Deflation: The Dangers of Falling Prices – Why Cheaper Isn’t Always Better

Imagine walking into a store and seeing prices drop every single week. Groceries are cheaper, your new TV costs less than last month, and even houses are becoming more affordable. Sounds like a dream, right? More money in your pocket, greater purchasing power! While this might seem like a consumer’s paradise, a widespread and sustained fall in prices – a phenomenon known as deflation – is actually one of the most feared economic scenarios for economists and central banks worldwide.

Far from being a boon, deflation can be a hidden economic threat, leading to stagnation, job losses, and a painful economic spiral. In this comprehensive guide, we’ll dive deep into what deflation is, why it sounds appealing but isn’t, and the very real dangers it poses to individuals, businesses, and entire economies.

What Exactly is Deflation?

At its core, deflation is the opposite of inflation. While inflation means the general level of prices for goods and services is rising, deflation means the general level of prices is falling. This leads to an increase in the purchasing power of money – your dollar buys more today than it did yesterday.

Think of it this way:

- Inflation: Your $100 buys fewer goods over time.

- Deflation: Your $100 buys more goods over time.

While a slight, healthy drop in prices due to increased efficiency or technological advancement (e.g., computers getting cheaper over time) isn’t necessarily bad, true deflation refers to a broad, sustained, and undesirable decline in the overall price level across an economy. It’s not just a sale; it’s a fundamental shift in economic dynamics.

Why Deflation Sounds Good (But Isn’t)

On the surface, deflation appears to be a wonderful thing for consumers. Who wouldn’t want their money to go further?

- Increased Purchasing Power: Your savings are worth more, as they can buy a larger quantity of goods and services.

- Cheaper Goods: Everyday items, electronics, and even big-ticket purchases become more affordable.

- Reduced Cost of Living: Theoretically, your daily expenses could decrease significantly.

However, these immediate benefits are overshadowed by a cascade of negative consequences that can cripple an economy. The short-term consumer delight quickly turns into long-term economic despair.

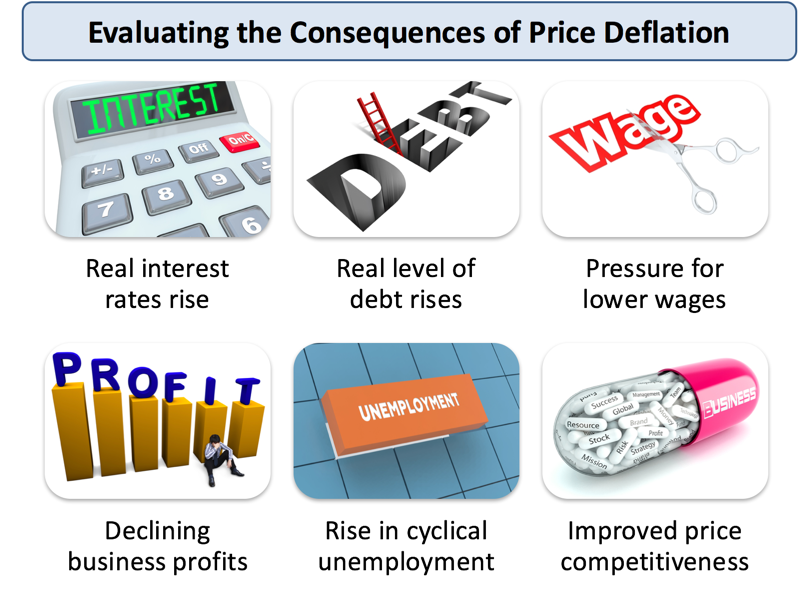

The Alarming Dangers of Deflation: A Deep Dive

The real dangers of deflation emerge when prices fall across the board and for an extended period. Here’s why it’s so problematic:

1. The Debt Burden Deepens

This is perhaps the most insidious danger of deflation. Imagine you borrowed $300,000 to buy a house. In a deflationary environment:

- The Real Value of Debt Increases: While the nominal amount you owe (e.g., $300,000) stays the same, the real value of that debt (what it can buy) goes up. This is because the money you earn (your income) and the value of your assets (like your house) are likely falling along with prices.

- Harder to Repay: If your income is falling, but your debt remains constant, it becomes much harder to make your loan payments. This applies to mortgages, car loans, student loans, and credit card debt.

- Increased Defaults: As individuals and businesses struggle to repay debts, loan defaults rise, which then hurts banks and the entire financial system.

2. Delayed Spending & The "Wait-and-See" Mentality

Why buy something today if you know it will be cheaper tomorrow? This logical consumer behavior in a deflationary environment leads to a dangerous cycle:

- Reduced Consumer Demand: People postpone purchases, especially for big-ticket items like cars, appliances, or new homes, anticipating lower prices in the future.

- Lower Business Revenue: With less demand, businesses sell fewer products and services.

- Downward Price Pressure: To try and attract the few buyers available, businesses are forced to cut prices even further, perpetuating the deflationary cycle.

