Unlocking Your Entrepreneurial Dream: Franchise Opportunities – Pros, Cons, and How to Choose the Right Fit

Dreaming of owning your own business but feeling daunted by the idea of starting from scratch? You’re not alone! Many aspiring entrepreneurs find the world of franchising an appealing alternative. It offers a unique path to business ownership, blending the independence of being your own boss with the safety net of an established brand and proven system.

But what exactly is a franchise? Is it the right path for you? And how do you navigate the often-complex process of choosing the perfect one? This comprehensive guide will break down everything you need to know about franchise opportunities, exploring the pros and cons, and providing a clear roadmap on how to choose the best fit for your entrepreneurial journey.

What Exactly is a Franchise? A Simple Explanation

At its core, a franchise is a license that allows a party (the franchisee) to use another party’s (the franchisor’s) proven business model, brand name, and operating system to sell a product or service. Think of it like this:

- The Franchisor: This is the company that owns the original business, its brand, and its successful operating methods (e.g., McDonald’s, Anytime Fitness, Kumon). They develop the system, provide the training, and offer ongoing support.

- The Franchisee: This is you! You pay an initial fee (the "franchise fee") and ongoing fees (like "royalty fees" and "advertising fund contributions") to the franchisor. In return, you get to open and operate a business under their established brand, using their recipes, procedures, marketing materials, and support.

It’s a "business in a box" concept, but with significant commitment and responsibility on your part.

The Pros of Buying a Franchise: Why It’s So Appealing

Many individuals choose the franchise route for good reason. It offers several compelling advantages that can significantly reduce the risks typically associated with starting a new business.

1. Established Brand Recognition & Proven Business Model

- Instant Credibility: You’re not building a brand from scratch. Customers already recognize and trust the brand name, which means less effort spent on initial marketing and building reputation.

- Reduced Risk: The franchisor has already tested the business model, ironed out kinks, and proven its profitability in various markets. You’re stepping into a system that works.

2. Comprehensive Training & Ongoing Support

- No Experience Necessary (Often): Many franchises don’t require prior industry experience. Franchisors provide extensive initial training covering everything from operations and customer service to marketing and financial management.

- Continuous Guidance: You’re never truly alone. Franchisors offer ongoing support, including field visits, online resources, help desks, and updated manuals, ensuring you stay on track and adapt to market changes.

3. Collective Marketing Power

- National Advertising: Franchisors often pool funds from all franchisees into a national advertising fund. This allows for large-scale marketing campaigns (TV, radio, online) that a single independent business could never afford.

- Local Marketing Support: While national campaigns build brand awareness, franchisors also provide templates and guidance for your local marketing efforts, making it easier to attract customers in your specific territory.

4. Access to Supply Chains & Purchasing Power

- Economies of Scale: Franchisors negotiate bulk discounts with suppliers for materials, equipment, and inventory, passing those savings on to franchisees. This can significantly reduce your cost of goods sold.

- Standardized Quality: You benefit from consistent product quality and reliable supply, ensuring your customers always receive the expected experience.

5. Easier Access to Financing

- Lender Confidence: Banks and lenders are often more willing to finance a franchise because they see a proven business model, a strong brand, and a structured support system. This perceived lower risk can make it easier to secure loans.

- Franchisor Relationships: Many franchisors have established relationships with lenders who understand their specific business model, further streamlining the financing process.

6. Built-in Network and Community

- Peer Support: You become part of a network of other franchisees who face similar challenges and opportunities. This community can be an invaluable source of advice, motivation, and shared best practices.

- Franchisor Conferences: Many franchisors host regular conferences and meetings, fostering a sense of community and providing opportunities for learning and networking.

