Unlock Your Retirement Potential: The Ultimate Guide to Solo 401(k) for Self-Employed Individuals

You’ve embraced the freedom and flexibility of self-employment – whether you’re a freelance designer, a consultant, a small business owner, or a gig economy worker. It’s an incredible journey, but with that freedom comes the responsibility of building your own safety nets, especially for retirement.

While traditional employees rely on their company’s 401(k) plans, what about you? How do you save for a comfortable future while maximizing your tax advantages? Enter the Solo 401(k), also known as an Individual 401(k) or One-Participant 401(k). This powerful retirement plan is specifically designed for business owners with no full-time employees, offering some of the most generous contribution limits and tax benefits available.

If you’ve ever felt lost navigating the world of self-employed retirement plans, you’re in the right place. This comprehensive guide will break down everything you need to know about the Solo 401(k) in plain English, helping you build a robust financial future.

What Exactly Is a Solo 401(k)?

Think of a Solo 401(k) as your very own, super-charged version of the 401(k) plans offered by large companies. It’s a retirement plan designed specifically for self-employed individuals and small business owners who have no full-time employees other than themselves (and potentially their spouse, if they also work for the business).

Unlike a traditional IRA or even a SEP IRA, the Solo 401(k) allows you to contribute to your retirement savings in two distinct ways:

- As an Employee: You can contribute up to the annual IRS limit (which changes yearly, so always check the latest figures) from your earnings. For 2024, this is up to $23,000, plus an additional catch-up contribution of $7,500 if you’re age 50 or older.

- As an Employer: Your business can also make a profit-sharing contribution on your behalf. This is typically up to 25% of your "net adjusted self-employment income" (or 25% of W-2 wages if your business is incorporated), up to a combined total limit for both employee and employer contributions.

This unique dual contribution structure is what makes the Solo 401(k) so powerful for maximizing your retirement savings.

Why Choose a Solo 401(k)? Key Benefits for Self-Employed Individuals

The Solo 401(k) isn’t just another retirement plan; it’s a strategic tool for wealth building. Here’s why it stands out:

-

High Contribution Limits (The #1 Advantage!)

As mentioned, you get to wear two hats: employee and employer. This allows for significantly higher annual contributions compared to other self-employed retirement options like a SEP IRA or a traditional IRA. You can potentially save tens of thousands of dollars more each year.

-

Significant Tax Advantages

Most contributions to a Solo 401(k) are tax-deductible, meaning they reduce your taxable income for the year. Your investments then grow tax-deferred until retirement, allowing your money to compound faster without being chipped away by annual taxes.

-

Optional Roth Contributions

Unlike some other self-employed plans, many Solo 401(k) providers offer a Roth Solo 401(k) option. This means you can make after-tax contributions, and then qualified withdrawals in retirement are completely tax-free. This provides excellent flexibility for tax planning, especially if you expect to be in a higher tax bracket in retirement.

-

Access to Your Money Through a Loan Provision

This is a unique feature of 401(k) plans that you won’t find with IRAs. Under certain circumstances, you can borrow up to 50% of your vested account balance (up to a maximum of $50,000) from your Solo 401(k). You repay yourself with interest, which goes back into your account. While not recommended for casual use, it offers a potential safety net.

-

Easy Rollover Flexibility

You can easily roll over funds from previous employer-sponsored retirement plans (like an old 401(k) or 403(b)) or even traditional IRAs into your Solo 401(k). This helps consolidate your retirement savings into one powerful, high-contribution vehicle.

-

Investment Control

You decide how your money is invested. Solo 401(k) plans typically offer a wide range of investment options, including stocks, bonds, mutual funds, ETFs, and even real estate or other alternative investments, depending on the plan provider.

Solo 401(k) Contribution Limits Explained

Understanding how much you can contribute is key to appreciating the power of this plan. The total contribution limit for a Solo 401(k) is the sum of your employee contribution and your employer contribution, capped at a maximum set by the IRS each year.

For 2024, the general combined limit is $69,000 ($76,500 if age 50 or older).

Let’s break down how you get there:

-

Employee Contributions (as a "salary deferral"):

- You can contribute 100% of your net self-employment earnings (or W-2 wages if incorporated) up to an annual maximum.

- For 2024, this maximum is $23,000.

