Mastering Letters of Credit (LCs): Your Essential Guide to Secure International Trade

In the dynamic world of international trade, trust is a precious commodity. When buyers and sellers are separated by continents, different legal systems, and vast distances, how can both parties ensure they get what they bargained for? The answer, for many decades, has been the Letter of Credit (LC), also known as a Documentary Credit.

If you’re new to importing or exporting, the concept of LCs might seem daunting. But fear not! This comprehensive guide will demystify Letters of Credit, breaking down their complexities into easy-to-understand steps. By the end, you’ll grasp why LCs are a cornerstone of secure global commerce and how they can protect your business.

What Exactly is a Letter of Credit (LC)? The Bank’s Promise

Imagine you’re buying a car from someone you’ve never met, who lives thousands of miles away. You wouldn’t send them the full payment upfront, hoping they ship the car. Similarly, they wouldn’t ship the car hoping you pay them later. There’s a trust gap.

A Letter of Credit (LC) bridges this gap. In essence, it’s a binding payment undertaking from a bank (the "Issuing Bank") to the seller (the "Beneficiary"). The bank promises to pay the seller a specific amount of money, provided the seller presents specific documents that comply with the terms and conditions outlined in the LC.

Key takeaway: With an LC, the seller’s primary assurance of payment comes from a reputable bank, not directly from the buyer. This significantly reduces the risk of non-payment for the seller and ensures the buyer only pays when the goods are shipped as agreed.

Think of it like this: The bank acts as a trusted intermediary, holding the buyer’s promise of payment and releasing it only when the seller proves they’ve fulfilled their end of the shipping bargain by presenting the correct documents.

Why Use Letters of Credit? The Benefits for Both Sides

LCs might seem complex, but their widespread use stems from the significant security they offer to both importers and exporters.

For the Exporter (Seller): Unwavering Payment Assurance

- Guaranteed Payment: The primary benefit. Once the LC is confirmed and all documents are presented correctly, the bank is legally obligated to pay, regardless of whether the buyer experiences financial difficulties or changes their mind.

- Reduced Commercial Risk: Eliminates the risk of the buyer refusing payment or delaying it.

- Access to Financing: Banks are often more willing to provide pre-shipment or post-shipment financing against a confirmed LC, as it reduces their risk.

- Proof of Buyer’s Creditworthiness: The fact that a bank has issued an LC indicates that the buyer has sufficient funds or credit lines.

For the Importer (Buyer): Control and Confidence

- Goods Assurance: The importer knows that payment will only be made once the exporter has shipped the goods and provided all the required documentation, proving compliance with the agreed terms.

- Specific Conditions: The LC allows the importer to dictate precise conditions that must be met (e.g., shipping date, port of loading/discharge, specific documents) before payment is released.

- Protection Against Non-Performance: If the exporter fails to ship the goods or provides non-compliant documents, the importer is not obligated to pay.

- Negotiating Power: Offering an LC can sometimes give an importer an edge in negotiations, as it signals a serious commitment and reduces the exporter’s risk.

General Benefits: Building Trust in Global Commerce

- Risk Mitigation: LCs significantly reduce both commercial (buyer non-payment) and political risks (currency controls, government interference).

- Standardized Rules: Governed by international rules published by the International Chamber of Commerce (ICC), primarily the Uniform Customs and Practice for Documentary Credits (UCP 600). This standardization ensures global consistency and understanding.

- Facilitates New Relationships: Enables businesses to trade with new partners in unfamiliar markets with greater confidence.

