Dodd-Frank Act: Unpacking Its Impact on US Financial Markets (A Beginner’s Guide)

Imagine a time when the global economy was on the brink, major banks were collapsing, and millions of people were losing their homes and jobs. This wasn’t a movie; it was the reality of the 2008 financial crisis. In the aftermath, policymakers worldwide scrambled to prevent such a catastrophe from ever happening again. In the United States, their answer was the Dodd-Frank Wall Street Reform and Consumer Protection Act, often simply called Dodd-Frank or DFA.

Passed into law in 2010, Dodd-Frank was the most significant overhaul of financial regulation in the U.S. since the Great Depression. Its goal was ambitious: to prevent future financial meltdowns, protect consumers, and bring more transparency and accountability to the financial system. But what exactly is it, and how has it reshaped the complex world of U.S. financial markets? Let’s break it down in easy-to-understand terms.

The Genesis: Why Dodd-Frank Was Necessary

To truly grasp Dodd-Frank, we need to briefly revisit the chaotic period that led to its creation: the 2008 Financial Crisis.

The Perfect Storm of 2008:

- Subprime Mortgages: Banks and lenders were giving out loans to people with shaky credit histories, often without proper checks. These were called "subprime mortgages."

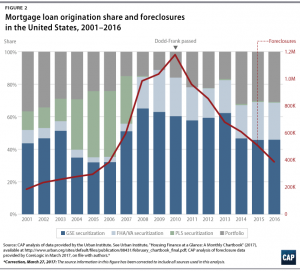

- Securitization Gone Wild: These risky mortgages were bundled together into complex financial products (like Mortgage-Backed Securities or MBS) and sold to investors worldwide. The idea was to spread the risk, but it also made it impossible to see how much bad debt was truly hidden within these packages.

- Credit Default Swaps (CDS): These were like insurance policies on the MBS. If the mortgages defaulted, the CDS paid out. But many companies (like AIG) sold far more CDS than they could ever afford to pay if things went wrong.

- "Too Big to Fail": Several massive financial institutions (like Lehman Brothers, Bear Stearns, AIG, and others) were so interconnected and deeply involved in these risky practices that their failure threatened to bring down the entire global financial system. The government faced a tough choice: let them collapse and trigger an even deeper depression, or bail them out using taxpayer money.

- Lack of Oversight: Regulators hadn’t kept pace with the complexity and interconnectedness of modern finance. There were gaps in oversight, allowing risks to build up unseen.

The crisis exposed gaping holes in the regulatory system. It became clear that new rules were desperately needed to rein in risky behavior, protect consumers from predatory practices, and ensure that no single financial institution could again hold the entire economy hostage. This urgent need gave birth to Dodd-Frank.

Pillars of Reform: Key Provisions of Dodd-Frank

Dodd-Frank is a massive and complex law, spanning over 2,300 pages. It introduced hundreds of new rules and created several new agencies. Here are some of its most important components, broken down by their core purpose:

1. Taming "Too Big to Fail" (Systemic Risk Mitigation)

One of the central goals of Dodd-Frank was to address the problem of "Too Big to Fail" (TBTF) – where a financial institution is so large and interconnected that its failure would trigger a widespread economic collapse, forcing the government to step in with a bailout.

