Understanding the Fair Labor Standards Act (FLSA): A Beginner’s Guide to Wage, Overtime, & Child Labor Laws

Navigating the complexities of labor law can feel like deciphering an ancient language, especially for new business owners, HR professionals, or even employees trying to understand their rights. At the heart of U.S. federal labor law lies the Fair Labor Standards Act (FLSA), a foundational piece of legislation that impacts millions of workers and businesses daily.

Often misunderstood, the FLSA is far more than just a minimum wage rule. It’s a comprehensive framework designed to protect workers and ensure fair labor practices across the nation. Ignoring its provisions can lead to significant legal and financial repercussions for employers.

This extensive guide will break down the FLSA into easy-to-understand concepts, helping you grasp its core requirements, avoid common pitfalls, and ensure compliance.

What is the Fair Labor Standards Act (FLSA)?

The Fair Labor Standards Act (FLSA) is a federal law enacted in 1938, during the Great Depression, to establish basic labor standards for most private and public employment. Administered and enforced by the Wage and Hour Division (WHD) of the U.S. Department of Labor (DOL), the FLSA is a cornerstone of American labor policy.

Its primary purpose is to protect workers from exploitative labor practices by setting national standards for:

- Minimum Wage: The lowest hourly rate an employer can legally pay.

- Overtime Pay: Compensation for hours worked beyond a standard workweek.

- Child Labor: Restrictions on the employment of minors.

- Recordkeeping: Requirements for employers to maintain accurate employee records.

Who Does the FLSA Apply To?

The FLSA generally covers "enterprises" and "individual employees."

- Enterprise Coverage: Most businesses with at least two employees and annual gross sales or business of $500,000 or more are covered. Hospitals, schools, and government agencies are also typically covered, regardless of their annual sales volume.

- Individual Coverage: Even if a business doesn’t meet the enterprise coverage threshold, individual employees whose work regularly involves interstate commerce (e.g., making phone calls to other states, processing credit card transactions, handling goods that have crossed state lines) may still be covered by the FLSA.

It’s important to remember that most employers and employees in the U.S. are subject to the FLSA, making its understanding crucial for nearly everyone in the workforce.

The Core Pillars of the FLSA

Let’s dive into the fundamental components of the FLSA that every employer and employee should know.

1. Minimum Wage

The FLSA sets the federal minimum wage, which is the lowest hourly wage that covered employers must pay non-exempt employees.

- Federal Minimum Wage: As of the last update, the federal minimum wage is $7.25 per hour.

- State and Local Laws: Many states, cities, and counties have their own minimum wage laws. When state or local laws require a higher minimum wage than the federal rate, employers must pay the higher amount. For instance, if your state minimum wage is $15.00/hour, you must pay $15.00, not $7.25.

- Tipped Employees: The FLSA allows employers to pay a lower direct cash wage to tipped employees (currently $2.13 per hour federally) if the employee’s tips, combined with that direct wage, meet or exceed the federal minimum wage. If not, the employer must make up the difference. State laws on tipped wages vary widely and often require a higher direct wage.

- Training Wage: Employers can pay a sub-minimum wage (currently $4.25 per hour) to employees under 20 years of age for their first 90 consecutive calendar days of employment, provided certain conditions are met.

Key Takeaway: Always check your state and local minimum wage laws, as they often surpass the federal standard.

2. Overtime Pay

One of the most significant and often misunderstood aspects of the FLSA is its requirement for overtime pay.

- Standard Workweek: The FLSA defines a standard workweek as 40 hours within a seven-consecutive-day period. This period does not have to align with the calendar week and can start on any day and at any hour.

- Overtime Rate: Non-exempt employees must be paid at least one and one-half times their regular rate of pay for all hours worked over 40 in a workweek. This is commonly referred to as "time and a half."

- "Regular Rate of Pay": This isn’t just an employee’s hourly wage. It includes most forms of compensation, such as non-discretionary bonuses, shift differentials, and certain commissions. Calculating the regular rate can be complex, especially with various forms of compensation.

- No Daily Overtime: The FLSA does not require overtime for hours worked in excess of 8 hours in a day, or for work on weekends or holidays, unless those hours push the total for the week over 40. Some state laws, however, may have daily overtime requirements.

- Compensatory Time ("Comp Time"): For private employers, offering "comp time" (paid time off in lieu of overtime pay) is generally not permitted under the FLSA. Overtime must be paid in cash. Public agencies, however, may be allowed to offer comp time under specific circumstances.

