Navigating the New Landscape: The Impact of Brexit on UK Trade Regulations Explained

Brexit – the United Kingdom’s departure from the European Union – has been one of the most significant political and economic events of our time. While the headlines often focus on broad economic impacts, one of the most fundamental shifts has occurred behind the scenes, in the complex world of UK trade regulations.

For businesses, consumers, and anyone involved in buying or selling goods and services across borders, understanding these changes isn’t just academic; it’s essential. This comprehensive guide will break down the intricate impact of Brexit on UK trade regulations in simple terms, making it accessible even for beginners.

What Exactly Are Trade Regulations and Why Do They Matter?

Before diving into Brexit, let’s clarify what we mean by "trade regulations." Think of them as the rulebook for international commerce. They dictate how goods and services move between countries.

These rules cover a wide range of areas, including:

- Tariffs (Customs Duties): Taxes on imported goods. If a product costs £100 and there’s a 10% tariff, it will cost £110 to import.

- Quotas: Limits on the quantity of specific goods that can be imported or exported.

- Customs Procedures: The paperwork, checks, and processes required for goods to cross borders. This includes declarations, permits, and inspections.

- Product Standards: Rules about how products must be made, their safety, quality, environmental impact, and labelling (e.g., toy safety standards, food hygiene rules).

- Rules of Origin: Criteria used to determine the "national source" of a product. This is crucial for applying tariffs and trade agreements.

- Services Regulations: Rules governing professional qualifications, data transfer, and market access for services like finance, law, or consulting.

Why do they matter? These regulations directly impact:

- Costs: Tariffs and compliance costs can make products more expensive.

- Efficiency: Complex customs procedures can cause delays and supply chain disruptions.

- Market Access: Regulations can open or close doors for businesses to sell into new countries.

- Consumer Choice & Safety: Standards ensure products are safe and meet certain quality levels.

Before Brexit: The UK as an EU Member State

For 47 years, the UK was a member of the European Union (and its predecessor, the European Economic Community). This membership profoundly shaped its trade regulations.

As an EU member, the UK was part of:

- The EU Single Market: This meant the free movement of goods, services, capital, and people between member states. There were effectively no tariffs or customs checks on trade within the EU. Goods produced in one EU country could be sold in another without significant regulatory hurdles, as standards were largely harmonised.

- The EU Customs Union: This meant that all EU member states applied the same external tariffs to goods coming in from outside the EU. Once goods entered any EU country, they could move freely within the Union. The EU negotiated trade deals as a bloc, giving it significant negotiating power.

In simple terms: For trade with other EU countries, it was largely like trading within different regions of the same country – fast, seamless, and largely free of tariffs and border checks. For trade with non-EU countries, the UK followed the EU’s common trade policy.

The Big Shift: Leaving the Single Market and Customs Union

The most fundamental impact of Brexit on UK trade regulations stemmed from the decision to leave both the EU Single Market and the EU Customs Union. This was a deliberate choice by the UK government to "take back control" of its laws, borders, and trade policy.

What this meant immediately:

- No longer part of the EU’s common external tariff: The UK could now set its own tariffs on imports from countries outside the EU.

- No longer enjoying frictionless trade with the EU: Goods moving between the UK and the EU (and vice-versa) became international trade, subject to new rules, checks, and procedures.

This shift marked the end of the seamless trade environment the UK had enjoyed with its closest and largest trading partner – the EU.

The New Era: The UK-EU Trade and Cooperation Agreement (TCA)

On 30 December 2020, the UK and the EU reached the Trade and Cooperation Agreement (TCA), which came into effect on 1 January 2021. This agreement sets the framework for their future relationship, particularly concerning trade.

Key features of the TCA regarding trade regulations:

- Zero Tariffs, Zero Quotas (Mostly): For goods that originate in the UK or the EU, the TCA ensures that there are no tariffs or quotas applied when they cross the border. This was a significant achievement, preventing a sudden price surge for many goods.

