Budgeting for Non-Profits: Navigating Unique Challenges and Paving the Way for Impact

Welcome to the vital world of non-profit organizations! You’re driven by a powerful mission – whether it’s protecting the environment, feeding the hungry, supporting education, or advocating for human rights. But even the noblest causes need a solid financial foundation to thrive and make a lasting impact. That’s where budgeting comes in.

For many, the word "budget" conjures images of spreadsheets, strict rules, and perhaps a bit of dread. But for non-profits, budgeting isn’t just about crunching numbers; it’s a strategic roadmap that translates your passion into actionable programs, ensuring transparency, accountability, and ultimately, a greater reach for your mission.

This comprehensive guide will demystify non-profit budgeting, highlighting its unique challenges and offering practical, easy-to-understand solutions. Whether you’re a new executive director, a dedicated board member, or a passionate program manager, understanding these principles is your key to sustainable success.

Why Budgeting Matters More Than You Think for Non-Profits

Before we dive into the nitty-gritty, let’s understand why a robust budget is absolutely essential for any non-profit:

- Translates Mission into Action: Your budget allocates resources to specific programs and initiatives, showing exactly how your money directly serves your cause.

- Ensures Financial Stability: It helps you understand your financial health, identify potential shortfalls, and plan for the future, preventing crises before they happen.

- Builds Trust and Transparency: Donors, grantors, and the public want to know their contributions are being used wisely. A clear budget demonstrates accountability.

- Aids Decision-Making: When faced with tough choices (e.g., expanding a program vs. investing in new technology), your budget provides a data-driven basis for smart decisions.

- Measures Performance: It allows you to compare actual spending against planned spending, helping you evaluate efficiency and impact.

- Supports Fundraising Efforts: A well-structured budget is a powerful tool for grant applications and donor solicitations, showing how their investment will be utilized.

- Complies with Regulations: Non-profits have specific legal and accounting requirements, and a good budget helps ensure you meet them.

Unique Challenges in Non-Profit Budgeting

Budgeting for a non-profit isn’t quite the same as for a for-profit business. While both need to manage income and expenses, non-profits face distinct hurdles that require specific strategies.

1. Funding Volatility and Uncertainty

- The Challenge: Unlike businesses with predictable sales, non-profits often rely on grants, donations, and fundraising events. These income streams can be unpredictable, varying significantly from year to year, or even month to month. A major grant might not be renewed, or a fundraising event could underperform.

- Why it’s unique: It’s hard to forecast income accurately when it depends on external factors like economic downturns, donor preferences, or the whims of grant foundations.

2. The Labyrinth of Restricted vs. Unrestricted Funds

- The Challenge: This is perhaps the biggest differentiator. Donors and grantors often specify how their money can be used.

- Restricted Funds: Money designated for a specific program, project, or time period (e.g., "this $10,000 is only for our youth literacy program"). You cannot use it for anything else, even if another area desperately needs it.

- Unrestricted Funds: Money that the organization can use for any purpose, including administrative costs, fundraising, or general operations.

- Why it’s unique: It creates a complex puzzle. You might have plenty of money in restricted funds but be struggling to cover basic operational costs like rent or utilities, which often fall under unrestricted expenses.

3. Balancing Mission Impact with Financial Reality

- The Challenge: Non-profits are driven by passion and a desire to serve. This can sometimes lead to a "heart over head" approach, where the desire to do more (expand programs, serve more people) clashes with limited financial resources. It’s tough to say "no" to a great idea that directly serves your mission.

- Why it’s unique: The primary goal isn’t profit, but impact, which can make financial discipline feel counter-intuitive or even morally challenging at times.

4. The "Overhead Myth" and Perception of Administrative Costs

- The Challenge: Many donors and the public mistakenly believe that non-profits should spend almost nothing on "overhead" (administrative costs like salaries, rent, utilities, marketing). They want their money to go directly to programs.

- Why it’s unique: This perception puts pressure on non-profits to minimize essential administrative and fundraising costs, even though these are vital for effective operation, growth, and long-term sustainability. It’s hard to run a good program without a well-managed office, skilled staff, and effective fundraising.

5. Complex Grant Reporting and Compliance

- The Challenge: Each grant often comes with its own unique set of reporting requirements, financial statements, and performance metrics. Managing multiple grants means juggling different deadlines, formats, and data points.

