Consensus Mechanisms Explained: PoW vs. PoS – The Ultimate Beginner’s Guide

Imagine a world without a central bank or a government to verify transactions. How would you know who owns what, or if a transaction truly happened? This is the core challenge faced by decentralized digital currencies like Bitcoin and Ethereum. The answer lies in something called Consensus Mechanisms.

In the world of blockchain, a consensus mechanism is essentially the set of rules and processes that allows all the computers (nodes) in a decentralized network to agree on the single, true state of the ledger. Without it, there would be chaos, double-spending, and no trust.

This article will demystify the two most prominent consensus mechanisms: Proof of Work (PoW) and Proof of Stake (PoS). We’ll break down how they work, their advantages, disadvantages, and why understanding them is crucial for anyone interested in the future of digital assets and Web3.

What Exactly is a Consensus Mechanism?

At its heart, a blockchain is a distributed ledger – a shared, continuously updated database that everyone on the network can see. But unlike a traditional database managed by a single entity (like a bank), a blockchain has no central authority. So, how do all the participants agree on which transactions are valid and which blocks should be added to the chain?

Think of it like this: Imagine a group of people building a giant LEGO castle together, but without a blueprint or a leader. A consensus mechanism provides the "rules of the game" that ensure everyone is building the same castle, in the same way, and agreeing on which bricks have been placed.

The primary goals of a consensus mechanism are:

- Decentralization: No single entity controls the network.

- Security: Preventing malicious actors from manipulating the ledger (e.g., spending the same money twice, known as "double-spending").

- Immutability: Once a transaction is recorded, it cannot be changed or deleted.

- Agreement: Ensuring all participants have the same, accurate copy of the ledger.

Now, let’s dive into the two titans of consensus: Proof of Work and Proof of Stake.

Proof of Work (PoW): The Original Heavyweight

Proof of Work (PoW) is the oldest and most well-known consensus mechanism, famously pioneered by Bitcoin. It’s a system that requires participants to expend a significant amount of computational effort to prove they’ve done "work."

How Does PoW Work? (The Mining Process)

In a PoW system, the process of adding new blocks of transactions to the blockchain is called "mining." Here’s a simplified breakdown:

- Gathering Transactions: Miners collect unconfirmed transactions from the network.

- Solving a Puzzle: They then compete to solve a complex mathematical puzzle. This puzzle isn’t about intelligence; it’s about brute-force computation. It requires a lot of trial and error, like guessing a massive combination lock. The solution to this puzzle is called a "nonce."

- The Race: Thousands of miners around the world are simultaneously trying to solve this puzzle. The first miner to find the correct solution gets to:

- Add the new block of transactions to the blockchain.

- Broadcast the newly verified block to the entire network.

- Receive a reward in the form of newly minted cryptocurrency (e.g., Bitcoin) and transaction fees.

- Verification: Once a block is added, other miners verify its validity. If it’s correct, they start working on the next puzzle, which is linked to the newly added block. This linking creates the "chain" in blockchain, making it incredibly difficult to alter past transactions.

Think of it like a digital gold rush: Miners are digging for digital gold by expending electricity and computational power. The "difficulty" of the puzzle adjusts to ensure that a new block is found, on average, at a consistent rate (e.g., every 10 minutes for Bitcoin).

Advantages of Proof of Work (PoW)

- Proven Security: PoW has been battle-tested for over a decade with Bitcoin, securing trillions of dollars in value. The immense computational power required to attack the network makes it incredibly difficult and expensive.

- High Decentralization (Initially): Anyone with the right hardware and electricity can become a miner, theoretically leading to a distributed network of participants.

- Simplicity: The core concept is relatively straightforward: do work, get rewarded.

Disadvantages of Proof of Work (PoW)

- Massive Energy Consumption: This is the most significant criticism. The computational effort translates into enormous electricity usage, comparable to the energy consumption of small countries. This raises environmental concerns.

