Countervailing Duties: Leveling the Playing Field Against Unfair Subsidies

In the intricate world of international trade, the goal is often a "level playing field" – where businesses from different countries can compete fairly based on their efficiency, innovation, and quality. However, this ideal is frequently challenged by practices that distort competition, one of the most prominent being government subsidies.

When a foreign government provides financial assistance to its domestic industries, it can give them an unfair advantage in global markets. This is where Countervailing Duties (CVDs) come into play. Designed as a crucial trade remedy, CVDs act as a defensive mechanism, aiming to neutralize the unfair benefit provided by these subsidies and restore fair competition.

This comprehensive guide will break down what countervailing duties are, why they are necessary, how they work, and their impact on global trade, all in easy-to-understand language.

What Exactly Are Subsidies? The Root of the Problem

Before diving into CVDs, it’s essential to understand the underlying issue: subsidies.

In simple terms, a subsidy is a financial benefit or support extended by a government to a specific industry or business. The goal is often to promote economic policy, encourage certain activities (like research and development), or support a particular sector.

Examples of Subsidies Can Include:

- Direct Cash Grants: The government directly pays money to a company.

- Low-Interest Loans: Loans provided by the government or government-backed banks at rates significantly lower than market rates.

- Tax Breaks: Exemptions, deductions, or credits that reduce a company’s tax burden.

- Provision of Goods or Services: The government provides raw materials, land, or infrastructure at below-market prices.

- Debt Forgiveness: The government cancels a company’s outstanding debts.

Why Are Subsidies a Problem for Fair Trade?

While some subsidies are generally accepted (like those for basic research or environmental protection), others can severely distort international trade. When a foreign company receives a significant subsidy, it can:

- Lower Production Costs: The subsidy allows the company to produce goods at a lower actual cost than its competitors who don’t receive similar support.

- Enable Undercutting Prices: With lower costs, the subsidized company can sell its products in foreign markets at prices that domestic industries cannot match without incurring losses.

- Increase Market Share Unfairly: By selling cheaper, they gain market share not because they are more efficient, but because they are financially propped up by their government.

- Harm Domestic Industries: Unsubsidized domestic companies struggle to compete, potentially leading to job losses, reduced investment, and even business closures.

What Are Countervailing Duties (CVDs)? The Solution

Imagine a race where one runner starts halfway down the track, or is given performance-enhancing gear by their coach. That’s similar to how an unfair subsidy works in trade. Countervailing Duties are like adding a handicap to that unfairly advantaged runner to make the race fair again.

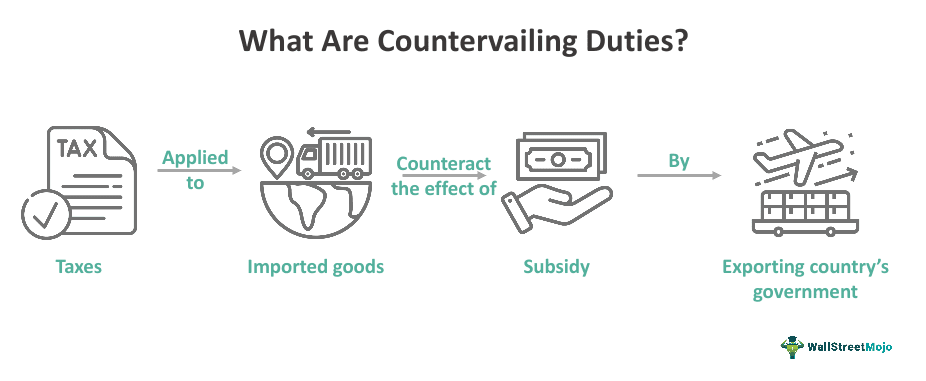

Countervailing Duties (CVDs) are special import taxes imposed by an importing country on goods that have been subsidized by a foreign government.

Key Characteristics of CVDs:

- Purpose: To offset or "countervail" the unfair price advantage created by the foreign subsidy.

- Amount: The duty is typically set at a rate equivalent to the amount of the subsidy per unit of the imported product. For example, if a product receives a $0.50 subsidy per unit, a CVD of $0.50 per unit would be applied.

- Target: They are applied to specific products from specific countries that are found to have benefited from actionable subsidies.

- Temporary or Permanent: CVDs can be provisional (temporary, while an investigation is ongoing) or definitive (permanent, after a final determination).

In essence, CVDs aim to restore the "level playing field" by adding back the cost advantage that the subsidy provided, ensuring that domestic industries can compete fairly.

