How to Create a Startup Budget: A Step-by-Step Guide for Aspiring Entrepreneurs

Starting a business is an exhilarating journey filled with innovation, passion, and big dreams. But amidst the excitement of developing your product or service, it’s easy to overlook one of the most critical elements for long-term success: a robust startup budget.

Think of your startup budget not as a restrictive cage, but as a detailed financial roadmap. It’s the essential blueprint that guides your spending, helps you understand your financial needs, identifies potential pitfalls, and ultimately, determines your business’s viability and ability to attract funding.

Many aspiring entrepreneurs dive in without a clear financial picture, leading to unexpected cash flow crises, missed opportunities, and even early collapse. This comprehensive, step-by-step guide will demystify the process, helping you build a clear, realistic, and actionable startup budget, even if you’re a complete beginner to financial planning.

Why a Startup Budget Isn’t Just a Good Idea – It’s Essential

Before we dive into the "how," let’s understand the "why." A well-crafted startup budget is your business’s financial backbone because it helps you:

- Understand Your True Costs: It forces you to think about all potential expenses, from the obvious to the easily forgotten.

- Prevent Cash Flow Crises: By projecting income and outgo, you can anticipate lean periods and plan accordingly, avoiding the dreaded "running out of money."

- Make Informed Decisions: Knowing your financial limits and projections empowers you to make strategic choices about hiring, marketing, product development, and more.

- Attract Investors: No serious investor will consider funding your startup without a detailed, well-researched financial plan and budget. It demonstrates your professionalism and understanding of the business.

- Set Realistic Goals: It helps you determine your break-even point and set achievable revenue targets.

- Monitor Performance: A budget provides a benchmark against which you can measure your actual spending and revenue, allowing for timely adjustments.

