What is Fiscal Policy? Its Role in Open Economies

Understanding the Government’s Economic Steering Wheel

Have you ever wondered how governments try to keep the economy stable, create jobs, or manage prices? They have several powerful tools at their disposal, and one of the most significant is fiscal policy. Far from being a complex, abstract concept, fiscal policy is essentially the government’s strategy for using its budget – how much it spends and how much it collects in taxes – to influence the overall health of the economy.

In a world where countries are increasingly connected through trade and finance, understanding fiscal policy isn’t just about domestic affairs. Its impact reverberates across borders, especially in what we call "open economies." This article will break down fiscal policy in simple terms, explore its objectives, and then delve into the unique challenges and considerations it faces in our globally intertwined world.

What Exactly Is Fiscal Policy?

At its core, fiscal policy refers to the use of government spending and taxation to influence the economy. Think of the government as a giant household, but instead of managing a family budget, it’s managing a national budget.

The two main levers of fiscal policy are:

-

Government Spending (Expenditure): This includes all the money the government spends on goods and services, such as:

- Infrastructure projects: Building roads, bridges, public transport.

- Public services: Education, healthcare, defense, police.

- Social welfare programs: Unemployment benefits, pensions, food assistance.

- Government salaries: Paying public sector employees.

-

Taxation (Revenue): This is how the government collects money from individuals and businesses. Taxes can take many forms:

- Income tax: On wages and salaries.

- Corporate tax: On company profits.

- Sales tax/VAT (Value Added Tax): On goods and services purchased.

- Property tax: On real estate.

- Excise tax: On specific goods like fuel, tobacco, or alcohol.

By adjusting these two levers, governments aim to achieve specific economic goals.

The Primary Objectives of Fiscal Policy

Why do governments bother with fiscal policy? They use it as a tool to achieve key macroeconomic goals, which typically include:

- Promoting Economic Growth: By stimulating demand for goods and services, fiscal policy can encourage businesses to produce more and hire more people.

- Achieving Full Employment: When the economy grows, businesses need more workers, leading to lower unemployment rates.

- Maintaining Price Stability (Controlling Inflation): If prices are rising too fast (inflation), fiscal policy can be used to cool down the economy. If prices are falling (deflation), it can be used to boost demand.

- Redistributing Income and Wealth: Through progressive taxation (higher earners pay a larger percentage) and social welfare programs, governments can aim to reduce income inequality.

- Managing External Balance (in Open Economies): Fiscal policy can indirectly influence a country’s trade balance and capital flows, which we’ll discuss in detail later.

Types of Fiscal Policy: Expansionary vs. Contractionary

Fiscal policy can be broadly categorized into two main types, depending on the economic situation:

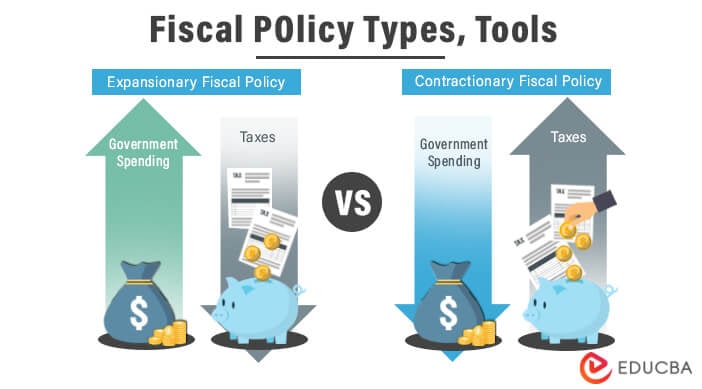

1. Expansionary Fiscal Policy

- When Used: During recessions, periods of low economic growth, or high unemployment.

- How it Works: The government aims to inject money into the economy to stimulate demand. This is typically done by:

- Increasing Government Spending: Directly boosting demand (e.g., funding infrastructure projects, increasing social benefits).

- Decreasing Taxes: Leaving more money in the hands of consumers and businesses, encouraging them to spend and invest.

- Goal: To boost aggregate demand, encourage investment, create jobs, and stimulate economic growth.

- Effect: Often leads to a budget deficit (spending more than collected in taxes).

2. Contractionary Fiscal Policy

- When Used: During periods of high inflation or when the economy is "overheating" (growing unsustainably fast).

- How it Works: The government aims to cool down the economy by reducing the amount of money circulating. This is typically done by:

- Decreasing Government Spending: Reducing demand in the economy.

- Increasing Taxes: Taking more money out of the hands of consumers and businesses, reducing their spending power.

- Goal: To curb inflation, prevent asset bubbles, and ensure sustainable economic growth.

- Effect: Often leads to a budget surplus (collecting more in taxes than spent).

How Fiscal Policy Influences the Economy: The Ripple Effect

Imagine dropping a pebble into a pond – the ripples spread outwards. Fiscal policy works similarly through what economists call the multiplier effect.

When the government spends money (e.g., on building a new hospital), that money becomes income for construction workers, suppliers, and engineers. These individuals then spend a portion of their new income on goods and services, which in turn becomes income for others, and so on. This creates a ripple effect, where the initial government spending leads to a larger overall increase in economic activity.

Similarly, a tax cut leaves more disposable income with individuals. They might spend some of it, save some, or invest some. The portion they spend also contributes to the multiplier effect, boosting demand.

