The Great Moderation: Understanding a Golden Age of Economic Stability (and Its End)

Imagine a time when the economy seemed to hum along, steadily growing, with prices staying relatively stable and big economic ups and downs becoming a rare sight. This wasn’t a fantasy; for a significant period, many developed economies, especially the United States, experienced just that. This era is known as The Great Moderation.

But what exactly was this period of economic calm? Why did it happen? What were its benefits, and were there any hidden costs? And crucially, what eventually brought this era to a dramatic end? This article will break down The Great Moderation in easy-to-understand terms, exploring its defining characteristics, the reasons behind its stability, its impact, and the lessons we learned when it finally concluded.

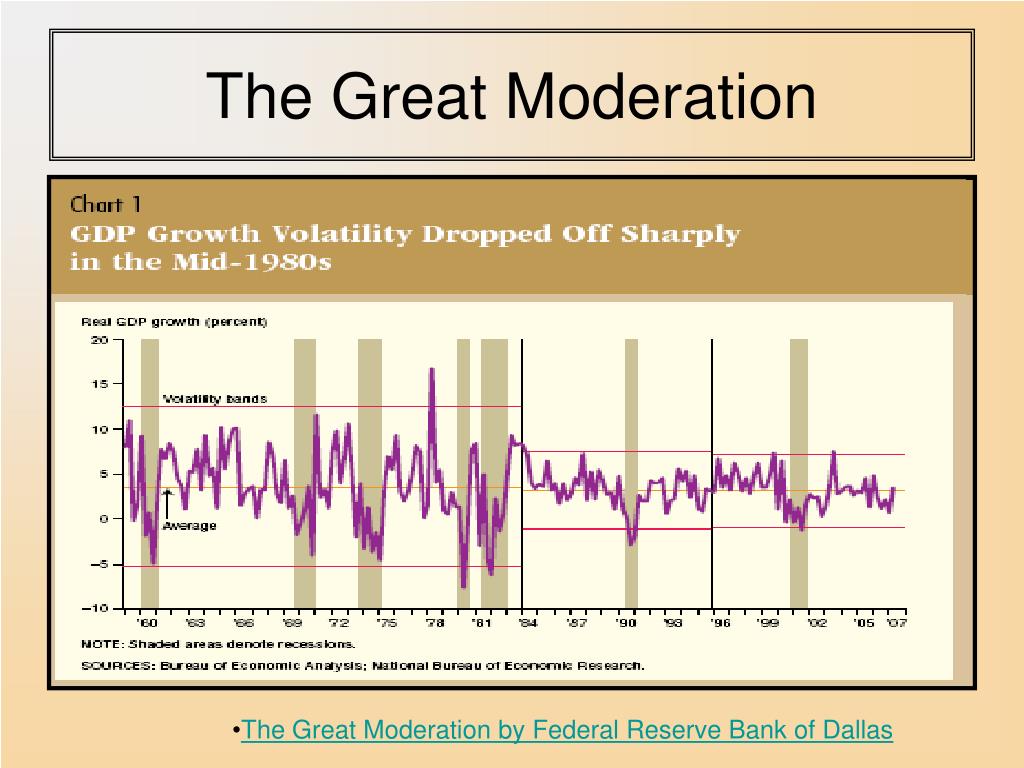

What Was The Great Moderation? A Period of Unprecedented Calm

The Great Moderation refers to a period, roughly from the mid-1980s to the mid-2000s, characterized by significantly reduced economic volatility. Think of it like an economic cruise control:

- Lower and More Stable Inflation: Unlike the turbulent 1970s, where prices soared (a phenomenon called "stagflation"), inflation during the Great Moderation was generally low and predictable. This meant your money didn’t lose its value quickly, and businesses could plan for the future with more certainty.

- Reduced Business Cycle Volatility: Economic growth became smoother. The "boom and bust" cycles – rapid growth followed by deep recessions – became less extreme. Recessions were shorter and less severe, and expansions were longer and more consistent.

- Greater Economic Predictability: With less dramatic swings in inflation and growth, economists, businesses, and consumers found the economy easier to forecast. This fostered confidence and encouraged long-term planning.

In essence, The Great Moderation was a welcome relief after decades of economic turbulence, offering a sense of calm and predictability that had been largely absent.

The Pillars of Stability: Why Did It Happen?

Economists debate the exact causes, but a combination of factors is widely credited for ushering in The Great Moderation. These can be broadly categorized into three main areas:

1. Smarter Central Banking and Monetary Policy

Perhaps the most commonly cited reason for The Great Moderation’s success was a fundamental shift in how central banks, like the Federal Reserve in the U.S., managed the economy.

