401(k) Plans Explained: Maximize Your Employer Match for a Secure Retirement

Are you new to the world of retirement savings, or perhaps you’ve heard about 401(k)s but feel a bit overwhelmed by the jargon? You’re not alone! Many people find the topic of retirement planning daunting, but understanding your 401(k) and, more importantly, how to maximize your employer match, is one of the smartest financial moves you can make.

Think of your 401(k) as a powerful tool your employer offers to help you build a nest egg for your future. It’s designed to make saving for retirement easier, more tax-efficient, and incredibly rewarding – especially when your company contributes alongside you.

In this comprehensive guide, we’ll break down everything you need to know about 401(k) plans in simple, easy-to-understand language. We’ll demystify the terms, explain how to take full advantage of the "free money" your employer might be offering, and set you on the path to a more secure financial future.

What Exactly is a 401(k) Plan?

At its core, a 401(k) is a retirement savings and investment plan sponsored by an employer. It allows eligible employees to save and invest a portion of their paycheck before taxes are taken out (or after taxes in the case of a Roth 401(k)), with the goal of building a substantial sum for retirement.

Here’s why it’s such a popular and effective retirement vehicle:

- Convenience: Contributions are automatically deducted from your paycheck, so you don’t have to remember to transfer money.

- Tax Advantages: Your money grows tax-deferred (Traditional 401(k)) or tax-free (Roth 401(k)), offering significant benefits.

