Overtime Pay Regulations: Who is Eligible? A Beginner’s Guide to Understanding Your Rights

Navigating the world of work can be complex, and one area that often causes confusion is overtime pay. Many employees assume that if they work more than 40 hours a week, they automatically qualify for extra pay. However, the truth is a bit more nuanced. Not everyone is eligible for overtime, and understanding the rules is crucial for both employees and employers.

This comprehensive guide will break down the overtime pay regulations, focusing on who is eligible in an easy-to-understand language. We’ll demystify the key laws, common exemptions, and what you need to know to protect your rights.

What is Overtime Pay? The Basics

At its core, overtime pay is extra compensation for working beyond a standard workweek. In the United States, the primary law governing overtime is the Fair Labor Standards Act (FLSA).

Key Overtime Basics:

- Standard Workweek: The FLSA defines a standard workweek as 40 hours over seven consecutive days.

- Overtime Rate: For eligible employees, overtime must be paid at a rate of at least one and one-half times (1.5x) their regular rate of pay for all hours worked over 40 in a workweek. This is often called "time and a half."

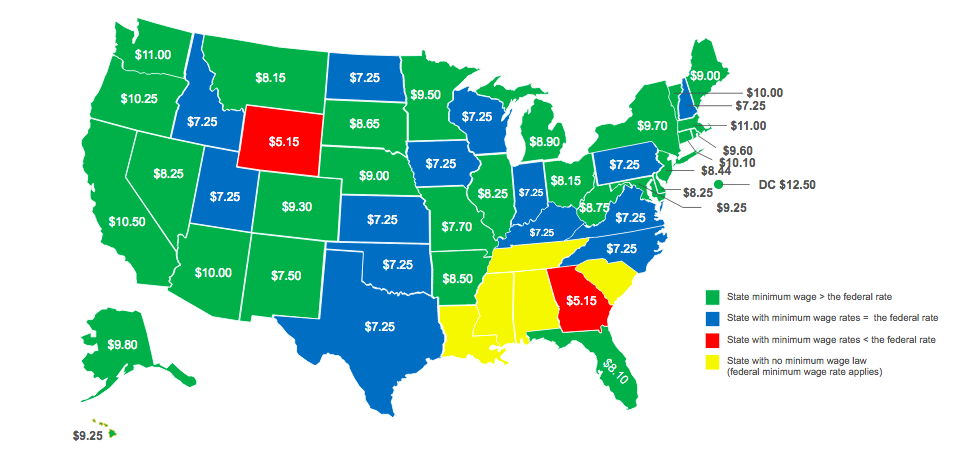

- No Daily Overtime: The FLSA does not require overtime pay for hours worked over 8 in a day, or for work on weekends or holidays, unless those hours result in more than 40 hours for the week. (Some state laws do have daily overtime rules, but federally, it’s about the weekly total).

So, if overtime is 1.5 times your regular rate, who actually gets it? This is where the concept of "exempt" versus "non-exempt" employees comes into play.

The Foundation: The Fair Labor Standards Act (FLSA)

The FLSA is a federal law that establishes minimum wage, overtime pay, recordkeeping, and child labor standards affecting full-time and part-time workers in the private sector and in federal, state, and local governments.

Its main goal regarding overtime is to ensure that most workers are compensated fairly for extended hours. However, it also recognizes that certain types of jobs, often those with higher levels of responsibility or discretion, don’t fit the traditional hourly mold. This leads us to the critical distinction:

- Non-Exempt Employees: These are employees who ARE covered by FLSA overtime rules and ARE eligible for overtime pay.

- Exempt Employees: These are employees who ARE NOT covered by FLSA overtime rules and ARE NOT eligible for overtime pay. They are "exempt" from its requirements.

The vast majority of American workers are non-exempt.

Non-Exempt Employees: The Overtime Winners

If you are a non-exempt employee, congratulations! You are entitled to overtime pay for all hours worked over 40 in a workweek.

Who is typically non-exempt?

- Hourly Employees: Most employees who are paid an hourly wage are non-exempt.

- Many Salaried Employees: Just because you receive a salary doesn’t automatically mean you’re exempt. Many salaried workers, especially those in administrative support, production, or customer service roles, are non-exempt and must receive overtime.

- Employees Paid by Piece Rate or Commission: These workers can also be non-exempt, and their regular rate of pay for overtime calculation can be more complex but still required.

Example:

Sarah works as a receptionist and earns $20 per hour. Last week, she worked 45 hours.

- First 40 hours: 40 hours * $20/hour = $800

- Overtime hours: 5 hours ($20/hour 1.5) = 5 hours * $30/hour = $150

- Total Pay: $800 + $150 = $950

It’s important to remember that "hours worked" includes all time an employee is on duty, on the employer’s premises, or at a prescribed workplace. This can include travel time between job sites, required training, and even some "on-call" time.

