How to Create an Effective Business Budget from Scratch: Your Beginner’s Guide to Financial Clarity

Starting a business is an exciting adventure, full of big dreams and even bigger potential. But whether you’re just launching your entrepreneurial journey or have been operating for a while without a clear financial roadmap, one tool is absolutely non-negotiable for success: an effective business budget.

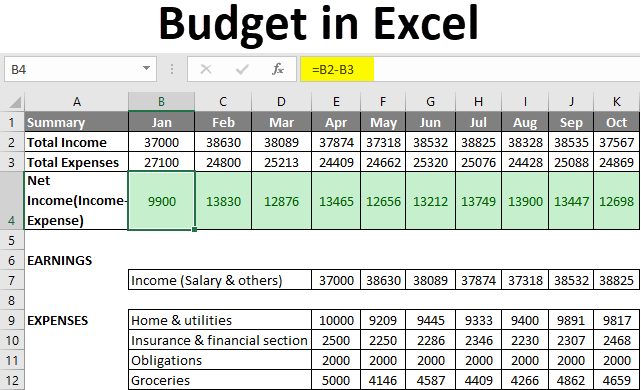

For many, the word "budget" conjures images of complex spreadsheets, daunting numbers, and restrictive rules. But here’s the truth: a budget is simply your business’s financial plan. It’s a powerful tool that gives you clarity, helps you make smart decisions, and ultimately steers your business towards profitability and sustainable growth. And the best part? You can absolutely create one from scratch, even if you’re a complete beginner.

This comprehensive guide will walk you through every step of building a robust business budget, using easy-to-understand language, practical examples, and actionable advice. Get ready to take control of your financial future!

Why a Business Budget is Your Best Friend (Not a Financial Foe)

Before we dive into the "how," let’s quickly understand the "why." Why should you invest your time in creating and maintaining a business budget?

- Gain Financial Clarity: A budget provides a clear snapshot of where your money is coming from and where it’s going. No more guessing games!

- Make Informed Decisions: Knowing your financial limits and opportunities empowers you to make smarter choices about hiring, marketing, inventory, and investments.

- Spot Problems Early: A budget acts as an early warning system. If expenses are creeping up or revenue is falling short, your budget will highlight it, allowing you to take corrective action before it’s too late.

- Achieve Financial Goals: Whether it’s saving for a new piece of equipment, expanding your team, or simply increasing your profit margins, a budget helps you set and achieve specific financial targets.

- Secure Funding: Lenders and investors want to see a well-thought-out financial plan. A solid budget demonstrates your financial responsibility and foresight, increasing your chances of securing loans or investments.

- Minimize Debt: By understanding your cash flow, you can avoid unnecessary borrowing and manage existing debt more effectively.

Before You Start: Gathering Your Tools and Information

You don’t need fancy software to start. A simple spreadsheet (like Google Sheets or Microsoft Excel) or even a pen and paper can work. What you do need is information.

For Existing Businesses:

- Bank Statements: Go back at least 3-6 months (preferably 12 months for a full picture).

- Credit Card Statements: Same as bank statements.

- Invoices & Receipts: Keep all records of money coming in (sales) and money going out (expenses).

- Payroll Records: If you have employees.

- Past Tax Returns: Can provide a good overview of income and expenses.

For New Businesses (Startups):

- Market Research: Understand potential pricing, sales volume, and competitor costs.

- Startup Cost Estimates: Research the one-time expenses needed to get off the ground (e.g., equipment, legal fees, initial inventory).

- Operational Cost Estimates: Research recurring monthly expenses (e.g., rent, utilities, software subscriptions).

- Sales Projections: Make realistic estimates of how much revenue you expect to generate. Be conservative!

Step-by-Step Guide: Creating Your Business Budget from Scratch

Let’s break down the process into manageable steps.

Step 1: Calculate Your Income (Revenue)

This is the money your business brings in from selling its products or services.

- For Existing Businesses:

- Look at your past sales records, bank deposits, and invoices.

- Calculate your average monthly income over the past 3-12 months.

- Be realistic: If sales are seasonal, take that into account. Don’t just use your best month.

