Unlocking the Power of Interest Rate Differentials: How They Drive Currency Exchange

Have you ever wondered why the value of one currency goes up while another goes down? Why sometimes your vacation money stretches further, and other times it feels like you’re paying a premium? The world of currency exchange, also known as Forex (Foreign Exchange), might seem like a complex maze, but at its heart lies a powerful, yet understandable, driver: Interest Rate Differentials.

This comprehensive guide will demystify interest rate differentials, explain their profound impact on currency exchange, and equip you with the foundational knowledge to understand how global money flows. Whether you’re a budding investor, a curious traveler, or just someone who wants to grasp the mechanics behind daily financial news, you’re in the right place.

What Exactly Are Interest Rate Differentials? A Simple Explanation

Let’s break down this somewhat intimidating term into its two core components:

-

Interest Rate: In simple terms, an interest rate is the cost of borrowing money or the reward for lending (saving) money.

- When you borrow from a bank, you pay interest.

- When you save money in a bank account, the bank pays you interest.

- Central banks (like the Federal Reserve in the US, the European Central Bank, or the Bank of England) set key interest rates that influence all other rates in an economy.

-

Differential: This simply means "the difference between two things."

So, an Interest Rate Differential is simply the difference between the interest rates of two different countries.

Example:

- Imagine Country A has an interest rate of 3%.

- Country B has an interest rate of 1%.

- The interest rate differential between Country A and Country B is 3% – 1% = 2%.

This 2% difference might seem small, but in the world of global finance, it’s a massive signal that can trigger billions of dollars to move across borders.

Why Do Interest Rates Matter for Currencies? The Basic Idea

Think of money like water. Water flows from high ground to low ground. Similarly, in the financial world, money tends to flow towards wherever it can earn a higher return.

If you have money to invest, and you have the choice between putting it in a bank account in Country A that pays 3% interest or a bank account in Country B that pays 1% interest, where would you put it? All else being equal, you’d choose Country A, right?

This is the fundamental principle:

- Higher interest rates attract foreign capital. When a country offers higher interest rates, it becomes more attractive for investors from other countries to send their money there to earn a better return.

- Increased demand for a currency strengthens its value. To invest in Country A, foreign investors first need to convert their own currency into Country A’s currency. This increased demand for Country A’s currency drives its value up relative to other currencies.

- Lower interest rates can deter foreign capital. Conversely, if a country offers very low interest rates, investors might pull their money out to seek better returns elsewhere, or simply avoid investing there in the first place. This decreased demand (or increased supply as money leaves) can weaken the currency’s value.

This phenomenon is often referred to as capital flow – the movement of money for investment purposes from one country to another.

The "Carry Trade": A Popular Strategy Driven by Differentials

One of the most direct applications of interest rate differentials in currency markets is a strategy called the "Carry Trade."

Here’s how it works:

- Borrow in a Low-Interest Rate Currency: An investor borrows money in a country where interest rates are very low (the "funding currency").

- Invest in a High-Interest Rate Currency: They then convert that borrowed money into a currency of a country where interest rates are significantly higher (the "target currency").

- Profit from the Difference: The investor earns the higher interest rate on their investment, while only paying the lower interest rate on their borrowed funds. The difference is their profit, assuming the exchange rate doesn’t move unfavorably.

Example:

- An investor borrows 10 million Japanese Yen (JPY) at a near-zero interest rate (because Japan has historically had very low rates).

- They convert the 10 million JPY into Australian Dollars (AUD), which at the time might offer a 4% interest rate.

- They then invest the AUD in an Australian bond or bank account.

- The investor collects 4% interest on the AUD, while only paying almost 0% interest on the JPY loan. The 4% difference is their "carry."

Risks of the Carry Trade: While seemingly attractive, the carry trade is not without risks. The primary risk is that the high-yielding currency might depreciate significantly against the low-yielding currency, wiping out or even exceeding the interest rate gains. For instance, if the AUD suddenly drops in value against the JPY, the investor could lose money when converting their AUD back to JPY to repay the loan.

Who Sets Interest Rates and Why? The Role of Central Banks

Understanding interest rate differentials requires knowing who pulls the strings. In most major economies, this responsibility falls to the Central Bank.