- If you are age 50 or older, you can contribute an additional $7,500 as a "catch-up" contribution, bringing your employee contribution total to $30,500.

-

Employer Contributions (as a "profit-sharing" contribution):

- Your business can contribute up to 25% of your "net adjusted self-employment income" (which is your net earnings minus one-half of your self-employment taxes and the deductible portion of your self-employment health insurance premiums).

- If your business is structured as an S-Corp or C-Corp, this is generally 25% of your W-2 wages.

- This contribution is also tax-deductible for your business.

Example Scenario (Hypothetical for 2024):

Let’s say you’re a self-employed consultant under age 50, and your net self-employment income for the year is $100,000.

- Employee Contribution: You contribute the maximum allowed: $23,000

- Employer Contribution: Your business can contribute 25% of your eligible compensation. If we simplify and say your eligible compensation is $100,000, your employer contribution would be $100,000 * 0.25 = $25,000.

- Total Solo 401(k) Contribution: $23,000 (employee) + $25,000 (employer) = $48,000

This $48,000 goes into your retirement account, all growing tax-deferred, and potentially all deductible from your current year’s income! This significantly outpaces what you could contribute to a SEP IRA (which only allows employer contributions) or a traditional IRA.

Important Note: The exact calculation for your "net adjusted self-employment income" for the employer contribution can be a bit tricky. It’s always a good idea to consult with a tax professional or use a reliable online calculator to determine your precise contribution limits.

Traditional vs. Roth Solo 401(k): Which is Right for You?

Just like with regular IRAs, Solo 401(k)s often come with a choice between Traditional (pre-tax) and Roth (after-tax) contributions.

-

Traditional Solo 401(k) (Pre-Tax)

- Contributions: Made with pre-tax dollars. This means the money you contribute reduces your taxable income in the year you make the contribution.

- Growth: Investments grow tax-deferred. You don’t pay taxes on earnings until you withdraw them in retirement.

- Withdrawals in Retirement: Taxable as ordinary income.

- Best For: Individuals who expect to be in a higher tax bracket now than they will be in retirement. You get an immediate tax break.

-

Roth Solo 401(k) (After-Tax)

- Contributions: Made with after-tax dollars. You don’t get an immediate tax deduction for these contributions.

- Growth: Investments grow tax-free.

- Withdrawals in Retirement: Qualified withdrawals are completely tax-free.

- Best For: Individuals who expect to be in a higher tax bracket in retirement than they are now. You pay taxes upfront to enjoy tax-free income later. It’s also great if you want to diversify your tax exposure in retirement.

Key Point: While your employee contributions can be designated as either Traditional or Roth, the employer profit-sharing contributions must always be made on a pre-tax basis (Traditional). This means even if you opt for a Roth Solo 401(k), a portion of your contributions (the employer part) will still be pre-tax.

Who is Eligible for a Solo 401(k)?

The eligibility rules for a Solo 401(k) are quite straightforward:

- You must have self-employment income. This could be from a sole proprietorship, an LLC (single-member or multi-member, as long as the other members are owners), a partnership, or a corporation (S-Corp or C-Corp).

- You (and your spouse, if applicable) must be the only full-time employees of your business.

- This is the critical rule. If you have any full-time employees (other than yourself or your spouse), you are generally not eligible for a Solo 401(k) and would need to consider a traditional 401(k) or other small business retirement plans.

- What about part-time or seasonal employees? The IRS generally defines a "full-time employee" as someone who works 1,000 hours or more in a year. So, having part-time or seasonal help usually won’t disqualify you, as long as they don’t meet the 1,000-hour threshold.

In essence, if you’re a true "one-person show" or a husband-and-wife business, the Solo 401(k) is likely a perfect fit.

How to Open and Administer Your Solo 401(k)

Opening a Solo 401(k) isn’t as complicated as it might seem, but it does involve a few more steps than opening a traditional IRA.