- New Customs Checks and Paperwork: Even without tariffs, goods must now undergo full customs procedures. This means:

- Customs Declarations: Businesses must complete detailed paperwork for every consignment.

- Safety and Security Declarations: Additional forms are required for security purposes.

- Border Checks: Goods are subject to checks at the border, particularly for animal products (SPS checks) and plant products.

- Rules of Origin (RoO) Are Crucial: To benefit from the zero-tariff regime, goods must prove they "originate" in the UK or the EU. This can be complex for products made with components from multiple countries. If a product doesn’t meet the RoO, tariffs can apply.

- Regulatory Divergence: The TCA allows both the UK and the EU to set their own regulations and standards. While it aims for some level of cooperation, it doesn’t prevent divergence over time. This means:

- UK and EU standards could gradually differ.

- Businesses might need to meet both UK and EU standards if they sell into both markets.

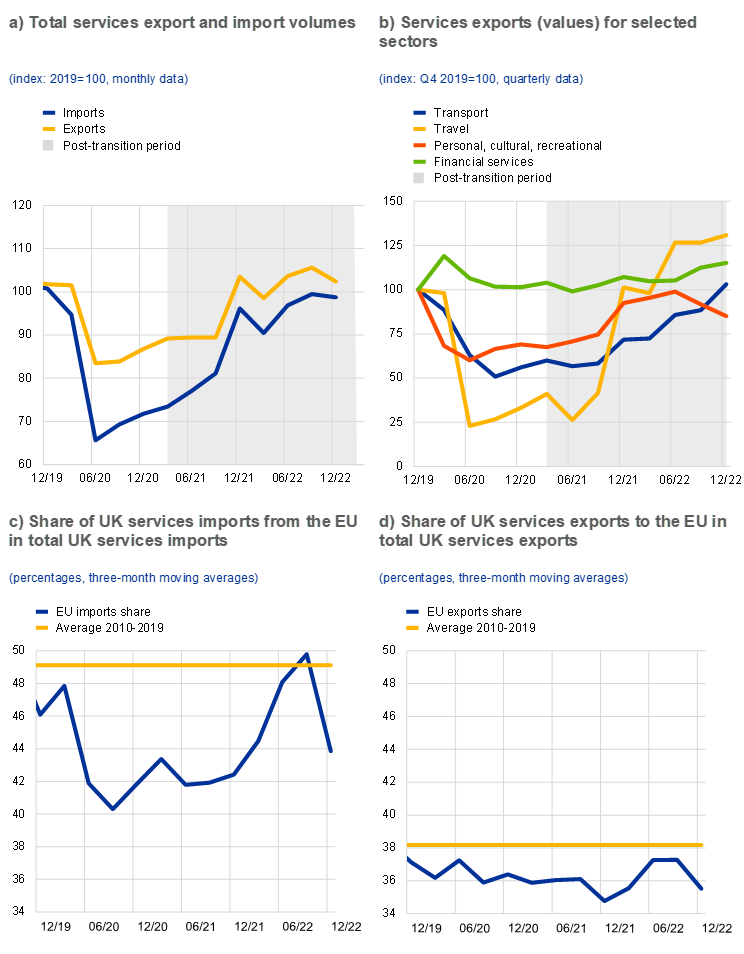

- Limited Scope for Services: The TCA provides much less comprehensive access for services than for goods. It doesn’t restore the "passporting" rights that allowed UK financial firms to operate freely across the EU, for example. Service providers face new barriers like visa requirements, recognition of professional qualifications, and local licensing rules.

In essence: The TCA prevents the worst-case scenario of a "no-deal" outcome with immediate tariffs, but it introduces significant new administrative burdens, costs, and complexities for businesses trading between the UK and the EU.

Beyond the EU: The UK’s Independent Trade Policy

With Brexit, the UK gained the ability to negotiate its own trade deals independently for the first time in decades. This has been a key stated benefit of leaving the EU.

