What is an Annuity and Should You Get One? Your Complete Beginner’s Guide

Retirement planning can feel like navigating a dense jungle. Between 401ks, IRAs, stocks, and bonds, it’s easy to get lost. One financial product that often comes up in conversations about guaranteed retirement income is the annuity. But what exactly is an annuity, and is it the right financial tool for your future?

This comprehensive guide will demystify annuities, breaking down their complexities into easy-to-understand language. We’ll explore what they are, how they work, the different types available, and most importantly, help you determine if an annuity should be part of your financial strategy.

Table of Contents

- What Exactly is an Annuity? (The Basics)

- How Do Annuities Work? The Two Phases

- Understanding the Different Types of Annuities

- By Payout Timing: Immediate vs. Deferred

- By Investment Growth: Fixed, Variable, and Fixed Indexed

- The Pros of Annuities: Why Consider One?

- The Cons of Annuities: What Are the Drawbacks?

- Should YOU Get an Annuity? Who Benefits Most?

- Important Considerations Before Buying an Annuity

- Annuities vs. Other Retirement Options

- Conclusion: Are Annuities Right for You?

1. What Exactly is an Annuity? (The Basics)

At its core, an annuity is a contract between you and an insurance company. You pay the insurance company a sum of money (either a lump sum or a series of payments), and in return, they promise to pay you regular income payments, either immediately or at a future date. Think of it like buying a personal pension plan.

The primary purpose of an annuity is to provide a guaranteed income stream, often for life, helping to alleviate the fear of outliving your savings in retirement. It’s a way to turn a portion of your retirement nest egg into predictable, recurring payments.

Key Concepts to Remember:

- Contract: It’s a legal agreement with an insurance company.

- Income Stream: Its main goal is to provide regular payments.

- Retirement Focus: Primarily designed for long-term financial security in retirement.

- Guaranteed: Many annuities offer a guaranteed income for life, regardless of market fluctuations (though the amount of the guarantee can vary by type).

2. How Do Annuities Work? The Two Phases

Annuities typically operate in two distinct phases:

Phase 1: The Accumulation Phase (If Applicable)

This phase applies to deferred annuities. During the accumulation phase, the money you’ve paid into the annuity grows on a tax-deferred basis. This means you don’t pay taxes on the investment gains until you start withdrawing money or receiving payments.

- How you pay: You can fund your annuity with a single lump sum or through a series of payments over time.

- How it grows: The way your money grows depends on the type of annuity (fixed, variable, or indexed, which we’ll cover next).

- Flexibility: You decide when the accumulation phase ends and the payout phase begins.

Phase 2: The Payout (or Annuitization) Phase

This is when the insurance company starts making payments to you. You can choose to receive payments in various ways:

- Lump Sum: You can withdraw the entire accumulated value (though this usually negates the annuity’s primary benefit and triggers immediate taxes).

- Systematic Withdrawals: You can take out specific amounts periodically until the money runs out.

- Annuitization: This is the traditional way annuities pay out. You convert your accumulated funds into a series of regular, guaranteed income payments. Once you annuitize, the decision is generally irreversible.

Common Payout Options for Annuitization:

- Life Only: Payments continue for your entire life, but stop upon your death, even if you only received a few payments. This offers the highest monthly payout.

- Life with Period Certain: Payments continue for your life, but if you die before a specified period (e.g., 10 or 20 years), your beneficiary receives payments for the remainder of that period.

- Joint and Survivor: Payments continue for your life and then for the life of a named beneficiary (e.g., your spouse). The payments usually decrease after the first person dies.

- Period Certain Only: Payments continue for a specific number of years, regardless of whether you are alive or not. If you die, your beneficiary receives the remaining payments.

3. Understanding the Different Types of Annuities

Annuities aren’t a one-size-fits-all product. They come in several varieties, each with unique features, risks, and benefits. Understanding these differences is crucial.

We can categorize annuities in two main ways: by when they start paying out, and by how their value grows.

