Unlock Financial Stability: The Indispensable Role of Budgeting in Mastering Cash Flow Management

In today’s dynamic economic landscape, whether you’re managing a household, a small business, or a large corporation, one truth remains constant: cash is king. But simply having cash isn’t enough; you need to understand where it comes from, where it goes, and how to control its flow. This is where the powerful duo of budgeting and cash flow management comes into play.

For many, the terms sound intimidating, conjuring images of complex spreadsheets and financial jargon. However, at its heart, it’s about gaining clarity and control over your money. This comprehensive guide will demystify these concepts, explaining why budgeting isn’t just a good idea, but an absolute necessity for robust cash flow management and lasting financial health.

Understanding the Core Concepts: Cash Flow & Budgeting

Before we dive into their intertwined relationship, let’s break down what each term truly means in simple language.

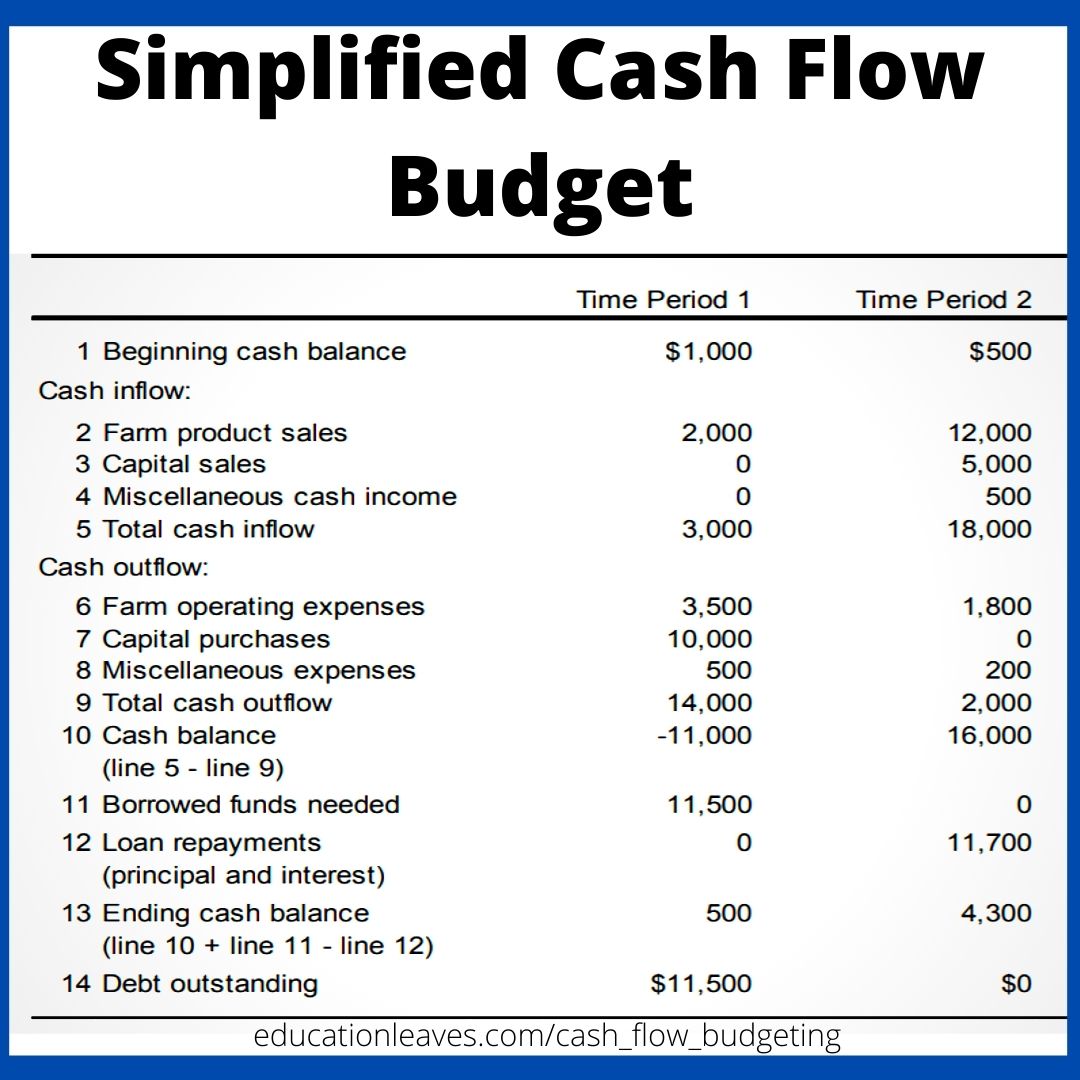

What is Cash Flow? The Financial Heartbeat

Imagine your money as water. Cash flow is simply the movement of this water into and out of your financial reservoir.

