Business Exit Strategies: Selling Your Business, IPO, and More – Your Complete Guide

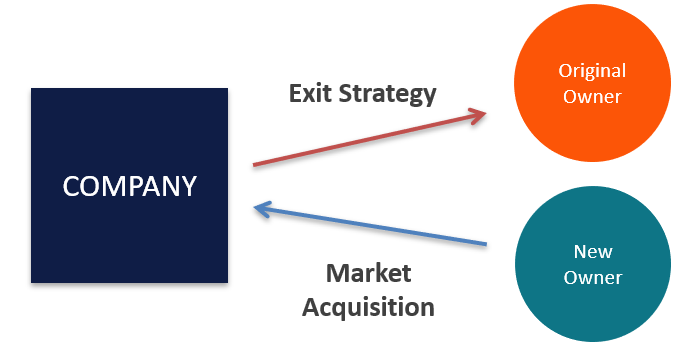

Every great journey has a destination, and for entrepreneurs, the ultimate destination for their business is often a well-planned exit. While building a successful company is a monumental achievement, knowing how and when to leave it is equally crucial. An "exit strategy" isn’t just about closing shop; it’s a carefully crafted plan for how you, as the owner, will eventually transition out of your business, ideally while maximizing its value and achieving your personal goals.

Think of it like planning your retirement, but for your business. It’s about securing your financial future, preserving your legacy, and ensuring the smooth continuation of what you’ve built, even after you’ve stepped away.

This comprehensive guide will break down the most common and effective business exit strategies, explaining them in simple terms, so you can start planning your successful departure.

Why Do You Need an Exit Strategy? It’s Not Just About Leaving!

Many business owners focus solely on growth, sales, and operations, pushing the "exit" thought to the back burner. However, having a clear exit strategy from the outset, or at least planning one well in advance, offers numerous advantages:

- Maximizing Value: A planned exit allows you to prepare your business for sale, making it more attractive to potential buyers and commanding a higher price. This means getting your financials in order, streamlining operations, and reducing your personal reliance on the business.

- Achieving Personal Goals: Whether it’s funding your retirement, pursuing a new venture, spending more time with family, or leaving a legacy, an exit strategy is your roadmap to achieving these personal aspirations.

- Smooth Transition: A well-thought-out plan ensures a less chaotic and more organized transfer of ownership, benefiting employees, customers, and the new owners.

- Minimizing Stress: Knowing your options and having a plan reduces anxiety and uncertainty about the future of your business and your own financial well-being.

- Tax Efficiency: Planning ahead often allows for strategies that can minimize the tax implications of selling or transferring your business.

Key Factors to Consider When Choosing an Exit Strategy

Before diving into the specific types of exit strategies, it’s important to consider what truly matters to you and your business.

- Your Personal Goals:

- What financial return do you need or want?

- How much involvement do you want in the business post-exit (if any)?

- What kind of legacy do you want to leave?

- What’s your ideal timeline for exiting?

- Business Readiness:

- How profitable and stable is your business?

- Are your operations well-documented and not overly reliant on you?

- Do you have a strong management team in place?

- Are your financials clean and transparent?

- Market Conditions:

- Is there demand for businesses like yours?

- Are interest rates favorable for buyers to get financing?

- What’s the overall economic climate?

- Risk Tolerance:

- How much risk are you willing to take for a potentially higher reward?

- Are you comfortable with the complexities of certain exit types (like an IPO)?

Now, let’s explore the most common business exit strategies.

The Main Business Exit Strategies Explained

1. Selling Your Business (The Most Common Path)

Selling your business to an external buyer is by far the most popular exit strategy for small to medium-sized businesses. It typically offers a clean break and a significant lump sum payment.

Who are the potential buyers?

- Strategic Buyers: These are often larger companies in the same industry looking to expand, gain market share, acquire new technology, or eliminate a competitor. They might pay a premium for "synergy" – the idea that your business combined with theirs is worth more than the sum of its parts.

- Financial Buyers: These are usually private equity firms or investment groups looking to buy a profitable business, grow it, and then sell it for an even higher price within a few years. They focus heavily on your financial performance and growth potential.

- Individual Buyers: Often entrepreneurs or individuals looking to acquire an established business rather than starting one from scratch. They are common for smaller businesses.

The Selling Process (Simplified):

- Preparation: Get your financials audited, clean up any legal loose ends, organize all critical documents, and ensure your operations are running smoothly without you.

- Valuation: Determine a realistic price for your business. This often involves professional appraisers who use various methods (e.g., asset-based, income-based, market-based).

- Marketing: Work with a business broker or M&A advisor to confidentially market your business to potential buyers.

- Due Diligence: Once a buyer is interested, they will conduct a thorough investigation of your business’s financial, legal, operational, and customer records. This is where transparency is key.

- Negotiation: Agree on the final price, terms, and conditions of the sale. This often involves lawyers and financial advisors.

