What is a Market? Your Comprehensive Guide to Understanding Market Types and Functions

Have you ever bought a cup of coffee, searched for a new job, or invested in stocks? If so, you’ve participated in a market! Far from just being a physical place like a bustling street fair, a "market" is a fundamental concept that underpins almost every economic activity in our daily lives.

In this comprehensive guide, we’ll break down what a market truly is, explore its various types, and understand the crucial functions it performs in our economy. Whether you’re a student, an aspiring entrepreneur, or just curious about how the world works, this article will provide you with a clear, easy-to-understand foundation.

What Exactly IS a Market? (More Than Just a Place!)

At its simplest, a market is any place or system where buyers and sellers interact to exchange goods, services, or assets. It’s the mechanism that facilitates trade and allows people to get what they need or want, and for producers to offer what they have.

Think of it less as a building and more as a meeting point – whether virtual or physical – where:

- Demand (what buyers want and are willing to pay for) meets Supply (what sellers have and are willing to offer).

- Prices are determined through the negotiation and interaction between these two forces.

- Transactions occur, leading to the exchange of value.

Key Elements of Any Market:

- Buyers (Demand Side): Individuals, households, businesses, or governments who want to purchase goods or services.

- Sellers (Supply Side): Individuals, businesses, or organizations who offer goods or services for sale.

- Goods/Services/Assets: The items being traded. This could be anything from a loaf of bread to a complex financial derivative.

- Price: The value or cost at which the exchange takes place.

- Interaction: The communication and negotiation (direct or indirect) between buyers and sellers that leads to a transaction.

Why Are Markets So Important?

Markets are the engines of economic activity. They allow for:

- Specialization: Individuals and businesses can focus on producing what they do best, knowing they can acquire other goods and services from the market.

- Efficiency: Competition in markets often drives producers to be more efficient, offering better quality or lower prices.

- Innovation: The desire to gain a competitive edge encourages businesses to develop new and improved products and services.

- Resource Allocation: Markets help direct resources (labor, capital, raw materials) to where they are most needed and valued.

Diving Deeper: Types of Markets

Markets can be categorized in many ways, depending on what’s being traded, their physical presence, or the level of competition. Let’s explore some common types:

1. By Physical Presence:

-

Physical Markets (Traditional/Brick-and-Mortar):

- These are markets you can physically visit.

- Examples: Local farmers’ markets, supermarkets, shopping malls, car dealerships, stock exchanges (where traders meet on a floor).

- Characteristics: Direct interaction, tangible products, often local or regional in scope.

-

Online Markets (Digital/Virtual):

- These operate entirely on the internet, connecting buyers and sellers globally.

- Examples: E-commerce websites (Amazon, eBay), online service platforms (Uber, Airbnb), digital marketplaces for apps, music, or e-books.

- Characteristics: Global reach, convenience, 24/7 access, lower overhead costs for sellers, often less direct personal interaction.

2. By What’s Being Traded:

-

Product Markets (Goods & Services Markets):

- The most common type, where everyday goods and services are bought and sold.

- Examples: Grocery stores selling food, clothing boutiques selling apparel, restaurants selling meals, consulting firms selling advice, barbershops selling haircuts.

- Focus: The final consumption goods and services.

-

Financial Markets:

- Where financial assets are bought and sold. These markets facilitate capital formation and investment.

- Examples:

- Stock Market: Where shares of company ownership (stocks) are traded.

- Bond Market: Where debt securities (bonds) are issued and traded.

- Foreign Exchange (Forex) Market: Where currencies are exchanged.

- Derivatives Market: Where financial instruments whose value is derived from other assets are traded.

- Focus: The exchange of money, credit, and investments.

-

Labor Markets:

- Where individuals offer their skills and labor in exchange for wages, and employers seek to hire workers.

- Examples: Job boards (LinkedIn, Indeed), recruitment agencies, university career fairs, direct hiring by companies.

- Focus: Employment and human capital.

-

Commodity Markets:

- Where raw materials and primary agricultural products are bought and sold.

- Examples: Markets for oil, gold, silver, wheat, coffee, sugar.