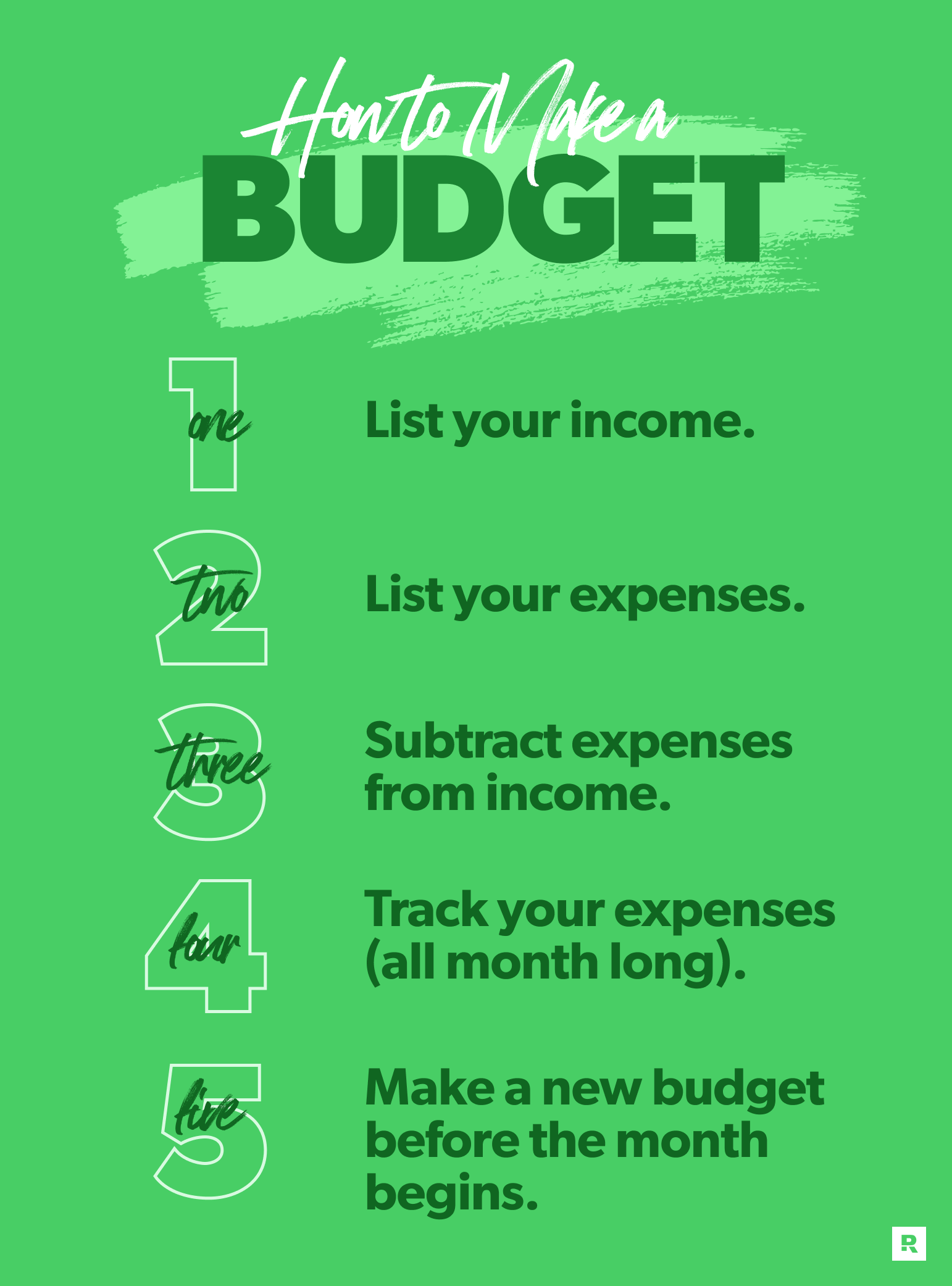

Your Step-by-Step Guide to Creating a Startup Budget

Ready to take control of your startup’s financial future? Let’s break down the process into manageable steps.

Step 1: Identify ALL Your Potential Startup Costs

This is the foundational step. You need to brainstorm and list every single expense your business might incur, from the moment you conceive the idea to your first few months of operation. It’s helpful to categorize these costs into two main types:

A. One-Time (Startup) Costs:

These are expenses you’ll likely incur only once, primarily during the initial setup phase of your business.

- Legal & Administrative Fees:

- Business registration (LLC, Corporation, etc.)

- Business licenses and permits

- Trademark and patent applications

- Legal counsel for contracts, terms of service, etc.

- Initial accounting setup fees

- Branding & Marketing Setup:

- Logo design and brand identity development

- Website design and development (initial build)

- Professional photography/videography for launch

- Initial marketing material design (brochures, business cards)

- Equipment & Technology:

- Computers, laptops, printers

- Specialized machinery or tools (e.g., for manufacturing, food service)

- Office furniture and fixtures

- Initial software licenses (e.g., CRM, accounting software setup)

- Initial inventory purchase (if applicable)

- Property & Facilities (if applicable):

- Security deposit for office/retail space

- Initial build-out or renovation costs

- Utility connection fees

- Initial Inventory/Supplies:

- First batch of products to sell

- Raw materials for production

- Packaging supplies

B. Recurring (Operational) Costs:

These are ongoing expenses you’ll pay regularly – monthly, quarterly, or annually – to keep your business running.

- Rent & Utilities:

- Office or retail space rent

- Electricity, water, gas, internet

- Trash removal

- Salaries & Wages:

- Your own salary (if you’re paying yourself)

- Employee salaries, wages, and benefits (health insurance, retirement contributions)

- Payroll taxes

- Contractor fees

- Marketing & Advertising:

- Ongoing digital ad spend (Google Ads, social media ads)

- Content creation (blog posts, videos)

- Email marketing software subscriptions

- Public relations retainers

- Software & Subscriptions:

- CRM software (e.g., Salesforce, HubSpot)

- Accounting software (e.g., QuickBooks, Xero)

- Project management tools (e.g., Asana, Trello)

- Cloud storage, domain hosting, website maintenance

- Insurance:

- General liability insurance

- Professional liability insurance

- Property insurance

- Workers’ compensation

- Supplies & Inventory:

- Ongoing office supplies

- Regular replenishment of inventory or raw materials

- Shipping and fulfillment costs

- Professional Services:

- Ongoing accountant/bookkeeper fees

- Legal retainers (if needed)

- IT support

- Travel & Entertainment:

- Business travel expenses

- Client entertainment

- Loan Payments:

- If you’ve taken out business loans, include the principal and interest payments.