-

Choose a Solo 401(k) Provider:

Many financial institutions offer Solo 401(k) plans. Look for providers that cater to self-employed individuals and offer:

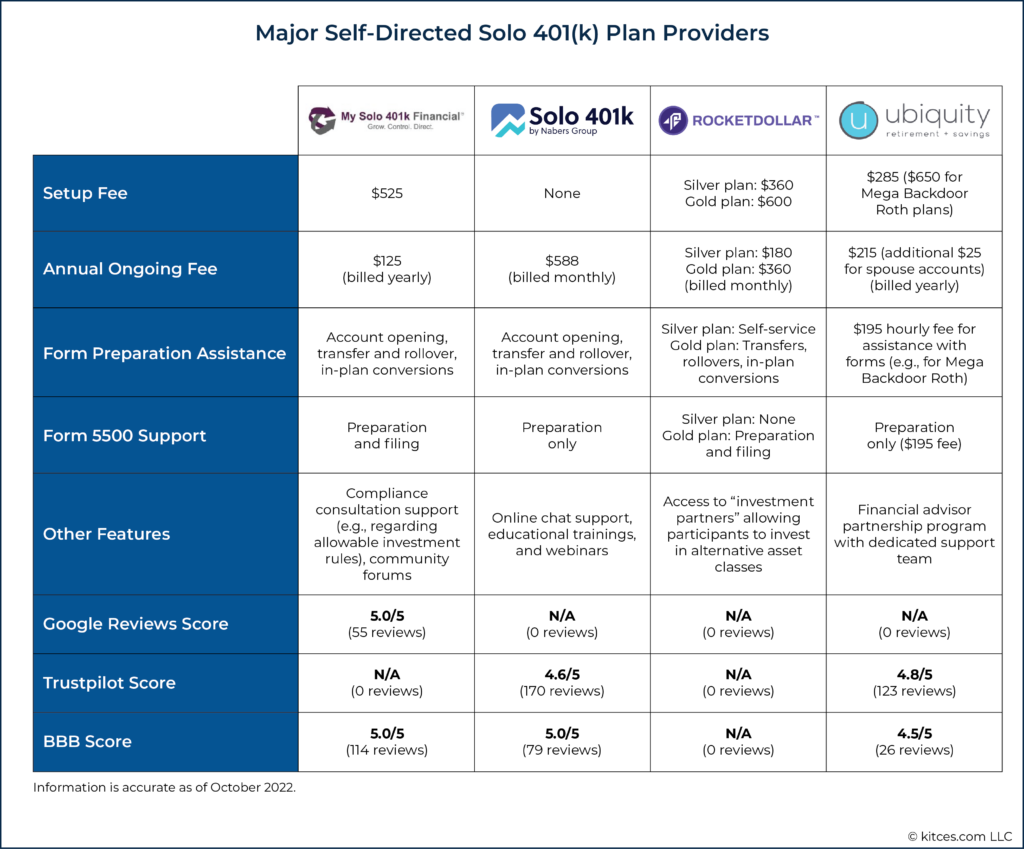

- Competitive fees (some are free, others charge annual administration fees).

- A wide range of investment options (brokerage accounts are common).

- Easy-to-use platform for contributions and managing investments.

- Good customer support.

- Examples of providers include Fidelity, Vanguard, Charles Schwab, E*TRADE, and specialized Solo 401(k) providers.

-

Complete the Application and Plan Documents:

The provider will guide you through this. You’ll typically need to:

- Provide your Employer Identification Number (EIN) for your business (you’ll need one even if you’re a sole proprietor without employees).

- Sign the plan adoption agreement, which outlines the rules of your specific Solo 401(k) plan.

- Set up a trust account for the plan (this is a legal requirement for 401(k)s).

-

Fund Your Account:

Once your account is set up, you can start making contributions.

- Employee contributions: These are typically transferred from your personal bank account or business account.

- Employer contributions: These come from your business bank account.

- Contribution Deadline: Contributions must generally be made by your tax filing deadline (including extensions) for the tax year in which you want to claim the deduction.

-

Invest Your Contributions:

Once funds are in the account, you’ll need to actively choose your investments within the plan. Don’t just let the money sit in cash!

-

Ongoing Administration (It’s Simpler Than It Sounds):

For most Solo 401(k)s, administration is minimal:

- Record Keeping: Keep good records of your contributions and any distributions.

- Form 5500-EZ: If your Solo 401(k) plan’s assets exceed $250,000 at the end of the year, you’ll need to file Form 5500-EZ with the IRS annually. Your plan provider might help with this, or you may need to do it yourself or hire an accountant. Below $250,000, no annual filing is typically required.

- Annual Contribution Limits: Stay aware of the IRS limits, which change annually, to ensure you don’t over-contribute.

