The Essential Duo: Cash Flow and Profit – Why Both Matter Equally for Business Success

In the bustling world of business, two terms often pop up that sound similar but are critically different: Cash Flow and Profit. Many aspiring entrepreneurs and even seasoned business owners might mistakenly think they’re interchangeable, or that one is vastly more important than the other. However, understanding both, and recognizing why they both matter equally, is fundamental to your business’s survival, growth, and long-term prosperity.

Think of it this way: If profit is the fuel in your car, cash flow is the engine. You can have a full tank of fuel (profit potential), but if your engine isn’t running (no cash), you’re not going anywhere. Conversely, an engine running on fumes (poor profit) will eventually seize up, no matter how much cash you’re burning through.

Let’s demystify these two crucial financial concepts and reveal their symbiotic relationship.

Unpacking Profit: The "Why We Do Business" Metric

Profit is often the first thing people think about when discussing a successful business. It’s the ultimate score on your financial report card, indicating whether your business is making more money than it’s spending.

What Exactly is Profit?

At its simplest, Profit is what’s left over when you subtract all your expenses from your revenue (the money you bring in from sales).

- Revenue (Sales): The total money your business earns from selling its goods or services.

- Expenses: All the costs associated with running your business, such as rent, salaries, utilities, marketing, raw materials, etc.

The Formula:

Revenue – Expenses = Profit (or Net Income)

Why Profit Matters: The Scorecard of Success

Profit is more than just a number; it’s a vital indicator of your business’s health and efficiency.

- Measure of Success & Efficiency: A healthy profit margin shows that your business model is viable, your pricing is effective, and you’re managing your costs well. It indicates that you’re creating value.

- Funding Growth & Reinvestment: Profits can be reinvested back into the business to fund expansion, research and development, new equipment, or marketing initiatives. This allows your business to grow without relying solely on external funding.

- Attracting Investors & Lenders: Investors look for profitable businesses because it signals a good return on their investment. Banks also prefer lending to profitable companies, as it suggests they’ll be able to repay their loans.

- Owner’s Compensation: For many small business owners, profit is eventually what they take home as their compensation after all business expenses are paid.

- Long-Term Sustainability: Consistently making a profit is essential for long-term survival. A business that never makes a profit is essentially a hobby, and it’s unsustainable in the long run.

Key Takeaway on Profit: Profit tells you if your business model works. It’s about long-term viability and growth potential.

Demystifying Cash Flow: The "Oxygen" for Your Business

While profit shows if you’re making money, Cash Flow tells you if you have money. It’s the actual movement of money in and out of your business bank account. Think of it as the oxygen supply or the bloodstream of your business. Without it, your business, no matter how profitable on paper, can suffocate.

What Exactly is Cash Flow?

Cash Flow refers to the net amount of cash and cash equivalents being transferred into and out of your business.

- Cash Inflows: Money coming into your business (e.g., customer payments, loan proceeds, investments).

- Cash Outflows: Money leaving your business (e.g., paying suppliers, salaries, rent, loan repayments).

The Formula:

Cash Inflows – Cash Outflows = Net Cash Flow

Why Cash Flow Matters: The Lifeblood of Operations

Positive cash flow is non-negotiable for day-to-day operations.

- Paying Bills & Operating Expenses: You need cash to pay your employees, rent, suppliers, utilities, and taxes on time. A lack of cash flow can lead to missed payments, late fees, damaged supplier relationships, and even legal troubles.

- Seizing Opportunities: Having available cash allows you to take advantage of bulk purchase discounts, invest in new technology, or quickly respond to market changes.

- Surviving Lean Times: Every business experiences ups and downs. A healthy cash reserve (built from positive cash flow) acts as a buffer during slow periods, unexpected expenses, or economic downturns.

- Maintaining Solvency: Solvency means your ability to pay your debts as they come due. Even a highly profitable company can become insolvent and face bankruptcy if it doesn’t have enough cash on hand.

- Business Credibility: Suppliers and partners prefer working with businesses that pay promptly. Good cash flow management builds trust and a strong reputation.

Key Takeaway on Cash Flow: Cash flow tells you if your business can operate today. It’s about immediate survival and liquidity.

