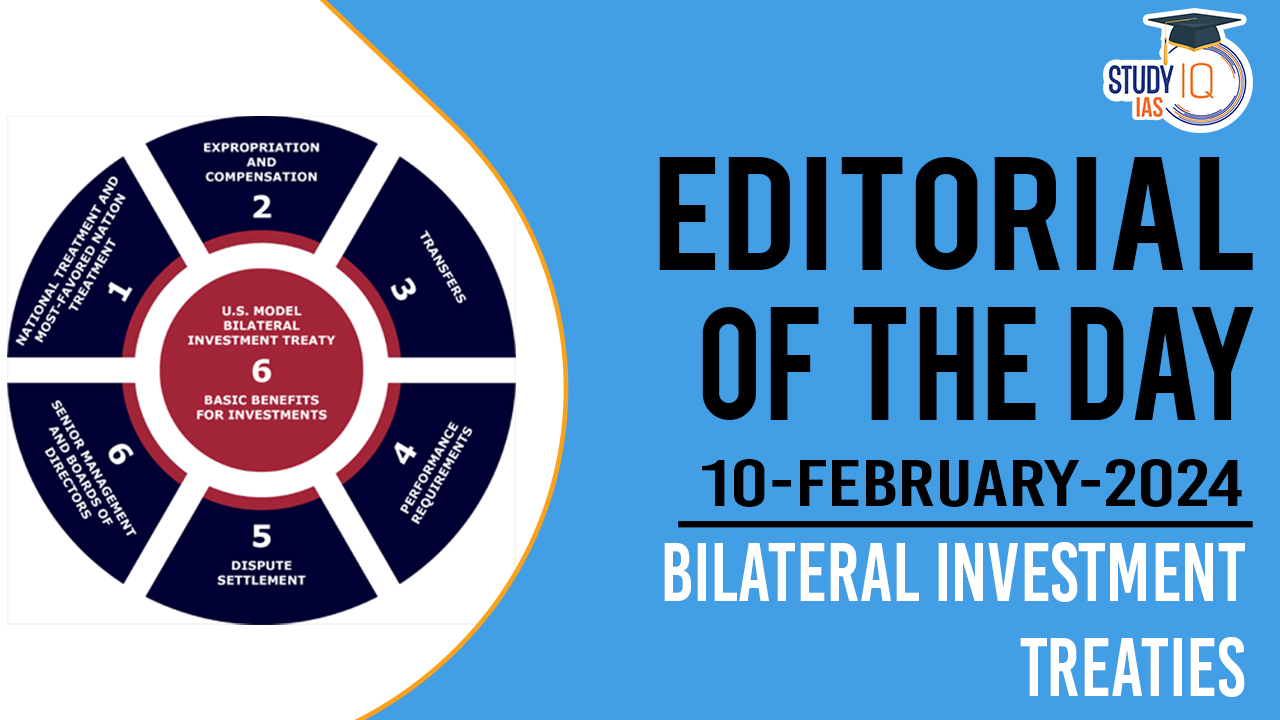

Bilateral Investment Treaties (BITs): Protecting Foreign Investments – A Beginner’s Guide

In today’s interconnected global economy, businesses are constantly looking beyond their borders for new opportunities. Investing in foreign countries, known as Foreign Direct Investment (FDI), can bring immense benefits – from creating jobs and fostering innovation to boosting economic growth. However, international waters can be choppy, and investing abroad comes with its own unique set of risks. What if a foreign government suddenly changes its laws, unfairly seizes assets, or prevents profits from being sent home?

This is where Bilateral Investment Treaties (BITs) come into play. Often hailed as the "international insurance policies" for foreign investors, BITs are crucial agreements designed to provide a stable, predictable, and fair environment for investments across borders.

In this comprehensive guide, we’ll break down what BITs are, why they matter, the protections they offer, and how they help safeguard the global economy.

What Exactly Are Bilateral Investment Treaties (BITs)?

At its core, a Bilateral Investment Treaty (BIT) is an agreement signed between two countries. Think of it as a special contract that lays down the rules for how investments from one country’s citizens or companies will be treated by the other country’s government.

- Bilateral: Means "between two." So, a BIT is always an agreement between two specific nations (e.g., the United States and Vietnam, or Germany and Argentina).

- Investment: Refers to various types of assets, including money, property, shares in companies, intellectual property (like patents and trademarks), and contractual rights.

- Treaty: Signifies a formal, legally binding agreement under international law.

The primary goal of a BIT is to promote and protect foreign investments made by investors from one treaty country into the territory of the other. By establishing clear standards and a mechanism for dispute resolution, BITs aim to make foreign investment safer and more attractive.