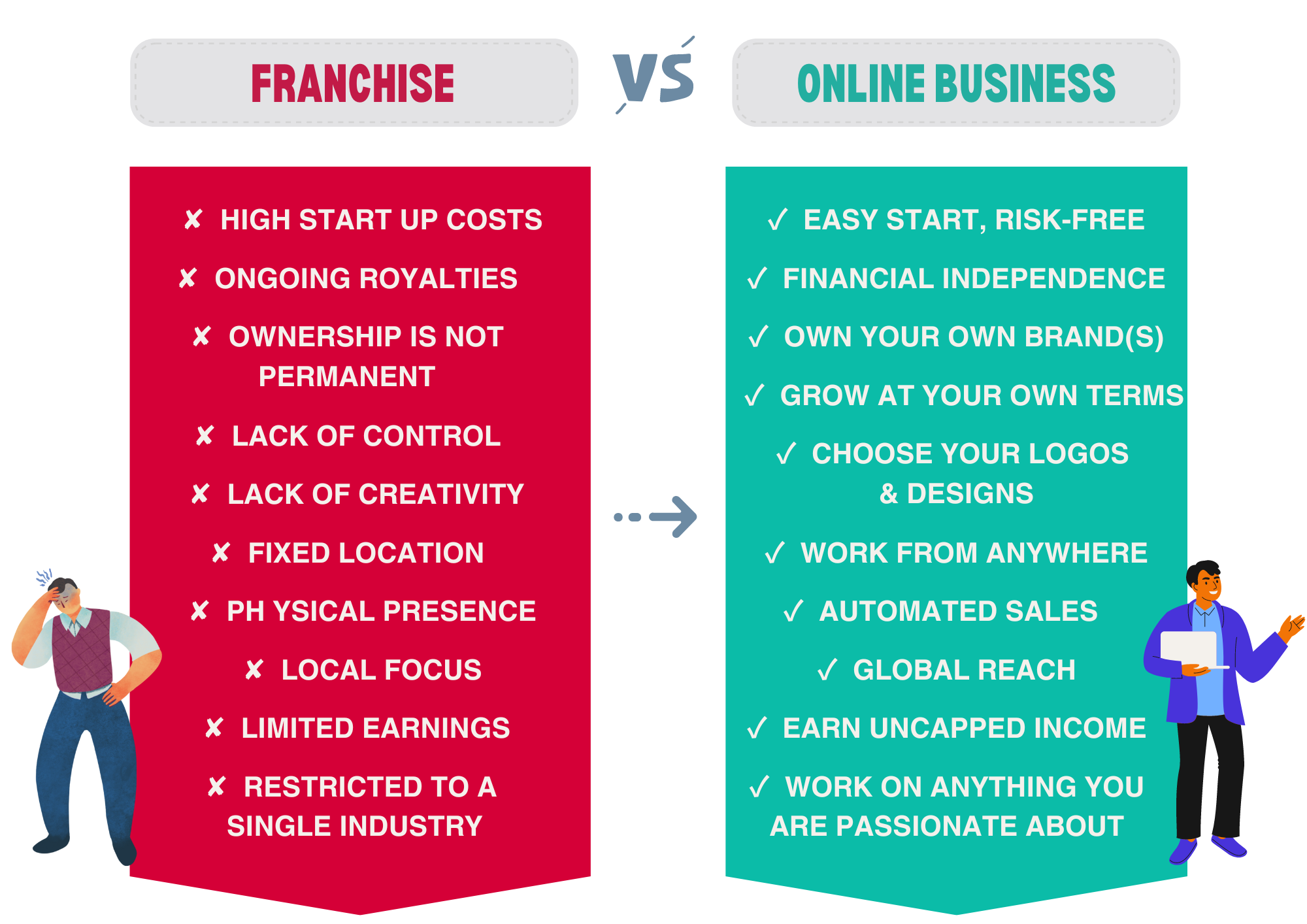

The Cons of Buying a Franchise: The Downsides to Consider

While the advantages are significant, franchising isn’t a perfect fit for everyone. It comes with its own set of limitations and financial obligations that potential franchisees must carefully consider.

1. Lack of Independence & Less Control

- Strict Rules: As a franchisee, you must adhere strictly to the franchisor’s operating manual and brand guidelines. This means little to no room for personal creativity, innovation, or deviation from the established system.

- Limited Decision-Making: You can’t just change the menu, alter the decor, or introduce a new service without the franchisor’s approval. This can be frustrating for highly independent entrepreneurs.

2. Significant Initial Investment & Ongoing Fees

- Upfront Costs: You’ll need to pay an initial franchise fee, which can range from a few thousand to hundreds of thousands of dollars, depending on the brand.

