The Role of Speculation in Market Bubbles: A Beginner’s Guide to Understanding Financial Frenzies

Have you ever heard stories of people making a fortune overnight in the stock market, only to lose it all just as quickly? Or perhaps you’ve seen news reports about housing prices skyrocketing, only to crash a few months later, leaving many in financial distress. These dramatic ups and downs often involve something called a "market bubble," and a key player in their formation is speculation.

For beginners trying to understand the often-complex world of finance, market bubbles can seem mysterious and unpredictable. But by understanding the role of speculation, you can gain valuable insights into why these events occur and how to potentially navigate them.

What Exactly is Speculation?

Let’s start with the basics. In simple terms, speculation is the act of buying an asset (like a stock, a house, or even a piece of art) with the primary goal of selling it for a quick profit in the near future. The speculator isn’t necessarily interested in the long-term value or intrinsic worth of the asset; they’re betting on its price going up, often quickly, due to perceived demand or market trends.

Think of it like this:

- Investing: Buying a share in a company because you believe the company has strong fundamentals, good management, and will grow its profits over many years. You’re in it for the long haul.

- Speculating: Buying that same share because you heard a rumor it’s about to be "the next big thing," and you expect its price to double in a few weeks, allowing you to sell it quickly for a profit. You’re trying to capitalize on short-term price movements.

Key characteristics of speculation:

- Short-term focus: Speculators are usually looking for quick gains, not long-term growth.

- High risk: Betting on rapid price changes is inherently risky. Prices can go down just as quickly as they go up.

- Driven by sentiment: Speculation is often fueled by market sentiment, rumors, and hype, rather than solid financial analysis.

- Price over value: The focus is on what someone else might pay for the asset, not its underlying worth.

