Digital Currency: The Government’s Take on CBDCs – A Beginner’s Guide to Central Bank Digital Currencies

The world of money is changing, and fast. While cryptocurrencies like Bitcoin and Ethereum have captured headlines, there’s another, less flashy but equally revolutionary digital currency concept gaining serious traction: Central Bank Digital Currencies (CBDCs). Unlike decentralized cryptocurrencies, CBDCs are digital money issued and backed by a country’s central bank – the same institution that issues physical cash.

This article will dive deep into the fascinating world of CBDCs, exploring why governments are so interested, the policies they’re grappling with, and what this could mean for your money and the global financial system. Don’t worry if you’re new to this; we’ll break it down into easy-to-understand terms.

What Exactly is a Central Bank Digital Currency (CBDC)?

Let’s start with the basics. Imagine the cash in your wallet, but in a purely digital form. That’s essentially what a retail CBDC aims to be.

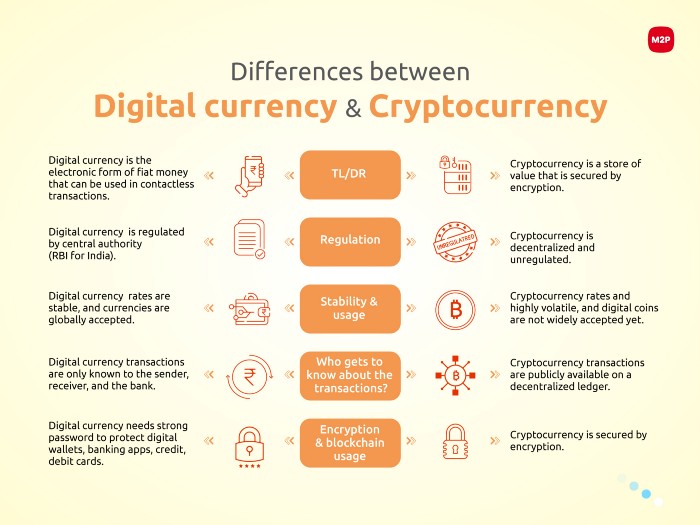

- It’s Not Cryptocurrency: This is crucial. CBDCs are not Bitcoin or Ethereum. They are centralized, meaning a single authority (the central bank) controls them, unlike decentralized cryptocurrencies. They are also backed by the full faith and credit of the government, just like your physical cash.

- It’s Digital Fiat Money: "Fiat money" is currency that a government declares to be legal tender, like the US Dollar, Euro, or Japanese Yen. A CBDC would simply be a digital version of this existing fiat money.

- Issued by the Central Bank: Currently, when you use digital money (like paying with a debit card), you’re typically using money held in a commercial bank account. This money is a liability of the commercial bank. With a CBDC, your digital money would be a direct liability of the central bank, just like physical cash.

Think of it this way:

- Cash: Physical money, a direct claim on the central bank.

- Commercial Bank Deposits: Digital money, a claim on a commercial bank.

- CBDC: Digital money, a direct claim on the central bank.

Why Are Governments Seriously Considering CBDCs?

It might seem like a complex endeavor, but central banks worldwide are exploring CBDCs for a variety of compelling reasons. These reasons often revolve around improving existing financial systems and adapting to the digital age.

1. Enhancing Monetary Policy and Financial Stability

Governments want more effective tools to manage their economies.

- Faster and More Direct Stimulus: In times of economic crisis, governments might want to distribute funds directly and quickly to citizens. A CBDC could allow for immediate, targeted payments, rather than relying on commercial banks to process checks or transfers.

- Better Control Over Money Supply: With a CBDC, the central bank could have a more granular view of money flows and potentially implement monetary policy more directly, for example, by adjusting interest rates on CBDC holdings.

- Reducing Bank Run Risks (Potentially): In theory, if people could directly hold central bank money digitally, they might be less likely to "run" on commercial banks during a crisis, as their money would be held directly by the central bank, considered the safest entity. However, this also poses risks to commercial banks (see below).

2. Improving Payment Systems: Efficiency, Speed, and Cost

Current payment systems, especially cross-border ones, can be slow, expensive, and opaque.

- Instant Settlements: CBDCs could enable instant payments 24/7, across borders, eliminating delays often associated with traditional banking hours and interbank transfers.

- Lower Transaction Costs: By streamlining the payment process and potentially cutting out intermediaries, CBDCs could reduce the fees associated with transactions for businesses and consumers.

- Increased Competition: A CBDC could introduce more competition into the payments landscape, pushing private payment providers to innovate and lower their costs.

3. Fostering Financial Inclusion

Billions of people worldwide are "unbanked," meaning they lack access to traditional financial services.

- Accessibility for All: A CBDC could potentially be accessed by anyone with a mobile phone, even without a traditional bank account. This could bring more people into the formal financial system, allowing them to save, receive payments, and conduct transactions securely.

- Reduced Reliance on Cash: For those in remote areas or where physical cash is cumbersome or unsafe, a digital alternative could be a lifeline.

4. Countering the Rise of Private Cryptocurrencies and Stablecoins

The rapid growth of private digital assets has raised concerns among central banks.

- Maintaining Monetary Sovereignty: Governments want to ensure they retain control over their nation’s currency and financial system. If private digital currencies become widely adopted, central banks worry they might lose their ability to manage the economy effectively.

- Addressing Risks: Private cryptocurrencies are volatile, and stablecoins (which aim to peg their value to a traditional asset like the US dollar) have faced scrutiny over their reserves and potential for instability. A CBDC offers a stable, risk-free digital alternative.

