CPI vs. PPI: Global Insights – Unraveling the Secrets of Inflation for Beginners

Ever wondered why your grocery bill keeps climbing, or why some products suddenly become more expensive? These everyday experiences are deeply tied to economic concepts like inflation, and two key indicators help economists, businesses, and even governments understand these price changes: the Consumer Price Index (CPI) and the **Producer Price Index (PPI).

While they both measure price changes, they tell different parts of the economic story. Think of them as two different lenses through which we view the complex world of prices. This comprehensive guide will break down CPI and PPI, explain their differences, and show you why understanding both is crucial for grasping global economic health.

Understanding the Economic Pulse: What are CPI and PPI?

Before diving into the nitty-gritty, let’s get a basic understanding of what these terms mean.

- Inflation: At its simplest, inflation is the rate at which the general level of prices for goods and services is rising, and consequently, the purchasing power of currency is falling. If your coffee cost $2 last year and $2.20 this year, that’s inflation!

Now, let’s meet our two main characters:

1. Demystifying the Consumer Price Index (CPI)

Imagine you have a shopping cart filled with all the things a typical household buys in a month – groceries, clothes, gas, rent, healthcare, entertainment, and even haircuts. The Consumer Price Index (CPI) is like a report card for that shopping cart.

What is it?

The CPI measures the average change over time in the prices paid by urban consumers for a "market basket" of consumer goods and services. It’s designed to track the cost of living.

How is it calculated?

Government agencies (like the Bureau of Labor Statistics in the U.S., Eurostat in Europe, or the National Bureau of Statistics in China) regularly survey households about their spending habits and then collect price data for thousands of specific goods and services from a wide range of retail outlets across the country. They then compare the current cost of that "basket" to its cost in a base period.

What does it measure?

- Cost of Living: Primarily, CPI indicates how much more or less expensive everyday life has become for consumers.

- Purchasing Power: It shows whether your money is buying more or fewer goods and services than before.

- Consumer Inflation: It’s the most widely cited measure of inflation experienced by the general public.

Why does it matter?

The CPI is incredibly important because it directly impacts:

- Wages and Salaries: Many employment contracts and collective bargaining agreements include CPI-based adjustments (Cost-of-Living Adjustments or COLAs) to help maintain purchasing power.

- Social Security and Benefits: In many countries, government benefits, pensions, and social security payments are indexed to CPI to protect recipients from inflation.

- Monetary Policy: Central banks (like the Federal Reserve in the U.S. or the European Central Bank) closely watch CPI data when making decisions about interest rates. If CPI is rising too fast, they might raise interest rates to cool down the economy and curb inflation.

- Investment Decisions: Investors use CPI data to gauge the real return on their investments and to anticipate central bank actions.

Global Variations:

While the concept is universal, the specific "basket of goods" and the methodology can vary significantly from country to country, reflecting different consumption patterns. For example, housing costs might be weighted differently in Tokyo than in Berlin, and food staples vary wildly from India to Brazil.

2. Unpacking the Producer Price Index (PPI)

Now, let’s shift our focus from the consumer’s shopping cart to the factory floor or the farm. The Producer Price Index (PPI) gives us a peek into the prices that producers (manufacturers, farmers, miners, service providers) receive for their output.

What is it?

The PPI measures the average change over time in the selling prices received by domestic producers for their output. It tracks price changes at various stages of the production process, from raw materials to finished goods.

How is it calculated?

Government agencies survey businesses about the prices they receive for their products and services at the "first commercial transaction." This means prices are typically measured when goods leave the factory, farm, or mine, before they reach wholesalers or retailers.

What does it measure?

- Input Costs: It reflects the costs faced by businesses in producing goods and services (e.g., raw materials, energy, labor).

- Wholesale Inflation: It’s often seen as a measure of "wholesale inflation" or "factory gate prices."

- Producer Profit Margins: Rising input costs (higher PPI) can squeeze profit margins for businesses if they can’t pass those costs on to consumers.

