Unlock Financial Insights: How to Use Budget Variances to Improve Performance

Ever feel like your budget is just a fancy set of numbers that sits in a spreadsheet, only to be looked at once a month (or maybe never)? What if I told you that those numbers hold the key to understanding your business’s health, spotting problems before they get big, and discovering opportunities for growth?

Welcome to the powerful world of budget variances. Don’t let the technical term scare you! At its core, a budget variance is simply the difference between what you expected to happen financially (your budget) and what actually happened. Understanding and acting on these differences is one of the most effective ways to improve your financial performance, whether you’re running a small business, managing a department, or even just overseeing your household finances.

This long-form guide will break down budget variances into easy-to-understand concepts, show you how to calculate them, interpret their meaning, and most importantly, how to use them as a powerful tool for continuous improvement.

What Exactly Are Budget Variances?

Let’s start with the basics. Imagine you plan to spend $1,000 on office supplies in a month. At the end of the month, you discover you only spent $800. The difference, $200, is a budget variance.

In simple terms:

Budget Variance = Actual Result – Budgeted Amount

This calculation can apply to anything financial:

- Revenue: How much money you brought in.

- Expenses: How much money you spent.

- Profit: The difference between your revenue and expenses.

Understanding Favorable vs. Unfavorable Variances

The sign of your variance tells you its nature:

-

Favorable Variance: This is usually a good thing. It means you either:

- Earned more revenue than you expected (e.g., actual sales of $12,000 vs. budgeted sales of $10,000 = +$2,000 favorable revenue variance).

- Spent less expense than you expected (e.g., actual utility bill of $300 vs. budgeted $400 = -$100 favorable expense variance).

- Think of it: Favorable means a positive impact on your profit.

-

Unfavorable Variance: This is usually a bad thing. It means you either:

- Earned less revenue than you expected (e.g., actual sales of $8,000 vs. budgeted sales of $10,000 = -$2,000 unfavorable revenue variance).

- Spent more expense than you expected (e.g., actual marketing costs of $1,500 vs. budgeted $1,000 = +$500 unfavorable expense variance).

- Think of it: Unfavorable means a negative impact on your profit.

Important Note for Beginners: While a "favorable" expense variance (spending less) seems straightforward, sometimes it can signal a missed opportunity (e.g., spending less on marketing might mean fewer leads). Always look beyond just the positive or negative sign!

Why Are Budget Variances So Important for Performance?

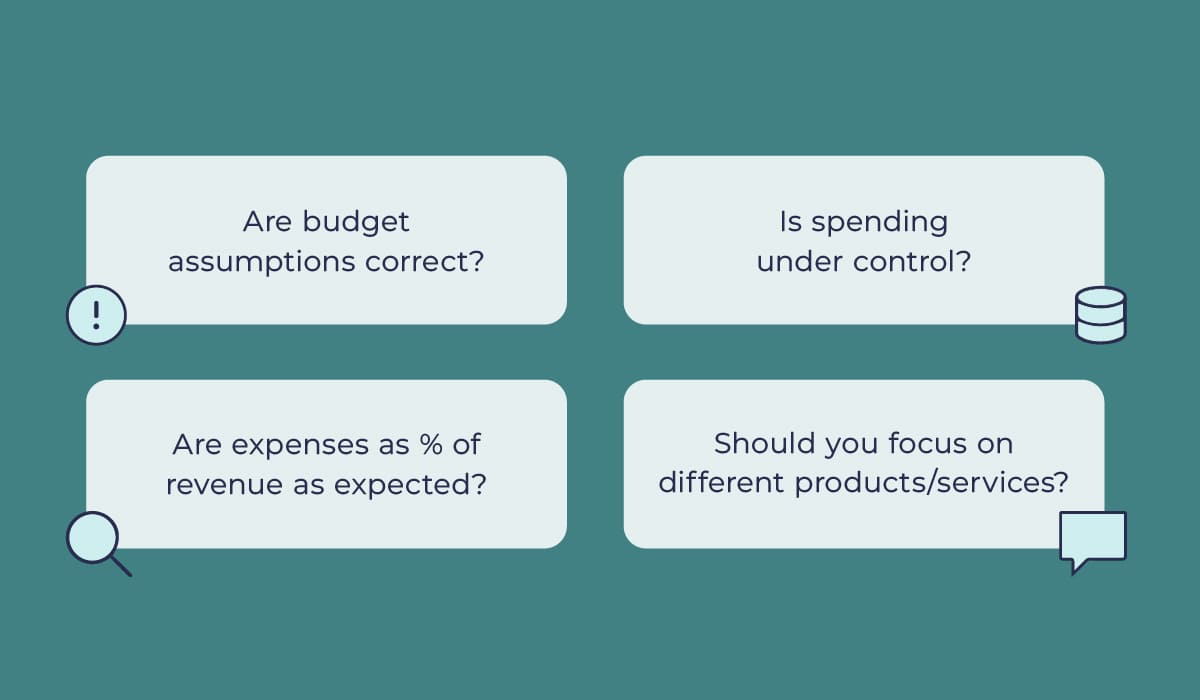

Budget variances are much more than just historical data. They are a powerful diagnostic tool, like a regular check-up for your business’s financial health. Here’s why they matter:

- Early Warning System: Unfavorable variances can signal problems brewing. Did a supplier raise prices? Are sales declining? Are your employees less efficient than planned? Catching these issues early allows you to react quickly before they become major crises.

- Opportunity Spotting: Favorable variances aren’t just a pat on the back; they can highlight unexpected successes. Did a new marketing campaign work exceptionally well? Did you find a cheaper, high-quality supplier? Understanding these successes allows you to replicate them and scale what works.

- Enhanced Accountability: Variances help you understand who is responsible for what. If a department consistently overspends its budget, it prompts a conversation about resource management and decision-making.

- Improved Forecasting & Budgeting: By analyzing past variances, you gain valuable insights into the accuracy of your budgeting process. This helps you create more realistic and reliable budgets for the future.

- Better Decision-Making: Armed with variance insights, you can make informed decisions about resource allocation, pricing, staffing, marketing spend, and more. It moves you from guessing to strategizing based on data.

- Resource Optimization: Identifying areas where money is being wasted or underutilized allows you to reallocate those resources to more productive areas, boosting overall efficiency.

The Step-by-Step Guide to Using Budget Variances to Improve Performance

Now that you understand what variances are and why they’re crucial, let’s dive into the practical steps of using them effectively.

Step 1: Calculate & Identify Significant Variances

- Gather Your Data: You’ll need your budget for the period (month, quarter, year) and your actual financial results for the same period.

- Perform the Calculation: For each line item (e.g., "Sales Revenue," "Rent," "Marketing Expenses," "Office Supplies"), calculate:

Variance = Actual Amount - Budgeted Amount - Focus on the Significant: Not every small difference is worth investigating. Establish a threshold for what’s "significant." This could be:

- A percentage (e.g., any variance greater than 5% or 10% of the budgeted amount).

- A fixed dollar amount (e.g., any variance over $500 or $1,000).

- A combination of both.

- Why this matters: You don’t want to spend hours chasing down a $5 difference in your stationery budget. Focus your energy on the variances that have a real impact.

Step 2: Investigate the "Why" (Root Cause Analysis)

This is the most critical step. A variance itself doesn’t tell you why it happened. You need to put on your detective hat and dig deeper.

Questions to Ask for Unfavorable Variances:

- Revenue Shortfall:

- Did sales volume drop (fewer customers, fewer units sold)?

- Did pricing change (lower average selling price)?

- Was there a problem with a product/service?

- Did a competitor enter the market or intensify efforts?

- Was a marketing campaign less effective than planned?

- Were economic conditions worse than expected?

- Expense Overruns:

- Did the price of goods/services increase (e.g., raw materials, software subscriptions)?

- Did the volume of activity increase (e.g., more sales meant more shipping costs, more production meant more electricity)?

- Was there an unexpected, one-off cost (e.g., emergency repair, legal fees)?

- Was there a lack of cost control or oversight?

- Were there inefficiencies in operations (e.g., more labor hours than planned for a task)?

- Was the initial budget simply unrealistic?

Questions to Ask for Favorable Variances:

- Revenue Overperformance:

- Did sales volume exceed expectations (more customers, higher units sold)?

- Was there an unexpected demand for a product/service?

- Did a new marketing campaign or sales strategy work exceptionally well?

- Was pricing higher than planned (e.g., less discounting)?

- Did you acquire a major new client?

- Expense Under-spending:

- Did you find a cheaper supplier or negotiate better terms?

- Was there less activity than planned (e.g., fewer deliveries meant less fuel)?

- Did you successfully implement efficiency improvements (e.g., energy-saving measures, optimized processes)?

- Was a planned expense delayed or canceled?

- Was the initial budget simply too high?

Distinguish Between Controllable and Uncontrollable Variances:

- Controllable: These are variances you can directly influence or change with future actions. Examples: marketing spend, staffing levels, efficiency of operations, pricing strategies.