- Cash Inflow: This is the money coming into your accounts.

- For Individuals: Salary, freelance income, investment dividends, gifts, tax refunds.

- For Businesses: Sales revenue, loan disbursements, investment income, grants.

- Cash Outflow: This is the money going out of your accounts.

- For Individuals: Rent/mortgage, utilities, groceries, loan payments, entertainment, transportation.

- For Businesses: Rent, salaries, inventory costs, marketing expenses, utility bills, loan repayments.

Positive Cash Flow occurs when more money comes in than goes out. This is like your reservoir filling up – you have a surplus.

Negative Cash Flow occurs when more money goes out than comes in. This is like your reservoir draining – you’re spending more than you earn.

Why is Cash Flow Important?

Think of cash flow as the financial heartbeat of your life or business. Without a healthy, consistent beat (positive cash flow), survival becomes difficult, growth is impossible, and financial stress mounts. It dictates your ability to pay bills, invest in the future, and handle unexpected challenges.

What is Budgeting? Your Financial Roadmap

If cash flow is the movement of water, then budgeting is the map and plan for how that water should flow. It’s a detailed financial plan that outlines your expected income and expenses over a specific period, typically a month or a year.

A budget is not about restricting yourself or living frugally (unless that’s your goal). Instead, it’s about:

- Awareness: Knowing exactly where your money comes from and where it goes.

- Control: Making conscious decisions about your spending and saving.

- Planning: Allocating funds to meet your financial goals, whether it’s saving for a down payment, expanding a business, or building an emergency fund.

In essence, a budget is a proactive tool that turns your financial dreams into actionable steps.

The Direct Connection: How Budgeting Impacts Cash Flow Management

Now that we understand the individual components, let’s explore why budgeting is not just a helpful tool, but an essential cornerstone of effective cash flow management.

Budgeting provides the structure and foresight needed to transform chaotic money movement into predictable, controlled financial progress.

1. Provides Clear Visibility and Awareness

- Before Budgeting: Many people and businesses operate in the dark, only realizing they have a cash flow problem when their bank account is low or bills start piling up.

- With Budgeting: A budget forces you to list all your income sources and every single expense. This creates a crystal-clear picture of your financial landscape, highlighting where your money actually goes versus where you think it goes. This awareness is the first step towards taking control.

2. Enhances Control and Discipline

- Budgeting as a Guardrail: Once you see where your money is going, a budget allows you to set limits and allocate funds intentionally. It acts as a set of guardrails, preventing impulsive or excessive spending that can quickly lead to negative cash flow.

- Prioritization: It helps you distinguish between needs and wants, allowing you to prioritize essential expenses and consciously decide where discretionary income should be spent or saved. This discipline is vital for maintaining a positive cash flow.

3. Facilitates Forecasting and Planning

- Predictive Power: A well-crafted budget isn’t just about what happened; it’s about what will happen. By tracking historical data and projecting future income and expenses, budgeting enables you to forecast your cash flow.

- Anticipating Shortfalls: This foresight allows you to anticipate potential cash flow shortfalls (e.g., a slow sales month for a business, or a large annual bill for a household) and plan for them in advance, rather than being caught off guard. You can then take proactive measures like reducing non-essential spending or seeking additional income.

4. Identifies and Addresses Cash Flow Issues Promptly

- Early Warning System: By regularly comparing your actual income and expenses against your budget, you create an early warning system. Deviations become immediately apparent.

- Pinpointing Problems: Is a particular expense category consistently over budget? Is income lower than expected? Budgeting helps you pinpoint the exact source of negative cash flow, allowing for targeted solutions rather than generalized worry.

5. Enables Strategic Decision-Making

- Informed Choices: When you have a clear understanding of your cash flow through budgeting, every financial decision becomes more informed. Should you invest in new equipment? Can you afford a new car? Is it time to hire more staff?

- Optimizing Resource Allocation: Budgeting ensures that your limited financial resources are allocated in the most efficient way possible to achieve your strategic goals, whether personal or business-related.

6. Supports Achievement of Financial Goals

- Goal Alignment: Whether your goal is to save for a down payment, pay off debt, build an emergency fund, expand your business, or retire comfortably, budgeting links your daily spending habits directly to your long-term aspirations.

- Trackable Progress: It allows you to dedicate specific funds towards these goals, monitor your progress, and stay motivated as you see your cash flow working for you, not against you.