Developments in independent trade policy:

- "Rollover" Deals: Initially, the UK "rolled over" many existing EU trade agreements with countries like Japan, Canada, and South Korea. This ensured continuity for businesses.

- New Free Trade Agreements (FTAs): The UK has signed new FTAs with countries such as:

- Australia: A comprehensive agreement reducing tariffs on many goods.

- New Zealand: Similar to the Australia deal, aiming for closer trade ties.

- CPTPP (Comprehensive and Progressive Agreement for Trans-Pacific Partnership): The UK has joined this major trade bloc, which includes countries like Japan, Canada, Australia, and Mexico. This is a significant step towards diversifying trade away from Europe.

- Ongoing Negotiations: The UK is pursuing new trade deals with other major economies, including India, the Gulf Cooperation Council, and the USA (though progress has been slow on the latter).

Impact on Regulations: These new FTAs come with their own sets of rules and regulations. While they generally aim to reduce tariffs and non-tariff barriers, businesses trading with these new partners still need to understand the specific rules of each agreement, including:

- Specific product standards required.

- Customs procedures for that country.

- Rules of origin relevant to that agreement.

Specific Regulatory Changes: A Deeper Dive

Let’s look at some of the key areas where trade regulations have changed most significantly.

1. Customs Checks and Paperwork

This is arguably the most immediate and widespread change.

- Pre-Brexit (UK-EU trade): Virtually no customs checks or declarations.

- Post-Brexit (UK-EU trade):

- Full Customs Declarations: Required for all goods moving between Great Britain (England, Scotland, Wales) and the EU, and between Great Britain and Northern Ireland (due to the NI Protocol).

- Increased Documentation: Businesses need to provide commercial invoices, packing lists, transport documents, and potentially specific licenses or certificates (e.g., health certificates for food products).

- New IT Systems: Businesses often need to use new government IT platforms (like HMRC’s Customs Declaration Service) or rely on customs brokers.

- Physical Checks: Certain goods, especially food, animals, and plants, are subject to physical inspections at Border Control Posts (BCPs) in both the UK and EU.

Impact: Increased administrative burden, delays at borders, higher shipping costs (due to compliance and potential storage fees), and a need for new expertise within businesses.

2. Product Standards and Certification

This is a complex area with potential for divergence.

- Pre-Brexit: The UK generally adopted EU standards (e.g., CE marking for product safety).

- Post-Brexit:

- UKCA Marking: The UK has introduced its own conformity marking, the UKCA (UK Conformity Assessed) mark, which replaces the EU’s CE mark for many products sold in Great Britain. Businesses selling into the UK market must eventually use the UKCA mark.

- Dual Marking: For products sold in both the UK and EU, businesses may need to meet both UKCA and CE marking requirements, potentially leading to increased testing and certification costs.

- Divergence Potential: Over time, the UK government may choose to adopt different standards from the EU in specific sectors, which could create new barriers for businesses. For example, if the EU updates a chemical safety standard, the UK might choose not to adopt it, creating two different sets of rules.

Impact: Businesses need to understand and comply with two sets of standards, potentially increasing product development, testing, and compliance costs.

3. Rules of Origin (RoO)

Often overlooked but critically important for avoiding tariffs.

- Pre-Brexit: Goods moving within the EU Customs Union were considered "originating" and faced no tariffs.

- Post-Brexit (UK-EU trade under TCA):

- Strict RoO: To qualify for zero tariffs under the TCA, goods must prove they "originate" in either the UK or the EU. This means they must be wholly obtained or undergo sufficient processing in one of these territories.

- "Cumulation" Rules: The TCA allows for "cumulation," meaning materials from the EU can be counted as "originating" in the UK (and vice-versa) when determining a product’s origin. However, this is still more complex than pre-Brexit.

- Proof of Origin: Businesses must provide documentation (like supplier declarations or statements on origin) to prove their goods meet the RoO criteria.

