Global Capital Flows: Navigating the Tides of Risk and Opportunity

Imagine the global economy as a vast, interconnected network of rivers and oceans. Money, like water, constantly flows between countries. This movement of money – from one nation to another for investment, trade, or other purposes – is what we call Global Capital Flows. It’s the lifeblood of the international financial system, fueling economies, creating opportunities, but also carrying inherent risks.

For beginners, understanding these flows can seem daunting. But think of it this way: when a company in Germany invests in a factory in Vietnam, or when an individual in the U.S. buys shares in a Japanese company, that’s a capital flow. These movements are massive, totaling trillions of dollars annually, and their impact reverberates across the globe.

In this comprehensive guide, we’ll dive deep into the fascinating world of global capital flows, exploring their essential role, the incredible opportunities they present, and the significant risks that policymakers and investors must carefully navigate.

What Exactly Are Global Capital Flows? A Simple Explanation

At its core, a global capital flow is simply money moving across international borders. This movement can take many forms and serve various purposes. It’s driven by individuals, companies, governments, and financial institutions all seeking to maximize their returns, diversify their assets, or finance their operations.

Think of it like this: If you have extra money, you might invest it in a local business or put it in a savings account. Global capital flows are the international equivalent – but on a much grander scale.

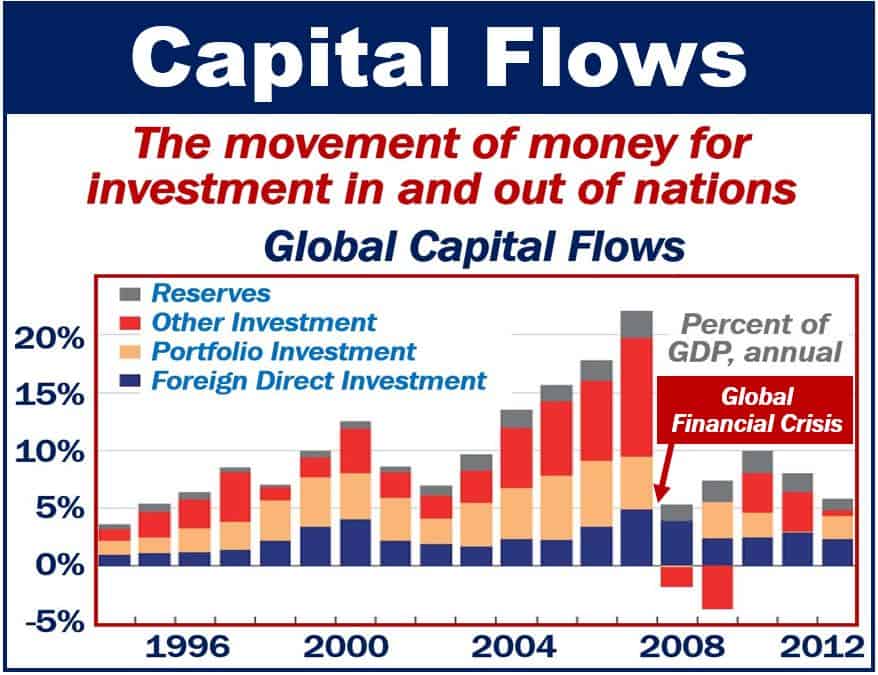

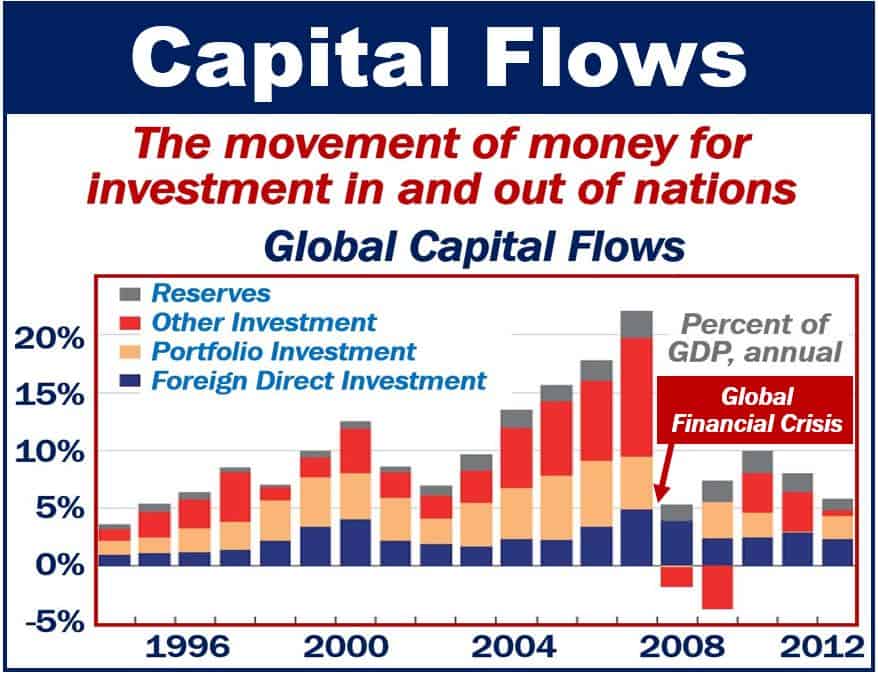

Key Types of Capital Flows:

To make it easier to understand, let’s break down the main categories:

- Foreign Direct Investment (FDI): This is the "sticky" money. It involves an investor (company or individual) from one country establishing a lasting interest in an enterprise in another country.