Why does it matter?

The PPI is a vital indicator for several reasons:

- Predictive Power: PPI is often considered a leading indicator for CPI. If producers are paying more for their raw materials and production, they are likely to pass those increased costs on to consumers in the future, leading to higher CPI down the line.

- Business Strategy: Businesses use PPI data to make decisions about pricing their products, managing supply chains, and forecasting future costs.

- Economic Health: A rapidly rising PPI can signal future inflation risks and potential challenges for businesses.

- Global Trade: Changes in PPI can impact the competitiveness of a country’s exports and imports.

Stages of Processing:

PPI data is often broken down by stages of processing, which can provide more nuanced insights:

- Crude Materials: Prices for unprocessed goods (e.g., crude oil, raw cotton, fresh vegetables).

- Intermediate Goods: Prices for partially processed goods used in further production (e.g., steel, lumber, chemicals).

- Finished Goods: Prices for goods ready for sale to wholesalers or retailers (e.g., cars, appliances, clothing).

CPI vs. PPI: The Key Differences Laid Bare

While both CPI and PPI are crucial inflation indicators, they differ significantly in their scope, perspective, and what they ultimately represent.

| Feature | Consumer Price Index (CPI) | Producer Price Index (PPI) |

|---|---|---|

| Perspective | Buyer/Consumer (what consumers pay) | Seller/Producer (what producers receive) |

| Scope | Retail prices for goods and services purchased by households. Includes imports. | Wholesale/Factory-gate prices for domestically produced goods and some services. Excludes imports for goods. |

| Inclusions | Goods (food, clothing, cars) AND Services (rent, healthcare, transportation, education, haircuts). | Primarily Goods (raw materials, intermediate, finished). Some services used by businesses are included, but consumer services are not. |

| Timing | Lagging/Coincident Indicator: Reflects current consumer prices. | Leading Indicator: Often predicts future consumer prices. Price changes at the producer level tend to filter down to consumers. |

| Purpose | Measures cost of living and consumer inflation. | Measures business input costs and wholesale inflation. |

| Import Prices | Includes prices of imported goods sold to consumers. | Generally excludes prices of imported goods used as inputs by domestic producers (separate import price indexes exist). |

The "Crystal Ball" Effect:

One of the most important distinctions is PPI’s role as a potential "crystal ball" for CPI. When producers face higher costs (reflected in rising PPI), they often pass these costs on to consumers through higher retail prices. This means a significant jump in PPI can often signal that a rise in CPI is just around the corner. However, this isn’t always a direct one-to-one relationship, as market competition, supply and demand dynamics, and global factors can influence how much of the PPI increase gets absorbed or passed on.

Why Both Matter: Global Insights and Interconnectedness

No single economic indicator tells the whole story. CPI and PPI, when analyzed together, provide a much richer and more comprehensive picture of inflationary pressures and overall economic health, both domestically and globally.

1. Guiding Monetary Policy for Central Banks

- The "Goldilocks" Zone: Central banks around the world (like the Federal Reserve, European Central Bank, Bank of England, Bank of Japan) aim for a "just right" level of inflation – typically around 2%. This low, stable inflation encourages spending and investment without eroding purchasing power too quickly.

- Dual View:

- CPI: Directly informs them about the inflation consumers are experiencing, which is crucial for maintaining economic stability and public confidence. If CPI is too high, they might raise interest rates to cool demand.

- PPI: Provides foresight into potential future inflation. If PPI is surging, it’s a warning sign that consumer prices could follow, prompting central banks to consider proactive measures.

- Global Coordination: In a globalized world, central banks also watch CPI and PPI trends in major trading partners. For example, rising producer prices in China could impact consumer prices in Europe or the US due to imported goods.

2. Informing Investment Decisions

- Protecting Returns: Investors constantly look for ways to protect their investments from inflation. High CPI erodes the real return on fixed-income investments like bonds.