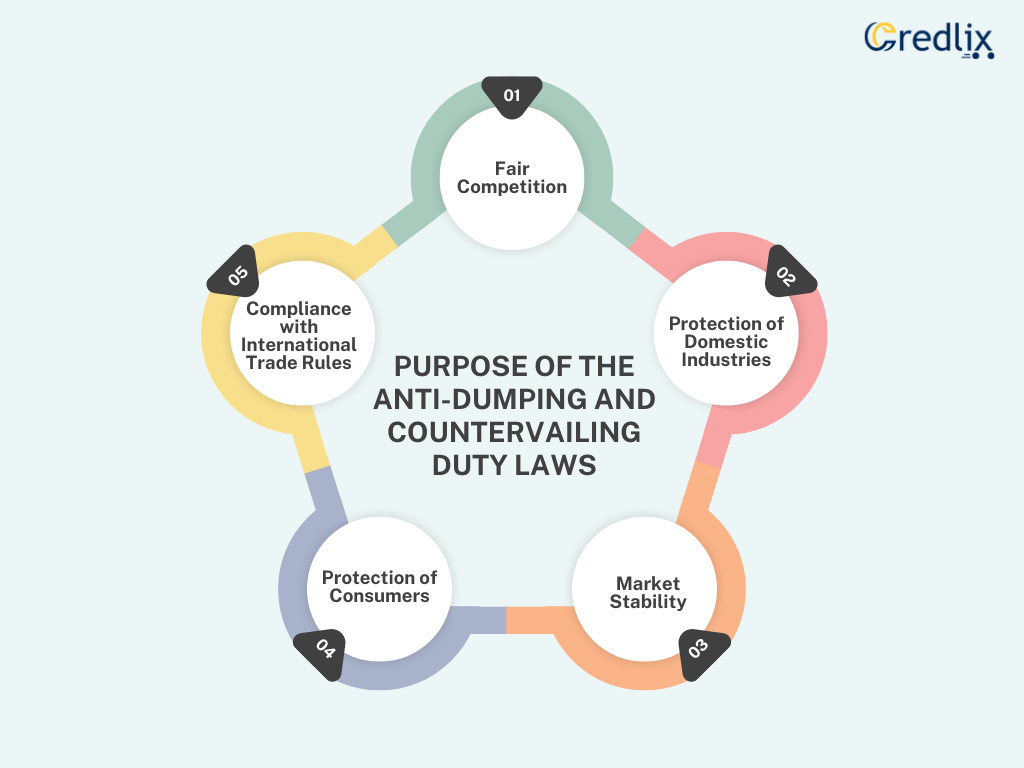

Why Do We Need Countervailing Duties? The Rationale

The existence of CVDs isn’t about protectionism for the sake of it; rather, it’s about enforcing rules of fair play in global commerce. Here’s why they are considered a necessary tool:

- Protecting Domestic Industries: Unfairly subsidized imports can severely damage local businesses. CVDs help prevent this damage, safeguarding jobs, investments, and technological capabilities within the domestic economy.

- Ensuring Fair Competition: They ensure that success in the market is based on genuine competitive advantages (like efficiency, quality, and innovation), not on artificial government support.

- Discouraging Unfair Practices: By imposing duties, countries signal that they will not tolerate trade-distorting subsidies, encouraging other nations to adhere to international trade rules.

- Maintaining Economic Stability: When key industries are threatened by unfair trade, it can have ripple effects throughout the economy. CVDs contribute to stability by defending these sectors.

- Upholding International Agreements: The imposition of CVDs is governed by international rules, particularly the World Trade Organization (WTO) Agreement on Subsidies and Countervailing Measures (ASCM), which provides a framework for their legitimate use.

The CVD Investigation Process: How It Works

Imposing Countervailing Duties isn’t a unilateral decision. It follows a structured, often lengthy, legal process. While specific procedures vary slightly by country (e.g., the U.S. has the Department of Commerce and the International Trade Commission), the general steps are quite similar across WTO member states:

-

Petition Filing:

- Typically, a domestic industry (or a significant portion of it) that believes it is being harmed by subsidized imports files a petition with its government’s trade authorities (e.g., the U.S. Department of Commerce and the International Trade Commission).

- The petition must include evidence of a subsidy, proof of injury, and a causal link between the two.

-

Initiation of Investigation:

- Trade authorities review the petition to determine if there’s enough evidence to proceed. If so, they formally initiate an investigation.

- They notify the foreign government and the exporting companies involved.

-

Subsidy Investigation (Determining if a Subsidy Exists):

- The investigating authority (e.g., the U.S. Department of Commerce) conducts a detailed analysis to determine:

- If a subsidy exists (financial contribution from a government or public body).

- If the subsidy is "specific" (i.e., targeted to a particular enterprise, industry, or group of enterprises, rather than being a generally available program). Only specific subsidies are "actionable" under WTO rules.

- The amount of the subsidy per unit of the product.

- The investigating authority (e.g., the U.S. Department of Commerce) conducts a detailed analysis to determine:

-

Injury Investigation (Determining if Domestic Industry is Harmed):

- A separate authority (e.g., the U.S. International Trade Commission) investigates whether the subsidized imports are causing "material injury" or threatening to cause material injury to the domestic industry.