- Focus on Inflation Taming: After the painful inflation of the 1970s, central bankers (most notably Paul Volcker and then Alan Greenspan at the Federal Reserve) became much more aggressive in fighting inflation. They learned that letting inflation get out of control was detrimental to long-term economic health.

- Credibility and Forward Guidance: Central banks became more transparent and predictable in their actions. When they said they would fight inflation, the markets believed them. This "credibility" helped anchor inflation expectations, meaning people didn’t expect prices to spiral, which in turn helped keep prices stable.

- Improved Monetary Policy Tools: Central banks refined their understanding of how interest rates and money supply influenced the economy. They became more adept at using these tools to fine-tune economic conditions, raising rates to cool down an overheating economy and lowering them to stimulate growth.

2. Structural Changes in the Economy

Beyond central bank policy, several underlying changes in the global economy also contributed to greater stability:

- Globalization: The increasing interconnectedness of global economies meant that shocks in one region could be absorbed or diversified away. For example, if one country faced supply issues, it could often import goods from another, reducing the impact on overall prices.

- Technological Advancements: The rise of information technology, computing, and the internet led to significant improvements in productivity and efficiency. Businesses could manage inventories better, communicate faster, and adapt more quickly to changing conditions, reducing waste and price pressures.

- Shift from Manufacturing to Services: Many developed economies saw a decline in the relative importance of heavy manufacturing and a rise in the service sector. Service industries are generally less prone to large inventory swings and volatile demand, which can smooth out the overall business cycle.

- Financial Innovation (Mixed Blessing): New financial products and markets emerged, theoretically allowing for better risk management and smoother capital flows. While this later proved to have a dark side, during the Moderation, it was seen as a contributing factor to stability.

3. Good Fortune and Lack of Major Shocks

Sometimes, it’s not just about what you do, but what doesn’t happen. The Great Moderation also benefited from a relatively quiet geopolitical and economic environment:

- Absence of Major Oil Shocks: Unlike the 1970s, there were no widespread, sudden spikes in oil prices that could derail economic growth and fuel inflation.

- Fewer Geopolitical Crises: While conflicts existed, there were no major global wars or widespread political instabilities that significantly disrupted global trade or supply chains on the scale seen in previous decades.

This combination of astute policy, underlying economic shifts, and a bit of luck created a uniquely stable economic environment.

The Benefits: Why Was It "Great"?

The sustained period of stability brought about tangible benefits for millions:

- Increased Confidence: Businesses and consumers felt more secure about the future, leading to increased investment, spending, and job creation.

- Lower Interest Rates: Stable inflation allowed central banks to keep interest rates relatively low, making it cheaper for people to borrow for homes and cars, and for businesses to invest and expand.

- Strong Job Growth: With consistent economic expansion, unemployment rates generally remained low, providing more people with stable incomes.

- Improved Living Standards: Lower inflation meant people’s wages went further, and the stable economic environment contributed to a general rise in prosperity.

- Reduced Poverty: Economic growth and job creation helped lift many out of poverty, particularly in developed nations.

For many, The Great Moderation truly felt like a golden age, a period where economic worries took a backseat to progress and prosperity.

The Clouds on the Horizon: Criticisms and Downsides

While celebrated, The Great Moderation wasn’t without its critics or its hidden dangers. In hindsight, some aspects of the era sowed the seeds for future problems:

- The "Greenspan Put": Critics argue that the Federal Reserve, under Alan Greenspan, became overly eager to cut interest rates during market downturns (like the dot-com bust of 2000), creating a "put option" for investors. This implied that the Fed would always step in to prevent major losses, encouraging excessive risk-taking in financial markets.

- Asset Bubbles: The low interest rates and ample liquidity (money available for lending) during this period contributed to the formation of asset bubbles, particularly in the stock market (dot-com bubble) and later, dangerously, in the housing market. People borrowed heavily, driving up prices of assets far beyond their fundamental value.

- Underestimation of Risk: The prolonged period of calm led to a sense of complacency among policymakers, regulators, and financial institutions. Many believed that the risk of a major financial crisis had been significantly reduced or even eliminated, leading to lax oversight.

- Growing Inequality: While not directly caused by The Great Moderation, the era coincided with a widening gap between the rich and the poor in many countries. Some argue that the benefits of low inflation and stable growth disproportionately favored those with assets (stocks, real estate) over wage earners.

- Too Much Debt: The low interest rates encouraged both households and businesses to take on unprecedented levels of debt, making them more vulnerable when the economic tide eventually turned.

These criticisms highlight that while the surface of the economy appeared calm, deeper structural issues were festering, largely unnoticed or ignored.