- Closing: Sign the final documents, transfer ownership, and receive payment.

Pros of Selling Your Business:

- Clean Break: Often allows for a full exit from the business.

- Significant Cash Payout: Can provide a large sum of money for retirement or new ventures.

- Simpler Than IPO: Less complex and costly than going public.

Cons of Selling Your Business:

- Time-Consuming: The process can take many months, sometimes years.

- Emotionally Challenging: Letting go of something you’ve built can be difficult.

- Confidentiality Issues: You’ll need to share sensitive information, often under Non-Disclosure Agreements (NDAs).

- Valuation Disagreements: Buyers may have different ideas about your business’s worth.

2. Initial Public Offering (IPO) – Going Public

An Initial Public Offering (IPO) is when a privately held company offers its shares to the public for the first time, listing them on a stock exchange (like the New York Stock Exchange or Nasdaq). This is typically reserved for large, established, and rapidly growing companies.

How it Works (Simplified):

A company works with investment banks (underwriters) to prepare for the IPO. This involves rigorous financial scrutiny, legal compliance, and marketing the company to potential investors. Once approved, shares are sold to the public, and the company becomes "publicly traded."

Pros of an IPO:

- Massive Capital Infusion: Can raise enormous amounts of money for growth, expansion, or debt repayment.

- Enhanced Prestige & Brand Awareness: Being a public company can boost your brand’s reputation and visibility.

- Liquidity for Shareholders: Existing shareholders (including the founder) can sell some of their shares on the open market, turning their ownership into cash.

- Attract Top Talent: Public companies often have an easier time attracting and retaining employees with stock options.

Cons of an IPO:

- Extremely Expensive & Complex: Involves significant legal, accounting, and underwriting fees, often millions of dollars.

- Loss of Control: You’ll have public shareholders to answer to, and your decisions will be scrutinized.

- Increased Scrutiny & Regulations: Public companies face strict reporting requirements, regulatory oversight (like the SEC in the US), and constant media attention.

- Short-Term Focus: The pressure to meet quarterly earnings targets can sometimes push companies to make short-term decisions over long-term strategy.

- Not Suitable for Most Businesses: Only a tiny fraction of companies ever go public.

3. Management Buyout (MBO)

In a Management Buyout (MBO), the existing management team of the company purchases the business from the owner(s). This is a great option if you have a strong, loyal, and capable management team who are keen to take the reins.

How it Works (Simplified):

The management team, often with the help of private equity firms or bank loans, raises the capital needed to buy out the owner. The owner might also agree to finance part of the sale.

Pros of an MBO:

- Smooth Transition: The management team already knows the business inside out, leading to minimal disruption.

- Preserves Company Culture: The existing culture and values are more likely to be maintained.

- Motivated Buyers: The buyers are already invested in the company’s success.

- Confidentiality: The process can often be kept more private than an external sale.

Cons of an MBO:

- Funding Challenges: The management team might struggle to secure enough financing.

- Valuation Issues: Owners might expect a higher price than the management team can afford or justify.

- Potential for Conflict: Negotiations can be tricky, especially if the owner has a close relationship with the management team.

4. Employee Stock Ownership Plan (ESOP)

An Employee Stock Ownership Plan (ESOP) is a qualified retirement plan that allows employees to own shares in the company. Instead of selling to an external buyer or management team, you sell your shares to the ESOP trust, which holds the shares on behalf of the employees.

How it Works (Simplified):

The ESOP trust borrows money to buy the owner’s shares. The company then makes tax-deductible contributions to the trust to repay the loan. As the loan is repaid, shares are allocated to individual employee accounts, vesting over time.

Pros of an ESOP:

- Significant Tax Benefits: Owners selling to an ESOP can defer or avoid capital gains taxes if certain conditions are met. The company also gets tax deductions for contributions to the ESOP.

- Employee Engagement & Productivity: Employee-owners often feel more invested in the company’s success, leading to higher morale and productivity.

- Preserves Legacy & Culture: The business remains independent, and its culture can be preserved.

- Gradual Exit: You can sell your shares over time, allowing for a phased transition.

Cons of an ESOP:

- Complex & Costly to Set Up: Requires significant legal and financial expertise.

- Ongoing Administration: ESOPs have ongoing compliance and administrative requirements.

- Internal Market: Employees can only sell their shares back to the company or the ESOP, limiting liquidity compared to a public market.

- Not Suitable for Very Small Businesses: Best for companies with 20+ employees.

5. Family Succession / Internal Transfer

For many family-owned businesses, passing the torch to the next generation or a trusted key employee is the most natural and desirable exit strategy.

How it Works (Simplified):

This involves mentoring and training a family member or key employee to take over leadership and ownership. The transfer can be a gift, a sale, or a combination, often structured over several years.

Pros of Family Succession:

- Preserves Legacy & Values: Ensures the business remains within the family or with someone who understands its core values.

- Smooth Transition: The successor is often already familiar with the business, employees, and customers.