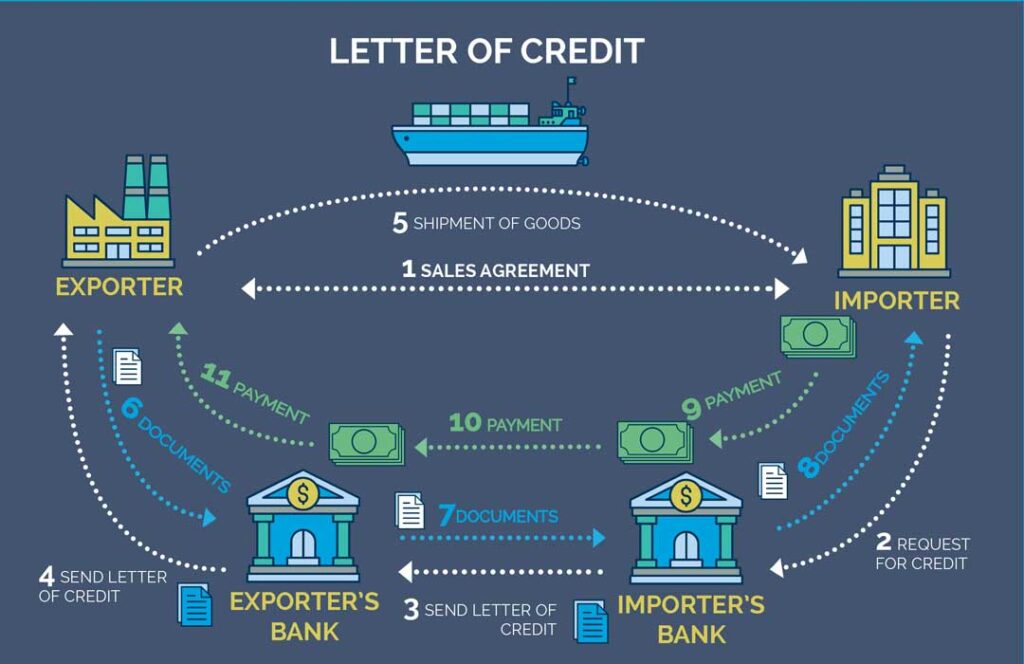

How Does a Letter of Credit Work? A Step-by-Step Walkthrough

Understanding the LC process is crucial. Let’s break down a typical transaction into simple steps:

-

Sales Contract & Agreement (Importer & Exporter):

- The importer (buyer) and exporter (seller) agree on the terms of a sale, including price, quantity, delivery schedule, and crucially, that payment will be made via an LC. They also agree on the specific documents required.

-

Importer Applies for LC (Importer & Issuing Bank):

- The importer applies to their bank (the Issuing Bank) to open an LC in favor of the exporter.

- The importer provides detailed instructions about the transaction, including the amount, beneficiary (exporter’s name), expiry date, goods description, shipping terms (Incoterms), and all required documents.

- The Issuing Bank assesses the importer’s creditworthiness and may require collateral or pre-payment.

-

LC Issuance (Issuing Bank):

- If approved, the Issuing Bank formally issues the LC. This is the bank’s commitment to pay.

-

LC Transmission & Advising (Issuing Bank & Advising Bank):

- The Issuing Bank sends the LC to a bank in the exporter’s country, typically the exporter’s own bank, which acts as the Advising Bank.

- The Advising Bank verifies the authenticity of the LC and then notifies the exporter that an LC has been opened in their favor.

-

Exporter Reviews LC (Exporter):

- This is a critical step! The exporter must carefully review every detail of the LC against the sales contract. Are all terms correct? Can all documents be obtained exactly as specified?

- If there are discrepancies, the exporter must request amendments through the importer.

-

Goods Shipment (Exporter):

- Once the exporter is satisfied with the LC’s terms, they proceed to manufacture/prepare and ship the goods as per the LC and sales contract.

-

Document Presentation (Exporter & Advising/Negotiating Bank):

- After shipment, the exporter gathers all the required documents (e.g., commercial invoice, bill of lading, packing list, certificate of origin, insurance certificate).

- They then present these documents to the Advising Bank (or a Negotiating Bank, if different) within the time frame specified in the LC.

-

Document Verification (Advising/Negotiating Bank & Issuing Bank):

- The Advising/Negotiating Bank examines the documents for strict compliance with the LC terms.

- If compliant, they forward the documents to the Issuing Bank.

-

Payment or Acceptance (Issuing Bank):

- The Issuing Bank also examines the documents for strict compliance.

- If all documents are compliant, the Issuing Bank pays the exporter (or accepts a draft for future payment in the case of a usance LC).

- Crucially, banks deal in documents, not goods. They don’t inspect the goods themselves. Their sole responsibility is to check the documents against the LC terms.