- Sector Analysis:

- PPI Insights: Investors in commodity markets or industrial sectors pay close attention to PPI. Rising PPI for raw materials might indicate strong demand for those commodities, benefiting companies that extract or produce them.

- CPI Insights: Companies that can easily pass on higher costs to consumers (e.g., strong brands) might be better investments during periods of rising CPI.

- Currency Movements: Inflation data can influence exchange rates. Countries with persistently higher inflation might see their currency depreciate.

3. Shaping Business Strategy and Operations

- Pricing Power: Businesses use PPI to understand their input costs and CPI to gauge consumer willingness to pay. This helps them determine optimal pricing strategies. Can they pass on higher PPI costs to consumers, or will competition force them to absorb some of it, squeezing profit margins?

- Supply Chain Management: PPI provides early warnings about rising costs in the supply chain, allowing businesses to explore alternative suppliers, negotiate better deals, or adjust inventory levels.

- Wage Negotiations: Companies often factor in CPI when negotiating wages with employees, aiming to balance employee satisfaction with cost control.

- Global Competitiveness: A country’s PPI can affect its export competitiveness. If domestic producer prices rise faster than those in competing countries, its exports become more expensive.

4. Understanding Global Economic Shocks

- Oil Prices: A surge in global oil prices will immediately impact PPI (higher fuel costs for transport and production) and, subsequently, CPI (higher gas prices at the pump, increased shipping costs for goods).

- Supply Chain Disruptions: Events like the COVID-19 pandemic or geopolitical conflicts can cause bottlenecks, driving up PPI first (e.g., higher shipping costs, component shortages) and then flowing through to CPI.

- Exchange Rates: A weakening local currency makes imports more expensive. This can directly increase CPI (for imported consumer goods) and PPI (for imported raw materials).

Limitations and Nuances

While powerful, CPI and PPI are not perfect. It’s important to understand their limitations:

- Sampling Bias: The "basket of goods" might not perfectly represent every household’s or every producer’s experience.

- Substitution Effect (CPI): When the price of one good rises, consumers might switch to a cheaper alternative. CPI models try to account for this, but it’s a complex behavior to capture perfectly.

- Quality Changes: A price increase might reflect an improvement in quality (e.g., a car with new safety features) rather than pure inflation. Adjusting for quality changes is challenging.