- Maintenance & Repairs:

- Regular upkeep of equipment or facilities.

Pro Tip: Don’t forget the small stuff! A coffee maker, cleaning supplies, or even parking fees can add up. It’s better to overestimate slightly than to underestimate significantly.

Step 2: Estimate Each Cost Accurately

Once you have your comprehensive list, the next step is to put numbers next to each item. This requires research and a dose of realism.

- Research, Research, Research:

- Get Quotes: For services like legal, accounting, web development, and insurance, get at least three quotes from different providers.

- Contact Suppliers: For equipment and initial inventory, reach out to suppliers for pricing.

- Industry Benchmarks: Look up average costs for similar businesses in your industry. Online resources, industry reports, and even competitors’ websites can provide clues.

- Local Market Research: Prices for rent, utilities, and labor vary significantly by location.

- Factor in Inflation: If you’re projecting several years out, consider a small percentage increase for recurring costs.

- Add a Buffer (The "Oops" Fund for Estimates): It’s almost guaranteed that some costs will be higher than you expect. Add a 10-15% buffer to each estimated cost to account for unforeseen expenses or initial miscalculations.

Step 3: Project Your Revenue Realistically

While focusing on costs is crucial, a budget isn’t complete without considering how money will come in. This is often the most challenging part for new businesses, but it’s vital for calculating your financial runway.

- Market Research is Key:

- Target Market Size: How many potential customers are there?

- Pricing Strategy: What will you charge for your products/services? How does this compare to competitors?

- Sales Volume: How many units do you realistically expect to sell, or how many clients do you expect to acquire in your first month, quarter, and year? Start small and be conservative.

- Consider Different Revenue Streams: Do you have multiple ways of making money (e.g., product sales, subscription fees, consulting, advertising)?

- Phased Projections: Don’t assume you’ll hit full capacity on day one. Project revenue month-by-month for at least the first 12 months, showing a gradual ramp-up.

- Be Conservative: It’s far better to underestimate revenue and be pleasantly surprised than to overestimate and face cash flow problems. Investors will also appreciate realistic projections over overly optimistic ones.

Step 4: Calculate Your Financial Runway (and Burn Rate)

Now that you have your estimated costs and projected revenue, you can calculate some critical financial metrics:

- Total Startup Costs: Sum up all your one-time expenses. This is the initial capital you’ll need just to get off the ground.

- Monthly Operating Costs (Burn Rate): Sum up all your recurring monthly expenses. This is how much money your business "burns" through each month to operate.

- Net Cash Flow: Subtract your monthly operating costs from your projected monthly revenue.

- Positive Net Cash Flow: You’re making a profit!

- Negative Net Cash Flow: You’re spending more than you’re earning. This is common for startups in their early stages.

- Financial Runway: If you have negative net cash flow, your financial runway is the number of months you can operate before running out of cash, given your current burn rate and available capital.

- Formula:

Total Available Capital / Monthly Net Cash Burn - Example: If you have $50,000 in savings/funding and your business is losing $5,000 per month, your runway is 10 months.

- Formula:

Why this matters: Knowing your runway helps you understand how long you have to become profitable or secure additional funding. Aim for at least 12-18 months of runway, especially if you’re seeking external investment.

Step 5: Create a Contingency Fund (The "Oops" Fund)

This step is so important it deserves its own mention. No matter how meticulously you plan, unexpected expenses will arise. Equipment breaks, marketing campaigns flop, a key employee leaves, or market conditions shift.

- Allocate 15-25% of your total estimated startup costs as a contingency fund. This money should be set aside specifically for emergencies and not touched for regular operations.