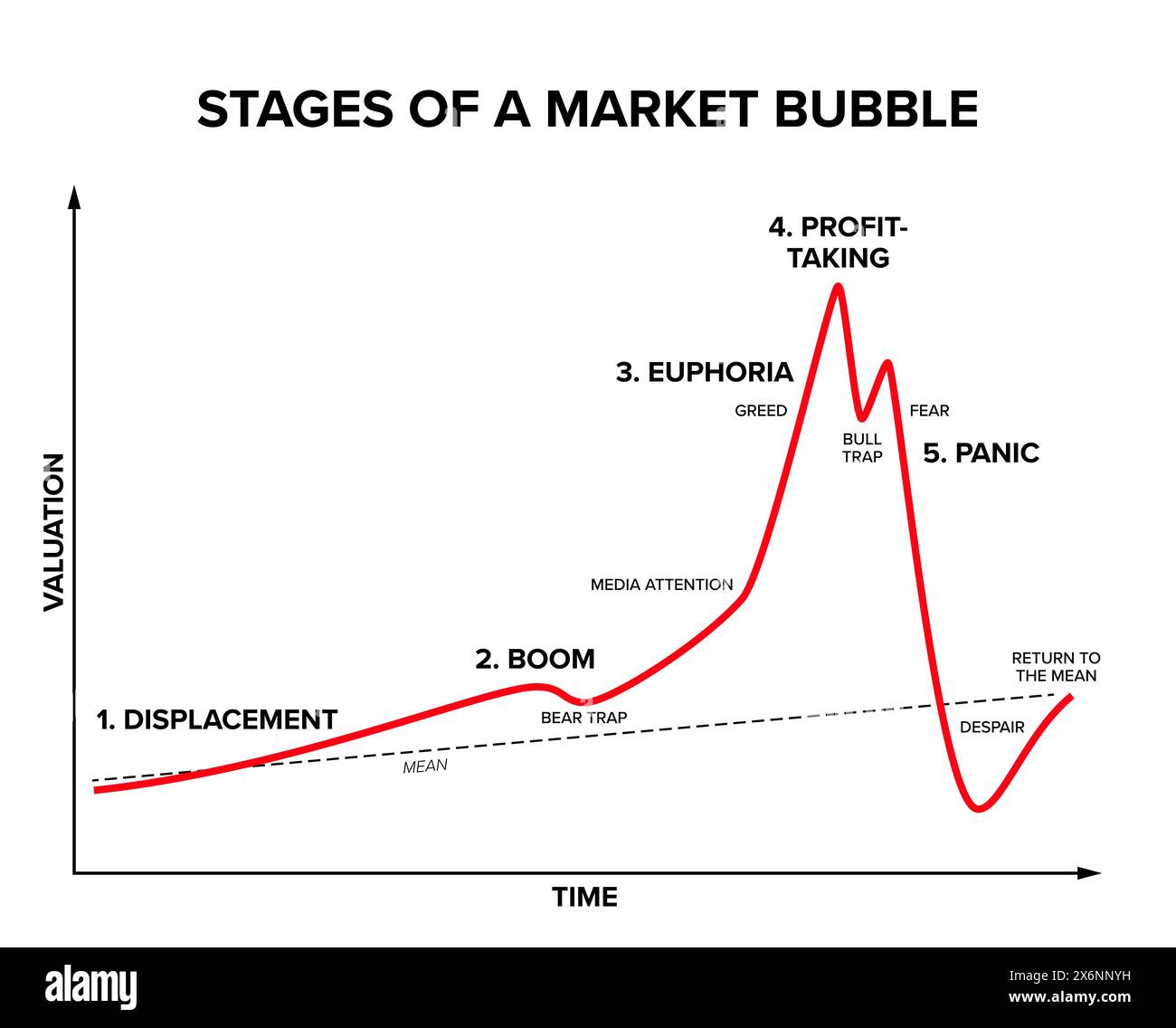

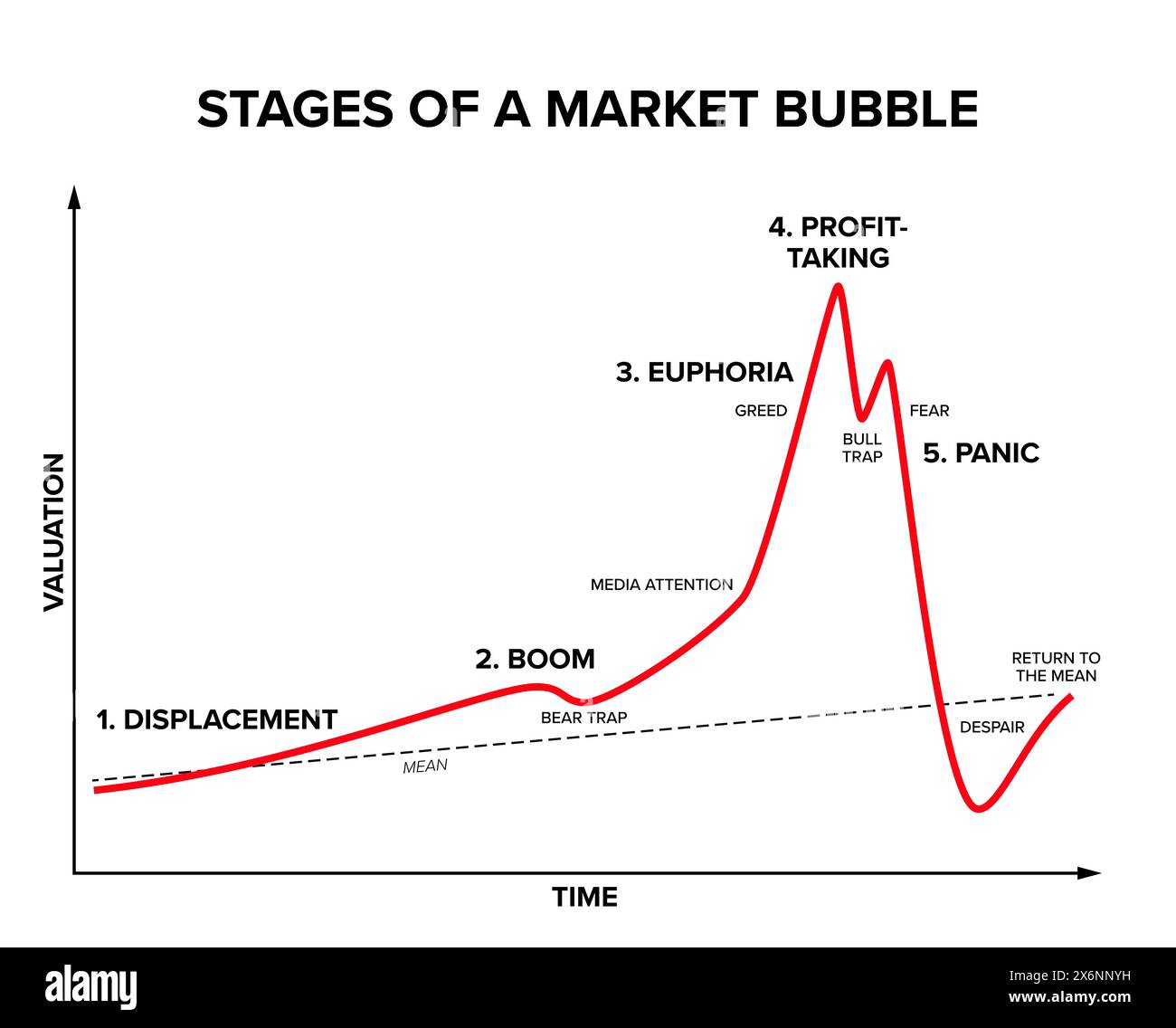

Understanding a Market Bubble

Now that we know what speculation is, let’s define a market bubble. A market bubble occurs when the price of an asset (or a class of assets, like all tech stocks or all houses in a certain area) rises rapidly and significantly, to levels that are far beyond its true, fundamental value.

Imagine inflating a balloon. It gets bigger and bigger, but eventually, it reaches a point where it can’t hold any more air. That’s when it bursts. A market bubble works similarly:

- Rapid Price Increase: Prices soar, often defying traditional valuation methods.

- Detachment from Fundamentals: The price of the asset becomes disconnected from its actual worth, earnings, or utility. For example, a house might be selling for ten times what it would cost to build, or a company with no profits might have a stock market value higher than established, profitable companies.

- Widespread Enthusiasm (Euphoria): Everyone seems to be talking about how much money can be made. Even people with no prior investment experience jump in.

- "Greater Fool" Theory: This is a crucial element. People buy assets at inflated prices, not because they believe in their true value, but because they expect to find an even "greater fool" who will pay even more for it.

- The Burst: Eventually, something triggers a change in sentiment – perhaps a piece of bad news, rising interest rates, or just a realization that prices are unsustainable. This causes a sudden, rapid drop in prices, leading to a "burst" where the bubble deflates, often causing significant financial losses.

The Unholy Alliance: How Speculation Fuels Bubbles

Speculation isn’t just present in market bubbles; it’s often the engine that drives them. Here’s how the two interact:

- The Seed of Opportunity (Early Stage): A new technology, a unique product, or a change in economic conditions creates genuine excitement around a particular asset or industry. "Smart money" (experienced investors) might identify genuine growth potential.

- The Buzz Begins (Growth Phase): As early investors see success, news spreads. More people hear about the rising prices and the easy money being made. This attracts speculators. They jump in, not necessarily understanding the underlying asset, but simply wanting to ride the upward wave.

- FOMO Takes Over (Acceleration Phase): The "Fear Of Missing Out" (FOMO) becomes a powerful force. As prices continue to climb, driven by increasing speculative demand, more and more people feel compelled to buy in, fearing they’ll be left behind. Even cautious investors might start to feel the pressure.