Solo 401(k) vs. Other Retirement Plans for Self-Employed

It’s helpful to see how the Solo 401(k) stacks up against other popular retirement options for the self-employed:

-

Solo 401(k) vs. SEP IRA

- Contribution Limits: Solo 401(k) generally allows for much higher contributions because you can contribute as both employee and employer. SEP IRAs only allow employer contributions (up to 25% of compensation, capped at the same overall limit as the Solo 401(k) for employer contributions, but without the additional employee deferral).

- Flexibility: Solo 401(k) offers Roth contributions and loan provisions; SEP IRAs do not.

- Complexity: SEP IRAs are slightly simpler to set up and administer as they are just a type of IRA. Solo 401(k)s involve plan documents and potentially Form 5500-EZ.

- Verdict: For maximizing contributions, the Solo 401(k) is usually the winner if you have substantial self-employment income and no employees.

-

Solo 401(k) vs. SIMPLE IRA

- Contribution Limits: SIMPLE IRAs have significantly lower contribution limits (e.g., $16,000 in 2024, plus catch-up and mandatory employer contributions). Solo 401(k) limits are much higher.

- Eligibility: SIMPLE IRAs are designed for businesses with up to 100 employees and require mandatory employer contributions (either 2% of compensation for all eligible employees or a 3% matching contribution). Solo 401(k)s are for businesses with no full-time employees.

- Verdict: If you have a few employees you want to provide a retirement plan for, and you’re not ready for a full 401(k), a SIMPLE IRA might be an option. But for a single owner, the Solo 401(k) is superior in terms of contribution potential.

-

Solo 401(k) vs. Traditional/Roth IRA

- Contribution Limits: IRAs have much lower annual contribution limits ($7,000 in 2024, plus catch-up). Solo 401(k) limits are vastly higher.

- Tax Benefits: Both offer tax benefits, but the scale is different due to the contribution limits.

- Verdict: While IRAs are a great starting point, a Solo 401(k) is the next level up for serious self-employed retirement savers who want to maximize their tax-advantaged contributions. You can (and often should) have both!

Common Solo 401(k) Questions Answered

-

What if I hire full-time employees later?

If your business grows and you hire full-time employees (other than your spouse), your Solo 401(k) will need to be converted into a traditional 401(k) that covers all eligible employees. This means you’ll need to either expand your existing plan or roll the funds into a new, compliant plan. This isn’t a penalty, just a natural progression as your business scales.

-

Can I have a Solo 401(k) and a 401(k) from another job?

Yes! If you have a W-2 job in addition to your self-employment, you can contribute to both. However, your employee contribution limit ($23,000 for 2024, or $30,500 if age 50+) applies across all 401(k) plans you participate in. Your employer contribution from your Solo 401(k) is separate and does not count against this limit.

-

Are there fees associated with a Solo 401(k)?

Yes, there can be. Some providers offer free Solo 401(k)s (like Vanguard or Fidelity), while others, especially those that offer "checkbook control" or alternative investments, may charge annual administration fees (ranging from a few hundred to over a thousand dollars). Always compare fees and services when choosing a provider.

-

What are the rules for withdrawing money from a Solo 401(k)?

Withdrawals are generally subject to the same rules as traditional 401(k)s. You can typically begin penalty-free withdrawals at age 59½. Withdrawals before this age may be subject to a 10% early withdrawal penalty, plus income taxes, unless an exception applies (e.g., disability, certain medical expenses, or the loan provision mentioned earlier). Required Minimum Distributions (RMDs) typically begin at age 73.

Conclusion: Your Path to a Powerful Retirement

The Solo 401(k) is an incredibly powerful tool for self-employed individuals looking to take control of their retirement savings and maximize their tax advantages. By allowing you to contribute as both an employee and an employer, it offers contribution limits that far exceed most other options, enabling you to build substantial wealth for your future.

While it requires a bit more setup and understanding than a simple IRA, the benefits of the Solo 401(k) – including higher limits, potential Roth contributions, and loan provisions – make it well worth the effort.

Don’t let the freedom of self-employment come at the cost of your retirement security. Take the reins of your financial future and explore how a Solo 401(k) can transform your savings strategy. Consult with a financial advisor or tax professional to determine if a Solo 401(k) is the right fit for your unique business and financial goals, and start building the retirement you deserve.

Post Comment