Why Do Economic Crises Keep Happening? Understanding the Boom and Bust Cycle

Economic crises. The very phrase can send shivers down one’s spine. From the Great Depression of the 1930s to the 2008 Global Financial Crisis and the recent economic fallout from the COVID-19 pandemic, it seems like the global economy is constantly riding a rollercoaster of ups and downs. If we learn from history, why do these periods of widespread job losses, business failures, and financial instability keep recurring?

It’s a complex question with no single, simple answer. Economic crises are not caused by one factor but are rather the result of a tangled web of human behavior, market dynamics, policy choices, and unforeseen events. This article will break down the core reasons why economic crises are a persistent feature of our world, making it easy for anyone to understand.

The Inevitable Dance: Understanding Economic Cycles

Before diving into the "why," let’s understand a fundamental concept: economic cycles. Economies don’t just grow in a straight line; they move in waves, much like the seasons.

- Boom (Expansion): This is the good time. Businesses are thriving, people are finding jobs easily, wages might be rising, and everyone feels optimistic. Spending increases, and investment pours into new projects.

- Peak: The economy reaches its highest point. Things might be getting a bit too good. Prices might start rising too fast (inflation), or people might be borrowing too much money.

- Bust (Contraction/Recession): This is where things slow down. Businesses might stop hiring or even lay off workers. People spend less, and confidence drops. If it gets severe and lasts a while, it’s called a recession. A very severe and prolonged recession is a depression.

- Trough: The economy hits its lowest point.

- Recovery: The economy starts to pick up again, leading back to another boom.

This "boom and bust" cycle is natural to some extent. The problem arises when the "bust" phase becomes an extreme, widespread, and devastating crisis.

Key Drivers Behind Recurring Economic Crises

So, why do these natural cycles sometimes spiral out of control into full-blown crises? Here are the main culprits:

1. Human Nature: The Irrational Element

Believe it or not, our own emotions play a huge role in economic ups and downs.

- Greed and "Irrational Exuberance": During a boom, people can get overly optimistic. They see prices of assets (like stocks or houses) going up and believe they will keep rising forever. This leads to what former Federal Reserve Chairman Alan Greenspan called "irrational exuberance" – investing based on hype rather than solid value. People might take on too much risk, borrowing heavily to buy assets they hope to sell for a quick profit.

- Example: The Dot-Com Bubble of the late 1990s. Everyone wanted to invest in internet companies, even those with no profits, simply because their stock prices were soaring.

- Fear and Panic: When things start to go wrong, optimism quickly turns to fear. People panic and rush to sell their investments or withdraw their money from banks, even if it means selling at a loss. This "herd mentality" can accelerate a downturn.

- Example: During the 2008 financial crisis, there was a widespread fear that banks would collapse, leading to a freeze in lending and a rush to withdraw money.

- Short-term Thinking: Both individuals and financial institutions often focus on immediate gains rather than long-term stability. This can lead to risky decisions that pay off in the short run but create huge problems down the line.

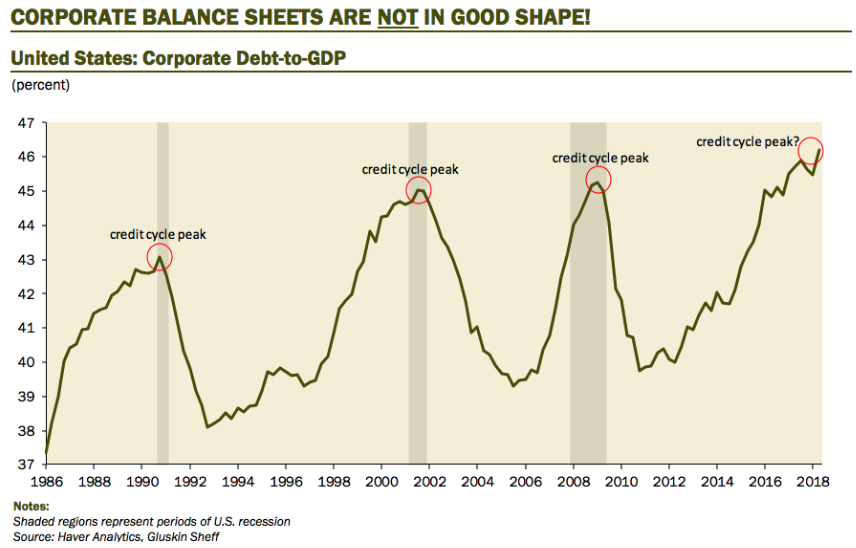

2. The Credit Cycle and Debt Accumulation

Debt is a powerful tool. It allows businesses to expand and individuals to buy homes or cars. But too much of a good thing can be dangerous.

- Easy Credit Leads to Borrowing: During economic booms, banks become more willing to lend money, and interest rates might be low. This makes it easy for people and businesses to borrow.

- Asset Bubbles Form: When lots of people borrow money to buy the same type of asset (like houses or stocks), the demand drives up prices far beyond their true value. This creates an asset bubble.

- Example: The US housing bubble before 2008. People were buying houses they couldn’t truly afford, often with risky loans, because they believed house prices would always go up.

- Debt Becomes Unsustainable: Eventually, the music stops. Interest rates might rise, or people’s incomes might not keep up with their loan payments. When people or businesses can no longer afford to pay back their loans, they default (fail to pay).

- The "Deleveraging" Process: When too many defaults happen, banks become hesitant to lend, and everyone tries to pay down their debt at the same time. This process, called deleveraging, means less spending, less investment, and a sharp economic contraction. It’s like everyone trying to get out of a crowded theater at once – it creates a bottleneck.

