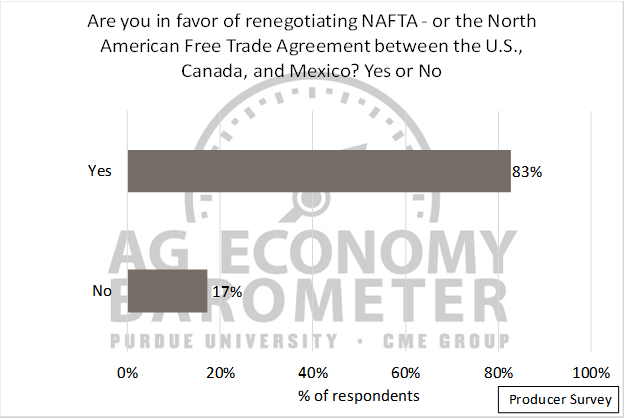

5. Impact of Geopolitical Events and Policies

Geopolitical tensions, trade disputes, tariffs, energy crises, and major policy changes (e.g., environmental regulations) can significantly impact producer sentiment. When such events occur, watching the surveys closely can reveal:

- Export order changes: How are manufacturers reacting to new trade barriers or agreements?

- Investment caution: Are businesses delaying investment due to uncertainty?

- Shift in sourcing: Are manufacturers looking to diversify their supply chains away from risky regions?

For example, a sudden drop in sentiment in a specific region might be directly linked to a new tariff or a regional conflict, showing its immediate impact on business confidence and future plans.

6. Regional Variations and Global Interconnectedness

By comparing sentiment surveys across different countries and regions, we can understand:

- Divergent growth paths: Is manufacturing booming in Asia while stagnating in Europe?

- Interdependencies: How does a slowdown in China’s manufacturing affect demand for German machinery or American raw materials?

- Global resilience: Are some regions proving more resilient to economic shocks than others?

This allows for a nuanced understanding of the highly interconnected nature of global manufacturing networks.

Who Uses This Information?

The insights from producer sentiment surveys are critical for various stakeholders:

- Investors: Use them to anticipate corporate earnings, identify sectors poised for growth or decline, and make informed investment decisions in stocks, bonds, and commodities.

- Policymakers (Governments & Central Banks): Rely on sentiment data to assess the effectiveness of current policies, forecast economic growth, and make decisions on fiscal spending, taxation, and interest rates. A sharp decline in sentiment might prompt a central bank to cut rates or a government to implement stimulus measures.

- Businesses Themselves: Companies use these surveys to benchmark their own performance, anticipate market demand, adjust production schedules, manage inventory, and plan for future investment and hiring. A company might decide to delay expansion if the overall manufacturing sentiment is negative.

- Economists & Analysts: Use the data to build economic models, refine forecasts, and provide expert commentary on the state of the economy.

Limitations and Nuances

While incredibly valuable, producer sentiment surveys are not infallible and come with certain caveats:

- Subjectivity: They measure feelings and expectations, which can be influenced by news headlines, short-term events, or even the mood of the respondent on a given day. They are not hard data.

- Lagging for Some Metrics: While overall sentiment is leading, some sub-components (like employment) might reflect decisions made based on past conditions, not just future expectations.

- Sector-Specific Nuances: A headline number might mask significant differences between sub-sectors. For example, automotive manufacturing might be struggling while aerospace is booming.

- Data Volatility: Readings can sometimes be volatile month-to-month, so it’s important to look at trends over several months rather than reacting to a single data point.

- "Black Swan" Events: Unforeseen global crises (like a pandemic or major war) can invalidate short-term forecasts, as sentiment can shift dramatically overnight.

Conclusion: Your Compass for Global Manufacturing Trends

Producer sentiment surveys are far more than just abstract economic figures; they are direct reflections of the confidence, challenges, and future plans of the businesses that power global manufacturing. By translating the "gut feeling" of thousands of manufacturers into actionable data, these surveys provide an indispensable early warning system for economic shifts.

For anyone looking to understand global economic trends, anticipate supply chain disruptions, gauge inflationary pressures, or simply gain a deeper insight into the engine of our global economy, paying attention to producer sentiment surveys is not just smart – it’s essential. They are your reliable compass, helping you navigate the complex and ever-evolving landscape of global manufacturing. Keep an eye on these reports, and you’ll be one step ahead in understanding where the world’s factories are heading.

Post Comment