- Herd Mentality (Euphoria Phase): Logic and fundamental analysis often go out the window. Everyone seems to be buying, so it must be a good idea, right? People borrow money, take out second mortgages, or use their life savings to buy into the bubble, convinced that prices will continue to rise indefinitely. The "greater fool" theory is in full swing.

- The Peak and the Precipice: At this point, prices are completely detached from reality. There are very few "greater fools" left to buy at even higher prices. Any small piece of negative news, a change in interest rates, or even just a few early buyers deciding to cash out their profits can act as a trigger.

- The Burst (Panic Selling): Once prices start to fall, even slightly, the speculative frenzy quickly turns into panic. Everyone who bought at inflated prices suddenly wants to sell to cut their losses. This rush to sell overwhelms demand, causing prices to plummet rapidly, leading to the bubble bursting. Those who bought late in the cycle often suffer the biggest losses.

Key Drivers of Speculation in Bubble Formation

Several factors amplify speculative behavior and contribute to the growth of market bubbles:

- Fear Of Missing Out (FOMO): This psychological phenomenon makes people buy assets simply because they see others making money, not because they’ve done their own research.

- Herd Mentality: Humans are social creatures. When everyone else is doing something, there’s a strong tendency to follow the crowd, even if it goes against one’s better judgment.

- Easy Credit/Low Interest Rates: When borrowing money is cheap, it encourages people to take on more debt to invest (or speculate). This influx of borrowed money can inflate asset prices.

- Novelty or "New Paradigm" Thinking: Bubbles often form around new technologies or industries (like the internet in the late 90s, or cryptocurrencies more recently). People believe "this time is different," and old rules of valuation don’t apply, leading to irrational exuberance.

- Media Hype: Intense media coverage, success stories, and even social media trends can amplify the excitement and draw in more speculators.

- Lack of Financial Literacy: Many people entering a speculative market may not understand basic investment principles, risk management, or how to value an asset.

Famous Examples of Market Bubbles Driven by Speculation

History is littered with examples of market bubbles fueled by speculation:

- Tulip Mania (1630s, Netherlands): One of the earliest recorded bubbles. Prices for tulip bulbs skyrocketed to astronomical levels, exceeding the cost of houses and even entire estates. People bought bulbs not for their beauty, but purely to sell them at a higher price to someone else. The bubble burst, leading to widespread financial ruin for many.

- The Dot-Com Bubble (Late 1990s): During this period, internet companies (dot-coms) saw their stock prices soar to incredible heights, often regardless of whether they had a viable business model or even any profits. Speculators poured money into anything with ".com" in its name, convinced the internet would change everything (which it did, but not every company would be successful). The bubble burst in 2000, leading to a massive tech stock crash.

- The U.S. Housing Bubble (Mid-2000s): Fueled by easy credit, low interest rates, and a belief that "housing prices never go down," people speculated heavily in real estate. Many bought multiple properties with the intention of "flipping" them for quick profits. When interest rates rose and subprime mortgages began to default, the bubble burst, leading to the 2008 global financial crisis.

- Cryptocurrency Bubbles (Various, e.g., 2017, 2021): While cryptocurrencies like Bitcoin and Ethereum have underlying technology and utility, their prices have also seen periods of extreme speculative frenzy, often fueled by social media hype, FOMO, and the hope of quick riches. These periods are typically followed by sharp corrections or "bursts."

The Aftermath: When Bubbles Burst

The bursting of a market bubble is rarely a gentle landing. It’s usually a painful and rapid correction that can have severe consequences:

- Massive Financial Losses: Individuals, businesses, and even financial institutions can lose enormous amounts of money as asset values plummet.

- Economic Downturns: A large bubble burst can trigger a recession, leading to job losses, reduced consumer spending, and a slowdown in economic growth.