-

Importer Receives Documents & Goods (Importer):

- The Issuing Bank releases the shipping documents to the importer.

- With these documents, the importer can take possession of the goods from the carrier at the destination port.

- The importer then reimburses the Issuing Bank if they haven’t already done so.

Key Parties Involved in an LC Transaction

Understanding the roles of each player is essential:

- Applicant (Buyer/Importer): The party who requests their bank to issue the LC. They are responsible for providing the necessary funds or credit.

- Beneficiary (Seller/Exporter): The party in whose favor the LC is issued and who receives payment upon presenting compliant documents.

- Issuing Bank (Buyer’s Bank): The bank that issues the LC on behalf of the applicant. It makes the commitment to pay the beneficiary.

- Advising Bank (Beneficiary’s Bank): The bank in the beneficiary’s country that authenticates the LC and advises it to the beneficiary. It typically does not undertake any payment obligation unless it is also a Confirming or Negotiating Bank.

- Confirming Bank (Optional): An additional bank, usually in the beneficiary’s country, that adds its own guarantee to the LC. This provides an extra layer of security for the beneficiary, protecting them even if the Issuing Bank or its country faces financial or political instability.

- Negotiating Bank (Optional): A bank authorized by the Issuing Bank to pay or purchase (negotiate) the beneficiary’s drafts (bills of exchange) and/or documents.

Types of Letters of Credit: Choosing the Right Fit

LCs come in various forms, each suited to different trade scenarios:

-

Revocable vs. Irrevocable LC:

- Revocable LC: Can be amended or canceled by the Issuing Bank without the beneficiary’s consent. Rarely used in international trade due to lack of security for the seller.

- Irrevocable LC: Cannot be amended or canceled without the consent of all parties (applicant, beneficiary, and issuing bank). This is the standard and most common type used in international trade.

-

Confirmed vs. Unconfirmed LC:

- Unconfirmed LC: The payment obligation rests solely with the Issuing Bank. The Advising Bank only authenticates and passes on the LC.

- Confirmed LC: A Confirming Bank (usually the Advising Bank) adds its own guarantee to the LC, meaning it also promises to pay the beneficiary if the documents are compliant, even if the Issuing Bank defaults. This offers the highest level of security for the exporter, especially when dealing with buyers in countries with higher political or economic risk.

-

Sight LC vs. Usance (Deferred Payment) LC:

- Sight LC: Payment is made "at sight," meaning immediately upon presentation of compliant documents.

- Usance LC (or Term LC): Payment is made at a future date (e.g., 30, 60, 90 days after sight or bill of lading date). This allows the importer time to sell the goods before payment is due. While the exporter waits for payment, the bank’s undertaking remains.

-

Transferable LC:

- Allows the original beneficiary (often a middleman) to transfer all or part of the LC to one or more "second beneficiaries" (the actual suppliers of the goods). This is useful in back-to-back transactions where the middleman doesn’t produce the goods themselves.

-

Standby Letter of Credit (SBLC):

- Unlike a commercial LC which is a primary payment mechanism, an SBLC acts as a "fallback" or guarantee. It’s only drawn upon if the applicant fails to fulfill a contractual obligation (e.g., fails to pay for goods, defaults on a loan). It’s more akin to a bank guarantee than a traditional trade finance instrument.

Essential Documents Required for an LC

The "documents are king" principle is paramount in LC transactions. Banks deal strictly with documents, not the physical goods. Any discrepancy, no matter how minor, can lead to payment delays or refusal. Common documents include:

- Commercial Invoice: Details of the goods, price, quantity, and parties involved. Must exactly match the LC description.

- Bill of Lading (B/L) / Air Waybill (AWB) / Other Transport Document: Proof that the goods have been shipped by a carrier. A B/L is for sea freight, AWB for air freight. It shows who the goods are consigned to and the terms of shipment.

- Packing List: Details the contents of each package, including weight and dimensions.

- Certificate of Origin: Certifies the country where the goods were manufactured or produced. Important for customs duties and trade agreements.