- Scalability Issues: PoW blockchains like Bitcoin are inherently limited in the number of transactions they can process per second. This leads to slower transaction speeds and potentially higher fees during peak demand.

- Centralization of Mining Power: Over time, specialized and expensive hardware (ASICs) and the formation of large "mining pools" (groups of miners combining their power) can lead to a degree of centralization, where a few large entities control a significant portion of the network’s hash rate.

- High Entry Barrier: To be a competitive miner, you need substantial investment in hardware and access to cheap electricity.

Proof of Stake (PoS): The Modern Contender

Proof of Stake (PoS) is a newer and increasingly popular consensus mechanism that aims to address some of the limitations of PoW, particularly its energy consumption. Instead of computational work, PoS relies on participants "staking" (locking up) a certain amount of the cryptocurrency as collateral.

How Does PoS Work? (The Staking Process)

In a PoS system, there are no "miners" in the traditional sense. Instead, there are "validators." Here’s how it generally works:

- Staking Collateral: Participants who want to become validators must "stake" a certain amount of the network’s native cryptocurrency (e.g., 32 ETH for Ethereum). This stake acts as a security deposit and a commitment to honest behavior.

- Selection of Validators: Instead of competing to solve a puzzle, validators are randomly selected to create new blocks and validate transactions. The probability of being chosen is proportional to the amount of cryptocurrency they have staked – the more you stake, the higher your chances.

- Block Creation & Validation: The chosen validator proposes a new block of transactions. Other validators then verify the block’s validity.

- Rewards & Penalties: If the block is valid and accepted by the network, the proposing validator receives a reward (newly minted coins and transaction fees). If a validator tries to act maliciously or goes offline, they can face "slashing" – losing a portion or all of their staked collateral. This economic penalty incentivizes honest behavior.

Think of it like a digital lottery: The more tickets you buy (the more you stake), the higher your chances of winning the right to create the next block and earn a reward. But if you try to cheat, you lose your tickets (your stake).

Prominent Examples: Ethereum (after "The Merge" transition from PoW), Cardano, Solana, Polkadot.

Advantages of Proof of Stake (PoS)

- Energy Efficiency: This is PoS’s biggest selling point. It consumes significantly less energy than PoW because it doesn’t rely on competitive computational power. Validators simply need to run a node and participate in the consensus process.

- Better Scalability Potential: Without the need for computationally intensive mining, PoS networks can potentially process more transactions per second, leading to faster and cheaper transactions.

- Lower Entry Barrier (for some): While becoming a full validator might require a significant stake, many PoS networks allow users to "delegate" their stake to a staking pool, enabling participation with smaller amounts of crypto.

- Stronger Economic Security: The "slashing" mechanism provides a powerful economic disincentive against malicious behavior. A successful attack would require an attacker to acquire and stake a massive amount of the cryptocurrency, which would become incredibly expensive and risky.

Disadvantages of Proof of Stake (PoS)

- "Rich Get Richer" Concern: Critics argue that PoS could lead to centralization of power, as those with more stake have a higher chance of being selected and earning more rewards, potentially widening the wealth gap. However, many PoS protocols implement mechanisms to mitigate this.

- Less Battle-Tested: Compared to PoW, PoS is a newer technology, and its long-term security in the face of sophisticated attacks is still being observed and refined.

- "Nothing at Stake" Problem (Mitigated): In early PoS designs, validators had no real cost to validate on multiple forks (versions of the chain), which could lead to network instability. Modern PoS protocols (like Ethereum’s) have introduced slashing to address this.

- Complexity: The underlying mechanisms of PoS can be more complex to understand and implement than PoW.

