Unemployment Rate Spikes: A Post-Crisis Indicator – Understanding the Economic Rollercoaster

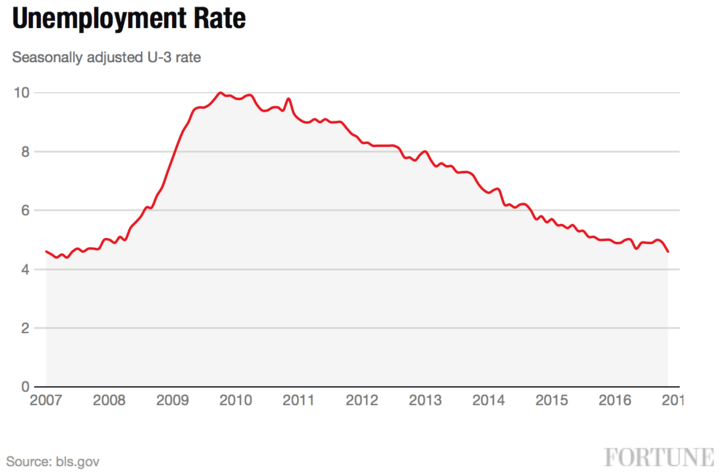

Imagine the economy as a vast, interconnected machine. When a major crisis hits – be it a financial meltdown, a global pandemic, or a natural disaster – this machine grinds to a halt. Businesses close, jobs are lost, and the unemployment rate skyrockets. But what happens after the immediate crisis subsides, as the economy tries to pick itself back up? Often, we see another peculiar phenomenon: unemployment rate spikes.

While an initial spike during a crisis is easy to understand, subsequent spikes after the worst seems over can be confusing, even alarming. Are we heading for another downturn? Or is this just a normal, albeit counter-intuitive, part of the healing process?

This article will break down why unemployment rates can spike post-crisis, what these spikes really mean, and how to interpret them as a crucial indicator of our economic journey. We’ll make it easy to understand, even if you’re new to economic concepts.

What Exactly is the Unemployment Rate? (The Basics)

Before we dive into spikes, let’s quickly define what the unemployment rate is. It’s one of the most talked-about economic indicators, and for good reason!

The unemployment rate is simply the percentage of the total labor force that is unemployed but actively seeking employment and available to work.

Let’s break that down:

- Labor Force: This isn’t everyone in the country. It includes people who are employed and those who are unemployed but actively looking for work. It generally excludes people under 16, retirees, full-time students, stay-at-home parents, and those who are institutionalized (like in prison).

- Unemployed: To be counted as unemployed, you must meet three criteria:

- You don’t have a job.

- You’ve been actively looking for work in the past four weeks.

- You are currently available to start a job.

Why does it matter? A low unemployment rate generally means the economy is healthy, businesses are hiring, and people have jobs and money to spend. A high rate means the opposite: fewer jobs, more competition, and less consumer spending, which can slow down the entire economy.

Why Do Unemployment Rates Spike After a Crisis?

This is the core question. It seems counter-intuitive, right? If the crisis is over, shouldn’t things just get better? The reality is more complex, and there are several key reasons why these post-crisis spikes occur:

1. The "Lag Effect" of Business Recovery

Think of a massive ship turning around. It doesn’t happen instantly. The economy is similar.

- Initial Shock: During the crisis, businesses cut costs drastically, often laying off workers to survive. They might reduce production, close stores, or simply pause operations.

- Cautious Reopening: As the crisis subsides, businesses don’t immediately rehire everyone. They are cautious. They want to see if demand truly returns, if supply chains are stable, and if economic conditions are sustainable. They might start with fewer staff, temporary workers, or increased automation.

- Delayed Hiring: This caution means that even as the economy slowly improves, the demand for labor (jobs) lags behind. It can take months, or even a year or more, for businesses to feel confident enough to start rehiring on a large scale. This delay can contribute to a prolonged period of high unemployment, which might look like a spike if other factors are at play.

2. The "Discouraged Worker" Effect Reversing

This is one of the most significant and often misunderstood reasons for post-crisis spikes, and it can actually be a sign of improving confidence!

- During the Crisis: When jobs are scarce and the future looks bleak, many people who lose their jobs become "discouraged workers." They stop actively looking for work because they believe there are no jobs available for them. Remember, to be counted as unemployed, you must be actively looking. So, these discouraged workers are not counted in the unemployment rate. This can actually make the unemployment rate look better than the reality during the depths of a crisis.

- Post-Crisis Resurgence: As the economy starts to show signs of life – perhaps some businesses reopen, or there’s positive news – these discouraged workers regain hope. They start actively searching for jobs again.

- The Spike: When these previously discouraged workers re-enter the labor force and start looking for jobs (but haven’t found one yet), they are now counted as unemployed. If a large number of people do this at once, it can cause the unemployment rate to spike, even though it’s a sign that people are feeling more optimistic about their job prospects!

Think of it like this: If 100 people are looking for jobs and 10 are unemployed (10% unemployment). If 50 people get so discouraged they stop looking, now only 50 are in the labor force, and 10 are unemployed (20% unemployment, but fewer people looking!). When the 50 discouraged people start looking again, the labor force goes back to 100. If those 50 haven’t found jobs yet, the unemployment number jumps to 60 (60% unemployment!), even though the economy is improving enough for them to start looking.

