Navigating the Digital Frontier: Cryptocurrency Regulation – Global Approaches and Trends Explained

The world of cryptocurrency, once a niche interest for tech enthusiasts, has exploded into the mainstream. From Bitcoin and Ethereum to thousands of altcoins and NFTs, digital assets are reshaping finance, technology, and even art. But as this innovative space grows, so does the demand for clear rules. Just like the early internet, which began as a wild frontier before evolving with laws and standards, cryptocurrency is now at a crucial juncture: the era of regulation.

For beginners, understanding cryptocurrency regulation can seem daunting. It’s a complex tapestry woven from legal frameworks, technological advancements, and diverse national interests. This article will break down why regulation is needed, explore the different approaches countries are taking, highlight key trends, and discuss the challenges and opportunities ahead, all in easy-to-understand language.

Why is Cryptocurrency Regulation Needed?

Imagine a bustling marketplace with no rules. That’s a bit like the early crypto space. While decentralization is a core tenet, a complete lack of oversight can lead to significant problems. Here’s why governments and international bodies are stepping in:

- Investor Protection: The crypto market is volatile and prone to scams, hacks, and fraudulent schemes. Regulations aim to protect individuals from losing their savings due to misleading information or outright theft. This includes requirements for exchanges to be transparent, secure, and offer proper disclosures.

- Combating Illicit Activities: Cryptocurrencies, especially those offering enhanced anonymity, have unfortunately been used for money laundering, terrorist financing, and other criminal activities. Regulations like Anti-Money Laundering (AML) and Know Your Customer (KYC) aim to make it harder for criminals to use crypto undetected.

- Financial Stability: As crypto markets grow, their interconnectedness with traditional financial systems increases. A major collapse in the crypto world could potentially spill over and destabilize banks or financial markets. Regulators want to prevent this by ensuring stability and managing systemic risks.

- Market Integrity: Regulations seek to prevent market manipulation, insider trading, and other unfair practices that undermine trust and create an uneven playing field.

- Taxation: Governments want to ensure that economic activity involving cryptocurrencies is taxed fairly, just like other assets or income. Clear tax guidelines help both individuals and businesses understand their obligations.

- Consumer Confidence: Clear regulations build trust. When people feel secure and understand the rules, they are more likely to participate, fostering broader adoption and innovation in a responsible manner.