- Potential for Tax Planning: Can be structured to minimize estate or gift taxes.

- Emotional Satisfaction: For many, seeing their creation continue under trusted hands is highly rewarding.

Cons of Family Succession:

- Family Dynamics: Can be complicated by personal relationships and potential conflicts.

- Capability Issues: The chosen successor might not have the necessary skills or desire to run the business.

- Financing Challenges: The successor might struggle to afford the buyout, requiring the owner to finance part of the sale.

- Limited Pool of Buyers: You’re limited to specific individuals, not the open market.

6. Liquidation / Winding Down

Liquidation means selling off all the company’s assets (equipment, inventory, property, etc.) and using the proceeds to pay off debts, with any remaining money distributed to the owners. Winding down is a similar process, but it’s a more controlled closure, often done when the business is no longer viable or the owner simply wants to retire without selling.

How it Works (Simplified):

The business ceases operations. Assets are sold, debts are paid, and the company is legally dissolved. This can be voluntary or involuntary (e.g., bankruptcy).

Pros of Liquidation/Winding Down:

- Simplicity (Sometimes): Can be a straightforward way to close a business, especially if it’s small or has few assets.

- Cuts Losses: If the business is struggling, it can prevent further financial drain.

- Quick Exit: Can be faster than trying to find a buyer.

Cons of Liquidation/Winding Down:

- Loss of Value: You typically get much less than the business might be worth as a going concern.

- Reputational Damage: Can affect your professional reputation.

- Employee Impact: Leads to job losses.

- Not a "Value Maximization" Strategy: Usually a last resort when other options aren’t feasible.

7. Mergers & Acquisitions (M&A) – Becoming Part of Something Bigger

While "selling your business" is a broad term, M&A specifically refers to the joining of two companies. A merger is when two companies combine to form a new entity. An acquisition is when one company buys another, and the acquired company ceases to exist as an independent entity. For most business owners, this is essentially a form of selling their business, often to a larger strategic buyer.

How it Works (Simplified):

A larger company identifies your business as a strategic fit and makes an offer to acquire it. The terms can involve cash, stock in the acquiring company, or a combination. The owner might stay on for a transition period.

Pros of M&A:

- Potentially Higher Valuation: Strategic buyers often pay a premium for your business’s assets, customer base, technology, or market share.

- Access to Resources: Your business gains access to the larger company’s capital, distribution networks, and talent.

- Greater Market Impact: Combined forces can achieve things neither company could alone.

- Less Personal Responsibility: You transition out of day-to-day operations.

Cons of M&A:

- Loss of Independence & Control: Your business becomes part of a larger corporate structure.

- Cultural Clashes: Integrating two different company cultures can be challenging.

- Job Security Concerns: Employees might worry about their roles in the new combined entity.

- Complex Negotiations: Can be long, complex, and require extensive due diligence.

Preparing Your Business for Any Exit Strategy

No matter which path you choose, a well-prepared business is a valuable business. Here are critical steps to take:

- Get Your Financials in Order: Ensure all financial records are accurate, up-to-date, and ideally, audited by an independent accountant. This includes profit & loss statements, balance sheets, and cash flow projections.

- Build a Strong Management Team: Reduce your personal reliance on the business. A strong, autonomous team makes the business more attractive and capable of thriving without you.

- Document Everything: Create clear, written procedures for all key operations, sales processes, and administrative tasks. This shows that the business can run smoothly even with a new owner.

- Clean Up Legal & Regulatory Issues: Resolve any outstanding lawsuits, compliance issues, or expired contracts. Ensure all licenses and permits are current.

- Diversify Your Customer Base: Don’t rely too heavily on one or two major clients. A diversified customer base reduces risk for a potential buyer.

- Invest in Technology & Systems: Modern, efficient systems make your business more attractive and easier to integrate.

- Understand Your Valuation: Get a professional valuation to understand your business’s worth and identify areas for improvement.

The Role of Professional Advisors

Navigating a business exit is complex and requires specialized expertise. Don’t go it alone!

- Business Brokers / M&A Advisors: They help value your business, market it confidentially, find potential buyers, and guide you through the negotiation and closing process.

- Accountants / CFOs: Crucial for getting your financials in order, tax planning, and understanding the financial implications of different exit options.

- Attorneys (Lawyers): Essential for drafting and reviewing all legal documents, ensuring compliance, and protecting your interests throughout the process.

- Financial Planners: Can help you integrate your business exit with your overall personal financial goals, including retirement planning and investment strategies.

Conclusion: Plan Your Exit, Secure Your Future

An exit strategy isn’t just an afterthought; it’s a fundamental part of responsible business ownership. Whether you dream of a lucrative sale, passing your legacy to the next generation, or simply moving on to your next adventure, a well-planned exit ensures you achieve your goals and maximize the value of the incredible enterprise you’ve built.

Start thinking about your exit strategy today. It’s never too early to begin preparing for your successful departure.

Post Comment