- Why it’s unique: This creates significant administrative burden and requires meticulous record-keeping to ensure compliance and maintain good relationships with funders.

6. Reliance on Volunteers

- The Challenge: While volunteers are invaluable, their involvement can impact the budget indirectly. There are costs associated with recruiting, training, supervising, and appreciating volunteers. Their hours also represent a significant "in-kind" contribution that needs to be tracked for some grants and reporting.

- Why it’s unique: It’s an asset that doesn’t show up directly on the balance sheet but has real implications for resource allocation and program delivery.

7. Long-Term Sustainability vs. Short-Term Needs

- The Challenge: Many non-profits live grant-to-grant, focusing on immediate needs and program delivery. It can be difficult to allocate funds to build reserves, invest in technology upgrades, or develop long-term strategic plans when current programs are demanding every penny.

- Why it’s unique: The constant pressure to deliver impact now can overshadow the critical need to build a resilient financial future.

Key Components of a Non-Profit Budget

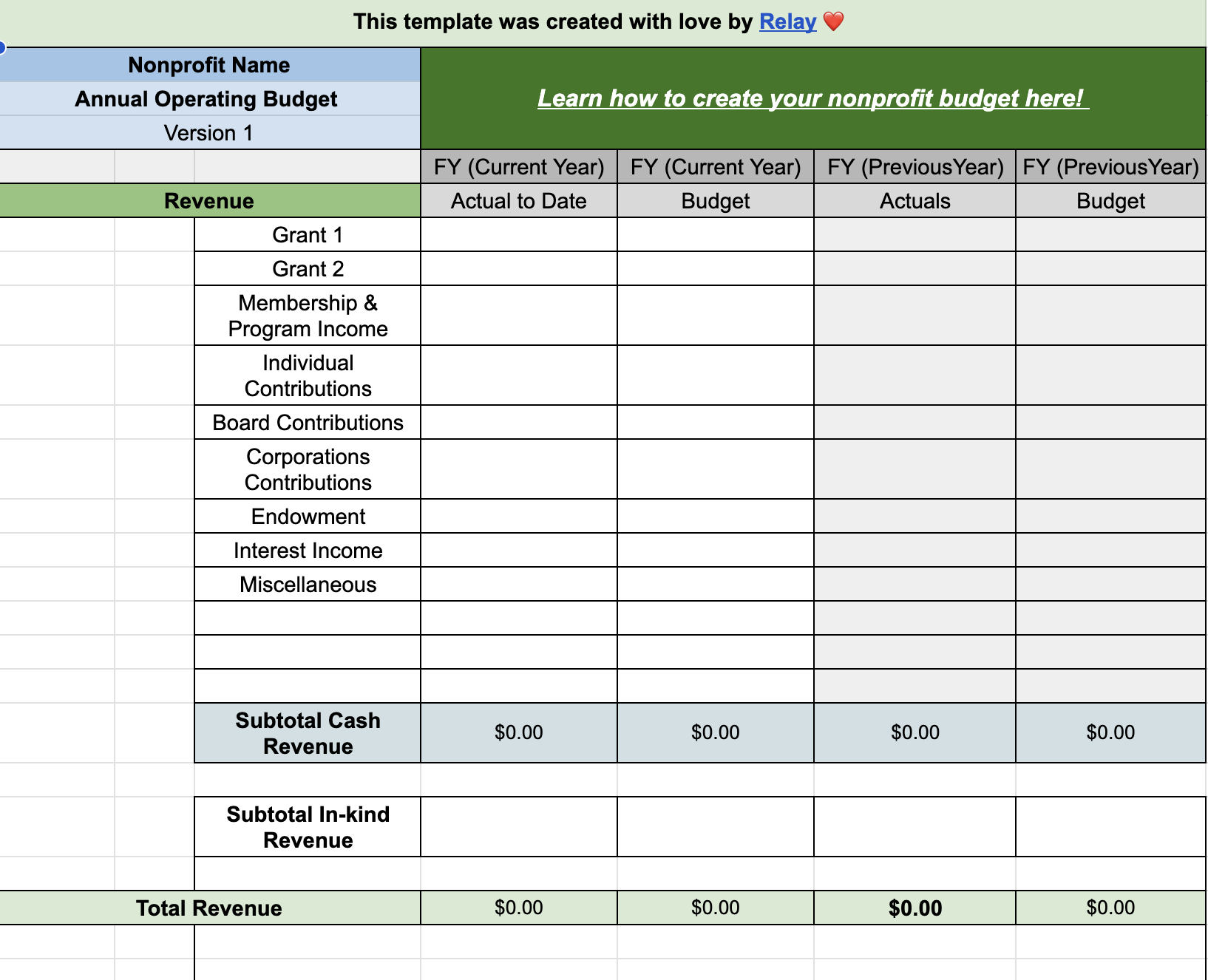

A non-profit budget typically has two main sections: Revenue (Income) and Expenses (Spending).