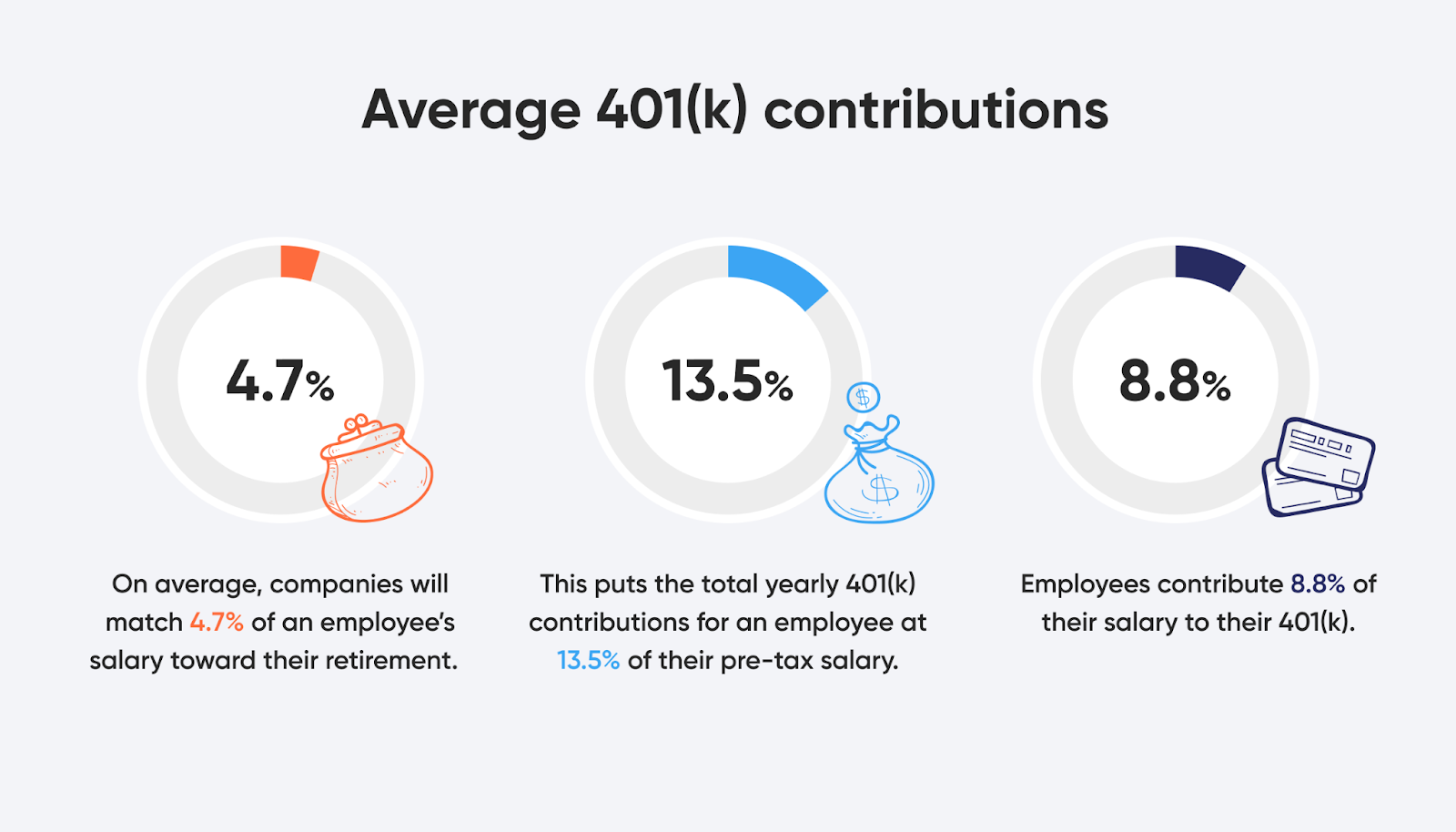

- Employer Contributions: Many employers offer to match a portion of your contributions, essentially giving you "free money" towards your retirement. This is the golden ticket we’ll focus on maximizing!

- Professional Management: While you choose your investments, the plan itself is administered by a professional company, handling the complex paperwork.

The Power of the Employer Match: Your "Free Money" Advantage

This is arguably the most exciting and crucial aspect of a 401(k) plan. An employer match is when your company contributes money to your 401(k) account based on how much you contribute. It’s like getting a bonus specifically for saving for your future.

Why is it "Free Money"?

Because it costs you nothing extra beyond what you’re already contributing. If your employer offers to match your contributions, and you don’t contribute enough to get the full match, you are literally leaving money on the table. This is money that could be growing for your retirement!

How Employer Matching Typically Works:

Employer match programs vary, but here are some common structures:

- Percentage Match (e.g., 50 cents on the dollar up to 6%): This is one of the most common. It means for every dollar you contribute, your employer contributes 50 cents, up to a certain percentage of your salary (e.g., 6%).

- Example: If you earn $50,000 and your employer offers a 50% match up to 6% of your salary:

- 6% of $50,000 = $3,000.

- If you contribute $3,000 (6% of your salary), your employer will contribute 50% of that, which is $1,500.

- Your total annual contribution becomes $4,500 ($3,000 from you + $1,500 from your employer).

- Example: If you earn $50,000 and your employer offers a 50% match up to 6% of your salary:

- Dollar-for-Dollar Match (e.g., 100% match up to 3%): Your employer matches every dollar you contribute, up to a certain percentage of your salary.

- Example: If you earn $50,000 and your employer offers a 100% match up to 3% of your salary:

- 3% of $50,000 = $1,500.

- If you contribute $1,500 (3% of your salary), your employer will also contribute $1,500.

- Your total annual contribution becomes $3,000 ($1,500 from you + $1,500 from your employer).

- Example: If you earn $50,000 and your employer offers a 100% match up to 3% of your salary:

- Fixed Contribution: Some employers contribute a set amount or percentage of your salary regardless of your contribution, but this is less common than a match.

- Profit Sharing: Some companies make contributions based on their annual profits, distributing a portion to employee 401(k) accounts.

The Importance of Vesting:

While the employer match is fantastic, there’s an important concept called vesting that you need to understand. Vesting refers to the ownership you have over the money your employer contributes to your 401(k).

- Fully Vested: If you are fully vested, you own 100% of the employer contributions and can take them with you if you leave the company.

- Vesting Schedule: Many companies have a vesting schedule, meaning you gain full ownership over time. Common types include:

- Cliff Vesting: You become 100% vested after a certain number of years (e.g., 3 years). If you leave before that period, you lose all unvested employer contributions.

- Graded Vesting: You become partially vested over several years, with your ownership increasing each year (e.g., 20% after 2 years, 40% after 3 years, up to 100% after 6 years).

- Your Contributions are Always 100% Vested: The money you contribute from your paycheck is always yours, regardless of vesting schedules. Vesting only applies to the employer’s contributions.

Why Vesting Matters: Understanding your company’s vesting schedule helps you know how much of your employer’s contributions you can truly count on if you were to leave your job.

How Your 401(k) Works: A Deeper Dive

Beyond the employer match, it’s helpful to understand the mechanics of your 401(k).

-

Contributions:

- You decide how much you want to contribute from each paycheck, typically as a percentage of your salary.

- These contributions are automatically deducted before your net pay hits your bank account.

- There are annual contribution limits set by the IRS (these limits change periodically, so check the latest figures).

-

Investment Options:

- Unlike a regular savings account, your 401(k) money is invested in various funds to help it grow.