The Spectrum of Global Regulatory Approaches

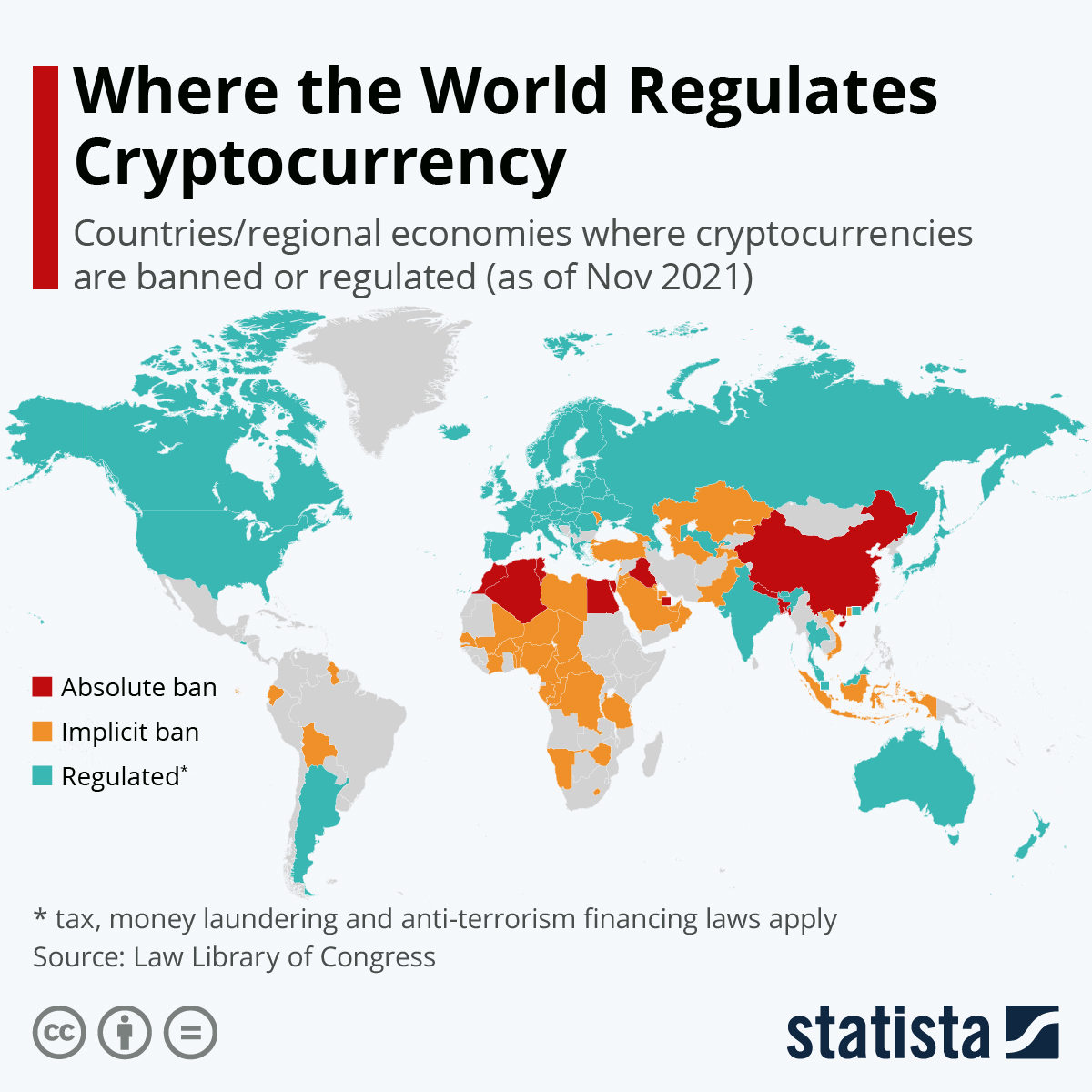

There isn’t a single global rulebook for crypto (yet!). Instead, countries are taking a variety of approaches, often influenced by their economic priorities, existing financial regulations, and risk tolerance. We can categorize these approaches along a spectrum:

1. Strict Prohibition or Bans

Some countries have taken a hardline stance, viewing cryptocurrencies as a threat to their financial stability, capital controls, or national security.

- Examples:

- China: Has implemented comprehensive bans on crypto mining, trading, and services. While individuals may still own crypto, the ability to interact with it within China’s borders is severely restricted.

- Other Nations: A few other countries, particularly those with strict capital controls or a history of financial instability, have also imposed outright bans or severe restrictions.

- Reasons: Often cited reasons include preventing capital flight, maintaining control over the financial system, combating illicit activities, and promoting their own central bank digital currencies (CBDCs).

2. Cautious Observation and Limited Regulation

Many countries initially adopted a "wait and see" approach, perhaps regulating specific aspects like AML/KYC for exchanges, but holding back on a comprehensive framework.

- Characteristics:

- Focus on specific high-risk areas.

- Often treating crypto as property or an asset for tax purposes, rather than currency.

- Less emphasis on innovation-friendly frameworks initially.

- Evolution: Many nations that started here are now moving towards more comprehensive frameworks as the crypto market matures.

3. Progressive Integration and Comprehensive Frameworks

A growing number of jurisdictions are actively working to integrate digital assets into their existing legal and financial systems, aiming to foster innovation while managing risks. This is where most of the significant regulatory trends are emerging.

- Characteristics:

- Developing specific licenses for crypto businesses (exchanges, custodians).

- Creating frameworks for stablecoins and other digital assets.

- Focusing on consumer protection and market integrity.

- Often seeking to become "crypto hubs" to attract businesses and talent.

- Examples: The European Union, the United Kingdom, Singapore, Japan, and parts of the United States are leading the charge in this area.

Key Areas of Regulatory Focus & Emerging Trends

Regardless of their overall approach, most jurisdictions are grappling with similar questions about how to categorize and regulate specific aspects of the crypto ecosystem.

1. Anti-Money Laundering (AML) & Know Your Customer (KYC)

This is perhaps the most universally adopted form of crypto regulation.

- What it means:

- AML: Rules designed to prevent criminals from disguising illegally obtained money as legitimate funds.

- KYC: The process of verifying the identity of clients (requiring ID, address proof, etc.) to ensure they are who they say they are.

- Impact: Most reputable crypto exchanges and service providers worldwide now require users to complete KYC procedures before they can trade or withdraw funds. This aligns crypto with traditional financial services regulations.

- Trend: Increasingly being extended to cover a wider range of crypto activities, including self-hosted wallets in some proposals (though this is highly controversial).

2. Consumer and Investor Protection

Regulators are keen to shield everyday investors from the unique risks of the crypto market.

- Key Measures:

- Disclosure Requirements: Making sure investors understand the risks involved before buying crypto.