Impact: Businesses need to carefully track their supply chains and manufacturing processes to determine the origin of their goods. Failure to meet RoO can result in tariffs being applied, making goods more expensive and less competitive.

4. Services Trade

This area has been hit particularly hard.

- Pre-Brexit: UK service providers (e.g., lawyers, accountants, architects, financial services) could often operate freely across the EU with minimal additional regulation, thanks to "passporting" rights and mutual recognition of qualifications.

- Post-Brexit:

- Loss of Passporting: UK financial services firms lost their automatic right to operate in the EU. They now need to seek separate licences or establish subsidiaries within EU member states.

- Professional Qualifications: UK professional qualifications are no longer automatically recognised in the EU (and vice-versa). Professionals may need to re-qualify or seek local recognition.

- Visa and Immigration Rules: UK citizens travelling to the EU for work, even for short-term projects, may now require visas or face restrictions on the length and type of work they can undertake.

- Data Flows: While the EU has granted the UK "data adequacy" (allowing data to flow freely for now), this status can be reviewed, adding uncertainty for businesses reliant on cross-border data transfer.

Impact: Significant barriers for UK service businesses looking to operate in the EU, leading to increased costs, reduced market access, and a potential "brain drain" as professionals relocate.

5. The Northern Ireland Protocol (NIP)

This is a unique and particularly complex regulatory arrangement.

- The Challenge: How to avoid a hard border on the island of Ireland (a key part of the Good Friday Agreement) while also allowing Great Britain to leave the EU Single Market and Customs Union.

- The Solution (NIP): Northern Ireland remains part of the UK’s customs territory but also continues to apply EU customs rules and single market rules for goods.

- Regulatory Impact:

- "Sea Border": Goods moving from Great Britain to Northern Ireland are subject to EU customs checks and regulatory alignment checks. This creates an effective "border in the Irish Sea."

- Dual Regulatory Regime: Northern Ireland is subject to both UK and EU regulations for goods. This means businesses in Northern Ireland have continued access to the EU Single Market for goods, but also face new checks on goods coming from Great Britain.

- Specific Rules: Complex rules apply, including the UK Internal Market Act (which aims to ensure goods from GB can still be sold in NI) and various waivers and grace periods.

Impact: Creates significant complexity and cost for businesses moving goods between Great Britain and Northern Ireland, and vice-versa. It has also been a source of ongoing political tension.

Challenges and Opportunities for UK Businesses

The changes in trade regulations post-Brexit have presented both significant challenges and, for some, new opportunities.

Key Challenges:

- Increased Costs: Higher administrative costs (customs declarations, compliance), increased shipping costs, potential tariffs if RoO are not met.

- Supply Chain Disruption: Delays at borders, increased lead times, and the need to re-route or re-think supply chains.