3. Policy & Regulatory Lapses

Governments and central banks (like the Federal Reserve in the US) have a huge influence on the economy. Their choices can either stabilize or destabilize the system.

- Deregulation: Sometimes, governments reduce rules and oversight on financial institutions, believing it will spur growth. However, this can allow banks and other firms to take on excessive risks without proper checks and balances.

- Example: Many argue that deregulation in the years leading up to 2008 allowed banks to engage in risky mortgage lending practices.

- Monetary Policy Errors: Central banks manage interest rates and the money supply.

- Interest rates too low for too long: Can encourage excessive borrowing and fuel asset bubbles.

- Interest rates too high: Can stifle economic growth and make it hard for businesses to invest or people to afford loans.

- Fiscal Policy Mistakes: This refers to government spending and taxation.

- Excessive Government Debt: If a government spends much more than it collects in taxes for too long, it accumulates large debts. This can make investors nervous and lead to a crisis of confidence in the government’s ability to pay its bills.

- Lack of Counter-Cyclical Policy: During a boom, governments should ideally save or pay down debt. During a bust, they should be ready to spend to stimulate the economy. Sometimes, these policies aren’t applied effectively.

- Lack of Oversight: Regulators might fail to identify or address risky behavior in the financial system until it’s too late.

4. Globalization and Interconnectedness

Our world is more connected than ever before. While this has many benefits, it also means that problems can spread rapidly across borders.

- The "Contagion Effect": A financial crisis starting in one country can quickly spread to others like a disease. If a major bank in one country collapses, it can impact banks in other countries that lent to it or invested in it.

- Example: The 1997 Asian Financial Crisis started in Thailand but quickly spread to Indonesia, South Korea, and other Asian economies due to intertwined financial markets. The 2008 crisis started in the US but became global very quickly.

- Global Capital Flows: Money moves freely and quickly across borders. While beneficial for investment, rapid withdrawals of capital (money leaving a country) can trigger currency crises and economic instability.

- Supply Chain Dependencies: Modern production relies on complex global supply chains. A disruption in one part of the world (like a natural disaster or pandemic) can halt production and cause economic ripples globally.

5. External Shocks and Unforeseen Events

Sometimes, economic crises are triggered by events completely outside the normal workings of the economy.

- Natural Disasters: Major earthquakes, tsunamis, or hurricanes can devastate regions, destroy infrastructure, and disrupt economic activity.

- Pandemics: As seen with COVID-19, global health crises can force lockdowns, shut down businesses, disrupt supply chains, and lead to massive job losses.

- Wars and Geopolitical Conflicts: Conflicts can disrupt trade routes, destroy infrastructure, cause energy price spikes, and lead to massive uncertainty that harms investment.

- Sudden Price Shocks: A sudden, sharp increase in the price of a critical commodity, like oil, can act like a tax on consumers and businesses, slowing down the entire economy.

6. Income Inequality and Imbalances

While not always a direct trigger, growing income inequality can contribute to economic instability.

- Reduced Aggregate Demand: If a large portion of the population has stagnant wages and limited disposable income, overall consumer spending (a key driver of economic growth) can be constrained.

- Increased Reliance on Debt: To maintain their living standards, lower and middle-income households might rely more on borrowing, increasing their vulnerability to economic shocks.

- Political Instability: Extreme inequality can lead to social unrest and political instability, which in turn can harm investor confidence and economic growth.

Can We Prevent Future Crises?

Given the complex interplay of these factors, completely preventing economic crises is likely impossible. Human nature, unforeseen events, and the dynamic nature of markets mean that "boom and bust" cycles will probably always be with us.

However, we can learn from past mistakes and implement policies to mitigate their severity and frequency:

- Stronger Regulation: Implementing and enforcing robust rules for banks and financial institutions to prevent excessive risk-taking.

- Prudent Monetary Policy: Central banks carefully managing interest rates and money supply to avoid bubbles and support stable growth.

- Responsible Fiscal Policy: Governments managing their budgets wisely, building reserves during good times, and being prepared to stimulate during downturns.

- International Cooperation: Countries working together to coordinate policies and address global financial risks.

- Early Warning Systems: Developing better tools to identify potential risks and bubbles before they become critical.

- Social Safety Nets: Programs like unemployment benefits and food assistance help cushion the blow for individuals during a downturn, preventing a deeper spiral.

The Role of Resilience and Recovery

Even when a crisis hits, economies often demonstrate remarkable resilience. Governments and central banks learn to respond with various tools:

- Stimulus Packages: Government spending to boost demand (e.g., infrastructure projects, direct payments).

- Interest Rate Cuts: Central banks lowering rates to make borrowing cheaper and encourage spending.

- Quantitative Easing: Central banks buying bonds to inject money directly into the financial system.

- Bailouts: Providing financial support to critical institutions (like banks) to prevent a total collapse of the financial system.

These measures aim to shorten the duration of the crisis and accelerate the path to recovery.

Conclusion: A Continuous Learning Process

Economic crises are a deeply ingrained part of the global economic landscape, driven by a blend of predictable patterns and unpredictable events. While our understanding of their causes has grown significantly, the complexity of the global economy, coupled with the enduring influence of human behavior, ensures that the challenge of preventing them remains.

Instead of a complete prevention, the goal is continuous learning, adaptation, and building a more resilient system. By understanding the forces at play – from our own emotional decisions to global interconnectedness and policy choices – we can better prepare for, mitigate, and ultimately recover from the inevitable economic storms that lie ahead. It’s a never-ending journey of balancing growth with stability, and risk with responsibility.

Post Comment