- Startup Costs: Beyond the franchise fee, you’ll need capital for real estate, equipment, inventory, signage, grand opening marketing, and working capital to cover initial operating expenses before the business becomes profitable.

- Ongoing Royalties: A percentage of your gross sales (typically 4-10%) is paid to the franchisor regularly (e.g., weekly or monthly). You pay this even if your business isn’t highly profitable.

- Advertising Fund Contributions: Another percentage of your gross sales usually goes into a communal advertising fund, whether you agree with how it’s spent or not.

- Other Fees: There might be additional fees for training, software, or technology upgrades.

3. Limited Innovation and Adaptability

- Slow to Change: Because the system is standardized across many locations, franchisors can be slow to adapt to new market trends or local customer preferences. You might see a great opportunity but be unable to act on it without franchisor approval, which can be a lengthy process.

- No Unique Selling Proposition: Your business will be identical to other locations of the same franchise, making it harder to stand out locally based on unique offerings.

4. Your Success is Tied to the Franchisor’s Reputation

- Negative Impact: If the franchisor faces a scandal, a product recall, or a decline in brand reputation, your individual franchise business can suffer, even if you’ve done nothing wrong.

- Systemic Issues: If the franchisor’s overall system becomes inefficient or loses its competitive edge, it directly impacts your ability to operate successfully.

5. Difficulty in Selling the Business

- Franchisor Approval: When you want to sell your franchise, the franchisor usually has the right to approve the new buyer. They might also have a "right of first refusal" or charge transfer fees.

- Restrictions: The terms of your franchise agreement can make selling more complex than selling an independent business.

6. Long-Term Commitment

- Franchise Agreement: You sign a legally binding contract (the Franchise Agreement) that typically lasts for 5, 10, or even 20 years. Breaking this agreement early can result in severe penalties.

- Renewal Terms: Even at renewal, there might be new fees or updated terms to accept.

How to Choose the Right Franchise for You: A Step-by-Step Guide

Choosing a franchise is a significant decision, requiring careful research, self-reflection, and due diligence. Don’t rush into it! Follow these steps to find the best franchise opportunity for your goals and resources.

Step 1: Self-Assessment – Understand Yourself First

Before you even look at a single franchise brand, look inward.

- What are your passions and interests? While you don’t need to be passionate about every aspect, enjoying the industry will make the long hours more bearable.

- What are your skills and strengths? Are you a people person, a manager, a numbers guru, or a marketing whiz?

- How much capital do you have access to? Be realistic about your financial comfort level for initial investment, startup costs, and living expenses during the initial lean months.

- What is your risk tolerance? Even with a proven model, there’s always risk.

- What are your lifestyle goals? Are you looking for a hands-on, owner-operator role, or a more semi-absentee management position?

Step 2: Research Industries and Concepts

Based on your self-assessment, start exploring different industries and franchise types.

- High-Growth Sectors: Look at trends. Are service businesses, health and wellness, tech-related services, or specific food categories booming?

- Recession-Resistant Industries: Consider businesses that tend to perform well even during economic downturns (e.g., essential services, auto repair).

- Your Personal Fit: Would you genuinely enjoy running a fitness center, a quick-service restaurant, a home cleaning service, or an educational tutoring center?

- Emerging vs. Established Brands: Emerging brands might offer more territory availability but carry higher risk. Established brands offer stability but might have higher costs and fewer prime locations.

Step 3: Financial Feasibility – Can You Afford It?

Once you have a few concepts in mind, delve into the financial requirements.

- Initial Franchise Fee: This is the upfront payment to the franchisor.

- Total Initial Investment Range: Franchisors provide an estimated range in their FDD (see Step 4). This includes everything from the franchise fee to build-out costs, equipment, initial inventory, and working capital.

- Working Capital: This is crucial! You need enough money to cover operating expenses (rent, payroll, utilities, supplies) for at least 6-12 months until the business generates sufficient profit.

- Royalty and Advertising Fees: Understand the percentages and how they are calculated.

- Franchisor Financial Health: Research the franchisor’s financial stability. You want to partner with a strong, solvent company.

Step 4: Due Diligence – Dig Deep and Ask Questions!

This is the most critical step. Don’t skip any part of it.