- Combating Illicit Activities: The anonymity of some private cryptocurrencies makes them attractive for money laundering and terrorist financing. A CBDC, depending on its design, could offer a more traceable and regulated digital currency environment.

5. International Competitiveness and Geopolitical Influence

In an increasingly digital world, nations are looking to maintain their financial standing.

- Setting Global Standards: Countries that develop successful CBDCs early could play a significant role in setting the technical and regulatory standards for global digital payments, influencing future international finance.

- Cross-Border Payment Innovation: A CBDC could make international trade and remittances cheaper and faster, potentially giving countries an edge in global commerce.

The Big Policy Questions and Challenges for Governments

While the potential benefits of CBDCs are significant, implementing them is far from straightforward. Governments face complex policy decisions and must navigate a minefield of potential challenges.

1. Privacy vs. Surveillance: A Core Dilemma

This is perhaps the most contentious issue surrounding CBDCs.

- The Fear of "Big Brother": If all transactions are processed digitally by the central bank, there’s a legitimate concern that governments could monitor every purchase, financial activity, and even restrict spending.

- Balancing Act: Governments need to balance the need for privacy with the need to prevent illicit activities like money laundering and terrorism financing (AML/CTF).

- Design Choices Matter: Different CBDC designs could offer varying levels of privacy. For example, a "token-based" system might offer more anonymity for small transactions, similar to cash, while larger transactions might require identification.

2. Impact on Commercial Banks: Disintermediation Risks

Currently, commercial banks play a vital role in taking deposits and lending money.

- "Disintermediation": If people move large amounts of their money from commercial bank accounts into CBDC accounts (direct with the central bank), commercial banks could lose a significant source of their funding (deposits).

- Changing Business Models: This could force banks to find new ways to fund their lending activities, potentially increasing costs for borrowers or leading to a less stable banking sector.

- Government Solutions: Central banks are exploring ways to mitigate this, such as a "two-tiered" system where commercial banks would still manage customer accounts, or by limiting the amount of CBDC an individual can hold.

3. Cybersecurity and Systemic Risk

A CBDC system would be a massive, attractive target for cyberattacks.

- High-Value Target: A national digital currency system would hold immense value and be critical infrastructure, making it a prime target for hackers, hostile states, and terrorists.

- Resilience and Redundancy: Governments must ensure the system is incredibly robust, resilient to outages, and has multiple layers of security and backup systems to prevent widespread disruption or loss of funds.

4. International Coordination and Interoperability

Money moves globally, and CBDCs need to work together across borders.

- Standardization: Different countries developing their own CBDCs could create a fragmented global financial system if they can’t easily communicate and transact with each other.

- Regulatory Arbitrage: Without coordinated international regulations, countries might compete to offer more attractive CBDC rules, potentially leading to loopholes for illicit activities.

- Cross-Border Payments: For CBDCs to truly revolutionize international payments, they need to be interoperable, allowing seamless exchange between different national digital currencies.

5. Design Choices and Implementation Challenges

Governments face fundamental decisions about how a CBDC would actually work.

- Wholesale vs. Retail CBDC:

- Retail CBDC: Designed for general public use (like digital cash).

- Wholesale CBDC: Restricted to financial institutions for interbank settlements and wholesale transactions.

- Interest-Bearing vs. Non-Interest-Bearing: Would your CBDC holdings earn interest? This has major implications for monetary policy and competition with commercial banks.

- Technology Stack: What underlying technology would be used? While blockchain is often associated with digital currencies, a CBDC doesn’t necessarily need to use it; traditional database systems could also be employed.

- Access Models: Would people hold accounts directly with the central bank, or would commercial banks still serve as intermediaries for CBDC access?

The Global Landscape: Who’s Doing What?

The approach to CBDCs varies widely across the globe, from advanced pilot programs to cautious research.

- China (e-CNY / DCEP): China is a frontrunner, having conducted extensive trials of its digital yuan (e-CNY) in major cities. Their focus is on domestic retail payments, financial inclusion, and maintaining monetary sovereignty.

- Europe (Digital Euro): The European Central Bank (ECB) is deep into its investigation phase for a digital euro. They are exploring various design options, with a strong emphasis on privacy, financial stability, and maintaining the role of commercial banks.

- United States (Digital Dollar): The U.S. Federal Reserve has been more cautious, conducting extensive research and public consultation on the potential benefits and risks of a digital dollar. They emphasize that any CBDC must protect privacy, prevent illicit activity, and complement existing financial systems.

- Bahamas (Sand Dollar): The Bahamas was one of the first countries to fully launch a retail CBDC, the Sand Dollar, aimed at improving payment efficiency and financial inclusion across its many islands.

- Sweden (e-Krona): As cash usage declines rapidly, Sweden’s Riksbank is actively researching an e-Krona, driven by the need to maintain public access to central bank money in a digital form.

- Many Others: Countries like Canada, the UK, India, and Australia are all at various stages of research, pilots, or public consultation regarding their own CBDCs, reflecting the global interest in this evolving area.

Conclusion: A New Era of Money?

The concept of Central Bank Digital Currencies represents a fundamental shift in how money could be designed, distributed, and used. While the technical capabilities exist, the real challenge for governments lies in crafting policies that balance innovation with stability, privacy with security, and efficiency with fairness.

CBDCs are not just a technological upgrade; they are a profound policy question with far-reaching implications for banking, privacy, monetary policy, and a nation’s role in the global economy. As central banks continue their research and pilots, the world watches to see how these digital currencies will shape the future of finance, bringing us closer to a truly digital economy where the very nature of money is redefined.

Whether your country ultimately adopts a CBDC or not, understanding these policy discussions is key to grasping the evolving landscape of money in the 21st century.

Post Comment