Customs Union vs. Free Trade Area: Unpacking the Key Differences for Global Trade

In our interconnected world, international trade agreements are the backbone of global commerce. They dictate how goods move across borders, influencing everything from the price of your morning coffee to the availability of electronics. But not all trade agreements are created equal. Two of the most common, yet often confused, forms of economic integration are the Free Trade Area (FTA) and the Customs Union (CU).

For beginners diving into the fascinating world of international economics, distinguishing between these two can seem daunting. This comprehensive guide will break down the core differences, helping you understand their nuances, implications, and why they matter to businesses, consumers, and governments alike.

Why Do Trade Agreements Matter?

Before we dive into the specifics, let’s understand the "why." Countries enter into trade agreements primarily to:

- Reduce Trade Barriers: Lowering or eliminating tariffs (taxes on imports) and non-tariff barriers (like quotas or complex regulations).

- Increase Trade Flows: Making it cheaper and easier for goods and services to move between member countries.

- Boost Economic Growth: By encouraging specialization, efficiency, and greater market access.

- Foster Political Cooperation: Trade often goes hand-in-hand with diplomatic relations and regional stability.

Now, let’s explore how FTAs and CUs achieve these goals, and where their paths diverge.

What is a Free Trade Area (FTA)?

Imagine a group of friends who agree that they won’t charge each other for borrowing things, but each friend still has their own rules for what they charge outsiders who want to borrow from them. That’s a good analogy for a Free Trade Area.

In formal terms, a Free Trade Area (FTA) is a type of trade bloc where member countries agree to eliminate tariffs, quotas, and other non-tariff barriers on most, if not all, goods traded among themselves. This means that products originating from one member country can enter another member country without facing import duties.

Key Characteristics of an FTA:

- Internal Tariff Elimination: This is the defining feature. Goods moving between member countries are essentially tariff-free.

- Independent External Tariffs: Crucially, each member country retains its own independent trade policy with countries outside the FTA. This means Country A in an FTA might charge a 10% tariff on cars from Japan, while Country B (also in the same FTA) might charge 5% on the exact same cars from Japan.

- Rules of Origin (ROO) are Essential: Because each member has its own external tariffs, a problem called "trade deflection" can arise.

- Trade Deflection: This happens when a non-member country sends its goods to the FTA member with the lowest external tariff, and then those goods are re-exported tariff-free to other FTA members (who have higher external tariffs).

- To prevent this, FTAs must implement Rules of Origin (ROO). These rules determine where a product genuinely comes from. For a product to qualify for tariff-free access within the FTA, it must be proven to have originated substantially within one of the member countries. This often involves complex calculations about the percentage of value added within the FTA.

Examples of Free Trade Areas:

- North American Free Trade Agreement (NAFTA) / United States-Mexico-Canada Agreement (USMCA): A prominent example where goods traded between the U.S., Canada, and Mexico are largely tariff-free, but each country maintains its own tariffs with the rest of the world.

- ASEAN Free Trade Area (AFTA): A free trade agreement among the member states of the Association of Southeast Asian Nations.

- European Free Trade Association (EFTA): Comprising Iceland, Liechtenstein, Norway, and Switzerland.

Pros and Cons of a Free Trade Area

Like any economic arrangement, FTAs come with their own set of advantages and disadvantages:

Advantages of an FTA:

- Increased Trade and Economic Growth: By removing internal barriers, businesses can access larger markets, leading to increased exports, production, and economic expansion.

- Lower Consumer Prices: Reduced tariffs mean imported goods are cheaper, offering consumers more choices and better value.

- Greater Efficiency and Specialization: Countries can focus on producing goods and services where they have a comparative advantage, leading to more efficient resource allocation.

- Flexibility and National Sovereignty: Members retain control over their individual trade policies with non-member countries, preserving a degree of national autonomy.

- Stepping Stone: FTAs can be a less politically sensitive first step towards deeper economic integration.

Disadvantages of an FTA:

- Complexity of Rules of Origin (ROO): ROO can be incredibly complex and burdensome for businesses, especially smaller ones, leading to higher administrative costs and potential delays.

- Potential for Trade Deflection: Despite ROO, loopholes or difficulties in enforcement can still lead to goods being diverted through the lowest-tariff member.

- Limited Integration: While trade in goods is liberalized, services, capital, and labor movement may still face significant barriers.