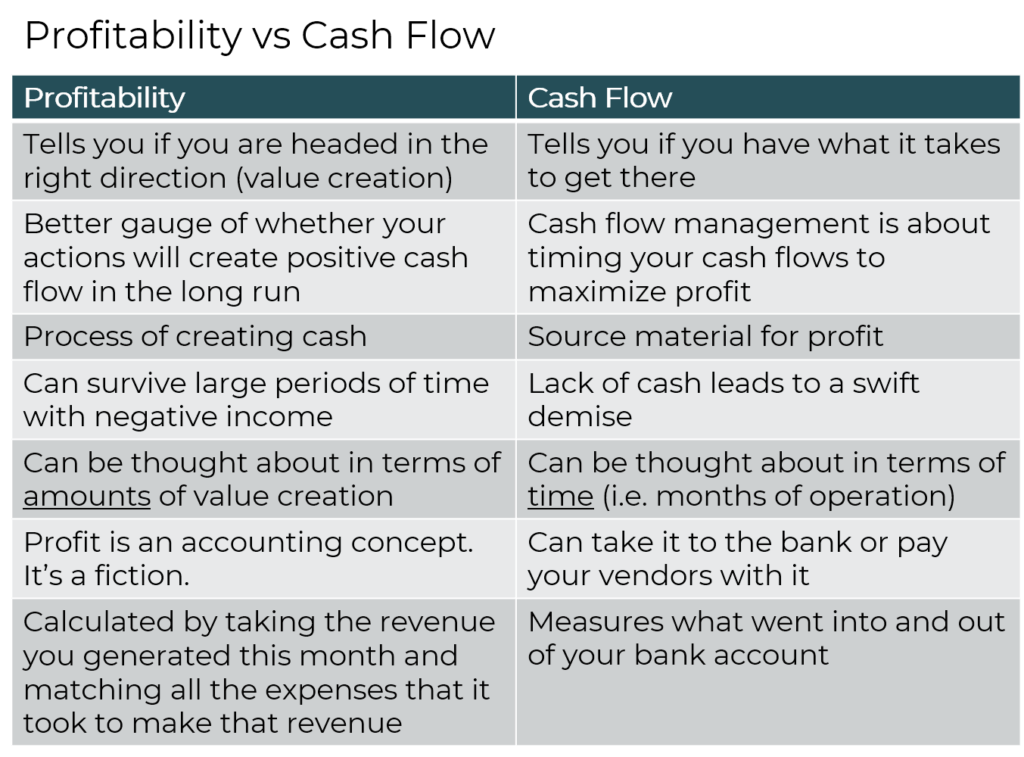

The Crucial Differences: Why They Aren’t the Same

The primary reason cash flow and profit can diverge lies in timing and accounting methods.

-

Accrual Accounting vs. Cash Accounting:

- Accrual Accounting (used for Profit calculation): Recognizes revenue when it’s earned (e.g., when you send an invoice), and expenses when they’re incurred (e.g., when you receive a bill), regardless of when the money actually changes hands. This gives a more accurate picture of performance over a period.

- Cash Accounting (closer to Cash Flow): Recognizes revenue when cash is received and expenses when cash is paid. While simpler, it might not show the full financial picture.

-

Timing Differences:

- Credit Sales: You might make a large sale and record it as revenue (increasing profit), but if the customer pays you in 60 or 90 days, you won’t see the cash until then. Your profit looks good, but your bank account might be empty.

- Inventory Purchases: You might pay for a large order of inventory (a cash outflow) months before you sell it and generate revenue (affecting profit later).

- Bills Paid Later: You might incur an expense (affecting profit now) but pay the bill 30 days later (affecting cash flow later).

-

Non-Cash Expenses:

- Depreciation: This is a common example. It’s an accounting expense that reduces profit, but it doesn’t involve an actual outflow of cash in the current period (the cash was spent when the asset was purchased).

-

Debt & Loans:

- Taking out a loan significantly increases your cash (cash inflow) but doesn’t directly impact your profit (it’s not revenue).

- Repaying the principal on a loan is a cash outflow but doesn’t reduce profit (only the interest portion of the payment reduces profit).

Why Both Matter Equally: The Symbiotic Relationship

Understanding the individual importance of profit and cash flow is one thing; appreciating their equal necessity is another. They are two sides of the same coin, each providing a unique yet equally vital perspective on your business’s health.

The "Profitable but Broke" Scenario

This is a classic paradox where a business shows excellent profit on paper but runs out of money to pay its bills.

- Example: A consulting firm lands a huge project, invoicing $100,000. They record this as revenue, making them highly profitable. However, the client has 90-day payment terms. In the meantime, the firm still needs to pay its consultants, rent, and other operating expenses now. If they don’t have enough existing cash or other sources of funds, they could go bankrupt even with a massive profit pending.