- Think of it as your business’s emergency savings account. It provides a buffer against the unforeseen and can save your business from minor hiccups becoming major crises.

Step 6: Choose Your Budgeting Method

How will you track and manage your budget?

- Spreadsheets (Excel, Google Sheets):

- Pros: Free, highly customizable, great for detailed breakdowns.

- Cons: Can be time-consuming to set up and maintain manually, prone to human error.

- Accounting Software (QuickBooks, Xero, FreshBooks):

- Pros: Automates expense tracking, integrates with bank accounts, generates financial reports, scales with your business.

- Cons: Subscription costs, steeper learning curve initially.

- Budgeting Apps/Templates: Many free and paid templates exist specifically for startup budgets, offering a good starting point.

For beginners, a simple spreadsheet is a great place to start. As your business grows, migrating to dedicated accounting software will become essential.

Step 7: Monitor, Review, and Adjust Regularly

Your startup budget isn’t a static document you create once and then forget. It’s a living tool that needs constant attention.

- Monthly Review: At the end of each month, compare your actual income and expenses against your budgeted figures.

- Where did you overspend?

- Where did you underspend?

- Was revenue higher or lower than expected?

- Understand Variances: Don’t just note the differences; understand why they occurred. Was it a one-time issue, or does it indicate a trend?

- Adjust as Needed: Based on your review, update your budget for the coming months. Your initial projections will almost certainly be off; that’s normal. The key is to learn and adapt.

- Re-forecast Quarterly/Annually: As your business evolves, your budget needs to evolve with it. Major changes (new product launch, significant hiring, market shifts) warrant a complete re-forecast.

Common Startup Budgeting Pitfalls to Avoid

Even with a step-by-step guide, it’s easy to stumble. Be aware of these common mistakes:

- Underestimating Costs: This is the most frequent error. People often forget legal fees, software subscriptions, marketing costs, or simply underestimate how much things really cost.

- Overestimating Revenue: The "build it and they will come" mentality rarely translates to instant sales. Be realistic, even pessimistic, about early revenue.

- Ignoring Cash Flow: A profitable business can still go bankrupt if it runs out of cash. Understand the difference between profit (revenue minus expenses) and cash flow (actual money moving in and out).

- No Contingency Fund: Skipping the "Oops" fund is a recipe for disaster when the inevitable unexpected expense pops up.

- Set-It-and-Forget-It Mentality: A budget is a tool for continuous management, not a one-time task.

- Not Paying Yourself: Many founders sacrifice their own salary initially, but not factoring it in can lead to personal financial strain and burnout. Even a small, realistic founder’s salary should be budgeted for.

- Mixing Personal and Business Finances: This makes tracking incredibly difficult and can have serious legal and tax implications. Set up separate bank accounts from day one.

Tools and Resources to Help You

- Spreadsheet Software: Google Sheets (free), Microsoft Excel

- Accounting Software: QuickBooks, Xero, FreshBooks, Wave Accounting (free for basic features)

- Budget Templates: Search online for "startup budget template Excel" or "startup budget template Google Sheets." Many reputable sources (like SCORE, SBA, or financial blogs) offer free templates.

- Business Calculators: Online calculators can help estimate startup costs for specific industries.

- Mentors & Advisors: Seek advice from experienced entrepreneurs or small business advisors who can review your budget and offer insights.

Conclusion: Your Budget – Your Blueprint for Success

Creating a startup budget might seem daunting at first, but by breaking it down into manageable steps, you gain invaluable clarity and control over your business’s financial destiny. It’s more than just a list of numbers; it’s your strategic blueprint, your early warning system, and your key to attracting the resources you need to thrive.

Embrace the process, be thorough, be realistic, and most importantly, remember that your budget is a living document. Regularly monitoring and adjusting it will not only save you from financial headaches but also empower you to make smarter, more confident decisions as you navigate the exciting world of entrepreneurship.

Don’t delay. Start building your startup budget today, and lay the strongest possible foundation for your future success!

Post Comment