A. By Payout Timing:

-

Immediate Annuity (SPIA – Single Premium Immediate Annuity)

- What it is: You make one lump-sum payment, and income payments begin almost immediately (usually within one year).

- Best for: Retirees who need immediate, predictable income to cover living expenses.

- Growth Phase: There is no accumulation phase; the money is converted directly into income.

- Pros: Instant income, predictability.

- Cons: No growth potential, funds are illiquid once annuitized.

-

Deferred Annuity

- What it is: You pay a lump sum or make payments over time, and the income payments are delayed until a future date (e.g., when you retire).

- Best for: Individuals who want to save for retirement, allow their money to grow tax-deferred, and then convert it into income later.

- Growth Phase: Has an accumulation phase where your money grows.

- Pros: Tax-deferred growth, flexibility to choose when payments start.

- Cons: Access to your money can be limited during the accumulation phase.

B. By Investment Growth:

-

Fixed Annuity

- How it grows: Your money grows at a guaranteed, fixed interest rate for a set period (e.g., 3-5 years), similar to a CD (Certificate of Deposit).

- Risk Level: Low risk. You know exactly how much your money will grow.

- Best for: Conservative investors who prioritize principal protection and predictable growth over higher potential returns.

- Pros: Principal protection, guaranteed returns, simplicity.

- Cons: Lower growth potential compared to market-linked options, inflation can erode purchasing power.

-

Variable Annuity

- How it grows: Your money is invested in subaccounts, which are similar to mutual funds, chosen by you. The value of your annuity will fluctuate based on the performance of these underlying investments.

- Risk Level: Higher risk. You bear the investment risk, and your principal is not guaranteed.

- Best for: Investors willing to take on market risk for potentially higher returns, often with an eye toward future income. Many variable annuities offer optional riders for guaranteed income or death benefits, but these come with extra fees.

- Pros: Potential for higher returns, tax-deferred growth, customizable investment options.

- Cons: Investment risk (you can lose money), high fees (management fees, mortality & expense fees, rider fees), complexity.

-

Fixed Indexed Annuity (FIA)

- How it grows: A hybrid product. Your money grows based on the performance of a specific market index (e.g., S&P 500) but with a "floor" (usually 0%) to protect against losses and a "cap" or "participation rate" that limits your upside.

- Floor: Guarantees you won’t lose principal due to market downturns.

- Cap: The maximum percentage gain you can earn in a given period.

- Participation Rate: The percentage of the index’s gain you’ll receive.

- Risk Level: Moderate risk. Offers principal protection but limits upside potential.

- Best for: Savers who want market-linked growth potential without the risk of losing principal, and who are okay with capped returns.

- Pros: Principal protection, potential for better returns than fixed annuities, less volatile than variable annuities.

- Cons: Capped returns limit upside, complex calculations, less transparent than fixed annuities, surrender charges apply.

- How it grows: A hybrid product. Your money grows based on the performance of a specific market index (e.g., S&P 500) but with a "floor" (usually 0%) to protect against losses and a "cap" or "participation rate" that limits your upside.

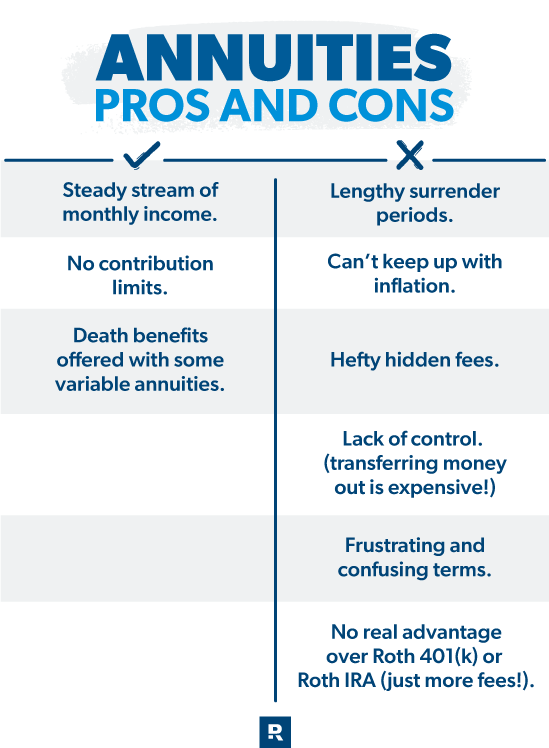

4. The Pros of Annuities: Why Consider One?

Annuities offer several compelling benefits, particularly for those concerned about retirement income security:

- Guaranteed Income for Life: This is often the biggest draw. Many annuities offer a promise of payments that you cannot outlive, providing immense peace of mind in retirement.

- Tax-Deferred Growth: Your money grows without being taxed until you start withdrawing it. This allows your earnings to compound faster over time.

- Customizable Payouts: You can choose from various payout options (single life, joint life, period certain) to fit your specific needs and ensure income for a spouse or other beneficiary.

- Death Benefits: Many annuities include a death benefit, ensuring that if you pass away before annuitization, your beneficiaries receive at least your original premium (minus any withdrawals) or the accumulated value, bypassing probate.

- Protection from Market Volatility (for Fixed & Indexed Annuities): Fixed and Fixed Indexed Annuities offer a degree of principal protection, shielding your retirement savings from stock market crashes.

- Avoid Probate: Annuities typically have a named beneficiary, meaning the proceeds can pass directly to them upon your death without going through the often lengthy and costly probate process.

5. The Cons of Annuities: What Are the Drawbacks?

Despite their benefits, annuities are not without their downsides. It’s crucial to understand these before committing your money:

- Complexity & High Fees: Annuities, especially variable and indexed annuities, can be very complex products with numerous riders and charges. These fees (e.g., mortality and expense fees, administrative fees, subaccount fees, rider fees) can significantly eat into your returns.

- Lack of Liquidity (Surrender Charges): Your money is often locked up for a period (e.g., 5-10 years) during the accumulation phase. If you need to withdraw money beyond a small percentage (typically 10% per year) during this "surrender period," you’ll face substantial penalties, known as surrender charges.

- Inflation Risk: While annuities provide a guaranteed nominal income, that income’s purchasing power can be eroded by inflation over time. Some annuities offer inflation riders, but these come at an extra cost and may not fully offset inflation.

- Opportunity Cost: The money tied up in an annuity might have earned higher returns if invested elsewhere, especially in diversified portfolios of stocks and bonds over the long term.

- Taxation: While growth is tax-deferred, when you receive annuity payments, the earnings portion is taxed as ordinary income, not at potentially lower capital gains rates. If you fund an annuity with after-tax money, only the earnings are taxed.

- Insurance Company Risk: Your annuity payments are only as good as the financial strength of the issuing insurance company. While state guaranty associations offer some protection, it’s wise to choose highly-rated insurers.

- Irrevocability (for Annuitization): Once you annuitize your annuity, you generally cannot change your mind or get your lump sum back. This is a significant, permanent decision.

6. Should YOU Get an Annuity? Who Benefits Most?

Annuities are a specialized tool and are not suitable for everyone. They tend to be a better fit for specific financial situations and personality types.

You might benefit from an annuity if:

- You’ve maxed out other retirement accounts: If you’ve already contributed the maximum to your 401(k), IRA, and other tax-advantaged accounts, an annuity can be another way to save for retirement on a tax-deferred basis.

- You prioritize guaranteed income: If having a predictable, lifelong income stream is your top priority and eases your retirement worries, an annuity can provide that security.

- You are a conservative investor seeking stability: Fixed and fixed indexed annuities appeal to those who want principal protection and steady, if not spectacular, growth, without the volatility of the stock market.

- You are nearing or in retirement: Annuities are most effective when purchased closer to retirement, as they’re designed to convert savings into income.

- You are concerned about outliving your savings: The longevity protection offered by annuities is a key feature for those worried about their money running out.