Key Takeaway: For non-exempt employees, every hour over 40 in a workweek must be compensated at 1.5 times their regular rate of pay.

3. Child Labor Provisions

The FLSA includes strict rules to protect the educational opportunities and safety of minors. These provisions primarily focus on:

- Minimum Age: Generally, the minimum age for employment is 14, with some exceptions for agricultural work, newspaper delivery, and acting.

- Hours Restrictions for Minors:

- 14 and 15-year-olds:

- Cannot work during school hours.

- Maximum 3 hours on a school day.

- Maximum 18 hours in a school week.

- Maximum 8 hours on a non-school day.

- Maximum 40 hours in a non-school week.

- Work must be between 7 a.m. and 7 p.m. (or 9 p.m. from June 1st through Labor Day).

- 16 and 17-year-olds: No federal restrictions on hours, but generally cannot work in occupations declared hazardous by the Secretary of Labor.

- 14 and 15-year-olds:

- Hazardous Occupations: The FLSA prohibits minors under 18 from working in certain hazardous occupations, such as operating power-driven machinery, mining, or roofing.

Key Takeaway: Always verify age, hours, and permissible job duties for minor employees, and remember that state child labor laws can be more restrictive than federal law.

4. Recordkeeping Requirements

The FLSA mandates that employers keep accurate records of wages, hours, and other employment conditions. These records are essential for demonstrating compliance and can be requested by the DOL.

Employers must keep records for at least three years for:

- Employee’s full name and social security number.

- Address, including zip code.

- Birth date (if under 19).

- Sex and occupation.

- Time and day of week when employee’s workweek begins.

- Hours worked each day.

- Total hours worked each workweek.

- Regular hourly pay rate.

- Total daily or weekly straight-time earnings.

- Total overtime earnings for the workweek.

- All additions to or deductions from the employee’s wages.

- Total wages paid each pay period.

- Date of payment and the pay period covered by the payment.

Key Takeaway: Meticulous recordkeeping is not optional; it’s a legal requirement and your best defense in case of a wage and hour dispute.

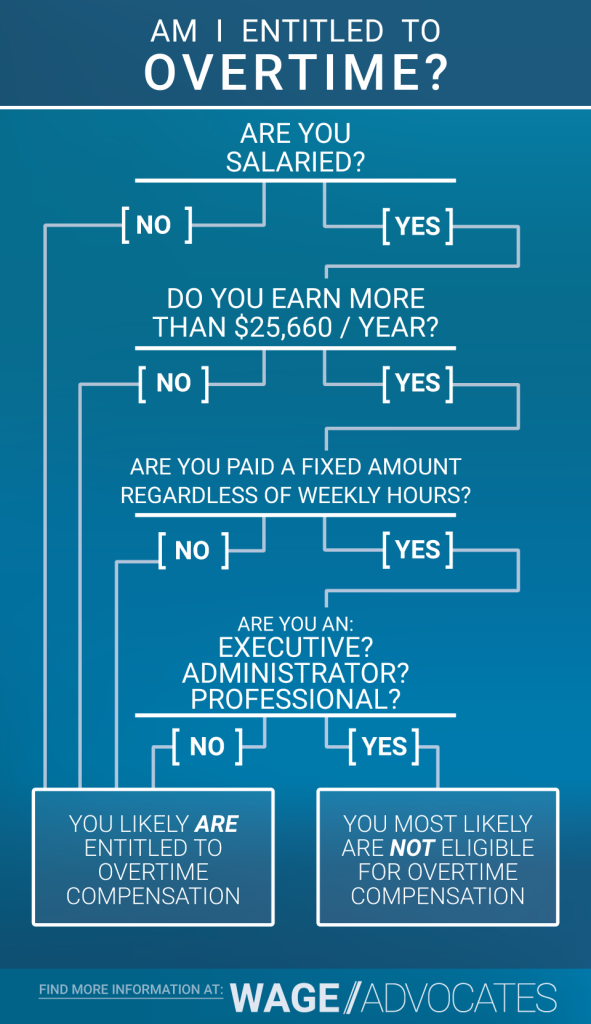

Understanding Exempt vs. Non-Exempt Employees: The FLSA’s Most Confusing Area

This distinction is perhaps the most critical, and often misunderstood, aspect of the FLSA. It dictates whether an employee is entitled to minimum wage and overtime pay protections.