The End of an Era: The Global Financial Crisis

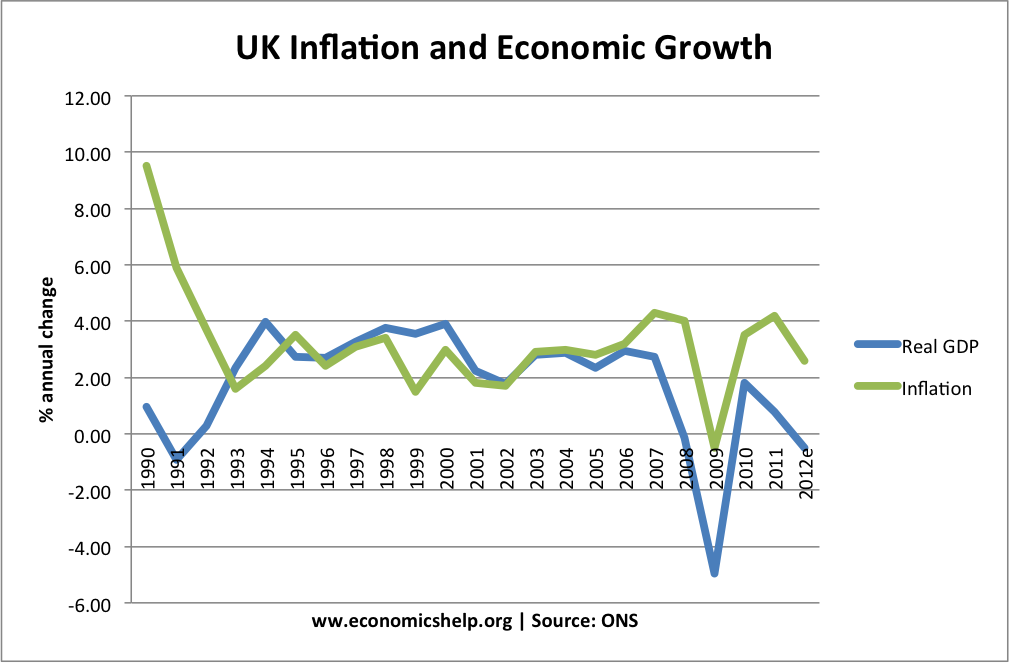

The Great Moderation came to a dramatic, shattering end with the onset of the Global Financial Crisis (GFC), which began in 2007 and intensified dramatically in 2008.

- The Housing Bubble Bursts: The massive housing bubble, fueled by subprime mortgages (loans given to borrowers with poor credit histories), unsustainable lending practices, and widespread speculation, began to deflate.

- Financial System Collapse: As homeowners defaulted on their loans, the value of mortgage-backed securities (complex financial products based on these loans) plummeted. This triggered a cascade of failures among major financial institutions, leading to a credit crunch where banks stopped lending to each other and to businesses.

- Global Recession: The financial crisis quickly spread, pulling the U.S. and then the rest of the world into the deepest recession since the Great Depression of the 1930s. Unemployment skyrocketed, economic activity ground to a halt, and governments had to intervene with massive bailouts and stimulus packages.

The Global Financial Crisis exposed the severe vulnerabilities that had built up during the seemingly calm years of The Great Moderation, proving that underlying stability was not as robust as once believed.

Lessons Learned from The Great Moderation

The Great Moderation, and its painful end, offered invaluable lessons for economists, policymakers, and the public:

- Monetary Policy Matters: Good central bank policy can indeed contribute to economic stability, but it’s not a magic bullet.

- Beware of Complacency: Prolonged periods of calm can foster overconfidence and lead to the accumulation of hidden risks within the financial system.

- Financial Regulation is Crucial: Unchecked financial innovation and deregulation can create systemic risks that threaten the entire economy. Robust oversight is necessary to prevent excessive risk-taking and asset bubbles.

- The Interconnectedness of the Economy: Economic stability depends not just on inflation and growth, but also on the health of the financial system, housing markets, and global trade.

- The Role of Debt: While debt can fuel growth, excessive debt, particularly when tied to speculative assets, can lead to catastrophic collapses.

- No "End of the Business Cycle": Despite hopes during the Moderation, the business cycle of booms and busts was not abolished, merely suppressed and transformed.

Conclusion

The Great Moderation remains a fascinating and complex chapter in economic history. It was a period of genuine economic calm and prosperity for many, driven by improved monetary policy, structural economic changes, and a bit of good fortune. However, beneath the surface of low inflation and stable growth, risks were accumulating, particularly in the financial sector.

Its dramatic conclusion with the Global Financial Crisis served as a powerful reminder that economic stability is a delicate balance, requiring constant vigilance, sound policy, and a healthy respect for the potential for financial excesses. While we may never perfectly replicate The Great Moderation, understanding its causes, benefits, and ultimate downfall provides crucial insights for navigating the economic challenges of the future.

Post Comment