Who Signs Them?

Almost every country in the world has signed at least one BIT. Developed nations, as major capital exporters, often sign BITs to protect their companies investing abroad. Developing nations, seeking to attract foreign capital for their economic development, also eagerly sign BITs to signal their commitment to a safe investment climate.

Why Are BITs So Important? The Benefits for All

BITs aren’t just pieces of paper; they are vital tools that bring tangible benefits to both investors and the countries hosting investments.

For Foreign Investors: Confidence and Security

Imagine pouring millions into a factory in a new country. Without clear rules, you’re at the mercy of that country’s political whims or sudden policy changes. BITs provide a safety net:

- Reduced Risk: BITs significantly lower the political and regulatory risks associated with investing abroad. Investors know their rights are protected.

- Predictability: They create a more stable and predictable legal environment, allowing investors to make long-term plans with greater certainty.

- Fair Treatment: Investors are assured that they will be treated fairly and not discriminated against compared to local businesses or investors from other countries.

- Recourse for Disputes: If something goes wrong, BITs provide a neutral, international way to resolve disputes, rather than relying solely on the host country’s potentially biased court system.

For Host Countries: Attracting Investment and Economic Growth

While BITs protect investors, they also serve the strategic interests of the countries hosting the investments:

- Attracting FDI: By signing BITs, countries signal to the world that they are committed to protecting foreign investors, making them more attractive destinations for foreign capital.

- Economic Development: Increased FDI brings capital, technology, management expertise, and job creation, all of which are crucial for economic growth and development.

- Enhanced Reputation: Adhering to international investment standards through BITs can boost a country’s reputation on the global stage, fostering trust and long-term economic partnerships.

- Legal Clarity: BITs can also help host countries by providing a framework for their own investment laws, promoting good governance and transparency.

Key Protections Offered by BITs: Your Investment Shield

BITs typically contain a standard set of core protections that aim to prevent host governments from taking actions that could harm foreign investments. Let’s break down some of the most common and crucial provisions:

-

Fair and Equitable Treatment (FET):

- What it means: This is one of the most frequently invoked provisions. It requires the host country to treat foreign investors and their investments fairly and justly, in line with international law.

- In simple terms: Governments can’t act arbitrarily, discriminatorily, or in a way that creates a hostile or unpredictable business environment. It protects against actions like lack of transparency, denial of justice, or harassment.

-

Full Protection and Security (FPS):

- What it means: This clause obligates the host country to provide physical and legal protection to foreign investments.

- In simple terms: It ensures that the government takes necessary measures to protect the investor’s assets from physical harm (e.g., from riots or civil unrest) and also provides legal security, meaning a stable and predictable legal framework.

-

National Treatment (NT):

- What it means: The host country must treat foreign investors and their investments no less favorably than it treats its own domestic investors in similar circumstances.

- In simple terms: Foreign companies shouldn’t be put at a disadvantage compared to local companies just because they’re foreign. If a local company gets tax breaks, a foreign company should too, under similar conditions.

-

Most-Favored Nation (MFN):

- What it means: The host country must treat investors from the other treaty country no less favorably than it treats investors from any third country.

- In simple terms: If Country A gives a better deal (e.g., a special permit or a more favorable regulation) to investors from Country C, it must also extend that same better deal to investors from Country B, if Country A has an MFN clause in its BIT with Country B. It ensures no country’s investors are left out of the best treatment offered.

-

Protection Against Expropriation:

- What it means: This is a cornerstone of investment protection. It prevents a host government from taking an investor’s property without proper compensation.

- In simple terms: A government cannot nationalize or seize a foreign company’s assets (like a factory or land) unless four strict conditions are met:

- It’s for a public purpose (e.g., building a road).

- It’s done in a non-discriminatory way.

- It’s done with due process of law.

- Crucially: It must be accompanied by "prompt, adequate, and effective compensation" at fair market value.

- Direct vs. Indirect Expropriation:

- Direct: The government directly takes ownership of the asset.

- Indirect: The government doesn’t take ownership, but its actions (e.g., extreme regulatory changes, excessive taxes) effectively deprive the investor of the use or value of their investment, making it worthless. BITs protect against both.

-

Free Transfer of Funds:

- What it means: Investors should be able to freely transfer their capital, profits, dividends, royalties, and other earnings out of the host country without undue restrictions or delays.

- In simple terms: You can get your money out when you need to, without the government blocking or excessively taxing it.