Practical Steps: Budgeting for Better Cash Flow

Ready to take control? Here’s a simple, actionable guide to creating a budget that will enhance your cash flow management.

Step 1: Track Your Income

- List All Sources: Identify every source of money coming in.

- For Individuals: Salary, side hustle income, rental income, benefits, etc.

- For Businesses: Sales revenue, service fees, interest income, etc.

- Calculate Total: Sum up all your reliable income for the period (e.g., monthly). Be conservative, especially with variable income.

Step 2: Track Your Expenses

- Gather Data: Collect bank statements, credit card statements, receipts, and invoices for the last 1-3 months.

- List Every Outflow: Go through each transaction and list every single expense. This can be eye-opening!

- Don’t Forget Irregular Expenses: Think about annual subscriptions, insurance premiums, holiday spending, or quarterly tax payments. Divide them by 12 to get a monthly equivalent.

Step 3: Categorize and Analyze Your Spending

- Group Similar Expenses: Create categories to make sense of your spending.

- Fixed Expenses: These are typically the same amount each month and are difficult to change in the short term (e.g., rent/mortgage, loan payments, insurance premiums).

- Variable Expenses: These fluctuate month-to-month and you have more control over them (e.g., groceries, utilities, entertainment, transportation, dining out).

- Discretionary Expenses: These are "wants" rather than "needs" (e.g., subscriptions, hobbies, luxury items).

- Identify Trends: Where is most of your money going? Are there any "money leaks" you weren’t aware of? This analysis is crucial for identifying areas where you can optimize your cash flow.

Step 4: Create Your Budget (Allocate Funds)

- Subtract Expenses from Income:

- Income – Expenses = Net Cash Flow

- Allocate to Categories: Based on your analysis, assign specific dollar limits to each spending category.

- If Positive Cash Flow: Great! Decide how to allocate the surplus: savings, debt repayment, investments, or discretionary spending.

- If Negative Cash Flow: This is where budgeting becomes your superpower. Identify areas (usually variable or discretionary expenses) where you can cut back to bring your outflows below your inflows.

- Choose a Method:

- 50/30/20 Rule: 50% Needs, 30% Wants, 20% Savings/Debt Repayment.

- Zero-Based Budgeting: Every dollar of income is assigned a "job" (expense, saving, debt repayment).

- Envelope System: Physically allocate cash into envelopes for different categories.

- Be Realistic: Don’t create a budget that’s impossible to stick to. Start small, make gradual changes.

Step 5: Monitor and Adjust Regularly

- Regular Review: A budget is a living document, not a one-time task. Review your budget against your actual spending at least weekly or bi-weekly.

- Track Your Spending: Use apps, spreadsheets, or even a simple notebook to log every expense.

- Be Flexible: Life happens! Your income or expenses might change. Adjust your budget as needed. If you consistently overspend in one category, consider if the allocation is realistic or if you need to find ways to reduce that spending.

Beyond the Basics: Advanced Tips for Robust Cash Flow

Once you’ve mastered the fundamentals, consider these strategies to further strengthen your cash flow management:

- Build an Emergency Fund: A dedicated savings account with 3-6 months of living expenses is crucial. It acts as a buffer against unexpected expenses (job loss, medical emergency, car repair) preventing them from derailing your positive cash flow.

- Prioritize Debt Repayment: High-interest debt (like credit card debt) can quickly drain your cash flow. Budgeting helps you allocate extra funds to pay down these debts faster, freeing up more cash in the long run.

- Optimize Revenue and Expenses:

- On the Income Side: Explore opportunities for additional income (side hustles, investing, price increases for businesses).

- On the Expense Side: Continuously look for ways to reduce costs without sacrificing quality (negotiate bills, shop around, reduce subscriptions).

- Separate Personal and Business Finances (for entrepreneurs): This is non-negotiable for clear cash flow management and accurate budgeting for your business.

- Invest in Financial Education: The more you learn about personal finance or business finance, the better equipped you’ll be to make informed decisions that positively impact your cash flow.

Conclusion: Budgeting – Your Key to Financial Empowerment

The role of budgeting in cash flow management cannot be overstated. It transforms your financial situation from a reactive, often stressful, experience into a proactive, controlled, and empowering journey.

By embracing budgeting, you gain:

- Clarity: A full picture of your financial inflows and outflows.

- Control: The ability to direct your money where it serves you best.

- Confidence: The peace of mind that comes from knowing you can handle financial challenges and achieve your goals.

Start today. It might feel overwhelming at first, but with consistent effort and a willingness to learn, you will unlock the power of effective cash flow management and pave the way for lasting financial stability and success. Your financial future depends on it.

Post Comment