The "Cash-Rich but Unprofitable" Trap

Conversely, a business might have plenty of cash but be fundamentally unprofitable, indicating a deeper, unsustainable problem.

- Example: A startup raises a large sum of money from investors (a significant cash inflow). They have plenty of cash in the bank. However, if their operating expenses consistently exceed their revenue, they are burning through that cash without generating sustainable income. Eventually, the cash will run out, and without a profitable business model, they’ll fail.

The Sweet Spot: Balanced Financial Health

True business success lies in achieving a healthy balance of both:

- Consistent Profitability: Ensures your business model is viable and can generate long-term wealth and growth.

- Robust Cash Flow: Guarantees your business can meet its immediate obligations, seize opportunities, and weather financial storms.

Neglecting one in favor of the other is a recipe for disaster. A business needs profit to grow and thrive in the long run, and it needs cash flow to survive day-to-day.

How to Monitor Both: Your Financial GPS

To effectively manage both cash flow and profit, you need to regularly review your financial statements. These are your business’s GPS system.

-

For Profit: The Income Statement (or Profit & Loss – P&L)

- What it shows: Your revenues, expenses, and profit (or loss) over a specific period (e.g., a month, quarter, or year).

- Key Insight: Reveals your business’s profitability and operational efficiency. Are you making money? Where are your expenses highest?

-

For Cash Flow: The Cash Flow Statement

- What it shows: Details the movement of cash in and out of your business from three main activities:

- Operating Activities: Cash generated from your core business operations (sales, paying suppliers, employees).

- Investing Activities: Cash used for or generated from investments (buying or selling assets like equipment, property).

- Financing Activities: Cash related to debt, equity, and dividends (taking out loans, issuing stock, paying dividends).

- Key Insight: Reveals your business’s liquidity and solvency. Do you have enough cash to pay your bills? Where is your cash coming from and going to?

- What it shows: Details the movement of cash in and out of your business from three main activities:

-

The Balance Sheet:

- While not directly showing profit or cash flow over time, the Balance Sheet provides a snapshot of your assets, liabilities, and owner’s equity at a specific point in time. It helps you understand your overall financial position, including how much cash you have at that moment.

Actionable Tips for Balancing Both

Managing both cash flow and profit requires ongoing attention and strategic decision-making.

To Improve Profitability:

- Optimize Pricing: Ensure your prices cover costs and provide a healthy margin. Don’t be afraid to adjust if market conditions or costs change.

- Control Costs: Regularly review all expenses. Can you negotiate better deals with suppliers? Are there unnecessary expenditures?

- Increase Sales Volume: Focus on marketing, sales strategies, and customer retention to drive more revenue.

- Improve Efficiency: Streamline operations to reduce waste and optimize resource utilization.

- Manage Inventory: Avoid overstocking, which ties up capital and can lead to obsolescence.

To Enhance Cash Flow:

- Invoice Promptly and Clearly: Send invoices immediately after a sale or service, with clear payment terms.

- Follow Up on Receivables: Don’t hesitate to gently remind customers about overdue payments.

- Negotiate Favorable Payment Terms with Suppliers: Can you get 60 or 90 days to pay instead of 30?

- Manage Inventory Wisely: Keep only what you need to meet demand, preventing cash from being tied up in unsold goods.

- Build a Cash Reserve: Save a portion of your positive cash flow in an emergency fund.

- Consider Early Payment Discounts: Offer incentives for customers to pay faster.

- Explore Financing Options: Understand lines of credit or short-term loans as a backup, but use them wisely.

- Delay Non-Essential Payments: If cash is tight, prioritize critical payments and delay non-essential ones (e.g., non-urgent equipment upgrades).

Conclusion: The Holistic View of Financial Health

In the grand scheme of business, profit and cash flow are not competing metrics but complementary indicators of your financial health. Profit paints the picture of your long-term viability and growth potential, while cash flow ensures your immediate survival and operational agility.

Ignoring either one is akin to trying to fly a plane with only one wing. A profitable business can still crash due to a lack of cash, and a cash-rich business without profitability is simply running on borrowed time.

By diligently monitoring both your Income Statement and your Cash Flow Statement, understanding their distinct purposes, and implementing strategies to optimize both, you equip your business with the ultimate financial intelligence needed to not just survive, but truly thrive. Embrace the essential duo, and pave your way to sustainable business success.

Post Comment