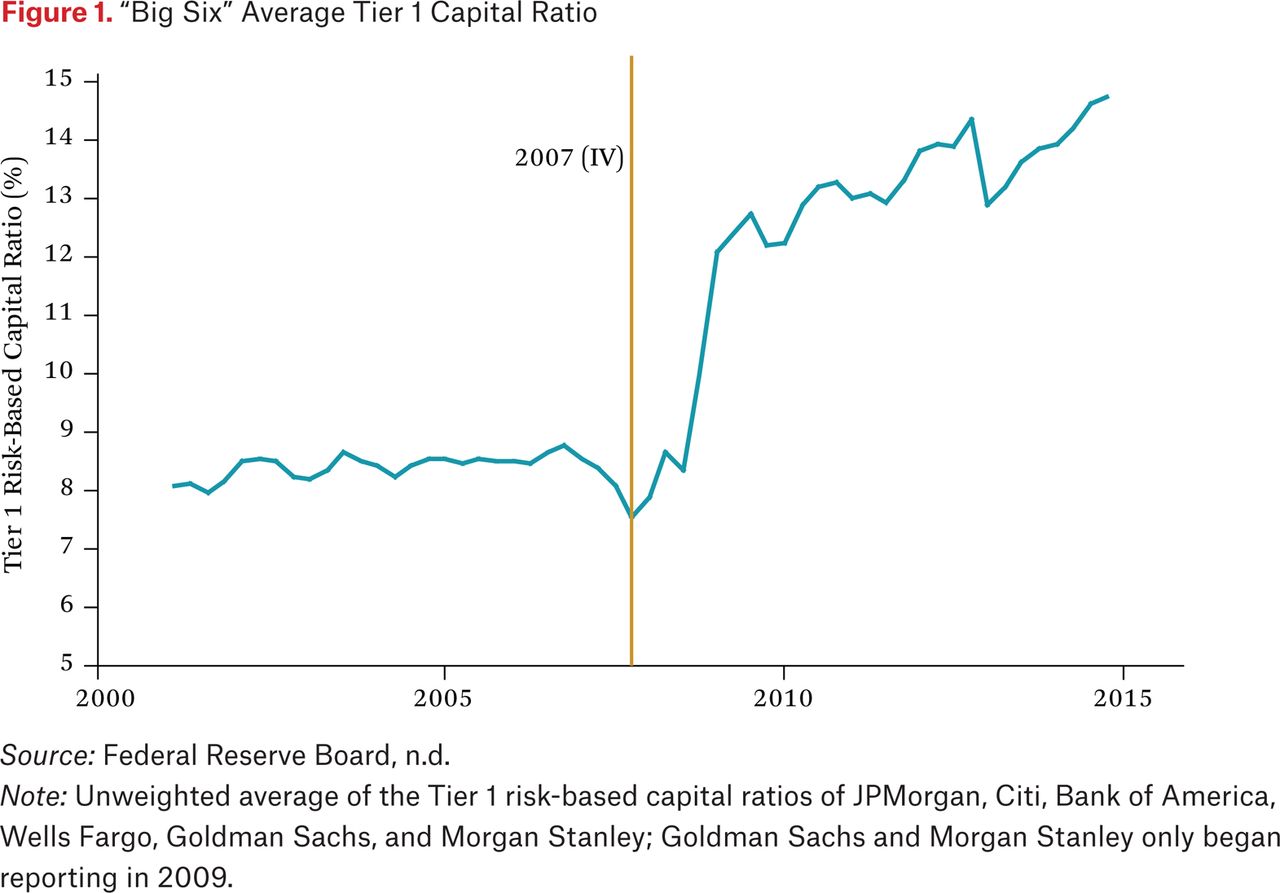

- Enhanced Capital Requirements & Stress Tests:

- Concept: Banks are now required to hold more money (capital) in reserve. Think of it like banks needing a bigger "rainy day fund." This makes them more resilient to losses and less likely to collapse.

- Stress Tests: Large banks must undergo annual "stress tests." These are like rigorous financial simulations where regulators see if the bank could survive a severe economic downturn (e.g., a massive recession, a housing market crash, etc.) without needing a bailout.

- Living Wills (Resolution Plans):

- Concept: Large financial firms must submit "living wills" to regulators. These are detailed plans outlining how they could be safely shut down or restructured in the event of severe financial distress, without causing chaos in the broader market. The idea is to make sure they can fail in an orderly way, without taxpayer money.

- Orderly Liquidation Authority (OLA):

- Concept: This provision gives the government a new tool, similar to bankruptcy, to take over and dismantle a failing, systemically important financial firm (a "SIFI" – Systemically Important Financial Institution) without resorting to a taxpayer bailout. It’s designed to protect the financial system, not the company’s shareholders or creditors.

- Financial Stability Oversight Council (FSOC):

- Concept: This new council, made up of various financial regulators, was created to monitor the entire financial system for emerging risks and identify potential "SIFIs" that could pose a threat if they failed. It’s like a central command center for spotting and addressing financial dangers.

2. Protecting Consumers: A New Watchdog

Before Dodd-Frank, consumer financial protection was scattered across many different agencies, leading to gaps and confusion.

- Consumer Financial Protection Bureau (CFPB):

- Concept: This was one of the most significant new agencies created by Dodd-Frank. The CFPB is a dedicated, independent agency solely focused on protecting consumers in the financial marketplace.

- What it Does: It writes and enforces rules for financial products and services like mortgages, credit cards, student loans, and bank accounts. It also takes consumer complaints and educates the public. Think of it as a powerful watchdog for your money.

- Mortgage Lending Reforms:

- Concept: Dodd-Frank introduced stricter rules for mortgage lenders to prevent the risky and predatory lending practices that fueled the 2008 crisis.

- Key Changes: Lenders must now verify a borrower’s ability to repay a loan (the "ability-to-repay" rule). There are also new disclosure requirements to make sure borrowers understand the terms of their mortgages.

3. Reining in Risky Trading: The Volcker Rule

- The Volcker Rule:

- Concept: Named after former Federal Reserve Chairman Paul Volcker, this rule generally prohibits banks that take deposits (and thus have federal deposit insurance backing them) from engaging in proprietary trading.

- What it Means: Banks can’t use their own money (or money from their depositors) to make speculative investments for their own profit. The idea is to separate traditional banking activities (like taking deposits and making loans) from riskier investment activities, preventing banks from gambling with taxpayer-insured funds. There are some exceptions, such as for market-making (facilitating client trades) and hedging.

4. Shining a Light on Derivatives

Derivatives are complex financial contracts whose value is derived from an underlying asset (like a stock, bond, currency, or commodity). Before 2008, many derivatives were traded "over-the-counter" (OTC), meaning directly between two parties without central oversight, making it impossible for regulators to see the full extent of the risks building up.

- Central Clearing & Exchange Trading:

- Concept: Dodd-Frank pushed for more derivatives to be traded on exchanges and cleared through central clearinghouses.