Examples of major central banks:

- United States: The Federal Reserve (often called "the Fed")

- Eurozone: The European Central Bank (ECB)

- United Kingdom: The Bank of England (BoE)

- Japan: The Bank of Japan (BoJ)

- Australia: The Reserve Bank of Australia (RBA)

Central banks use interest rates as a primary tool of monetary policy to achieve specific economic goals, primarily:

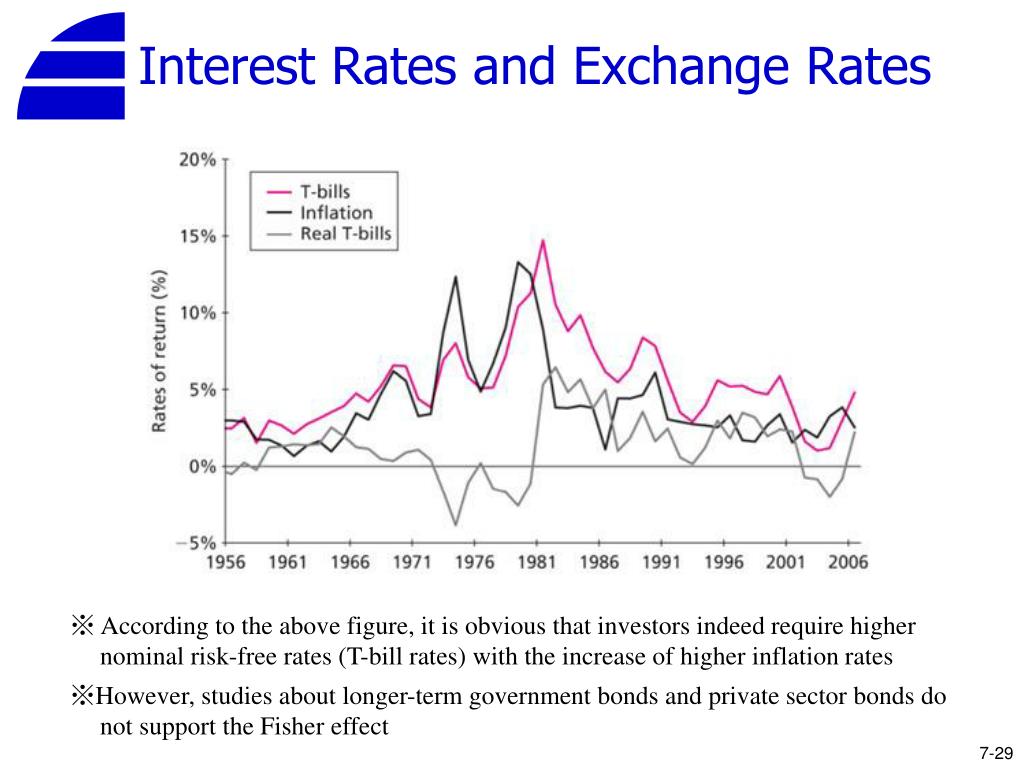

- Controlling Inflation: If inflation (the general increase in prices) is too high, central banks might raise interest rates to make borrowing more expensive and saving more attractive. This slows down economic activity, reduces demand, and helps bring inflation down.

- Promoting Economic Growth and Employment: If the economy is slowing down or unemployment is high, central banks might lower interest rates. This makes borrowing cheaper, encourages spending and investment, and stimulates economic activity.

- Maintaining Financial Stability: Central banks also aim to prevent financial crises and ensure the smooth functioning of the banking system.

Therefore, when a central bank adjusts its interest rates, it sends a powerful signal to global investors about the economic health and outlook of that country, directly influencing interest rate differentials and, consequently, currency values.

How Interest Rate Differentials Influence Currency Exchange: The Mechanisms

Let’s dive deeper into the specific ways interest rate differentials exert their influence:

-

Direct Capital Flow (Seeking Yield):

- As discussed, investors are always looking for the best return on their money. If Country A offers significantly higher interest rates than Country B, investment capital will flow from B to A.

- This necessitates buying Country A’s currency and selling Country B’s currency, directly increasing demand for Country A’s currency and increasing supply for Country B’s currency, thus strengthening Country A’s currency and weakening Country B’s.

-

Investor Sentiment and Expectations:

- It’s not just the current interest rate differential that matters, but also the expected future differential.

- If the market anticipates that a central bank is likely to raise interest rates soon (due to strong economic data or rising inflation), traders might start buying that currency in anticipation of the rate hike, even before it happens. This is called "pricing in" the rate hike.

- Conversely, if a central bank is expected to cut rates, the currency might weaken in advance.

- This forward-looking sentiment can cause significant currency movements even without an immediate rate change.