- Loss of Confidence: Investor and consumer confidence can be severely shaken, making people more hesitant to spend or invest, which further dampens economic activity.

- Bankruptcies: Companies that relied on inflated asset values or excessive borrowing may face bankruptcy.

How to Spot and Navigate Bubbles (for Beginners)

While predicting the exact timing of a bubble’s burst is impossible, understanding the role of speculation can help you recognize potential bubble-like conditions and protect your investments:

- Understand the Fundamentals: Before investing in anything, research its true value. For a company, look at its earnings, debt, and competitive landscape. For real estate, consider rental income potential or replacement cost. If the price seems wildly disconnected from these fundamentals, be wary.

- Be Skeptical of "Too Good to Be True": If everyone is talking about how easy it is to get rich quickly, and asset prices are soaring without any clear reason, it’s a major red flag. Easy money often comes with hidden risks.

- Avoid Herd Mentality: Don’t buy an asset just because your friends, family, or social media are pushing it. Do your own independent research and make decisions based on your own financial goals and risk tolerance.

- Beware of Leverage (Borrowed Money): Using borrowed money to speculate amplifies both potential gains and potential losses. It’s extremely risky during bubble conditions.

- Diversify Your Investments: Don’t put all your eggs in one basket. Spreading your investments across different asset classes and industries can help cushion the blow if one particular market experiences a bubble burst.

- Focus on Long-Term Investing: For most beginners, a long-term investment strategy, focusing on quality assets and consistent growth, is far less risky and generally more rewarding than trying to time the market or chase speculative gains.

- Stay Informed, But Don’t Get Swept Up: Read reliable financial news, but be cautious of sensational headlines and hype.

Conclusion

Speculation, while a natural part of financial markets, plays a pivotal and often destructive role in the formation and eventual bursting of market bubbles. It transforms rational investment into a high-stakes gamble, driven by emotion and the "greater fool" theory.

By understanding the psychology behind speculation, recognizing the signs of inflated asset prices, and prioritizing fundamental value over short-term hype, beginners can better protect themselves from the painful consequences of a market bubble burst. Remember, true wealth is often built slowly and steadily, not through chasing speculative frenzies.

Frequently Asked Questions (FAQs) about Speculation and Market Bubbles

Q1: Is all speculation bad?

A: Not necessarily. Speculation can provide liquidity to markets and help in price discovery. However, when it becomes widespread, detached from fundamentals, and driven by irrational exuberance, it becomes a significant risk factor for market bubbles.

Q2: How long do market bubbles last?

A: There’s no fixed timeline. Some bubbles, like the Tulip Mania, were relatively short-lived (a few years), while others, like the U.S. housing bubble, built up over several years before bursting. Predicting their duration is very difficult.

Q3: Can governments or central banks prevent bubbles?

A: They try to influence market conditions through monetary policy (like setting interest rates) and regulation. However, completely preventing bubbles is challenging because they are often driven by human psychology and market sentiment, which are hard to control. They can try to deflate bubbles slowly, but this is also risky.

Q4: What’s the difference between a correction and a bubble burst?

A: A correction is typically a short-term price decline (often 10-20%) in a market, which can be a healthy part of a market cycle, allowing prices to consolidate. A bubble burst involves a much more significant and rapid price collapse (often 50% or more), where prices fall far below what was considered normal, reflecting the collapse of an unsustainable price level.

Q5: Can I make money from a market bubble?

A: Some people do make money by buying early and selling before the peak. However, this is incredibly risky and requires precise timing, which is extremely difficult to achieve consistently. Many more people lose money by buying near the top. For beginners, trying to profit from a bubble is generally not recommended due to the high risk.

Q6: Are market bubbles inevitable?

A: Many economists believe that given human psychology (greed, fear, FOMO), market bubbles are a recurring phenomenon in financial history, though their specific form and asset class may change. They are often seen as part of the "boom and bust" cycle of economies.

Post Comment