- Example: A German car manufacturer building a new factory in Mexico, or an American tech giant acquiring a software company in India. FDI often brings not just money, but also technology, management expertise, and jobs.

- Portfolio Investment: This is generally "hotter" money, meaning it can move in and out more quickly. It involves buying financial assets like stocks (equities) or bonds (debt) in another country, without gaining direct control over the company or entity.

- Example: An American pension fund buying shares of a publicly traded Chinese company, or a Japanese investor purchasing U.S. Treasury bonds. Investors are seeking financial returns rather than management control.

- Other Investment: This category covers a broad range of financial transactions, including:

- Loans: Banks lending money across borders (e.g., a French bank lending to a Brazilian company).

- Trade Credits: Financing provided by exporters or importers for international trade.

- Currency Deposits: Holding money in bank accounts in foreign currencies.

- Remittances: While not strictly "investment," these are significant capital flows. They are funds sent by migrant workers back to their home countries.

- Example: A Filipino nurse working in Canada sending money back to her family in the Philippines. These flows are crucial for many developing economies.

Why Do Capital Flows Happen? The Driving Forces

So, what makes all this money move around the world? Several factors influence the direction and volume of global capital flows:

- Interest Rate Differences: If a country offers higher interest rates on its bonds or savings accounts than another, investors might move their money there to earn more.

- Economic Growth Prospects: Investors are always looking for opportunities. Countries or regions with strong growth potential (e.g., emerging markets with a growing middle class) tend to attract more investment.

- Political and Economic Stability: Investors prefer predictable environments. Countries with stable governments, clear laws, and sound economic policies are more attractive.

- Diversification: Investors don’t want to put all their eggs in one basket. Spreading investments across different countries and asset types can reduce overall risk.

- Technological Advancements: Modern technology (internet, instant communication) makes it incredibly easy and fast to move money globally, facilitating cross-border transactions.

- Deregulation: Many countries have relaxed rules on capital movements over the past few decades, making it easier for money to flow in and out.

The Bright Side: Opportunities and Benefits of Global Capital Flows

When managed well, global capital flows are a powerful engine for economic progress. They can unlock immense opportunities for both the countries receiving the capital and the investors providing it.

Here are some key benefits:

- 1. Fueling Economic Growth and Development:

- Capital for Investment: Developing countries often lack sufficient domestic savings to fund large-scale projects. Capital inflows provide the necessary funds for businesses to expand, innovate, and create new industries.

- Increased Productivity: Investment in new technologies and infrastructure boosts a country’s ability to produce goods and services more efficiently.

- 2. Creating Jobs and Raising Living Standards:

- When foreign companies invest, they often build new factories, offices, or businesses, directly creating employment opportunities.

- The ripple effect of this investment (e.g., suppliers, service providers) also leads to indirect job creation. More jobs mean higher incomes, which improves living standards for citizens.

- 3. Infrastructure Development:

- Large infrastructure projects (roads, ports, power plants, communication networks) are crucial for economic development but require massive funding. Foreign capital can bridge this financing gap, allowing countries to build the foundations for future growth.

- 4. Technology and Knowledge Transfer:

- FDI, in particular, often brings not just money but also cutting-edge technology, management expertise, and new business practices. Local workers learn new skills, and domestic companies can adopt more efficient methods, boosting overall competitiveness.

- 5. Diversification and Higher Returns for Investors:

- Investors in developed countries can seek higher returns in faster-growing emerging markets than they might find domestically.

- Investing across different countries helps diversify portfolios, reducing overall risk if one market experiences a downturn.

- 6. Promoting Financial Market Development:

- Capital inflows can deepen and broaden a country’s financial markets (stock markets, bond markets), making them more sophisticated and efficient. This can attract even more investment in the future.

- 7. Increased Competition and Efficiency:

- Foreign companies entering a market can introduce new products, services, and business models, fostering competition. This can lead to lower prices, higher quality, and more choices for consumers.

The Dark Side: Risks and Challenges of Global Capital Flows

While the opportunities are significant, global capital flows are a double-edged sword. Their rapid movement and sheer volume can also create instability and pose serious challenges, especially for smaller or less developed economies.

Here are the main risks associated with unchecked or poorly managed capital flows:

- 1. Volatility and "Hot Money":

- Sudden Inflows: A surge of foreign money can rapidly inflate asset prices (stocks, real estate), creating bubbles.

- Sudden Outflows (Capital Flight): If investor confidence suddenly drops (due to political instability, economic downturns, or global crises), money can flee a country just as quickly as it arrived. This "hot money" (primarily portfolio investment) is highly reactive and can cause severe financial shocks.