Exempt Employees: The Overtime Exceptions

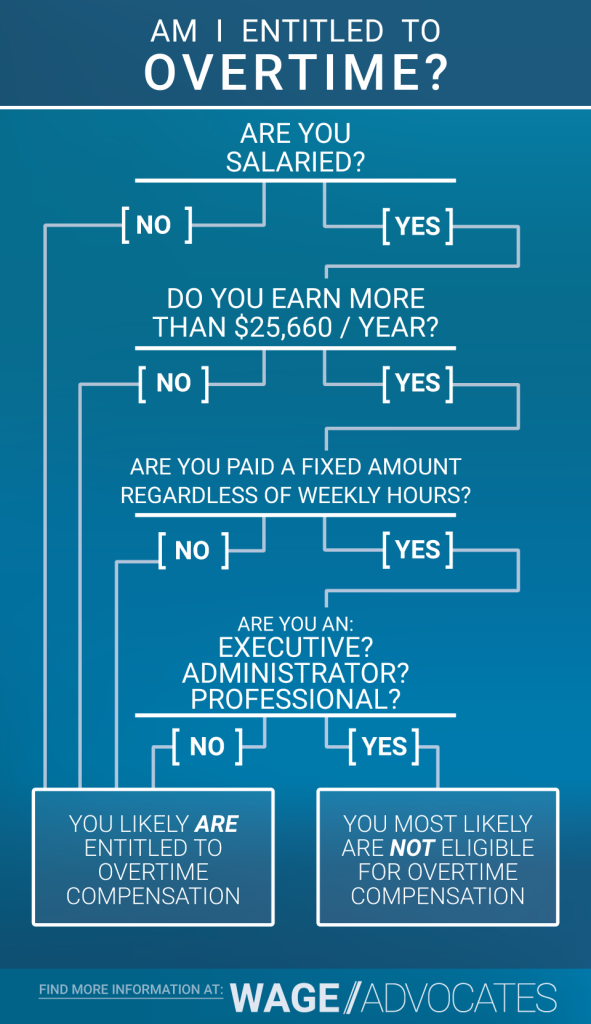

This is where eligibility becomes more complicated. For an employee to be "exempt" from overtime pay, they must meet ALL THREE of the following tests established by the FLSA:

-

The Salary Basis Test: The employee must be paid a predetermined, fixed salary that does not change based on the quality or quantity of work. This means they generally receive the full salary for any week in which they perform any work, regardless of the number of days or hours worked.

- Exception: Permissible deductions can include absences for personal reasons (not sickness/disability), FMLA leave, penalties for violating safety rules, or the first and final week of employment if they don’t work the full week.

-

The Salary Level Test: The fixed salary must meet a specific minimum weekly amount. As of January 1, 2020, the federal minimum salary level is $684 per week (equivalent to $35,568 per year).

- Important Note: This threshold can be updated by the Department of Labor. Also, some states have higher minimum salary levels. If a state law provides greater protection (e.g., a higher salary threshold), the employer must follow the state law.

-

The Duties Test: The employee’s primary job duties must fall within one of the specific categories defined by the FLSA as "exempt." This is the most complex part, as job titles alone do not determine exemption. It’s about what the employee actually does.

Let’s break down the most common "duties tests" for exemption:

A. Executive Exemption

This applies to employees whose primary duty is managing the enterprise or a recognized department or subdivision.

Key Requirements:

- Primary Duty: Managing the business or a department/subdivision.

- Supervision: Regularly directs the work of two or more other full-time employees (or their equivalent).

- Hiring/Firing Power: Has the authority to hire or fire other employees, or their suggestions and recommendations regarding hiring, firing, promotion, or other change of status are given particular weight.

Examples: Store managers, department heads, restaurant general managers.

B. Administrative Exemption

This applies to employees whose primary duty involves the performance of office or non-manual work directly related to the management or general business operations of the employer or the employer’s customers.

Key Requirements:

- Primary Duty: Office or non-manual work directly related to management or general business operations.

- Discretion & Independent Judgment: Exercises discretion and independent judgment with respect to matters of significance. This means they have the authority to make important decisions without direct supervision, rather than simply applying existing procedures or following detailed instructions.

Examples: HR managers, executive assistants who handle complex projects, purchasing agents, financial analysts. (Note: A typical administrative assistant who mostly does clerical tasks is generally not exempt).

C. Professional Exemption

This exemption is divided into two types: Learned Professionals and Creative Professionals.

1. Learned Professional Exemption:

- Primary Duty: Performing work requiring advanced knowledge, which is predominantly intellectual in character, and which includes consistent exercise of discretion and judgment.