- Non-Exempt Employees: These employees are covered by the FLSA’s minimum wage and overtime provisions. The vast majority of the workforce falls into this category. They must be paid at least the minimum wage for all hours worked and overtime for hours over 40 in a workweek.

-

Exempt Employees: These employees are exempt from the FLSA’s minimum wage and overtime requirements. This means they do not have to be paid overtime, regardless of how many hours they work. However, to qualify as exempt, an employee must meet all three of the following tests:

- Salary Basis Test: The employee must be paid a predetermined, fixed salary that is not subject to reduction because of variations in the quality or quantity of work performed. This means they generally receive the same amount each pay period, regardless of hours worked (as long as they perform any work in the workweek).

- Salary Level Test: The employee’s salary must meet a specific minimum threshold. As of January 1, 2020, the federal salary level for most exemptions is $684 per week (equivalent to $35,568 per year). This threshold is subject to change.

- Duties Test: The employee’s primary job duties must fall within one of the specifically defined categories for exemption, often referred to as "white collar" exemptions.

Common "White Collar" Exemptions:

Even if an employee meets the salary basis and salary level tests, their actual job duties must primarily involve specific types of work to qualify for exemption.

- Executive Exemption:

- Primary duty is managing the enterprise or a recognized department/subdivision.

- Regularly directs the work of two or more other full-time employees (or their equivalent).

- Has the authority to hire or fire other employees, or their suggestions and recommendations as to the hiring, firing, advancement, promotion, or any other change of status of other employees are given particular weight.

- Administrative Exemption:

- Primary duty is the performance of office or non-manual work directly related to the management or general business operations of the employer or the employer’s customers.

- Primary duty includes the exercise of discretion and independent judgment with respect to matters of significance.

- Professional Exemption (Learned or Creative):

- Learned Professional: Primary duty is work requiring advanced knowledge in a field of science or learning customarily acquired by a prolonged course of specialized intellectual instruction (e.g., doctors, lawyers, teachers).

- Creative Professional: Primary duty is work requiring invention, imagination, originality, or talent in a recognized field of artistic or creative endeavor (e.g., writers, musicians, artists).

- Computer Employee Exemption:

- Paid either on a salary basis of at least $684 per week OR an hourly basis of at least $27.63 per hour.

- Primary duty consists of:

- Application of systems analysis techniques and procedures.

- Design, development, documentation, analysis, creation, testing, or modification of computer systems or programs.

- OR a combination of these duties requiring the same level of skills.

- Outside Sales Exemption:

- Primary duty is making sales or obtaining orders or contracts for services.

- Customarily and regularly engaged away from the employer’s place of business.

- Unlike other exemptions, there is no minimum salary requirement for the outside sales exemption.

Crucial Point: Misclassification Risks

One of the most common and costly FLSA violations is misclassifying non-exempt employees as exempt. Employers often mistakenly believe that simply paying an employee a salary makes them exempt from overtime. This is incorrect! If an employee does not meet all three tests (salary basis, salary level, and duties), they are non-exempt and must be paid overtime, even if they are paid a salary.

Consequences of misclassification can include:

- Payment of back wages for unpaid overtime.

- Liquidated damages (often an additional amount equal to the back wages).

- Civil money penalties.

- Legal fees and reputational damage.

Key Takeaway: Do not assume an employee is exempt just because they are paid a salary. Always conduct a thorough review based on the FLSA’s specific tests.

Common FLSA Pitfalls & Misconceptions

Beyond the core pillars, there are several nuances of the FLSA that often lead to confusion and non-compliance.

- "Salaried means exempt": As discussed, this is the biggest myth. Salary alone does not determine exemption status.

- Independent Contractors vs. Employees: Misclassifying an employee as an independent contractor to avoid FLSA obligations is a serious violation. The DOL uses a multi-factor "economic reality" test to determine the true nature of the relationship, focusing on the worker’s economic dependence on the business.

- Working "Off the Clock": Any work performed by a non-exempt employee, even if unauthorized or done voluntarily, must be compensated. This includes checking emails from home, working through lunch, or staying late to finish tasks.

- Travel Time: For non-exempt employees, travel time can be compensable depending on the circumstances (e.g., travel that is an integral part of the job, or travel between job sites during the workday).