- Risk of "Spaghetti Bowl" Effect: A country might be part of multiple FTAs with different ROO, creating a complex web of regulations that can hinder trade rather than facilitate it.

- Less Bargaining Power: As each country negotiates individually with non-members, the bloc as a whole may have less collective bargaining power than a more integrated union.

What is a Customs Union (CU)?

Now, let’s go back to our friends. In a Customs Union, not only do they agree not to charge each other for borrowing things, but they also agree on a single, unified price they will all charge anyone outside their group who wants to borrow from them.

A Customs Union (CU) takes the concept of a Free Trade Area a significant step further. It combines the internal tariff elimination of an FTA with an additional, crucial element: a common external trade policy towards non-member countries.

Key Characteristics of a Customs Union:

- Internal Tariff Elimination: Just like an FTA, all tariffs and non-tariff barriers on trade between member countries are removed.

- Common External Tariff (CET): This is the defining differentiator. All member countries adopt a uniform set of tariffs and trade regulations for goods imported from outside the union. This means that a car imported from Japan would face the exact same tariff whether it enters through Country A or Country B of the Customs Union.

- No Need for Rules of Origin (within the union): Because there’s a common external tariff, trade deflection is no longer an issue. Once a product has entered the Customs Union (paying the CET at the first point of entry), it can move freely between all member countries without further customs checks or duties related to its origin. This significantly simplifies trade and logistics.

- Policy Coordination: Members need a mechanism to coordinate and agree on their common external trade policy, often requiring a degree of supranational decision-making.

Examples of Customs Unions:

- MERCOSUR: Comprising Argentina, Brazil, Paraguay, and Uruguay, it functions as a Customs Union with a common external tariff.

- Southern African Customs Union (SACU): The oldest existing customs union, including Botswana, Eswatini, Lesotho, Namibia, and South Africa.

- European Union (EU): While the EU is far more integrated than just a Customs Union (it’s a full Common Market and moving towards an Economic and Political Union), its foundation includes a robust Customs Union. Goods cleared at one EU border can move freely across all other EU member states.

Pros and Cons of a Customs Union

Customs Unions offer deeper integration but also demand greater sacrifices of national autonomy.

Advantages of a Customs Union:

- Simplified Internal Trade: The absence of Rules of Origin within the union drastically reduces administrative burden, customs checks, and costs for businesses, promoting smoother trade flows.

- Increased Trade Efficiency: Businesses can plan supply chains across the entire union without worrying about internal border complexities or varying external tariffs.

- Stronger International Bargaining Power: As a unified bloc, the Customs Union can negotiate trade agreements with non-members from a position of greater strength and influence.

- Reduced Trade Deflection: The common external tariff eliminates the incentive for goods to be routed through the lowest-tariff member.

- Foundation for Deeper Integration: CUs often serve as a stable platform for further steps towards economic integration, such as a common market or economic union.

Disadvantages of a Customs Union:

- Loss of National Sovereignty over Trade Policy: Individual member countries lose the ability to set their own tariffs and trade agreements with the rest of the world. This can be a significant political hurdle.

- Compromise and Negotiation: Agreeing on a common external tariff can be challenging, as different members may have varying economic interests and priorities for protecting specific domestic industries.

- Less Flexibility: Members cannot unilaterally react to global economic changes or protect specific industries through tariffs without the agreement of the entire union.

- Potential for Trade Diversion: While CUs reduce trade deflection, they can sometimes lead to trade diversion, where a country shifts its imports from a more efficient non-member producer to a less efficient member producer, simply because of the tariff advantage within the union.

Customs Union vs. Free Trade Area: The Key Differences at a Glance

To summarize, here’s a direct comparison of the fundamental distinctions:

| Feature | Free Trade Area (FTA) | Customs Union (CU) |

|---|---|---|

| Internal Tariffs | Eliminated among member countries | Eliminated among member countries |

| External Tariffs | Each member sets its own tariffs with non-members | Common External Tariff (CET) for all non-members |

| Rules of Origin (ROO) | Essential to prevent trade deflection | Not needed internally due to CET |

| Trade Policy | Independent external trade policies | Common, unified external trade policy |

| Level of Integration | Lower; focuses on goods trade | Higher; includes common external policy, often a precursor |

| Sovereignty Impact | Less impact on national trade policy autonomy | Significant loss of national trade policy autonomy |

| Complexity for Business | High due to ROO management | Lower for internal trade, unified for external trade |

Why Do These Differences Matter? Implications for Stakeholders

Understanding the distinction between FTAs and CUs isn’t just an academic exercise; it has real-world consequences for various stakeholders:

For Businesses:

- Supply Chain Management:

- In an FTA: Businesses must meticulously track the origin of components and finished products to comply with Rules of Origin, adding complexity and cost.