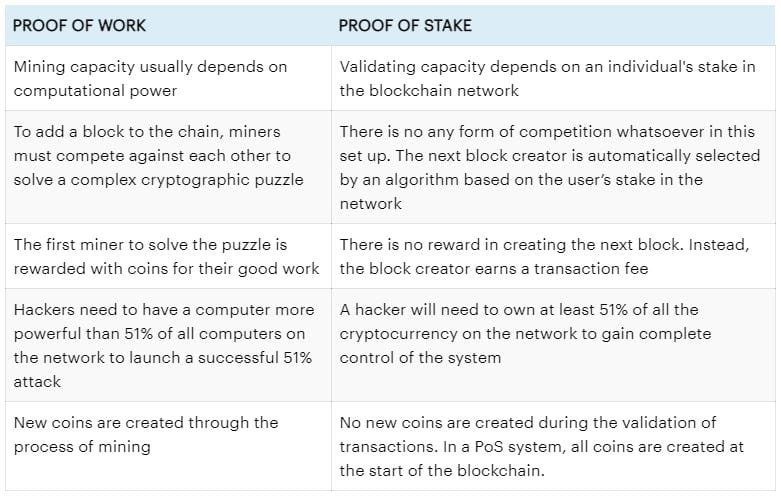

PoW vs. PoS: A Head-to-Head Comparison

| Feature | Proof of Work (PoW) | Proof of Stake (PoS) |

|---|---|---|

| Primary Mechanism | Solving complex computational puzzles ("mining") | Staking cryptocurrency as collateral ("validating") |

| Energy Consumption | Very High (major environmental concern) | Very Low (significantly more eco-friendly) |

| Security Model | Economic cost of hardware & electricity | Economic cost of acquiring & risking staked cryptocurrency |

| Scalability | Limited (slower transactions, higher fees) | Higher potential (faster transactions, lower fees) |

| Decentralization | Can be centralized by mining pools & ASICs | Can be centralized by large stakers, but often mitigated |

| Entry Barrier | High (expensive hardware, cheap electricity) | Can be high for full validator, but pools lower it |

| Rewards | Block rewards (newly minted coins) + transaction fees | Staking rewards (newly minted coins) + transaction fees |

| Vulnerability | 51% attack (control >50% of hash rate) | 51% attack (control >50% of staked coins) |

| Example Networks | Bitcoin, Litecoin, Dogecoin | Ethereum (after Merge), Cardano, Solana, Polkadot |

The Future of Consensus: Is There a Winner?

The debate between PoW and PoS is ongoing, and both have their merits. There isn’t a universally "better" mechanism; the choice often depends on the specific goals and values of a blockchain project.

- Bitcoin remains committed to Proof of Work, prioritizing its proven security and robust, simple design, despite the energy concerns. For many, Bitcoin’s PoW is fundamental to its "digital gold" narrative.

- Ethereum’s transition to Proof of Stake (known as "The Merge" in 2022) was a monumental event in the crypto world. It showcased a major network prioritizing energy efficiency and scalability for a more diverse ecosystem of decentralized applications (dApps).

- Newer blockchains are overwhelmingly choosing Proof of Stake or variations of it (like Delegated Proof of Stake – DPoS, or Proof of Authority – PoA) due to their inherent scalability and energy efficiency.

As the blockchain space continues to evolve, we may see hybrid models or entirely new consensus mechanisms emerge. The innovation in this field is relentless, driven by the need to build more secure, scalable, and decentralized networks for the future of Web3.

Conclusion

Consensus mechanisms are the unsung heroes of the blockchain world. They are the invisible engines that power trust, security, and agreement in a decentralized environment. Whether it’s the energy-intensive "work" of Bitcoin’s miners or the "stake" of Ethereum’s validators, these mechanisms ensure that every transaction is valid and every block is an undisputed part of the chain.

Understanding the fundamental differences between Proof of Work and Proof of Stake is key to grasping the core principles that drive different cryptocurrencies and the diverse visions for a decentralized future. As blockchain technology continues to integrate into our lives, knowing how these foundational systems operate will be increasingly valuable.

Post Comment