- Meal and Rest Breaks: The FLSA does not require employers to provide meal or rest breaks. However, if short breaks (5-20 minutes) are provided, they must be counted as compensable time. Bona fide meal periods (typically 30 minutes or more) are not compensable, provided the employee is completely relieved from duty. State laws often have their own requirements for breaks.

- Deductions from Pay: The FLSA generally prohibits deductions from wages if they reduce an employee’s pay below the minimum wage or cut into overtime pay. Even for exempt employees, deductions from salary are highly restricted.

- Donning and Doffing: Time spent by employees putting on or taking off protective gear or other work-related equipment may be compensable, depending on the nature of the equipment and the activities.

Key Takeaway: When in doubt about a specific scenario, err on the side of caution and consider the time compensable, or seek expert advice.

FLSA Enforcement and Penalties

The U.S. Department of Labor’s Wage and Hour Division (WHD) is responsible for enforcing the FLSA. They conduct investigations based on complaints, targeted enforcement initiatives, or routine audits.

Consequences of FLSA violations can be severe:

- Back Wages: Employers may be required to pay employees all unpaid minimum wages and overtime.

- Liquidated Damages: In many cases, an equal amount of liquidated damages (essentially double damages) can be assessed, unless the employer can prove they acted in good faith and had reasonable grounds for believing their actions complied with the FLSA.

- Civil Money Penalties: For willful violations or violations of child labor provisions, the DOL can assess significant civil money penalties.

- Injunctive Relief: Courts can issue injunctions to stop unlawful practices.

- Criminal Penalties: In rare cases of willful violations, criminal prosecution and fines or imprisonment are possible.

- Private Lawsuits: Employees can also file private lawsuits against employers to recover unpaid wages and damages.

Key Takeaway: FLSA compliance is not merely a recommendation; it’s a legal obligation with substantial penalties for non-compliance.

Why FLSA Compliance Matters

Beyond avoiding penalties, adhering to the FLSA offers significant benefits for businesses and fosters a positive work environment.

- Legal Protection: Proper compliance protects your business from costly lawsuits, audits, and government investigations.

- Reputation: A reputation as a fair and compliant employer helps attract and retain top talent. Conversely, labor violations can severely damage your brand.

- Employee Morale: Employees who feel fairly compensated and treated are more engaged, productive, and loyal. Understanding and respecting their rights under the FLSA builds trust.

- Stability: Consistent compliance creates a stable and predictable operational framework, allowing you to focus on business growth rather than legal battles.

Key Takeaways and Actionable Advice

Understanding the FLSA is an ongoing process, but here are some immediate steps you can take:

- Review Employee Classifications: Periodically audit your exempt and non-exempt employee classifications. Do not rely solely on job titles or salary; verify that each position meets all three FLSA exemption tests.

- Monitor Hours Worked: Implement robust timekeeping systems for all non-exempt employees to accurately track all hours worked, including any "off-the-clock" time.

- Stay Updated on Wage Laws: Regularly check federal, state, and local minimum wage and overtime laws, as they can change frequently.

- Train Managers: Educate your managers and supervisors on FLSA requirements, especially regarding overtime, compensable time, and proper classification, as their actions can create liability for the company.

- Consult Experts: When in doubt, consult with an experienced labor law attorney or HR consultant specializing in wage and hour compliance. This is especially crucial for complex compensation structures or unique work arrangements.

- Document Everything: Maintain accurate and complete records as required by the FLSA. This is your primary defense in the event of an audit or complaint.

Conclusion

The Fair Labor Standards Act is a fundamental pillar of U.S. employment law, designed to ensure fair treatment and compensation for workers. While its provisions can seem intricate, grasping its core principles regarding minimum wage, overtime, child labor, and employee classification is essential for any employer or employee.

By proactively understanding and adhering to the FLSA, businesses can protect themselves from significant legal and financial risks, foster a positive and compliant workplace culture, and contribute to a fair and equitable labor market. Don’t let the complexities deter you; see it as an opportunity to build a stronger, more responsible organization.

Disclaimer: This article provides general information about the Fair Labor Standards Act (FLSA) for educational purposes only and does not constitute legal advice. Labor laws are complex and subject to change, and state and local laws may impose additional or different requirements. You should consult with a qualified legal professional or HR expert for advice regarding your specific situation and to ensure compliance with all applicable federal, state, and local laws.

Post Comment