- Licensing for Crypto Businesses: Requiring exchanges, brokers, and custodians to obtain specific licenses and meet certain operational standards.

- Advertising Rules: Restricting misleading or overly aggressive advertising for crypto products.

- Preventing Market Manipulation: Developing rules to identify and punish practices like "pump and dump" schemes.

3. Stablecoin Regulation

Stablecoins are cryptocurrencies designed to maintain a stable value, usually pegged to a fiat currency like the US dollar. Their growing popularity, especially after events like the Terra/Luna collapse, has made their regulation a top priority.

- Why it’s crucial: If a major stablecoin fails, it could create significant ripple effects across the broader crypto market and potentially impact traditional finance.

- Key Focus Areas:

- Reserve Requirements: Ensuring that stablecoin issuers actually hold enough reserves (e.g., US dollars, government bonds) to back every stablecoin in circulation, and that these reserves are regularly audited and transparent.

- Redemption Rights: Ensuring that users can reliably convert their stablecoins back into fiat currency at par.

- Issuance Licensing: Requiring stablecoin issuers to be licensed and subject to supervision by financial authorities.

4. Decentralized Finance (DeFi) Regulation

DeFi refers to financial applications built on blockchain technology that operate without traditional intermediaries like banks. This is one of the trickiest areas for regulators.

- The Challenge: DeFi’s decentralized nature makes it hard to identify a central entity to regulate. Who is responsible for a protocol governed by code and community votes?

- Emerging Approaches:

- Targeting "Gateways": Regulating the on-ramps and off-ramps that connect DeFi to traditional finance (e.g., exchanges that list DeFi tokens).

- Focusing on "Identifiable Entities": If a DeFi protocol has identifiable developers, founders, or large token holders who exert significant control, regulators might try to hold them accountable.

- Classifying DeFi Products: Determining if certain DeFi products (like lending pools or liquidity provider tokens) qualify as securities or other regulated financial instruments.

- Trend: This area is still very much in its infancy, and regulators are struggling to keep pace with rapid innovation.

5. Central Bank Digital Currencies (CBDCs)

While not cryptocurrencies themselves, CBDCs are digital versions of a country’s fiat currency issued and backed by its central bank (e.g., a "digital dollar" or "digital euro").

- Impact on Private Crypto: The development of CBDCs is often seen as a response to the rise of private cryptocurrencies. They could offer some of the benefits of digital money (efficiency, speed) without the volatility or regulatory concerns of private crypto.

- Regulatory Implications: CBDCs could influence the regulatory landscape for private crypto by providing a clearer, regulated alternative for digital transactions.

6. Environmental Concerns

The energy consumption of certain cryptocurrencies (especially those using "Proof-of-Work" like Bitcoin) has become a growing concern for regulators and environmental advocates.

- Trend: Some jurisdictions are exploring ways to encourage or mandate more energy-efficient blockchain technologies, or even impose taxes related to carbon emissions from crypto mining.

7. Tax Implications

Almost universally, governments are seeking to clarify how cryptocurrencies should be taxed.

- Common Treatment: Most countries treat cryptocurrencies as property or assets for tax purposes, meaning:

- Capital Gains Tax: Applies when you sell crypto for a profit.

- Income Tax: Can apply if you earn crypto through mining, staking, or as payment for services.

- Trend: Increased enforcement and data sharing agreements between tax authorities and crypto exchanges to track transactions.

Leading Jurisdictions and Their Approaches

Let’s look at some specific examples of how different regions are approaching crypto regulation:

The European Union (EU)

The EU is leading the world in developing a comprehensive, bloc-wide regulatory framework.

- MiCA (Markets in Crypto-Assets) Regulation: This landmark legislation, passed in 2023 and coming into full effect by 2024-2025, is the first comprehensive legal framework for crypto assets in a major jurisdiction.

- Key Features:

- Classifies crypto assets into different categories (e.g., utility tokens, asset-referenced tokens, e-money tokens).

- Requires crypto-asset service providers (CASPs) to be licensed and comply with strict operational and prudential requirements.

- Sets rules for stablecoins, including reserve requirements and supervision.

- Aims to create a harmonized market across all 27 EU member states, making it easier for crypto businesses to operate across borders.

- Key Features:

- Impact: MiCA is expected to set a global precedent and influence regulatory approaches in other parts of the world.

The United States (US)

The US approach is often described as fragmented and complex, due to multiple regulatory bodies with overlapping jurisdictions.

- Key Regulators:

- SEC (Securities and Exchange Commission): Primarily views many cryptocurrencies as "securities" and regulates them under existing securities laws. Has been very active in enforcement actions against crypto companies.