- What it Does: This brings more transparency to the market, reduces counterparty risk (the risk that one party in a contract won’t fulfill their obligation), and allows regulators to see the volume and value of these trades. It’s like moving trades from dark alleys into a brightly lit marketplace.

- Reporting Requirements: All derivatives transactions must now be reported to regulators, providing a clearer picture of the overall market.

5. Improving Market Transparency & Oversight

- Office of Financial Research (OFR):

- Concept: This new office within the Treasury Department was created to provide high-quality financial data and analysis to the FSOC and other regulators. It’s designed to be a central hub for understanding financial risks.

- Whistleblower Protections: Dodd-Frank enhanced protections and rewards for whistleblowers who report financial fraud, encouraging more people to come forward with information about illegal activities.

The Impact: Reshaping US Financial Markets

Dodd-Frank has undeniably left a profound mark on the U.S. financial landscape. Its impact has been both praised for enhancing stability and criticized for its complexity and unintended consequences.

Perceived Benefits and Successes:

- Increased Financial Stability:

- Stronger Banks: U.S. banks are now significantly better capitalized and have more liquid assets than before 2008. They are generally considered much safer and more resilient to economic shocks.

- Reduced "Too Big to Fail" Risk: While the debate continues, the enhanced capital requirements, stress tests, and living wills have made it harder for banks to become excessively risky and have provided tools for an orderly wind-down if necessary, theoretically reducing the need for taxpayer bailouts.

- Enhanced Consumer Protection:

- A Dedicated Watchdog: The CFPB has been highly active, issuing rules, levying fines against financial institutions for misconduct, and recovering billions of dollars for consumers who were victims of unfair practices.

- Safer Mortgages: The "ability-to-repay" rule and other mortgage reforms have helped curb the kind of reckless lending that characterized the pre-crisis housing market.

- Greater Transparency:

- Derivatives Market: The shift towards central clearing and exchange trading for derivatives has made this previously opaque market much more transparent, allowing regulators to better assess systemic risks.

- Better Data: The OFR and new reporting requirements provide regulators with a more comprehensive view of the financial system.

Challenges and Criticisms:

- Complexity and Regulatory Burden:

- Massive Scope: Dodd-Frank is incredibly complex, requiring thousands of pages of rules and guidance. Critics argue this creates an enormous compliance burden, especially for smaller banks and financial institutions that don’t have the resources of larger firms.

- "Regulatory Drag": Some argue that the sheer volume of new regulations has slowed economic growth by making it harder and more expensive for banks to lend, particularly to small businesses.

- Impact on Market Liquidity:

- Derivatives Market: While transparency is good, some argue that the new derivatives rules (like higher capital requirements for trading) have reduced liquidity in certain markets, making it harder and more expensive for companies to hedge their risks.

- Volcker Rule: Critics argue the Volcker Rule has made it harder for banks to act as "market makers," which can reduce liquidity and increase volatility in certain trading segments.

- Debate Over Effectiveness:

- "Too Big to Fail" Still Exists? Some argue that despite Dodd-Frank, the largest banks are still effectively "too big to fail" and that the OLA might not work as intended in a true crisis.

- Unintended Consequences: Critics point to various unintended consequences, such as increased consolidation in the banking sector (as smaller banks struggle with compliance) and shifts of risky activities to less regulated parts of the financial system.

- Political Backlash and Rollbacks:

- Dodd-Frank has faced significant political opposition, particularly from Republicans and the financial industry. The Trump administration enacted the Economic Growth, Regulatory Relief, and Consumer Protection Act of 2018, which rolled back some aspects of Dodd-Frank, primarily easing regulations for smaller and regional banks, and adjusting the threshold for what constitutes a "SIFI." This ongoing debate highlights the constant tension between financial stability and economic growth.

The Evolving Landscape Post-Dodd-Frank

The financial markets are constantly evolving, and so too is the regulatory environment. Dodd-Frank, while a landmark piece of legislation, is not static.

- Ongoing Adjustments: Regulators continue to fine-tune its rules, and Congress occasionally debates amendments or rollbacks.

- Technological Advancements: The rise of FinTech (financial technology), cryptocurrencies, and new payment systems presents new challenges and opportunities that Dodd-Frank did not directly address, prompting ongoing discussions about how to regulate these emerging areas.

- Global Coordination: Financial markets are global, and U.S. regulations often interact with international standards. Dodd-Frank has influenced global regulatory efforts, but maintaining consistency across borders remains a challenge.

Conclusion: A Legacy of Reform and Debate

The Dodd-Frank Act stands as a testament to the U.S.’s determination to learn from the devastating 2008 financial crisis. It fundamentally reshaped the architecture of financial regulation, introducing a new era of heightened oversight, increased capital requirements, and dedicated consumer protection.

While it has been successful in making the financial system more resilient and transparent, it has also sparked intense debate over its complexity, costs, and ultimate effectiveness. Whether you view it as a necessary bulwark against future crises or an overly burdensome set of regulations, there’s no denying that Dodd-Frank has profoundly influenced the way U.S. financial markets operate today and will continue to be a subject of discussion and adaptation for years to come.

Post Comment