- Your plan provider will offer a selection of investment options, usually a mix of:

- Mutual Funds: Professionally managed portfolios of stocks, bonds, or other investments.

- Target-Date Funds: A popular choice, these funds automatically adjust their asset allocation (become more conservative) as you get closer to your target retirement year. They are often a great "set it and forget it" option for beginners.

- Index Funds/ETFs: Funds that track a specific market index, like the S&P 500.

- Bond Funds: Investments primarily in government or corporate bonds, generally considered less risky than stock funds.

- You’ll choose how to allocate your contributions among these options. Don’t worry if you’re new to investing; target-date funds are a fantastic starting point.

-

Tax Advantages:

There are two main types of 401(k)s, each with different tax benefits:

-

Traditional 401(k):

- Tax Deduction Now: Your contributions are made with pre-tax dollars, meaning they reduce your taxable income in the year you contribute. This lowers your current tax bill.

- Tax-Deferred Growth: Your investments grow over time, and you don’t pay taxes on the growth until you withdraw the money in retirement.

- Taxable Withdrawals in Retirement: When you take money out in retirement, all withdrawals (contributions and earnings) are taxed as ordinary income.

- Best for: People who expect to be in a higher tax bracket now than they will be in retirement.

-

Roth 401(k):

- After-Tax Contributions: Your contributions are made with after-tax dollars, meaning they do not reduce your current taxable income.

- Tax-Free Growth & Withdrawals: Your investments grow tax-free, and qualified withdrawals in retirement are completely tax-free.

- Best for: People who expect to be in a higher tax bracket in retirement than they are now, or who want to diversify their tax exposure in retirement.

-

Which one is right for you? The choice between Traditional and Roth depends on your current income, your projected future income, and your overall tax strategy. Some plans offer both options, allowing you to split your contributions.

-

-

Compounding Growth:

- This is the "magic" of long-term investing. Compounding means your investments earn returns, and then those returns themselves start earning returns.

- Over decades, even small contributions can grow into substantial sums thanks to the power of compounding. The earlier you start, the more time your money has to grow!

Why You Can’t Afford to Miss Your Employer Match

Let’s reiterate this because it’s that important. Missing out on your employer’s 401(k) match is like turning down a pay raise or free money.

- Instant Return on Investment: If your employer offers a 50% match, you’re essentially getting an immediate 50% return on your contribution (before any investment growth!). No other investment offers such a guaranteed, high initial return.

- Accelerated Growth: The employer’s contributions significantly boost your starting capital, giving compounding more money to work with from day one. This can shave years off your retirement savings journey.

- Building a Foundation: For many, contributing enough to get the full match is the first crucial step in building a solid retirement foundation.

Steps to Maximize Your 401(k) Employer Match

Ready to claim your free money? Here’s a simple, step-by-step guide:

-

Find Out Your Company’s 401(k) Policy:

- Talk to HR: Your Human Resources department is the best resource. They can provide you with the plan document, explain the matching policy, and tell you about the vesting schedule.

- Access Online Portal: Most 401(k) plans have an online portal where you can find all the details, enroll, and manage your contributions.

- Key Questions to Ask/Look For:

- What is the employer match formula (e.g., 50% up to 6%)?

- What is the vesting schedule?

- When do I become eligible to contribute (e.g., after 90 days, 1 year)?

- What are the contribution limits?

-

Calculate How Much You Need to Contribute for the Full Match:

- Once you know your company’s match formula, do the math.

- Example: If your salary is $60,000 and your company matches 50% of your contributions up to 6% of your salary:

- 6% of $60,000 = $3,600.

- You need to contribute $3,600 per year (or $300 per month) to get the full match.

- Your employer would then contribute 50% of that: $1,800.

- Total annual contribution to your account: $5,400.

- Prioritize this amount. This should be your absolute minimum contribution goal.

-

Enroll in Your 401(k) Plan and Set Up Contributions:

- Follow your company’s enrollment process, usually through HR or the plan’s online portal.

- Designate your contribution percentage. Start with the amount that gets you the full match.

- Choose your investments. If unsure, a target-date fund based on your approximate retirement year is a great, low-maintenance option.

-

Increase Your Contributions Over Time (Beyond the Match):

- While getting the full match is the priority, don’t stop there if you can help it.

- Aim to increase your contribution percentage each year, especially when you get a raise or bonus. Even an extra 1% or 2% can make a huge difference over decades due to compounding.