-

Economic Outlook and Attractiveness:

- Higher interest rates often (though not always) signal a strong or improving economy. A central bank typically raises rates when it believes the economy can handle it, or when it needs to cool down an overheating economy.

- A strong economic outlook attracts not just interest-seeking capital but also foreign direct investment (FDI) into businesses, stocks, and real estate, further boosting demand for the local currency.

- Conversely, a country with persistently low interest rates might signal economic weakness or a struggle with deflation, making its currency less attractive.

It’s Not Just Interest Rates: Other Influencing Factors

While interest rate differentials are a crucial driver, it’s vital for beginners to understand that they are part of a larger, complex puzzle. Currency exchange rates are influenced by a multitude of factors, and sometimes other factors can override the impact of interest rate differentials.

Other key influences include:

- Economic Data: GDP growth, employment figures, retail sales, manufacturing data – strong data generally supports a currency, while weak data can undermine it.

- Inflation: While central banks use rates to control inflation, actual inflation numbers (Consumer Price Index – CPI) are closely watched. High inflation that is not being addressed by central bank action can erode a currency’s purchasing power.

- Political Stability: Countries with stable governments and predictable policies are generally more attractive to investors. Political turmoil or uncertainty can lead to capital flight and currency depreciation.

- Trade Balances: A country that exports more than it imports (a trade surplus) will see higher demand for its currency from foreign buyers of its goods and services. A trade deficit (importing more than exporting) can weaken a currency.

- Geopolitical Events: Wars, natural disasters, international conflicts – these can all create uncertainty and impact currency values.

- Market Sentiment and Risk Appetite: In times of global uncertainty, investors might flock to "safe-haven" currencies like the US Dollar, Japanese Yen, or Swiss Franc, even if their interest rates are low. When risk appetite is high, investors might prefer higher-yielding, riskier currencies.

Risks and Considerations for Traders

While understanding interest rate differentials provides a powerful lens for analyzing currency movements, it’s essential to acknowledge the inherent risks:

- Unpredictability: Central bank decisions can be influenced by many factors and are not always perfectly predictable. Unexpected rate changes or shifts in monetary policy outlook can cause sharp currency swings.

- Economic Surprises: Economic data releases can surprise the market, leading to re-evaluations of future interest rate expectations and rapid currency adjustments.

- Exchange Rate Volatility: Even if you’re profiting from the interest rate differential (as in a carry trade), adverse movements in the exchange rate can quickly erode or even reverse those gains. Currencies are highly volatile.

- Global Events: "Black swan" events (unforeseen, high-impact events like a pandemic or a major financial crisis) can disrupt all normal market correlations and cause dramatic shifts in currency valuations, often favoring safe-haven assets regardless of interest rates.

- Leverage: Many currency traders use leverage, which can magnify both profits and losses. A small adverse movement can lead to significant losses if not managed carefully.

For Beginners: What to Watch Out For

To start applying your knowledge of interest rate differentials, here are some key things to monitor:

- Central Bank Announcements: Keep an eye on the schedules for central bank meetings (e.g., FOMC meetings for the Fed, ECB Governing Council meetings). Their statements and interest rate decisions are primary catalysts for currency moves.

- Economic Calendars: Use a reputable economic calendar (many financial news websites offer them for free). These calendars list upcoming economic data releases (inflation, GDP, employment) for various countries. Pay attention to "high-impact" events.

- Inflation Reports (CPI): These are crucial. If inflation is rising, it often puts pressure on the central bank to raise interest rates, making the currency more attractive.

- GDP Reports: Strong Gross Domestic Product (GDP) growth suggests a healthy economy, which can lead to higher interest rates and a stronger currency.

- Central Bank Speeches/Minutes: Often, clues about future interest rate policy are found in the speeches of central bank governors or in the minutes from their policy meetings. Look for "hawkish" (favoring higher rates) or "dovish" (favoring lower rates) language.

Conclusion: The Core of Currency Dynamics

Interest rate differentials are undeniably one of the most powerful and consistent forces driving currency exchange rates. They represent the fundamental economic principle of capital seeking the highest return, directly influencing the demand for and supply of a nation’s currency.

While the world of Forex is multifaceted and influenced by a myriad of factors, understanding the pivotal role of interest rate differentials provides a solid foundation for anyone looking to comprehend why currencies move the way they do. By keeping an eye on central bank policies, economic indicators, and the ever-shifting global financial landscape, you can begin to decipher the secret language of money and gain a deeper appreciation for the intricate dance of currency exchange. Remember, continuous learning and careful risk management are key to navigating this dynamic market.

Post Comment