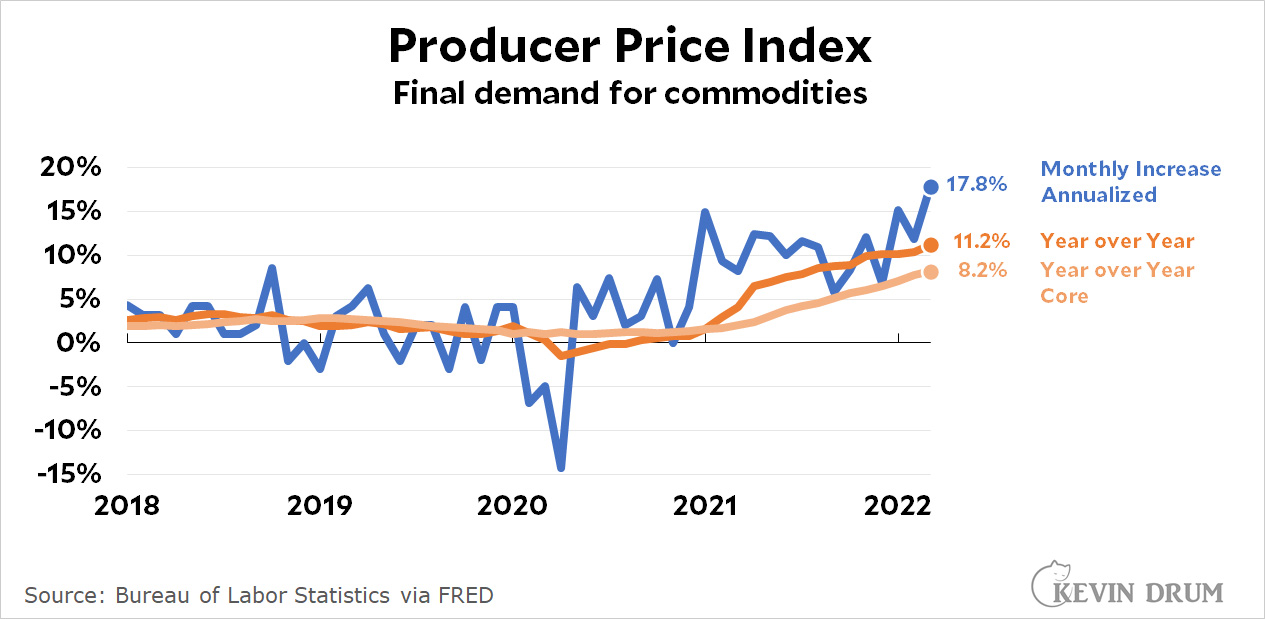

- Volatile Components: Both indexes can be heavily influenced by volatile items like energy and food. Economists often look at "core CPI" or "core PPI" (excluding food and energy) to get a clearer picture of underlying inflation trends.

- Lagging Data: The data is collected and released with a delay, meaning it reflects past conditions, not real-time.

- Global Complexity: In a world of complex global supply chains, a rise in PPI in one country might be due to rising costs in another, making analysis more intricate.

Conclusion: Two Sides of the Inflation Coin

The Consumer Price Index (CPI) and the Producer Price Index (PPI) are two essential yet distinct lenses through which we view inflation. CPI shows us the inflation hitting our wallets directly, reflecting the cost of living for everyday people. PPI, on the other hand, gives us an early warning system, revealing the cost pressures businesses face before they potentially trickle down to consumers.

Understanding both indicators is crucial for anyone trying to grasp the pulse of the economy – from policymakers setting interest rates to investors making strategic decisions, and from businesses planning their future to individuals simply trying to manage their household budgets. They are two sides of the same economic coin, each offering unique and valuable insights into the ever-changing landscape of prices in our interconnected global economy.

By keeping an eye on both CPI and PPI, you’ll be better equipped to understand the economic headlines and make more informed decisions in your financial life.

Frequently Asked Questions (FAQs)

Q1: Which is more important, CPI or PPI?

A: Neither is inherently "more important"; they serve different purposes and offer complementary insights. CPI is crucial for understanding consumer purchasing power and cost of living, while PPI is a valuable leading indicator for future consumer price trends and business health. Economists and policymakers analyze both together for a comprehensive view.

Q2: Do CPI and PPI always move in the same direction?

A: Not always. While PPI often leads CPI (meaning a rise in PPI can signal a future rise in CPI), they can diverge. For example, businesses might absorb higher PPI costs to remain competitive, or global supply chain issues might impact one more directly than the other at certain times.

Q3: How do central banks use CPI and PPI?

A: Central banks use both to inform their monetary policy decisions, especially regarding interest rates. If CPI is high, they might raise rates to curb inflation. If PPI is rising significantly, it signals potential future inflation, allowing them to consider proactive measures. They aim to maintain price stability, often targeting a specific inflation rate (e.g., 2%).

Q4: Can PPI be negative? What does that mean?

A: Yes, PPI can be negative, which is called producer deflation. This means that the prices producers are receiving for their goods and services are falling. While it might sound good for consumers, widespread deflation can be a sign of a weak economy, falling demand, and can lead to businesses cutting production, wages, and jobs.

Q5: How do global events affect CPI and PPI?

A: Global events have a significant impact. For instance:

- Geopolitical conflicts: Can disrupt supply chains and increase commodity prices (impacting PPI first, then CPI).

- Global demand shifts: A surge in global demand for a certain raw material will drive up its price (impacting PPI).

- Exchange rate fluctuations: A weaker domestic currency makes imports more expensive, raising both PPI (for imported inputs) and CPI (for imported consumer goods).

Post Comment