-

Umbrella Clause (Less Common, but Important):

- What it means: This clause obliges the host state to observe any obligations it has entered into with an investor regarding their investment.

- In simple terms: It "umbrellas" any separate contracts or agreements between the government and the investor under the BIT, making a breach of contract also a breach of the treaty.

How Are Disputes Resolved? Investor-State Dispute Settlement (ISDS)

One of the most powerful and unique features of BITs is the mechanism for Investor-State Dispute Settlement (ISDS). This provision allows a foreign investor to directly sue a host government if they believe their rights under the BIT have been violated.

- Direct Access: Instead of going through the host country’s domestic courts (which can be slow, biased, or unfamiliar), the investor can initiate an international arbitration process.

- Neutral Forum: Disputes are typically resolved by independent, impartial arbitrators, often chosen from lists provided by international institutions like:

- ICSID (International Centre for Settlement of Investment Disputes): Part of the World Bank, it’s the most common forum for investment disputes.

- UNCITRAL (United Nations Commission on International Trade Law): Provides procedural rules for ad hoc (one-off) arbitrations.

- Stockholm Chamber of Commerce (SCC) or International Chamber of Commerce (ICC): Other popular arbitration centers.

- Binding Decisions: The decisions (known as "awards") made by these arbitration tribunals are legally binding on both the investor and the host state. They can be enforced in most countries around the world.

Why is ISDS so important? It levels the playing field. Without ISDS, a powerful government could potentially ignore its obligations, leaving a foreign investor with little recourse. ISDS provides a credible and enforceable pathway for justice.

The Ongoing Debate: Pros and Cons of BITs

While BITs have been instrumental in fostering global investment, they are also subjects of intense debate and scrutiny.

Arguments In Favor (Pros):

- Promotes Rule of Law: Encourages governments to adopt more transparent, stable, and predictable legal frameworks.

- Boosts Economic Growth: Directly facilitates FDI, which is a major engine for economic development, job creation, and technology transfer.

- Reduces Political Risk: Provides a crucial safety net for investors, making challenging markets more accessible.

- Depoliticizes Disputes: Allows commercial disputes to be handled by legal means rather than escalating into diplomatic or political crises between states.

- Ensures Accountability: Holds governments accountable for their international commitments to investors.

Arguments Against (Cons/Criticisms):

- Sovereignty Concerns: Critics argue that ISDS mechanisms infringe on a country’s right to regulate in the public interest (e.g., environmental protection, public health) if such regulations negatively impact a foreign investment.

- "Regulatory Chill": Governments might hesitate to enact legitimate public policies for fear of being sued by investors under a BIT, leading to a "chilling effect" on necessary reforms.

- Lack of Transparency: Historically, ISDS proceedings have been private, leading to calls for greater transparency in documents and hearings.

- Cost and Fairness: ISDS cases can be extremely expensive, favoring large corporations over smaller investors or less wealthy states. Concerns also exist about the consistency and fairness of arbitral awards.

- Investor Obligations: BITs primarily focus on the rights of investors, with fewer explicit provisions for investor obligations (e.g., regarding environmental standards or labor rights).

The Future of BITs: Evolution and Reform

Recognizing the criticisms, the landscape of BITs is evolving. Many countries are reviewing their existing treaties and negotiating "next-generation" BITs that aim to strike a better balance between protecting investors and preserving a state’s right to regulate.

Key areas of reform include:

- Increased Transparency: Making arbitral proceedings and documents more public.

- Clarified Protections: Refining definitions of "Fair and Equitable Treatment" and "indirect expropriation" to reduce ambiguity and prevent overly broad interpretations.

- Sustainable Development: Integrating provisions related to environmental protection, labor rights, and corporate social responsibility.

- Appellate Mechanisms: Exploring options for an appeal process for ISDS awards to ensure consistency and correctness.

- Investment Courts: Some new agreements (like those of the EU) propose a permanent investment court system instead of ad hoc arbitration tribunals.

Conclusion: BITs – A Cornerstone of Global Investment

Bilateral Investment Treaties, despite their complexities and ongoing debates, remain a fundamental pillar of the international investment regime. They serve as essential legal instruments that bridge the gap between sovereign power and private enterprise, providing a crucial framework for protecting foreign investments.

For businesses looking to expand globally, understanding BITs is not just an academic exercise – it’s a strategic necessity. These treaties offer a vital layer of protection, fostering the confidence needed to invest across borders, create jobs, and drive economic prosperity worldwide. As the global economy continues to evolve, so too will BITs, adapting to ensure a more balanced and sustainable future for international investment.

Post Comment