- This involves analyzing factors like declining sales, market share, profits, employment, and production capacity of the domestic industry.

-

Preliminary Determination:

- After a few months, the investigating authorities make preliminary determinations on both the existence of a subsidy and injury.

- If both are affirmative, provisional CVDs may be imposed. These are temporary duties collected on imports while the investigation continues.

-

Final Determination:

- The investigation continues, often involving more detailed questionnaires, on-site verifications, and hearings.

- After a more thorough review, final determinations are made on the subsidy and injury.

- If both are affirmative, definitive CVDs (permanent duties) are imposed. The rate is set to offset the determined subsidy amount.

-

Duty Collection and Review:

- Customs authorities collect the countervailing duties on the affected imports.

- CVD orders can remain in effect for several years but are subject to periodic reviews (e.g., annual administrative reviews) and "sunset reviews" (typically every five years) to determine if the duties are still necessary.

Key Elements for a Successful CVD Case

For a country to legitimately impose Countervailing Duties under WTO rules, several conditions must be met:

- Existence of an Actionable Subsidy: There must be a financial contribution by a government or public body that confers a benefit, and this benefit must be specific to an enterprise or industry.

- Material Injury or Threat of Material Injury: The domestic industry must be suffering significant harm, or be clearly threatened with such harm. This harm must be quantifiable.

- Causation: There must be a clear link demonstrating that the subsidized imports are the cause of the material injury to the domestic industry, not other factors like a recession, changes in consumer tastes, or poor management by domestic firms.

The Role of the World Trade Organization (WTO)

The WTO plays a critical role in governing the use of countervailing duties. The Agreement on Subsidies and Countervailing Measures (ASCM) is the key WTO agreement that outlines the rules for:

- Defining Subsidies: What constitutes a subsidy and which types are prohibited (e.g., export subsidies) or actionable (i.e., can be subject to CVDs).

- Procedures for Investigation: The specific steps countries must follow when investigating and imposing CVDs, ensuring transparency and due process.

- Dispute Settlement: Provides a mechanism for member countries to challenge the use of CVDs if they believe they are unfairly applied or violate WTO rules.

The WTO’s framework aims to prevent countries from using CVDs as a disguised form of protectionism, ensuring they are applied only when legitimate unfair trade practices are identified and proven.

Impact of Countervailing Duties: Pros and Cons

Like any trade policy tool, CVDs have a range of effects:

Pros (Benefits):

- Restores Fair Competition: Helps level the playing field for domestic industries, allowing them to compete on merit.

- Protects Domestic Jobs and Industries: Prevents the erosion of local manufacturing, agricultural, and service sectors due to unfairly priced imports.

- Encourages Compliance with Trade Rules: Signals to other nations that trade-distorting subsidies will be challenged, promoting adherence to international norms.

- Supports Economic Stability: Helps maintain the viability of strategic industries within a country.

Cons (Challenges & Potential Drawbacks):

- Higher Import Costs: The duties increase the price of imported goods, which can sometimes be passed on to consumers or domestic industries that use these imports as inputs.

- Potential for Retaliation: The imposition of CVDs can sometimes lead to retaliatory measures from the affected foreign country, escalating trade tensions.

- Complexity and Cost of Investigations: CVD investigations are lengthy, resource-intensive, and can be costly for both the petitioning industry and the foreign exporters involved.

- Risk of Protectionism: While intended for fairness, there’s always a risk that CVDs could be misused for protectionist purposes, leading to trade disputes.

- Impact on Global Supply Chains: Can disrupt established supply chains and force companies to seek alternative, potentially more expensive, sources for materials or components.

Countervailing Duties vs. Anti-Dumping Duties: A Quick Distinction

It’s common to confuse Countervailing Duties with Anti-Dumping Duties (ADDs), as both are trade remedies designed to address unfair trade practices.

- Countervailing Duties (CVDs): Address unfair pricing due to government subsidies that lower a foreign producer’s costs.

- Anti-Dumping Duties (ADDs): Address unfair pricing due to "dumping," which occurs when a foreign company sells its products in an export market at a price lower than its domestic market price or below its cost of production, with the intent to gain market share or drive out competitors.

Both CVD and ADD investigations often occur simultaneously, as companies might be both subsidized and dumping.

Conclusion

Countervailing Duties are a vital, albeit complex, tool in the arsenal of international trade policy. They serve as a crucial defense mechanism, designed to address the distortions created by unfair government subsidies and ensure that global trade remains as fair and competitive as possible.

By providing a mechanism to offset the benefits of these subsidies, CVDs aim to protect domestic industries, safeguard jobs, and uphold the principles of open and equitable commerce. While their application can be contentious and involve intricate legal processes, their fundamental purpose remains clear: to level the playing field and foster a trading environment where success is earned through innovation and efficiency, not through government handouts. Understanding CVDs is key to navigating the complexities of global trade in the 21st century.

Post Comment