- In a CU: Once goods enter the union, they can move freely, simplifying logistics and potentially reducing costs. However, businesses outside the CU face a unified tariff wall.

- Market Access: Both offer preferential access to member markets, but CUs provide a more seamless internal market.

- Competitive Landscape: Businesses within a CU benefit from consistent external tariffs, creating a level playing field regarding imports from outside the bloc.

For Consumers:

- Prices and Choices: Both generally lead to lower prices and more choices for goods originating within the bloc.

- Variety: The common external policy of a CU might influence the types and prices of goods available from outside the union.

For Governments and Policymakers:

- National Sovereignty: This is the most significant trade-off.

- FTAs allow countries to maintain control over their trade relationships with the rest of the world, which can be politically attractive.

- CUs require members to surrender a significant portion of their trade policy autonomy to the union, necessitating deeper political commitment and coordination.

- Negotiating Power: A CU presents a unified front in global trade negotiations, potentially achieving better terms. An FTA’s members negotiate individually.

- Economic Strategy: The choice between an FTA and a CU depends on a country’s long-term economic goals, its willingness to integrate, and its political priorities.

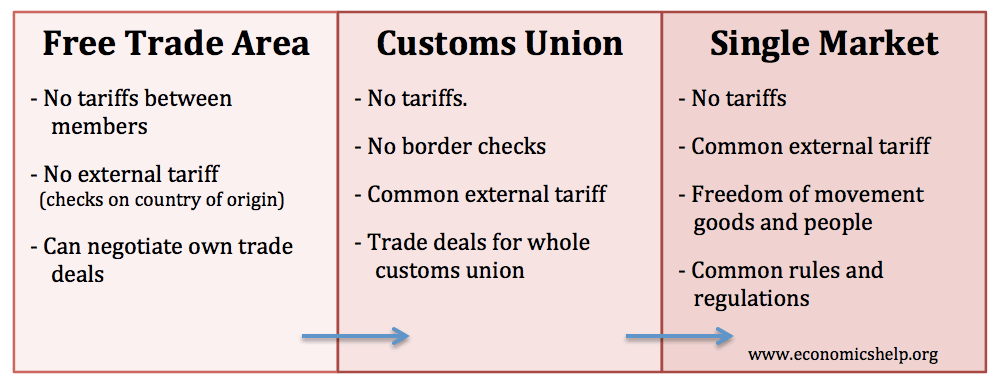

Beyond FTAs and CUs: The Spectrum of Economic Integration

It’s important to remember that Free Trade Areas and Customs Unions are just two steps on a broader ladder of economic integration. The journey often progresses as follows:

- Preferential Trade Area (PTA): Members agree to reduce tariffs on certain goods.

- Free Trade Area (FTA): Eliminate tariffs on most goods among members, but each keeps its own external tariffs.

- Customs Union (CU): FTA + a common external tariff.

- Common Market: Customs Union + free movement of factors of production (labor, capital, services).

- Economic Union: Common Market + harmonization of economic policies (e.g., monetary, fiscal, competition).

- Political Union: Deepest integration, involving common government structures and policies beyond economics.

The European Union, for example, started as a common market and has evolved significantly towards an economic and political union, encompassing elements from all these stages.

Conclusion

The distinction between a Free Trade Area and a Customs Union boils down to a single, crucial element: the common external tariff. An FTA eliminates internal tariffs but allows members to set their own external tariffs, necessitating complex Rules of Origin. A CU goes a step further, adopting a unified external tariff, which simplifies internal trade by removing the need for Rules of Origin, but at the cost of national sovereignty over trade policy.

Both forms of economic integration aim to foster trade and economic growth, but they represent different levels of commitment and yield different benefits and challenges. Understanding these differences is key to comprehending the complexities of global trade, international relations, and the strategic choices nations make in shaping their economic futures. As the global landscape continues to evolve, these frameworks will remain vital in defining how countries interact and prosper.

Post Comment