1. Revenue Sources (Where the Money Comes From)

- Grants: Funding from foundations, government agencies, or corporations for specific projects or general operations.

- Individual Donations: Contributions from private citizens, ranging from small online gifts to large philanthropic sums.

- Corporate Sponsorships: Support from businesses, often in exchange for branding or recognition.

- Fundraising Events: Income from galas, runs/walks, auctions, bake sales, etc. (Remember to subtract event costs from the gross revenue).

- Program Service Fees: Fees charged for services provided (e.g., tuition for an educational program, fees for a workshop, ticket sales for a performance).

- Government Contracts: Payments for services rendered on behalf of a government entity.

- Investment Income: Earnings from endowments or reserve funds.

- In-Kind Contributions: Donated goods or services (e.g., pro-bono legal work, donated office space, volunteer hours). While not cash, they have value and should be tracked.

2. Expense Categories (Where the Money Goes)

Non-profit expenses are usually categorized into three main functional areas:

-

Program Expenses (Mission-Related): These are the costs directly related to delivering your mission and services.

- Staff salaries directly involved in program delivery (e.g., counselors, teachers, field workers)

- Supplies and materials for programs

- Direct client support (e.g., food, shelter, educational materials)

- Travel for program activities

- Rent for program-specific facilities

- Think: What costs would disappear if this specific program ceased to exist?

-

Administrative Expenses (Overhead/Management & General): These are the costs of running the organization as a whole, regardless of specific programs. They are essential to support your mission.

- Executive Director’s salary, accounting staff, HR staff

- Office rent, utilities, insurance

- Office supplies, technology, software

- Legal and accounting fees

- Board meeting expenses

- Think: The "engine" that keeps the whole car running smoothly.

-

Fundraising Expenses: These are the costs associated with generating revenue for the organization.

- Salaries of fundraising staff

- Costs of fundraising events (venue rental, catering, marketing)

- Donor management software

- Marketing and communication materials for fundraising appeals

- Grant writing fees

- Think: The "fuel" that keeps the engine going.

Effective Solutions for Non-Profit Budgeting Challenges

Now that we understand the unique hurdles, let’s explore practical solutions to overcome them.

1. Diversify Your Funding Sources

- Solution: Don’t put all your eggs in one basket. Actively pursue a mix of grants, individual donations, corporate sponsorships, events, and potentially earned income.

- How it helps: If one funding stream dries up, others can help cushion the blow, providing more stable and predictable income over time.

- Actionable Tip: Set a goal for what percentage of your income should come from each source.

2. Meticulous Tracking of Restricted and Unrestricted Funds

- Solution: Implement robust accounting systems (software or even clear spreadsheets) that allow you to track every dollar as either restricted or unrestricted. Create separate accounts or sub-accounts for each major restricted grant.

- How it helps: This prevents misuse of funds, ensures compliance, and gives you a clear picture of what money is available for general operations vs. specific programs.

- Actionable Tip: Train all relevant staff (program managers, finance staff) on the importance and process of tracking fund restrictions.

3. Adopt Mission-Driven Budgeting

- Solution: Every budget line item should be scrutinized through the lens of your mission. Ask: "Does this expense directly advance our mission or enable us to do so more effectively?"

- How it helps: This ensures resources are always aligned with your core purpose, preventing "mission drift" and unnecessary spending.

- Actionable Tip: During budget review meetings, have a "mission moment" where you explicitly link budget allocations back to organizational goals.

4. Educate Stakeholders on the Value of Overhead

- Solution: Be transparent about your administrative and fundraising costs. Explain to donors and the public why these costs are essential for delivering effective programs. Highlight that smart overhead leads to greater impact.

- How it helps: It demystifies the "overhead myth" and helps stakeholders understand that a well-run organization needs investment in its infrastructure, just like any successful business.