- Focus: Standardized, undifferentiated products often used as inputs for other goods.

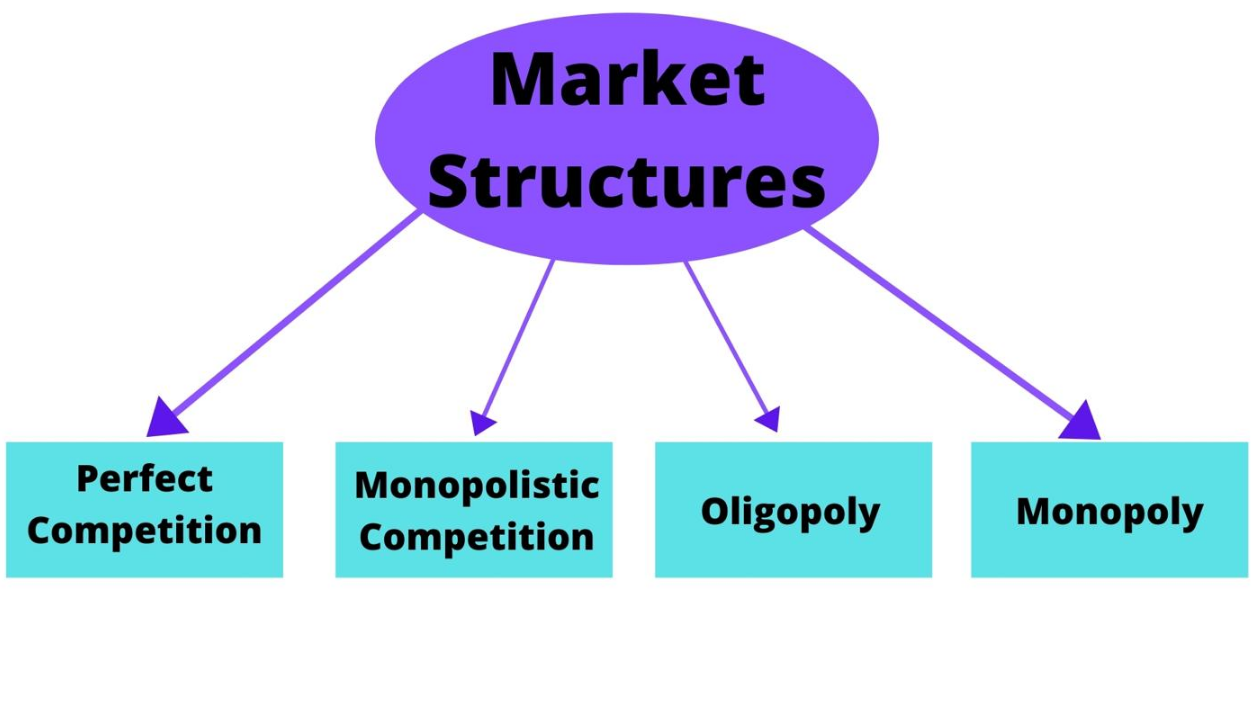

3. By Market Structure (Level of Competition):

This classification depends on the number of buyers and sellers, the ease of entry and exit, and the nature of the product.

-

Perfect Competition:

- Characteristics: Many buyers and sellers, identical products, free entry and exit, perfect information.

- Outcome: No single buyer or seller can influence prices. Prices are determined purely by supply and demand.

- Reality: A theoretical ideal; rarely seen in its purest form, but some agricultural markets (e.g., specific crops) come close.

-

Monopolistic Competition:

- Characteristics: Many sellers, differentiated products (products are similar but have unique features or branding), relatively easy entry and exit.

- Outcome: Sellers have some control over their prices due to product differentiation.

- Examples: Restaurants, clothing brands, hair salons, many consumer goods (e.g., different brands of shampoo).

-

Oligopoly:

- Characteristics: A few large sellers dominate the market, high barriers to entry, products can be identical or differentiated.

- Outcome: Sellers are highly interdependent; one firm’s actions significantly affect others. Often leads to strategic pricing and non-price competition.