- You have a substantial nest egg: Annuities work best when funding a portion of your retirement income, not your entire savings. They’re often suitable for people with significant assets who want to secure a baseline income.

An annuity might NOT be right for you if:

- You are young and have a long time until retirement: Your money would likely benefit more from the higher growth potential of diversified stock market investments over a long horizon.

- You need easy access to your money: The illiquidity and surrender charges of annuities make them unsuitable for emergency funds or money you might need in the short to medium term.

- You prefer to manage your own investments: If you enjoy actively managing your portfolio and seeking higher returns, the limitations and fees of annuities might frustrate you.

- You have limited funds: Annuities are not typically recommended for individuals with modest savings, as the fees can disproportionately eat into their returns.

- You have a low risk tolerance but are comfortable with minimal returns: A high-yield savings account or CDs might be a simpler and more liquid option than a fixed annuity.

7. Important Considerations Before Buying an Annuity

If you’re leaning towards an annuity, here are critical factors to evaluate:

- The Financial Health of the Insurer: Since your payments depend on the insurance company’s solvency, check their financial strength ratings from agencies like A.M. Best, Standard & Poor’s, Moody’s, and Fitch.

- Fees and Charges: Get a clear breakdown of all fees – administrative fees, mortality and expense charges, subaccount fees, rider fees, and surrender charges. High fees can severely erode your returns.

- Inflation Protection: Understand how the annuity addresses inflation. Does it offer an inflation rider? How much does it cost?

- Riders: Many annuities offer optional riders (e.g., guaranteed minimum withdrawal benefits, guaranteed lifetime income benefits, death benefits). Understand what each rider does, its cost, and if it aligns with your needs.

- Your Financial Goals and Risk Tolerance: Does the annuity truly fit into your overall retirement plan? Are you comfortable with the level of risk and liquidity?

- Tax Implications: Consult with a tax professional to understand how annuity payments will affect your overall tax situation in retirement.

- Compare Multiple Quotes: Don’t just look at one annuity. Shop around and compare offers from different insurance companies.

8. Annuities vs. Other Retirement Options

It’s helpful to view annuities as one tool in your overall retirement planning toolbox, rather than a replacement for other essential savings vehicles.

- Annuities vs. 401(k)s/IRAs: 401(k)s and IRAs are primarily accumulation vehicles for retirement savings, offering tax advantages for contributions and growth. Annuities are more focused on income generation in retirement. Many people use both: they save in 401(k)s/IRAs during their working years and then use a portion of those savings to purchase an annuity closer to retirement.

- Annuities vs. Social Security/Pensions: Social Security and traditional pensions also provide guaranteed income. Annuities can supplement these, providing an additional layer of guaranteed income to cover essential expenses in retirement.

- Annuities vs. Bonds/CDs: Fixed annuities offer similar safety to CDs and bonds but generally lock up your money for longer and might have less liquidity. Bonds offer more flexibility and often better inflation protection, but also carry interest rate and credit risk.

A well-diversified retirement plan often includes a mix of these options: a base of guaranteed income (Social Security, pension, and potentially an annuity) combined with growth-oriented investments (stocks, mutual funds) for long-term capital appreciation.

9. Conclusion: Are Annuities Right for You?

Annuities are powerful, yet complex, financial instruments designed to address a critical retirement concern: outliving your savings. They can provide valuable peace of mind through guaranteed income streams, tax-deferred growth, and principal protection (depending on the type).

However, their high fees, illiquidity, and complexity mean they are not a universal solution. For some, they represent a vital component of a secure retirement. For others, they can be an expensive mistake.

The decision to get an annuity should never be taken lightly. It requires careful consideration of your personal financial situation, risk tolerance, long-term goals, and a thorough understanding of the specific product being offered.

Our strongest recommendation: Before committing to any annuity, consult with a qualified and independent financial advisor who can assess your entire financial picture, explain the pros and cons in detail, and help you determine if an annuity aligns with your unique retirement planning needs. They can help you navigate the complexities and ensure you make an informed decision for your financial future.

Post Comment