- Actionable Tip: Feature testimonials from staff whose administrative roles directly contribute to program success. Use analogies: "You wouldn’t expect a top-chef to cook a gourmet meal without a clean kitchen and working oven."

5. Streamline Grant Management and Reporting

- Solution: Invest in grant management software or create standardized templates for tracking grant deadlines, requirements, and expenditures. Assign clear ownership for each grant.

- How it helps: Reduces administrative burden, minimizes errors, ensures timely reporting, and strengthens relationships with funders.

- Actionable Tip: Conduct internal "mock audits" for major grants to ensure all documentation is in order before the actual submission.

6. Invest in Technology for Efficiency

- Solution: Utilize accounting software (e.g., QuickBooks for Nonprofits), donor management systems (CRMs), and project management tools.

- How it helps: Automates tasks, improves data accuracy, provides better insights, and frees up staff time for mission-critical work.

- Actionable Tip: Start with one key system (e.g., accounting software) and gradually integrate others as your budget allows. Many companies offer non-profit discounts.

7. Build and Maintain a Healthy Operating Reserve

- Solution: Aim to set aside a portion of unrestricted funds in a separate savings account to cover 3-6 months of operating expenses. This is your "rainy day fund."

- How it helps: Provides a crucial safety net during funding gaps, economic downturns, or unexpected emergencies, preventing your organization from having to halt programs or lay off staff.

- Actionable Tip: Make building reserves a line item in your annual budget, even if it’s a small amount each year.

8. Foster a Culture of Financial Responsibility and Adaptability

- Solution: Regularly review your budget (monthly or quarterly), compare actuals to projections, and be prepared to make adjustments. Encourage all department heads to understand their budget responsibilities.

- How it helps: Ensures you stay on track, catch problems early, and can pivot quickly in response to changing circumstances. A budget isn’t set in stone; it’s a living document.

- Actionable Tip: Hold brief, regular "budget check-in" meetings with key staff, not just once a year.

9. Engage Your Board of Directors

- Solution: Your board should be actively involved in the budget approval process and financial oversight. Provide them with clear, easy-to-understand financial reports.

- How it helps: Leverages their expertise, ensures good governance, and provides an additional layer of accountability and strategic insight.

- Actionable Tip: Offer board members a "finance 101" session if needed, to ensure everyone understands the basics of non-profit financials.

Budgeting for Beginners: Simple Steps to Get Started

Feeling overwhelmed? Don’t be! Here’s a simplified approach to building your non-profit’s budget:

- Start with Your Mission & Goals: What do you want to achieve this year? How many people will you serve? What programs will you run? Your budget should reflect these ambitions.

- Estimate Your Income:

- Look at last year’s actual income.

- Be realistic about grants you expect to receive (only count what’s confirmed or highly likely).

- Project revenue from fundraising events and individual donations. Be conservative!

- Don’t forget to differentiate between restricted and unrestricted income.

- Estimate Your Expenses:

- Start with Fixed Costs: These are expenses that usually don’t change much month-to-month (e.g., rent, insurance, core salaries, utility bills).

- Add Variable Costs: These change based on activity (e.g., program supplies, event catering, marketing for specific campaigns).

- Don’t Forget "Hidden" Costs: Training, software subscriptions, professional development, unexpected repairs.

- Categorize: Break down expenses into Program, Administrative, and Fundraising.

- Balance the Books (Income – Expenses = 0 or a Small Surplus): Ideally, your projected income should at least cover your projected expenses. A small surplus is healthy for building reserves. If you have a deficit, you need to either:

- Find more income (fundraising).

- Reduce expenses (cut costs).

- Review and Revise (Regularly!): Your first budget won’t be perfect. It’s a living document.

- Review it monthly or quarterly.

- Compare what you planned to spend/receive with what actually happened.

- Adjust as needed. Life happens! Grants might come in late, or a program might cost more than expected.

Conclusion: Your Budget as a Catalyst for Change

Budgeting for non-profits doesn’t have to be a source of anxiety. When approached strategically and thoughtfully, it transforms from a mere financial document into a powerful tool for impact. By understanding the unique challenges, implementing smart solutions, and fostering a culture of financial responsibility, your non-profit can ensure every dollar works harder towards achieving its vital mission.

A strong budget builds trust, ensures sustainability, and ultimately, amplifies your ability to make a positive difference in the world. Start small, be consistent, and watch as your financial planning becomes a true catalyst for change. Your mission deserves nothing less.

Post Comment