3. Crushing Business Profits & Investment

For businesses, falling prices are a nightmare:

- Lower Revenue: They sell their products for less money, directly impacting their top line.

- Fixed Costs Remain: Many business costs, such as rent, loan repayments, and employee salaries (at least in the short term), don’t fall as quickly as prices. This squeezes profit margins.

- Reduced Investment: With profits shrinking or disappearing, businesses have less incentive and less capital to invest in new equipment, research and development, or expansion. This stifles innovation and future growth.

- Layoffs and Wage Cuts: To cut costs and stay afloat, businesses are often forced to reduce wages or, more drastically, lay off employees.

4. Rising Unemployment

As businesses struggle with declining profits and reduced demand, they inevitably resort to cost-cutting measures:

- Job Losses: Layoffs become common as companies try to align their workforce with lower production needs and revenue.

- Increased Competition for Jobs: With more people out of work, competition for the remaining jobs intensifies, potentially driving wages down further.

- Reduced Household Income: Unemployment leads to less money in people’s pockets, further reducing consumer spending and deepening the deflationary spiral.

5. The Deflationary Spiral: A Vicious Cycle

This is the ultimate fear of economists. A deflationary spiral is a self-reinforcing loop where the dangers feed into each other, making the problem worse and worse:

- Prices Fall: (Initial deflationary trigger)

- Consumers Delay Spending: "Wait and see" mentality.

- Business Revenue Drops: Less demand leads to lower sales.

- Businesses Cut Costs: To maintain profitability, businesses reduce production, cut wages, and lay off workers.

- Unemployment Rises & Incomes Fall: More people are out of work, and those with jobs may earn less.

- Consumer Spending Falls Even Further: With less income and job insecurity, people spend even less.

- Prices Fall Even More: Businesses cut prices further to stimulate demand, or simply due to oversupply.

This cycle repeats, pushing the economy into a deep recession or even a depression, making recovery extremely difficult.

6. Impact on Government & Public Services

Governments are not immune to deflation’s ill effects:

- Reduced Tax Revenue: Lower incomes, falling profits, and decreased spending all lead to lower tax collections (income tax, corporate tax, sales tax).

- Increased Social Safety Net Costs: With rising unemployment, the government faces higher costs for unemployment benefits, welfare, and other social programs.

- Higher Debt Burden: Similar to individuals, the real value of government debt increases in a deflationary environment, making it harder to service. This can lead to cuts in public services, infrastructure, education, and healthcare.

What Causes Deflation?

Deflation typically arises from a combination of factors, often linked to insufficient demand relative to supply:

- Shrinking Money Supply (Tight Monetary Policy): If a central bank drastically reduces the amount of money circulating in the economy (e.g., by sharply raising interest rates or selling off assets), there’s less money chasing goods, leading to falling prices.

- Lack of Demand (Low Consumer Confidence): If consumers are worried about the future (e.g., job security, economic recession), they tend to save more and spend less, reducing overall demand.

- Technological Advancement & Increased Productivity: While generally positive, rapid technological advances can dramatically lower production costs and, consequently, prices for certain goods. If this happens across many sectors too quickly, it can contribute to general deflation.

- Excess Supply (Overproduction): If businesses produce too much, and demand doesn’t keep up, they’re forced to lower prices to sell off inventory.

- Credit Contraction: A reduction in lending by banks (often due to fear or regulation) means less money is available for individuals and businesses to borrow and spend, stifling economic activity.

How Central Banks and Governments Fight Deflation

Because deflation is so damaging, central banks and governments employ powerful tools to combat it:

-

Monetary Policy (Central Banks):

- Lowering Interest Rates: Makes borrowing cheaper, encouraging spending and investment. When rates hit zero, central banks resort to other measures.

- Quantitative Easing (QE): The central bank buys large quantities of government bonds and other assets from banks. This injects money directly into the financial system, lowering long-term interest rates and encouraging lending and investment.

- Forward Guidance: Communicating their intention to keep interest rates low for an extended period to influence expectations and encourage spending.

-

Fiscal Policy (Governments):

- Increased Government Spending: Investing in infrastructure, education, or social programs directly injects money into the economy, creating jobs and stimulating demand.

- Tax Cuts: Leaving more money in the hands of consumers and businesses, hoping they will spend and invest it.

Fighting deflation can be incredibly challenging, as people’s expectations of falling prices can become deeply entrenched, making it hard to reverse the "wait-and-see" mentality. Japan, for example, battled deflation for decades.

Conclusion: The Unseen Threat

While the immediate thought of falling prices might bring a smile to your face, understanding the complex and far-reaching consequences of sustained deflation reveals it to be a significant economic threat. It stifles growth, burdens debtors, fuels unemployment, and can trap an economy in a vicious cycle of decline.

Economists and policymakers constantly strive to maintain a delicate balance, aiming for a small, stable amount of inflation (typically around 2%) to encourage spending and investment, while avoiding the dangers of both runaway inflation and the insidious grip of deflation. So, the next time you hear about falling prices, remember that while a bargain is great, widespread deflation is a signal of deep economic trouble beneath the surface.

Post Comment