- Examples: Automobile industry, telecommunications companies, major airlines, soft drink manufacturers.

-

Monopoly:

- Characteristics: Only one seller, unique product with no close substitutes, very high barriers to entry.

- Outcome: The single seller has significant control over price and supply.

- Examples: Historically, public utilities like water or electricity companies (often regulated by government). Some patented drugs for rare diseases.

The Core Functions of a Market

Beyond just facilitating transactions, markets perform several vital functions that are essential for a functioning economy:

-

Price Discovery:

- How it works: Through the interaction of buyers and sellers, and the forces of supply and demand, markets determine the equilibrium price at which goods and services will be exchanged.

- Importance: Prices act as signals. High prices indicate scarcity or high demand, encouraging more production. Low prices suggest abundance or low demand, discouraging production.

-

Resource Allocation:

- How it works: By providing price signals, markets guide resources (labor, capital, raw materials) to where they are most efficiently used and where demand is highest. Firms allocate resources to produce goods and services that consumers are willing to pay for.

- Importance: Prevents waste and ensures that society’s limited resources are used to satisfy the most pressing needs and wants.

-

Distribution of Goods and Services:

- How it works: Once goods and services are produced, markets provide the channels through which they are distributed from producers to consumers.

- Importance: Ensures that products reach the people who need them and are willing and able to pay for them.

-

Efficiency and Innovation:

- How it works: Competition within markets incentivizes firms to produce goods and services at the lowest possible cost (efficiency) and to constantly improve their offerings or create new ones (innovation) to attract customers.

- Importance: Leads to better quality products, more choices, and lower prices over time, benefiting consumers.

-

Information Dissemination:

- How it works: Markets act as vast information networks. Prices convey information about scarcity and value. Sales figures indicate consumer preferences.

- Importance: This information helps producers make decisions about what to produce and how much, and helps consumers make informed purchasing choices.

The Role of Government in Markets

While markets are powerful, they don’t always operate perfectly. Governments often play a role in:

- Regulation: Setting rules to ensure fair competition, protect consumers, and prevent monopolies.

- Providing Public Goods: Supplying goods and services that markets might under-provide (e.g., national defense, public parks).

- Addressing Market Failures: Intervening when markets fail to allocate resources efficiently (e.g., pollution, information asymmetry).

- Stabilization: Using fiscal and monetary policies to manage economic fluctuations.

Conclusion: Markets Are Everywhere!

From the simplest transaction at a roadside stall to the complex global movements of capital, markets are an intricate and indispensable part of our lives. They are not just physical locations but dynamic systems of interaction, driven by the fundamental forces of supply and demand.

Understanding "what is a market?" and its various types and functions provides a crucial lens through which to view the economy, business, and even our own daily choices. The next time you buy, sell, or simply observe an economic exchange, you’ll now recognize the powerful, invisible hand of the market at work.

Frequently Asked Questions (FAQs) about Markets

Q1: What is a market in simple words?

A1: A market is essentially any place or system where buyers and sellers meet to exchange goods, services, or assets for money. It’s where "demand" (what people want to buy) meets "supply" (what people want to sell) to determine prices.

Q2: What are the 3 main types of markets?

A2: While markets can be classified in many ways, three broad categories are:

- Product Markets: Where everyday goods and services are traded (e.g., food, clothes, haircuts).

- Financial Markets: Where financial assets like stocks, bonds, and currencies are exchanged.

- Labor Markets: Where people offer their skills and time for work, and employers seek employees.

Q3: What is the main function of a market?

A3: The main function of a market is price discovery and resource allocation. It helps determine the value of goods and services, and guides where resources (like labor and materials) should be directed in the economy based on supply and demand.

Q4: Is a market always a physical place?

A4: No, a market is not always a physical place. While traditional markets (like a farmers’ market) are physical, many modern markets are entirely digital or virtual, such as online shopping websites (Amazon) or stock trading platforms.

Q5: What is the difference between a market economy and a command economy?

A5: In a market economy, decisions about what to produce, how to produce it, and for whom are primarily made by individual buyers and sellers interacting in markets. In a command economy, these decisions are largely made by a central government.

Post Comment