- Uncontrollable: These are variances caused by external factors beyond your direct control. Examples: unexpected natural disaster, a sudden global rise in fuel prices, a new government regulation, a major economic recession.

- Why this distinction matters: You can’t change the past, but for controllable variances, you can implement changes to prevent recurrence or leverage success. For uncontrollable ones, you focus on mitigating their impact or adjusting your future plans accordingly.

Step 3: Develop Actionable Insights and Strategies

Once you understand why a variance occurred, the next step is to figure out what to do about it. This is where performance improvement truly begins.

-

For Unfavorable Variances:

- Cost Overruns: Can you renegotiate with suppliers? Implement stricter spending controls? Look for alternative vendors? Improve operational efficiency?

- Revenue Shortfalls: Can you adjust pricing? Launch a new marketing campaign? Retrain your sales team? Introduce new products/services? Improve customer retention?

-

For Favorable Variances:

- Revenue Overperformance: Can you scale the successful initiative? Invest more in the marketing channel that worked? Expand into new markets? Replicate the successful sales strategy?

- Expense Under-spending: Can you solidify the new, cheaper supplier relationship? Automate the efficient process? Reallocate the saved money to a growth-oriented initiative (e.g., R&D, new equipment)?

-

Brainstorm Solutions: Involve relevant team members. Their insights are invaluable.

-

Prioritize Actions: Not every action will have the same impact. Focus on those that offer the greatest return or address the most critical issues.

-

Set Clear Goals: What do you hope to achieve by taking this action? Make it measurable.

Step 4: Implement & Monitor

Taking action isn’t a one-time event. You need to put your plan into motion and then track its effectiveness.

- Assign Responsibilities: Who is doing what, by when?

- Set Timelines: Establish deadlines for implementation.

- Regular Monitoring: Continue to track your actual results against your budget (and your revised budget, if applicable). Are the actions you took having the desired effect?

- Adjust as Needed: If your initial actions aren’t working, don’t be afraid to pivot and try something new. The business environment is dynamic.

Step 5: Refine Future Budgets

The final, crucial step in the continuous improvement loop is to use your variance analysis to make your next budget even better.

- Incorporate Lessons Learned:

- If you consistently overestimated revenue from a certain source, adjust your future revenue projections down.

- If you consistently underestimated a utility bill, increase that budget line item for next year.

- If a new marketing strategy led to significant favorable revenue variances, budget more for that strategy in the future.

- Promote Realism: A budget that accurately reflects reality is a far more useful tool than one based on overly optimistic or pessimistic assumptions.

- Build Confidence: When your budget becomes a more reliable roadmap, you and your team will have more confidence in its ability to guide your financial decisions.

Practical Examples of Variance Analysis in Action

Let’s look at a few common scenarios to illustrate how variance analysis leads to performance improvement.

Example 1: Unfavorable Revenue Variance (Sales Shortfall)

-

Budgeted Sales: $50,000

-

Actual Sales: $40,000

-

Variance: -$10,000 (Unfavorable)

-

Investigation: After talking to the sales team, you discover:

- A key competitor launched a very aggressive discount campaign.

- One of your new product lines had quality issues, leading to returns and lost repeat sales.

- The marketing team reduced ad spend without clear communication.

-

Actionable Insights:

- Competitive Response: Develop a targeted counter-offer or value proposition.

- Product Quality: Work with production/supplier to resolve quality issues immediately; consider offering a discount or freebie to affected customers.

- Marketing Alignment: Re-evaluate marketing budget and strategy, ensuring it supports sales goals. Increase ad spend in areas that show good ROI.

-

Performance Improvement: By addressing product quality, responding to competition, and optimizing marketing, future sales are likely to rebound and exceed initial expectations.

Example 2: Unfavorable Expense Variance (Marketing Overspend)

-

Budgeted Marketing: $2,000

-

Actual Marketing: $3,500

-

Variance: +$1,500 (Unfavorable)

-

Investigation: You find that:

- An unexpected social media influencer campaign was launched mid-month without prior budget approval.

- The cost-per-click (CPC) for online ads increased significantly due to higher competition.

-

Actionable Insights:

- Budget Control: Implement stricter approval processes for new marketing initiatives.

- Ad Optimization: Review online ad campaigns, adjust bidding strategies, and explore new ad platforms or targeting options to reduce CPC.

- ROI Analysis: Evaluate the ROI of the influencer campaign. If it was highly successful, consider budgeting for it next time; if not, avoid similar spontaneous spending.

-

Performance Improvement: Tighter spending controls and more efficient ad management will prevent future overspending, ensuring marketing dollars are used more effectively to drive revenue.