- CFTC (Commodity Futures Trading Commission): Considers Bitcoin and Ethereum as "commodities" and regulates crypto derivatives.

- Treasury Department (FinCEN): Focuses on AML/KYC for money service businesses, including crypto exchanges.

- State Regulators: Many states have their own "BitLicense" or other specific crypto regulations.

- Challenges: The lack of a unified federal framework creates uncertainty for businesses and investors, leading to a "regulation by enforcement" approach, where clarity often comes through court cases.

- Trend: Calls for clearer legislation are growing, but political divisions make a comprehensive federal crypto law challenging to pass.

The United Kingdom (UK)

The UK aims to become a global hub for crypto innovation, while also ensuring robust consumer protection.

- Approach: Post-Brexit, the UK has more flexibility to design its own rules. It’s developing a phased approach, focusing on stablecoins first, then broader crypto activities.

- Key Initiatives:

- Financial Services and Markets Act 2023: Laid the groundwork for regulating stablecoins and other digital assets as specified financial activities.

- FCA (Financial Conduct Authority): The primary financial regulator, tasked with overseeing crypto firms and enforcing rules around advertising and consumer protection.

- Trend: The UK is trying to balance innovation with strong regulatory oversight, positioning itself as an attractive, yet safe, jurisdiction for crypto businesses.

Asia (Singapore, Japan, South Korea)

Several Asian countries have been early adopters and innovators in the crypto space, often developing comprehensive frameworks.

- Singapore: Has established itself as a leading crypto hub with a progressive regulatory stance.

- Payment Services Act: Regulates crypto service providers for AML/CFT and consumer protection.

- MAS (Monetary Authority of Singapore): Focuses on clear licensing and robust oversight, attracting many global crypto firms.

- Japan: Was one of the first countries to recognize Bitcoin as legal property and regulate crypto exchanges.

- Payment Services Act: Requires crypto exchanges to be licensed and adhere to strict security and consumer protection rules.

- South Korea: Has implemented strict AML/KYC rules and requires real-name accounts for crypto trading.

- Trend: These nations often prioritize innovation but with a strong emphasis on investor protection and financial stability.

Challenges and Opportunities in Crypto Regulation

The journey towards effective cryptocurrency regulation is fraught with challenges, but also opens up significant opportunities.

Challenges:

- Jurisdictional Arbitrage: Crypto businesses can easily move their operations to countries with more favorable (or less stringent) regulations, making consistent global oversight difficult.

- Rapid Innovation: The crypto space evolves incredibly fast. Regulations often struggle to keep pace with new technologies (like DeFi, NFTs, DAOs) and business models.

- Global Coordination: Crypto is borderless. Effective regulation often requires international cooperation, which is challenging given differing national interests and legal systems.

- Balancing Innovation vs. Protection: Regulators walk a tightrope: too much regulation can stifle innovation and drive businesses away; too little can expose consumers to significant risks.

- Defining Crypto Assets: The fundamental challenge of classifying different crypto assets (is it a currency, a commodity, a security, or something new?) impacts how they are regulated.

Opportunities:

- Legitimacy and Mainstream Adoption: Clear rules lend credibility to the crypto industry, encouraging traditional financial institutions and a broader public to participate.

- Enhanced Security and Trust: Regulation can push crypto firms to adopt better security practices, transparency, and consumer safeguards, reducing scams and hacks.

- New Economic Models: A well-regulated environment can foster the development of new, innovative financial products and services built on blockchain, driving economic growth.

- Global Standardization: As more countries adopt regulations, there’s an opportunity for international bodies (like the Financial Stability Board or FATF) to push for global standards, creating a more harmonized and predictable environment.

- Talent Attraction: Jurisdictions with clear, forward-thinking regulations can attract top talent and businesses in the blockchain and crypto space.

Conclusion: An Evolving Landscape

Cryptocurrency regulation is no longer a distant possibility; it’s a rapidly evolving reality. From the EU’s comprehensive MiCA framework to the US’s fragmented approach and Asia’s innovative spirit, global jurisdictions are actively shaping the future of digital assets.

For beginners, understanding that this is a dynamic process is key. The "Wild West" era of crypto is slowly giving way to a more structured environment. While challenges remain, the trend is clear: as cryptocurrencies become more intertwined with global finance, the need for robust, yet flexible, regulation will only grow. The goal is to strike a delicate balance – fostering the incredible innovation that blockchain technology offers, while simultaneously protecting investors, ensuring financial stability, and combating illicit activities. The digital frontier is being tamed, not by prohibition, but by thoughtful, evolving rule-making.

Post Comment