- Insurance Certificate/Policy: If the LC requires the seller to arrange insurance (e.g., CIF Incoterm), this proves the goods are insured against loss or damage during transit.

- Inspection Certificate: Issued by a third-party inspection agency, verifying the quality, quantity, or other specifications of the goods before shipment.

- Beneficiary’s Certificate: A declaration by the exporter confirming specific actions have been taken (e.g., "we certify that one set of non-negotiable documents has been sent directly to the applicant").

- Draft (Bill of Exchange): A formal order from the exporter to the Issuing Bank (or nominated bank) to pay a specific sum of money, either at sight or at a future date.

Risks and Challenges with LCs: What to Watch Out For

While LCs offer significant security, they are not without their potential pitfalls:

- Document Discrepancies: This is by far the most common issue. Even a typo, a missing initial, or a slight mismatch between documents and LC terms can lead to a bank refusing to pay. Exporters must be meticulous.

- Complexity and Cost: LCs involve multiple parties and require detailed documentation, making them more complex and expensive than simpler payment methods like wire transfers. Fees are charged by various banks involved.

- Bank Insolvency (Rare): Although rare, if the Issuing Bank becomes insolvent, the beneficiary may face payment issues unless the LC was confirmed by another strong bank.

- Fraud: While LCs reduce fraud related to non-payment, there’s still a risk of fraudulent documents being presented, or the goods themselves not matching the description, though banks are not responsible for inspecting goods.

- Delays: The process of opening, advising, amending, and presenting documents can lead to delays, especially if discrepancies arise.

- UCP 600 Interpretation: While standardized, nuances in interpreting the UCP 600 rules can sometimes lead to disputes.

Practical Tips for Using LCs Effectively

To maximize the benefits and minimize the risks of using LCs, keep these practical tips in mind:

For Exporters (Beneficiaries):

- Review the LC Immediately and Thoroughly: As soon as you receive the LC, compare every detail against your sales contract. If anything is incorrect, impossible to fulfill, or unclear, request an amendment before shipping.

- "Can Do" Mentality: Ensure you can literally produce every document exactly as required. If the LC asks for a "Certificate of Analysis" from a specific lab, ensure you can get it.

- Meticulous Document Preparation: This cannot be stressed enough. Ensure all documents are consistent with each other and perfectly match the LC terms. Even minor spelling errors or inconsistencies can lead to discrepancies.

- Meet Deadlines: Be aware of the last date for shipment and the last date for presenting documents.

- Consider a Confirmed LC: If dealing with an Issuing Bank in a politically or economically unstable country, or an unknown bank, request a confirmed LC for added security.

For Importers (Applicants):

- Be Precise in Your Application: Provide clear, unambiguous instructions to your Issuing Bank when applying for the LC. The more precise you are, the less room for misunderstanding.

- Don’t Over-Specify: While precision is good, don’t include overly restrictive or impossible conditions that the exporter won’t be able to meet. This will only lead to delays and amendment fees.

- Choose a Reputable Bank: Work with a bank experienced in trade finance that can offer expert advice.

- Understand the Costs: Be aware of all bank charges associated with opening, advising, and possibly confirming the LC.

- Manage Your Credit Line: Ensure you have sufficient credit or funds available with your bank to cover the LC amount.

General Tips for Both Parties:

- Clear Communication: Maintain open and clear communication with your trading partner and your bank throughout the process.

- Professional Advice: If you’re new to LCs or dealing with a complex transaction, consider seeking advice from a trade finance specialist or legal counsel.

- Understand UCP 600: While you don’t need to be an expert, a basic understanding of the UCP 600 rules can be highly beneficial.

Conclusion: LCs as Your Gateway to Secure Global Trade

Letters of Credit, while seemingly intricate, are an indispensable tool for mitigating risk and fostering trust in international trade. They transform potentially risky cross-border transactions into secure, bank-backed agreements, ensuring that both buyers and sellers can proceed with confidence.

By understanding the mechanics, benefits, risks, and best practices associated with LCs, you can leverage this powerful instrument to expand your global reach, protect your financial interests, and build lasting relationships with international partners. Embrace the LC, and unlock a world of secure trade opportunities for your business.

Post Comment