- Advanced Knowledge: This knowledge must be in a field of science or learning.

- Acquired Through Prolonged Instruction: The advanced knowledge must be customarily acquired by a prolonged course of specialized intellectual instruction (e.g., a college degree) and study.

Examples: Doctors, lawyers, teachers, accountants, engineers, registered nurses.

2. Creative Professional Exemption:

- Primary Duty: Performing work requiring invention, imagination, originality, or talent in a recognized field of artistic or creative endeavor.

Examples: Writers, musicians, actors, graphic designers (if their work truly involves artistic originality, not just applying templates).

D. Outside Sales Exemption

This applies to employees whose primary duty is making sales, and who customarily and regularly work away from the employer’s place of business.

Key Requirements:

- Primary Duty: Making sales or obtaining orders or contracts for services.

- Work Location: Customarily and regularly engaged away from the employer’s business. Unlike other exemptions, there is no salary basis or salary level test for outside sales employees.

Examples: Traveling sales representatives, door-to-door salespeople.

E. Computer Employee Exemption

This applies to certain highly skilled computer professionals.

Key Requirements:

- Primary Duty: Application of systems analysis techniques, design of computer systems, programming, or similar work.

- Salary Test: Must meet the salary basis and salary level test ($684/week) OR be paid on an hourly basis of at least $27.63 per hour.

Examples: Software engineers, network architects, database administrators. (Note: Help desk personnel, manufacturing employees who operate computer-controlled machinery, and those whose primary duties involve the manufacture or repair of computer hardware are generally not exempt under this category).

F. Highly Compensated Employee Exemption

This is a simplified duties test for employees who earn a very high total annual compensation.

Key Requirements:

- Total Annual Compensation: Must earn at least $107,432 per year (as of January 1, 2020), which must include at least $684 per week paid on a salary or fee basis.

- Primary Duty: Must customarily and regularly perform at least one of the exempt duties of an executive, administrative, or professional employee.

This exemption is for those at the top of the pay scale who still perform some exempt duties, even if those duties aren’t their primary responsibility.

Common Misconceptions About Overtime Eligibility

Don’t fall for these common myths!

- "I’m paid a salary, so I’m exempt." FALSE. As discussed, being paid a salary is only one of the three tests. Your salary must also meet the minimum level, and your job duties must qualify.

- "My job title is ‘Manager,’ so I’m exempt." FALSE. Job titles mean nothing. It’s all about your actual duties, not what your business card says. An "Assistant Manager" who mostly rings up sales is likely non-exempt.

- "I agreed to not get overtime." FALSE. You cannot waive your right to overtime under the FLSA. If you are a non-exempt employee, your employer is legally obligated to pay you overtime, regardless of any agreement.

- "I’m an independent contractor, so I don’t get overtime." Often TRUE, but be careful. Many employers misclassify employees as independent contractors to avoid paying benefits and overtime. If you are truly an independent contractor, you’re running your own business and set your own hours and terms. If your employer controls your work hours, provides your tools, and directs your tasks, you might actually be an employee and eligible for overtime.

What To Do If You Suspect Misclassification

If you believe you should be eligible for overtime pay but aren’t receiving it, here are steps you can take:

- Understand Your Job Duties: Thoroughly review your actual day-to-day responsibilities. Do they truly align with one of the FLSA exemption categories, especially the "duties test"?

- Document Your Hours: Keep detailed records of all hours you work, including start and end times, breaks, and any time worked outside of your regular schedule.

- Gather Pay Stubs: Collect your pay stubs to show your salary and any lack of overtime payments.

- Speak to Your Employer (Optional, but often recommended first): You might start by calmly discussing your concerns with your HR department or manager. They may have made an honest mistake.

- Contact the Department of Labor (DOL): If speaking with your employer doesn’t resolve the issue, or if you’re uncomfortable doing so, you can file a complaint with the Wage and Hour Division of the U.S. Department of Labor (DOL). They investigate claims and can help you recover unpaid wages.

- Consult an Attorney: For complex cases or if you’re seeking to recover significant unpaid wages, consulting with an employment law attorney is a wise step. They can advise you on your rights and legal options.

Conclusion: Know Your Rights!

Understanding overtime pay regulations is essential for every worker. While the rules can seem intricate, the core principle is simple: most employees are entitled to time and a half for hours worked over 40 in a week. Exemptions are specific and apply only when all three tests (salary basis, salary level, and duties) are met.

Don’t let a job title or a salary mislead you. Take the time to understand your actual job duties and compare them against the FLSA guidelines. Knowing your eligibility empowers you to ensure you are fairly compensated for your hard work.

Post Comment