Example 3: Favorable Expense Variance (Utilities Under-spending)

-

Budgeted Utilities: $700

-

Actual Utilities: $550

-

Variance: -$150 (Favorable)

-

Investigation: You discover that:

- The team implemented new energy-saving habits (turning off lights, unplugging equipment).

- A new, more energy-efficient HVAC system was installed last quarter, and its impact is now being felt.

-

Actionable Insights:

- Reinforce Habits: Congratulate the team and encourage continued energy conservation.

- Capitalize on Efficiency: Consider further investments in energy-efficient equipment.

- Reallocate Savings: The saved $150 could be reallocated to another area of need, like employee training or a small marketing test.

-

Performance Improvement: Identifying the source of savings allows you to reinforce positive behaviors, potentially invest in further efficiencies, and strategically re-invest the saved funds for growth.

Example 4: Favorable Revenue Variance (Unexpected Demand)

-

Budgeted Product X Sales: $10,000

-

Actual Product X Sales: $15,000

-

Variance: +$5,000 (Favorable)

-

Investigation: You learn that:

- A popular online reviewer unexpectedly featured your Product X, leading to a surge in demand.

- Your website’s conversion rate for Product X significantly improved.

-

Actionable Insights:

- Scale Production: Can you produce more of Product X quickly to meet demand?

- Leverage Publicity: Reach out to the reviewer, share the success, and explore other similar influencers.

- Analyze Website: Study the changes that led to the improved conversion rate and apply them to other product pages.

- Marketing Push: Allocate more marketing budget to promote Product X while demand is high.

-

Performance Improvement: By quickly recognizing and acting on this favorable variance, you can capitalize on unexpected success, maximize sales, and learn valuable lessons for future product launches and marketing efforts.

Key Benefits of Effective Variance Analysis

When you consistently apply the principles of budget variance analysis, your organization will experience significant advantages:

- Strategic Decision-Making: Move from reactive firefighting to proactive, data-driven planning. You’ll make better choices about where to invest, where to cut, and how to grow.

- Early Problem Detection: Catch financial issues (like declining sales or rising costs) when they are small and manageable, preventing them from escalating into major crises.

- Enhanced Accountability: Clearly understand who is responsible for specific budget line items and performance targets, fostering a culture of ownership.

- Improved Forecasting & Budgeting: Your budgets will become more accurate and reliable, serving as a truer roadmap for your financial future.

- Resource Optimization: Identify and eliminate waste, redirecting resources to their most productive uses, boosting efficiency and profitability.

- Continuous Improvement Culture: Foster a mindset within your team that constantly seeks to understand "why" things happened and how to do better next time.

- Increased Profitability: Ultimately, by managing costs, maximizing revenue, and making smarter decisions, effective variance analysis directly contributes to a healthier bottom line.

Tips for Beginners Using Budget Variances

If you’re new to this, it can feel overwhelming. Here are some tips to get started and build confidence:

- Start Small: Don’t try to analyze every single line item in your first go. Pick 3-5 major revenue or expense categories that have the biggest impact on your business.

- Don’t Get Overwhelmed by "Bad" News: Unfavorable variances are not failures; they are learning opportunities. Approach them with a curious, problem-solving mindset, not a punitive one.

- Focus on the "Why": Always push past the number to understand the underlying cause. This is where the real insights lie.

- Be Consistent: Make variance analysis a regular part of your financial review process – monthly is ideal for most businesses.

- Look for Trends: A one-time variance might be an anomaly. Consistent variances (favorable or unfavorable) over several months indicate a systemic issue or opportunity.

- Involve Your Team: The people on the ground often have the best insights into why things happened. Empower them to contribute to the analysis and solutions.

- It’s a Tool, Not a Judge: Use variance analysis to guide future actions and learn, not just to assign blame. A positive, forward-looking approach is key.

- Keep it Simple (at first): You don’t need complex software or advanced accounting degrees. A simple spreadsheet can be enough to start.

Conclusion: Your Budget is More Than Just Numbers

Your budget is not just a dusty document; it’s a living, breathing financial map. And budget variances are the compass that helps you navigate that map. By diligently calculating, investigating, and acting upon these differences between your plans and reality, you unlock a powerful mechanism for continuous improvement.

From spotting early warnings and seizing unexpected opportunities to optimizing resources and fostering accountability, understanding budget variances empowers you to make smarter, more strategic decisions. It transforms your financial data from a historical record into a dynamic tool for driving performance and achieving your goals.

So, don’t let those numbers sit idle. Start analyzing your budget variances today and watch your performance improve!

Post Comment