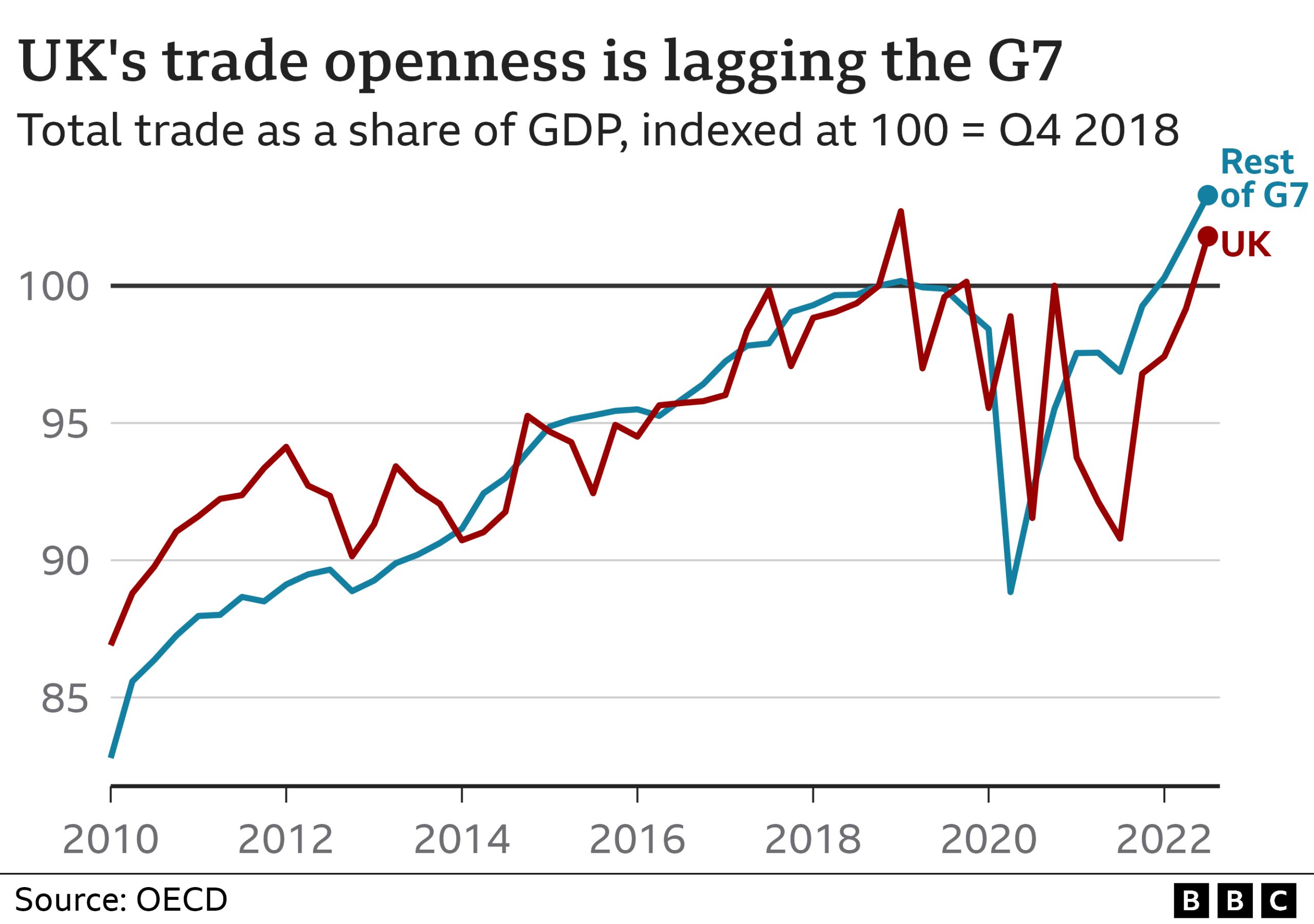

- Reduced Competitiveness: Higher costs can make UK exports less competitive in the EU market and EU imports more expensive in the UK.

- Bureaucracy and Complexity: The sheer volume of new rules, forms, and procedures requires significant time, effort, and often new staff or external advisors.

- Skills Shortages: A demand for new skills in customs compliance, international trade law, and logistics.

- Lost Market Access (Services): Significant barriers for service providers into the EU.

Potential Opportunities:

- Regulatory Freedom: The UK can now tailor its regulations to suit its own priorities, potentially creating a more agile or business-friendly environment in specific sectors (though this also carries the risk of divergence).

- New Trade Deals: The ability to strike independent FTAs can open up new markets for UK goods and services beyond the EU.

- Diversification: Encourages businesses to look beyond the EU for new suppliers and customers, potentially reducing reliance on a single market.

- Innovation: The need to adapt might spur innovation in logistics, technology, and business models.

- "First Mover" Advantage: Businesses that successfully navigate the new landscape and adapt quickly may gain an advantage over slower competitors.

The Ongoing Evolution of UK Trade Regulations

The impact of Brexit on UK trade regulations is not a static event; it’s an ongoing process.