- 2. Financial Crises and Contagion:

- Rapid outflows can deplete a country’s foreign currency reserves, making it difficult to pay for imports or repay foreign debts. This can lead to a currency crisis (where the local currency loses significant value) and a broader financial crisis.

- Contagion: A crisis in one country can quickly spread to others, especially those with similar economic vulnerabilities or strong financial ties, like a domino effect. The Asian Financial Crisis of 1997-98 is a stark example.

- 3. Asset Bubbles and Overheating:

- Excessive capital inflows can lead to too much money chasing too few goods or assets. This inflates prices in sectors like real estate or stock markets beyond their true value, creating unsustainable "bubbles." When these bubbles burst, it can lead to economic collapse.

- The economy can also "overheat" with rapid inflation, as too much money chases limited resources.

- 4. Currency Fluctuations and Loss of Competitiveness:

- Large capital inflows can cause a country’s currency to appreciate (become stronger). While a strong currency makes imports cheaper, it makes a country’s exports more expensive for foreign buyers, hurting export-oriented industries and overall competitiveness.

- Conversely, capital outflows cause the currency to depreciate, making imports more expensive and potentially fueling inflation.

- 5. Increased External Debt and Dependency:

- If capital inflows primarily come in the form of loans, a country’s external debt can quickly accumulate. If these loans are not used productively or if the economy falters, repaying them can become a massive burden, leading to a debt crisis.

- Excessive reliance on foreign capital can also make a country vulnerable to the whims of international investors.

- 6. Loss of Policy Autonomy:

- To attract or retain foreign capital, governments might feel pressured to adopt certain economic policies (e.g., low taxes, specific interest rates) even if they are not ideal for their domestic needs. This can limit a country’s ability to set its own economic course.

Managing the Flow: Policies and Best Practices

Given the dual nature of global capital flows, countries strive to harness their benefits while mitigating their risks. This requires careful policymaking and a robust regulatory environment.

Here are some key strategies:

- 1. Sound Macroeconomic Policies:

- Fiscal Prudence: Keeping government budgets under control and managing debt levels responsibly builds investor confidence.

- Stable Monetary Policy: Central banks aim to keep inflation in check and maintain stable interest rates, which helps prevent overheating and attracts long-term investment.

- 2. Strong Financial Regulation and Supervision:

- Banking Sector Oversight: Ensuring banks are well-capitalized and not taking on excessive risks prevents financial instability.

- Market Transparency: Clear rules and regulations in stock and bond markets reduce the chances of speculative bubbles and investor panic.

- 3. Building Foreign Exchange Reserves:

- Countries can accumulate reserves of foreign currencies (like the U.S. dollar or Euro) during times of high capital inflows. These reserves act as a buffer to cushion the impact of sudden capital outflows, allowing the country to meet its foreign obligations.

- 4. Careful Management of Capital Controls:

- Capital controls are measures a government can take to regulate the flow of money in and out of the country. These can include taxes on foreign investment, limits on how much currency can be exchanged, or restrictions on borrowing from abroad.

- While controversial (as they can deter some investment), they can be useful tools in times of crisis to stabilize the economy, but they must be used judiciously.

- 5. Developing Domestic Capital Markets:

- Encouraging domestic savings and investment reduces reliance on foreign capital. Developing strong local stock and bond markets provides alternative sources of funding for businesses.

- 6. International Cooperation:

- Organizations like the International Monetary Fund (IMF) and the World Bank play a crucial role in monitoring global capital flows, providing policy advice, and offering financial assistance to countries in crisis. Coordinated international efforts can help manage systemic risks.

- 7. Focusing on Foreign Direct Investment (FDI):

- Policymakers often prefer FDI over portfolio investment because it’s "stickier" and brings long-term benefits like job creation and technology transfer. Creating a welcoming environment for FDI (e.g., clear legal frameworks, investor protection) is a common goal.

The Future of Global Capital Flows

The world is constantly evolving, and so are capital flows. Globalization continues, technology advances rapidly, and new financial products emerge. The rise of digital currencies and decentralized finance (DeFi) could also bring new dimensions to cross-border capital movements in the future.

What remains constant is the need for vigilance. Governments, central banks, and international organizations must continuously adapt their policies to manage the ever-changing tides of global capital. The goal is to maximize the immense opportunities for growth and development while building resilience against the inevitable risks.

Conclusion: A Balancing Act for Global Prosperity

Global capital flows are an undeniable force in the modern world economy. They represent the interconnectedness of nations, the pursuit of opportunity, and the engine of economic development. From building new industries and creating jobs to fostering technological innovation, their potential benefits are truly transformative.

However, as we’ve seen, this powerful force also carries significant risks. The volatility of "hot money," the potential for financial crises, and the challenges of managing currency fluctuations demand constant attention and sophisticated policy responses.

Ultimately, navigating the world of global capital flows is a delicate balancing act. Countries that successfully harness their benefits while effectively mitigating their risks are better positioned for sustained economic growth and prosperity in our increasingly interconnected world. Understanding these flows is not just for economists; it’s essential for anyone seeking to grasp the dynamics of the global economy.

Post Comment