Fiscal Policy in Open Economies: A Global Perspective

So far, we’ve discussed fiscal policy largely in a "closed economy" context – where a country doesn’t interact much with the rest of the world. However, in today’s globalized world, most economies are open economies.

An open economy is one that engages in significant international trade (importing and exporting goods and services) and financial flows (investing in and borrowing from other countries). This openness introduces several new considerations and challenges for fiscal policy.

Here’s how fiscal policy’s role changes in an open economy:

1. Impact on the Trade Balance (Current Account)

- Expansionary Fiscal Policy: When a government increases spending or cuts taxes, it boosts domestic demand. Some of this increased demand will be met by increased imports. If domestic consumption rises significantly, people might buy more foreign goods, leading to a deterioration of the trade balance (more imports than exports).

- Contractionary Fiscal Policy: Conversely, reducing government spending or increasing taxes can lower domestic demand, potentially leading to fewer imports and an improvement in the trade balance.

2. Influence on Capital Flows and Interest Rates

- Government Borrowing: When a government runs a budget deficit (expansionary policy), it often needs to borrow money. In an open economy, it can borrow not only domestically but also from foreign investors.

- Attracting Foreign Capital: To attract foreign lenders, the government might need to offer higher interest rates. Higher domestic interest rates make it more attractive for foreign investors to buy a country’s bonds or invest in its assets, leading to an inflow of foreign capital.

- Crowding Out (International Version): While higher interest rates attract foreign capital, they can also "crowd out" domestic private investment by making it more expensive for local businesses to borrow money.

3. Effects on Exchange Rates

This is one of the most crucial aspects in an open economy:

-

Expansionary Fiscal Policy & Currency Appreciation:

- Increased government borrowing often leads to higher domestic interest rates (to attract funds).

- Higher interest rates attract foreign capital seeking better returns.

- As foreign investors buy domestic assets, they need to convert their currency into the domestic currency, increasing demand for it.

- Increased demand for the domestic currency leads to its appreciation (it becomes stronger relative to other currencies).

- A stronger currency makes a country’s exports more expensive for foreigners and imports cheaper for domestic consumers. This can further worsen the trade balance.

-

Contractionary Fiscal Policy & Currency Depreciation:

- Reduced government borrowing or a budget surplus can lead to lower domestic interest rates.

- Lower interest rates might reduce the attractiveness of domestic assets for foreign investors, leading to a capital outflow.

- Reduced demand for the domestic currency can lead to its depreciation (it becomes weaker).

- A weaker currency makes exports cheaper and imports more expensive, potentially improving the trade balance.

4. External Debt Accumulation

- If a government consistently runs large budget deficits and borrows heavily from foreign entities, it can accumulate significant external debt.

- High external debt can make a country vulnerable to changes in global interest rates, currency fluctuations, and investor confidence. It can also divert future resources towards debt repayment instead of public services.

5. International Policy Coordination

- In a highly interconnected world, the fiscal policy decisions of one large economy can have spillover effects on others. For instance, a major stimulus in one country could boost demand for imports from another.

- Sometimes, especially during global crises, countries may need to coordinate their fiscal policies to achieve broader stability or address shared challenges (e.g., climate change initiatives).

Limitations and Challenges of Fiscal Policy

Despite its power, fiscal policy isn’t a magic bullet and faces several limitations, some of which are amplified in open economies:

- Time Lags:

- Recognition Lag: It takes time to recognize that an economic problem exists.

- Implementation Lag: It takes time for governments to decide on and pass new spending bills or tax changes.

- Impact Lag: It takes time for the policy changes to actually affect the economy.

- Political Considerations: Tax increases or spending cuts can be unpopular, making it difficult for politicians to implement necessary contractionary policies.

- Crowding Out (Domestic): Large government borrowing can increase interest rates, making it more expensive for private businesses to borrow and invest, thus "crowding out" private sector activity. This effect can be mitigated in open economies if foreign capital inflows offset some of the domestic borrowing.

- Information and Forecasting Challenges: Governments need accurate and timely data to make informed decisions, which is often difficult.

- Debt Sustainability: Persistent budget deficits lead to increasing national debt, which can become unsustainable if not managed carefully, potentially leading to higher interest payments and reduced fiscal flexibility in the future.

- External Constraints (in Open Economies): The impact on exchange rates, capital flows, and trade balances can complicate policy objectives. For example, an expansionary policy aimed at boosting growth might lead to currency appreciation, harming export-oriented industries.

Conclusion: The Balancing Act in a Globalized World

Fiscal policy is a cornerstone of economic management, providing governments with powerful tools to influence growth, employment, and price stability. By strategically adjusting spending and taxation, policymakers aim to steer the economy toward desired outcomes.

However, in our increasingly interconnected world, where most nations operate as open economies, the dynamics of fiscal policy become far more intricate. The decisions made regarding government budgets no longer just impact domestic citizens; they send ripples through international trade, capital markets, and exchange rates. This global interplay adds layers of complexity, requiring policymakers to consider not only internal economic conditions but also the potential international ramifications of their actions.

Understanding fiscal policy, especially its role in open economies, is crucial for comprehending how governments navigate the complexities of modern economic challenges and strive for prosperity in a globalized landscape. It’s a continuous balancing act, requiring foresight, adaptability, and an acute awareness of both domestic needs and international realities.

Post Comment