-

For New Businesses (Projections):

- This requires more estimation. Consider:

- Pricing: How much will you charge for your products/services?

- Sales Volume: How many units or hours do you realistically expect to sell in a month?

- Customer Acquisition: How many customers do you expect to attract and convert?

- Be Conservative: It’s always better to underestimate income and overestimate expenses when starting out. You can always adjust later.

Example: If you sell handmade jewelry for $50 each and expect to sell 30 pieces a month, your projected monthly income is $1,500. Add any other income streams (e.g., workshops, consulting).

- This requires more estimation. Consider:

Your Goal: Arrive at a realistic, estimated total monthly (or quarterly) income.

Step 2: List All Your Expenses

This is where your money goes. This step is crucial and requires attention to detail. Don’t forget anything, no matter how small!

It’s helpful to categorize expenses into two main types:

-

Fixed Costs: These are expenses that generally stay the same each month, regardless of your sales volume.

- Examples:

- Rent for office or retail space

- Loan payments (business loans, vehicle loans)

- Insurance premiums (general liability, property, health)

- Salaries for full-time employees (not hourly wages tied to sales)

- Software subscriptions (SaaS tools, accounting software)

- Website hosting and domain fees

- Depreciation (if you have significant assets)

- Regular professional fees (e.g., monthly accountant retainer)

- Examples:

-

Variable Costs: These expenses fluctuate based on your business activity and sales volume. The more you sell, the higher these costs might be.

- Examples:

- Cost of Goods Sold (COGS): Raw materials, manufacturing costs, wholesale product costs.

- Shipping and delivery costs

- Sales commissions

- Hourly wages for part-time staff or contractors (if tied to sales/projects)

- Marketing and advertising spend (e.g., pay-per-click ads, social media boosts)

- Utilities (can be variable based on usage, though some might have a fixed component)

- Travel expenses (for sales calls, conferences)

- Packaging supplies

- Examples:

Don’t Forget These Often Overlooked Expenses:

- One-Time / Startup Costs: (Especially for new businesses) Legal fees, business registration, initial equipment purchases, branding/logo design, initial inventory.

- Taxes: Set aside money for income tax, sales tax (if applicable), payroll taxes, etc. This is a huge one often forgotten by beginners!

- Fees: Bank fees, payment processing fees (e.g., Stripe, PayPal), licensing fees.

- Repairs & Maintenance: Unexpected costs can pop up.

- Supplies: Office supplies, cleaning supplies, etc.

- Professional Development: Courses, workshops, books.

How to Calculate:

- Existing Businesses: Go through your bank statements, credit card statements, and receipts line by line. Categorize each transaction.

- New Businesses: Research thoroughly! Get quotes for rent, insurance, software. Estimate material costs based on your product. Talk to other business owners in your industry.

Your Goal: Create a comprehensive list of every single expense, categorize them, and estimate their monthly cost. Sum them up to get your Total Monthly Expenses.

Step 3: Calculate Your Profit (or Loss)

This is the moment of truth! Once you have your total income and total expenses, you can see how financially healthy your business is.

Simple Formula:

Total Monthly Income – Total Monthly Expenses = Net Profit (or Loss)

- If the number is positive: Congratulations, you’re currently projecting a profit! This is money you can reinvest, save, or take as owner’s draw/dividends.

- If the number is negative: Don’t panic! This means your expenses are currently higher than your income. This is why you budget – to identify these issues early. Now you need to make adjustments (see Step 4).

Example:

- Monthly Income: $5,000

- Monthly Expenses: $4,200

- Net Profit: $800

Step 4: Allocate Funds & Set Targets

Now that you know your profit (or loss), it’s time to get strategic.

- If you have a Net Profit:

- Allocate for Savings/Emergency Fund: A crucial step! Aim to build up 3-6 months of operating expenses in a separate business savings account. This acts as a buffer for slow periods or unexpected costs.

- Reinvest in Growth: Can you allocate funds for marketing, new equipment, product development, or hiring?

- Owner’s Pay/Draw: If you’re a sole proprietor, how much will you pay yourself? Make sure it’s sustainable.