3. Structural Shifts and Automation Acceleration

Crises often act as a catalyst, speeding up changes that were already underway in the economy.

- Automation: Businesses might invest more in technology and automation during a crisis to reduce reliance on human labor, cut costs, or operate with fewer staff. This means some jobs might not come back, or new jobs require different skills.

- Industry Shifts: Certain industries might be permanently impacted or shrink (e.g., brick-and-mortar retail facing e-commerce acceleration, or specific travel sectors). New industries might emerge, but the skills required might not match the available workforce immediately.

- Skill Mismatch: If the jobs that are created don’t align with the skills of the unemployed workforce, it can lead to prolonged unemployment for some groups, even as other sectors thrive. This "mismatch" can keep the overall unemployment rate higher for longer.

4. The End of Government Support Programs

During a crisis, governments often implement massive aid programs to cushion the blow. This can include:

- Unemployment Benefits: Extended and increased unemployment benefits can reduce the immediate pressure to find a job, allowing people to be more selective.

- Business Subsidies: Programs to keep businesses afloat (e.g., payroll protection programs) prevent immediate layoffs.

As the crisis subsides, these programs are often phased out.

- Increased Job Seeking: When enhanced benefits end, people have a greater financial incentive to actively search for work, again contributing to the "discouraged worker effect reversing" as more people re-enter the labor force and are counted as unemployed while searching.

- Business Adjustments: As subsidies end, some businesses might have to make tough decisions, potentially leading to a new wave of smaller layoffs if they haven’t fully recovered to sustainable profitability.

What Does a Post-Crisis Unemployment Spike Mean for You?

Understanding these spikes is crucial because they aren’t always a sign of impending doom. Here’s what they can mean:

- For Job Seekers:

- More Competition (Initially): If the spike is due to more people re-entering the labor force, you’ll face more competition for available jobs.

- Opportunity (Eventually): However, the fact that people are looking again, and businesses are slowly recovering, means that the job market is starting to thaw. Patience and adaptability (learning new skills) are key.

- For Businesses:

- Labour Availability: A higher unemployment rate means more available workers, which can be good for hiring.

- Consumer Caution: However, if a spike reflects genuine job losses or widespread caution, consumer spending might remain subdued, impacting your sales.

- For Consumers/The Public:

- Mixed Signals: It means you need to look beyond just the headline number. Is the spike due to discouraged workers re-entering (a good sign of confidence)? Or is it due to a new wave of layoffs (a more concerning sign)?

- Economic Patience: Recovery is rarely a straight line. There will be bumps along the way. These spikes are often part of that bumpy but ultimately upward journey.

Beyond the Headline: Other Indicators to Watch

Because the unemployment rate can be misleading in the post-crisis phase, economists and analysts look at a range of other data points to get a clearer picture of the job market and the broader economy:

- Labor Force Participation Rate: This measures the percentage of the working-age population that is either employed or actively looking for work. If this rate is rising alongside the unemployment rate, it strongly suggests the "discouraged worker" effect reversing, which is a positive sign.

- Initial Jobless Claims: This tracks the number of people filing for unemployment benefits for the first time each week. A consistent decline in these claims is a strong positive signal that layoffs are slowing down.

- Continuing Jobless Claims: This measures the number of people who are continuing to receive unemployment benefits. A decline here indicates that people are finding jobs and moving off unemployment rolls.

- Wage Growth: Are wages increasing? If demand for labor is truly picking up, employers will have to offer higher wages to attract and retain workers. Stagnant or declining wages, even with a stable unemployment rate, can signal underlying weakness.

- Job Openings (JOLTS data in the US): This data shows how many jobs employers are trying to fill. A high number of job openings, especially relative to the number of unemployed people, suggests a healthy demand for labor.

- Consumer Confidence: If people feel secure in their jobs and optimistic about the future, they are more likely to spend, which fuels economic growth.

- Gross Domestic Product (GDP) Growth: This measures the total value of goods and services produced in an economy. Sustained GDP growth is essential for creating new jobs.

By looking at these indicators together, we can get a much more nuanced and accurate understanding of where the economy stands and where it’s headed.

The Road Ahead: Navigating the Recovery

Unemployment rate spikes in a post-crisis environment are a complex phenomenon. They are often a sign of the economy adjusting, people regaining confidence, and structural changes taking root. While they can be unsettling, they are not always indicative of a fresh downturn.

- Patience is Key: Economic recoveries are rarely swift or smooth. They involve periods of adjustment, re-skilling, and rebuilding.

- Adaptability for Individuals: For workers, this means being open to new industries, acquiring new skills, and understanding that some jobs may not return in their previous form.

- Strategic Planning for Businesses: For businesses, it means being agile, investing in the future, and understanding the evolving needs of the workforce and consumers.

- Thoughtful Policy: Governments play a crucial role in supporting the transition, whether through unemployment benefits, job training programs, or investment in new technologies.

By understanding the dynamics behind these post-crisis unemployment spikes, we can move beyond the initial alarm and interpret them as vital, albeit sometimes confusing, signposts on the path to economic recovery. It’s a reminder that the journey back to full health is a marathon, not a sprint, and often includes a few unexpected climbs along the way.

Post Comment