- A common recommendation is to aim for a total contribution (your money + employer match) of 10-15% of your salary for a comfortable retirement.

-

Understand Your Vesting Schedule and Plan Accordingly:

- If you have a long vesting schedule, be mindful of it if you’re considering changing jobs. Losing unvested employer contributions can be a significant financial hit.

- If you’re close to being fully vested, it might be worth staying a bit longer to lock in that "free money."

Beyond the Match: Next Steps for Your Retirement Savings

Once you’ve mastered the employer match, here’s how to continue supercharging your retirement savings:

- Increase Your Contribution Rate: As mentioned, try to gradually increase your contribution percentage each year, even by 1%. Aim for that 10-15% total savings rate.

- Diversify Your Investments: As you learn more, you might want to explore different investment options within your 401(k) to ensure your portfolio is well-diversified and aligned with your risk tolerance. Don’t put all your eggs in one basket!

- Consider Other Retirement Accounts:

- Individual Retirement Accounts (IRAs): Traditional and Roth IRAs offer additional tax-advantaged savings opportunities beyond your 401(k). You can contribute to both!

- Health Savings Accounts (HSAs): If you have a high-deductible health plan, an HSA offers a triple tax advantage: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. It can also be used as a retirement account after age 65.

- Review Your Plan Regularly: At least once a year, log into your 401(k) account.

- Check your contribution rate.

- Review your investment performance.

- Rebalance your portfolio if necessary (adjusting your asset allocation back to your desired percentages).

- Ensure your beneficiary information is up-to-date.

Common 401(k) Mistakes to Avoid

- Not Contributing Enough to Get the Full Match: This is the #1 mistake and the most costly.

- Taking a Loan from Your 401(k): While sometimes possible, 401(k) loans come with risks. If you leave your job, you often have to repay the loan quickly or it becomes a taxable withdrawal.

- Cashing Out Your 401(k) When You Leave a Job: This is a huge mistake! You’ll pay income taxes on the entire amount, plus a 10% early withdrawal penalty if you’re under 59 ½. Instead, roll it over into your new employer’s 401(k) or an IRA to keep it growing tax-deferred/tax-free.

- Ignoring Your Investments: "Set it and forget it" is good for contributions, but you should still periodically review your investment choices and adjust them as your risk tolerance or retirement timeline changes.

- Not Naming a Beneficiary: Make sure you designate who will inherit your 401(k) funds if something happens to you. This avoids potential probate and ensures your money goes where you intend.

Frequently Asked Questions (FAQs) About 401(k) Plans

Q: What is the maximum I can contribute to a 401(k)?

A: The IRS sets annual contribution limits, which often increase each year. These limits apply to your contributions only, not your employer’s match. Check the IRS website for the most current limits. There are also "catch-up" contributions allowed for those aged 50 and over.

Q: Can I have both a 401(k) and an IRA?

A: Yes! You can contribute to both a 401(k) through your employer and an Individual Retirement Account (IRA) on your own. This can be a great strategy to diversify your retirement savings and potentially gain additional tax advantages.

Q: What happens to my 401(k) if I leave my job?

A: You have a few options:

- Leave it with your old employer: If the balance is above a certain amount (e.g., $5,000), you can often leave it in the plan.

- Roll it over to your new employer’s 401(k): If your new company’s plan accepts rollovers.

- Roll it over to an Individual Retirement Account (IRA): This gives you more control and often a wider range of investment options.

- Cash it out: This is generally not recommended due to taxes and penalties.

Q: Are there fees associated with a 401(k)?

A: Yes, all investment accounts have fees. These can include administrative fees, investment management fees (expense ratios of the funds), and sometimes transaction fees. Your plan administrator should provide information about these fees. Lower fees mean more money stays invested and grows for you.

Q: When can I withdraw money from my 401(k)?

A: Generally, you can start taking penalty-free withdrawals at age 59 ½. Withdrawals before this age are usually subject to a 10% early withdrawal penalty, in addition to regular income taxes, unless an exception applies (e.g., disability, certain medical expenses).

Conclusion: Don’t Leave Free Money on the Table!

Your 401(k) is more than just an employee benefit; it’s a powerful wealth-building tool that can secure your financial future. The employer match is the most straightforward way to get an immediate, significant boost to your retirement savings.

Take the time today to understand your company’s 401(k) plan. Find out their matching policy, calculate what you need to contribute, and set up your contributions to capture every dollar of that "free money." It’s a simple step that can have a profound impact on your long-term financial well-being. Start now, and watch your retirement savings grow!

Post Comment