- Debt Repayment: Can you pay down any business debts faster?

- If you have a Net Loss:

- Identify Areas to Cut Expenses: Go through your variable costs first, as they are often easier to reduce. Can you negotiate with suppliers? Reduce marketing spend temporarily? Look at subscriptions you don’t use.

- Explore Ways to Increase Income: Can you raise prices? Offer new services? Increase marketing efforts?

- Prioritize Spending: What are the absolute necessities to keep your business running? Cut back on discretionary spending until you’re profitable.

Your Goal: Ensure your budget shows a path to profitability and aligns with your business goals.

Step 5: Monitor and Adjust Regularly

Creating a budget isn’t a one-and-done task. It’s an ongoing process.

- Review Regularly: At least monthly, but ideally weekly. Compare your actual income and expenses against your budgeted figures.

- Track Everything: Continue to meticulously record all income and expenses. This is where accounting software (like QuickBooks, Xero, FreshBooks) or even a simple spreadsheet can be invaluable.

- Don’t Be Afraid to Adjust: Your business environment changes. Sales might be higher or lower than expected. New opportunities or unexpected costs might arise. Your budget is a living document – adapt it as needed.

- Example: If you launched a new marketing campaign that’s performing better than expected, you might increase your marketing budget next month to capitalize on the momentum. If a supplier raises prices, you’ll need to adjust your COGS.

- Look for Trends: Are your utility bills consistently higher in winter? Are sales always slower in August? Understanding these patterns helps you budget more accurately in the future.

Your Goal: Keep your budget current, accurate, and a useful tool for decision-making.

Tips for Budgeting Success

- Be Realistic, Not Optimistic: When projecting income, err on the side of caution. When estimating expenses, assume they might be a little higher than expected.

- Track Every Single Penny: Even small, seemingly insignificant expenses add up over time. Use an app, a spreadsheet, or a notebook – just track it.

- Build an Emergency Fund: This is crucial. Aim for at least 3-6 months of operating expenses in a separate, accessible savings account.

- Separate Personal and Business Finances: This cannot be stressed enough. Mixing funds makes budgeting, accounting, and tax preparation a nightmare. Get a separate business bank account and credit card.

- Use Technology (When Ready): Once you’re comfortable with the basics, consider accounting software. It automates tracking, categorizes expenses, and generates financial reports, saving you a lot of time.

- Seek Professional Advice: If you find yourself overwhelmed or need help with complex financial planning or tax implications, consult with an accountant or financial advisor.

- Don’t Get Discouraged: It takes time to get good at budgeting. There will be months when you’re off. Learn from it, adjust, and keep going.

Common Budgeting Mistakes to Avoid

- Ignoring Small Expenses: Those daily coffees, small software subscriptions, or minor office supplies seem insignificant but can collectively derail your budget.

- Being Overly Optimistic: Projecting sky-high sales and rock-bottom expenses is a recipe for financial stress. Be grounded in reality.

- Setting and Forgetting: A budget isn’t a static document. If you create it once and never look at it again, it’s useless.

- Not Building a Buffer: Unexpected costs will arise. Without an emergency fund or buffer in your budget, these can quickly turn into crises.

- Mixing Personal and Business Funds: This is a classic beginner mistake that complicates everything from tax filing to understanding your business’s true profitability.

- Not Accounting for Taxes: Taxes are a significant expense. If you don’t budget for them throughout the year, you could face a huge, unexpected bill.

Conclusion

Creating an effective business budget from scratch might seem daunting at first, but it’s one of the most empowering steps you can take for your business’s financial health. Think of it as your business’s GPS, guiding you through the unpredictable landscape of entrepreneurship.

By diligently tracking your income, listing your expenses, calculating your profit, and consistently monitoring and adjusting, you’ll gain invaluable insights into your operations. You’ll make smarter decisions, avoid unnecessary debt, and pave a clear path towards achieving your business goals.

Don’t wait for a financial crisis to start budgeting. Begin today, even if it’s just with a simple spreadsheet. Your business, and your peace of mind, will thank you for it. Take control, gain clarity, and build a truly effective business budget that drives your success!

Post Comment