- Further Divergence: Over time, the UK’s regulatory landscape may diverge further from the EU’s, creating new challenges and opportunities.

- New Trade Deals: More FTAs will be negotiated, each bringing its own specific rules and market access conditions.

- Protocol Adjustments: Discussions and potential adjustments to the Northern Ireland Protocol are likely to continue.

- Business Adaptation: UK businesses will continue to adapt, innovate, and find new ways to operate within the new framework.

Conclusion: A New Chapter for UK Trade

Brexit has undeniably ushered in a new era for UK trade regulations. The days of seamless, frictionless trade with the European Union are over, replaced by a more complex, albeit independent, system.

For businesses, this means a permanent shift in how they approach international trade. Understanding the nuances of new customs procedures, product standards, rules of origin, and the specific challenges of services trade and the Northern Ireland Protocol is no longer optional – it’s fundamental to success.

While the journey has been challenging for many, the UK is now forging its own path in global trade, navigating new agreements and regulatory freedoms. The ultimate impact will depend on how effectively businesses adapt, how strategically the government uses its newfound regulatory powers, and how the global trade landscape continues to evolve. Staying informed and agile will be key for anyone involved in UK trade in this dynamic new environment.

Frequently Asked Questions (FAQs) about Brexit and UK Trade Regulations

Q1: Do I have to pay tariffs on all goods imported from the EU to the UK (or vice-versa) now?

A1: No, not on all goods. The UK-EU Trade and Cooperation Agreement (TCA) means that most goods originating in the UK or the EU can be traded with zero tariffs and zero quotas. However, to benefit from this, you must prove the goods meet the "Rules of Origin" set out in the agreement. If they don’t, or if they are from a third country simply passing through the EU, tariffs can apply.

Q2: What are "non-tariff barriers"?

A2: Non-tariff barriers are obstacles to trade that aren’t direct taxes (tariffs). After Brexit, these include:

- Customs checks and declarations: The extra paperwork and processes at the border.

- Regulatory differences: Having to meet different product standards (e.g., UKCA instead of CE).

- Border inspections: Physical checks on certain goods, especially food and agricultural products.

- Rules of Origin complexity: The need to prove where a product genuinely comes from.

- Visa requirements: For service providers travelling to work.

These barriers add costs, delays, and complexity even without tariffs.

Q3: Has Brexit made it easier or harder for UK businesses to trade?

A3: Generally, for trade with the EU, it has become harder and more complex. The introduction of customs checks, paperwork, and new regulatory requirements has added significant burdens and costs. For trade with non-EU countries, the UK now has the freedom to negotiate its own deals, which could make it easier to trade with those specific nations in the long run, but this benefit is still developing.

Q4: What is the UKCA mark and why is it important?

A4: The UKCA (UK Conformity Assessed) mark is the new UK product marking that is used for goods being placed on the market in Great Britain (England, Scotland, and Wales). For most products, it replaced the EU’s CE mark from January 1, 2021. Businesses need to ensure their products meet UK safety and quality standards and are correctly marked if they want to sell them in Great Britain.

Q5: What is the Northern Ireland Protocol in simple terms?

A5: The Northern Ireland Protocol is a special arrangement designed to avoid a hard border on the island of Ireland after Brexit. It means that Northern Ireland largely follows EU rules for goods and remains part of the EU’s Single Market for goods. However, it also remains part of the UK’s customs territory. This creates a "sea border" for goods moving between Great Britain and Northern Ireland, where customs and regulatory checks are carried out.

Q6: What is "regulatory divergence"?

A6: Regulatory divergence refers to a situation where the UK’s laws and standards (regulations) begin to differ from those of the EU. Before Brexit, the UK mostly followed EU regulations. Now, the UK can set its own rules. This can be an opportunity for the UK to tailor regulations to its specific needs, but it can also create barriers for businesses that need to comply with two different sets of rules if they want to trade with both the UK and the EU.

Post Comment