- Review the Franchise Disclosure Document (FDD): This is a legal document that every franchisor in the U.S. (and similar documents exist in other countries) must provide to prospective franchisees. It contains 23 items of vital information, including:

- Item 19: Financial Performance Representations: This is where franchisors can provide details about the earnings or sales of their existing franchisees. Pay very close attention here, but understand it’s not a guarantee.

- Item 20: List of Franchisees: This is a goldmine! It lists contact information for current and former franchisees.

- Item 21: Financial Statements: Review the franchisor’s audited financial statements.

- Item 3: Litigation: Check for any lawsuits involving the franchisor or its executives.

- Item 6: Other Fees: Be aware of all potential ongoing costs.

- Talk to Current and Former Franchisees: This is arguably the most valuable part of due diligence.

- Current Franchisees: Ask about the franchisor’s support, training, profitability, marketing effectiveness, and any unexpected challenges. Ask if they would do it again.

- Former Franchisees: Understand why they left. Was it a positive or negative experience?

- Consult Professionals:

- Franchise Attorney: Absolutely essential! Have a lawyer specializing in franchise law review the FDD and the Franchise Agreement before you sign anything. They will explain your obligations and rights.

- Accountant: Have an accountant review the franchisor’s financials and help you create a realistic financial projection and business plan for your specific location.

- Business Consultant/Mentor: Get advice from experienced business owners.

Step 5: Understand the Franchise Agreement

This is the legally binding contract between you and the franchisor. It’s long and complex, covering every aspect of the relationship:

- Term of the agreement (how long it lasts)

- Renewal terms and fees

- Territory rights (exclusive or not?)

- Operating procedures and standards

- Training and support obligations of the franchisor

- Fees (initial, royalty, advertising, other)

- Termination clauses and consequences

- Transferability of the franchise (if you want to sell)

Do not sign this without a franchise attorney’s thorough review.

Step 6: Visit Locations and Experience the Business

If possible, visit several existing franchise locations, both successful and perhaps less so. Observe:

- The atmosphere and customer experience

- Efficiency of operations

- Cleanliness and adherence to brand standards

- Talk to employees (if appropriate and non-disruptive)

Also, try the products or services yourself. Are they high quality? Do you believe in them?

Step 7: Develop Your Business Plan

Even with a "business in a box," you need your own specific business plan. This plan will outline:

- Your local market analysis and competition

- Your marketing strategy for your territory

- Detailed financial projections (startup costs, operating expenses, sales forecasts, break-even analysis)

- Your management team and staffing plan

- Operational details specific to your location

This plan will be essential for securing financing and will serve as your roadmap for the first few years of operation.

Important Questions to Ask Before You Buy a Franchise

As you go through your due diligence, keep these critical questions in mind:

- To the Franchisor:

- What is your franchisee support system like after the initial training?

- What are your plans for future growth and innovation?

- How do you handle disputes with franchisees?

- What is the average ramp-up time until profitability?

- What kind of marketing support will I receive locally?

- What are the top 3 qualities you look for in a successful franchisee?

- Can I see your audited financial statements (from the FDD)?

- To Current Franchisees:

- How long did it take you to become profitable?

- Are you satisfied with the franchisor’s support?

- Are the royalty and advertising fees worth the value you receive?

- What were your biggest unexpected challenges?

- Would you buy this franchise again knowing what you know now?

- How much time do you spend working in the business vs. on the business?

- To Yourself:

- Do I truly believe in this product/service?

- Am I comfortable following someone else’s rules strictly?

- Do I have enough capital (and reserves) for the entire initial phase?

- Am I prepared for the long-term commitment?

- Do I have the personality and drive to be a successful business owner?

Conclusion: Your Franchise Journey Awaits

Franchise opportunities offer a structured, less risky, and often faster path to business ownership for many aspiring entrepreneurs. They provide the power of an established brand, proven systems, and comprehensive support, allowing you to focus on execution rather than invention.

However, franchising is not a get-rich-quick scheme, nor is it a passive investment. It requires significant financial investment, hard work, dedication, and a willingness to operate within a defined system. By thoroughly understanding the pros and cons and diligently following the steps on how to choose the right franchise, you can significantly increase your chances of achieving your entrepreneurial dreams and building a successful, rewarding business.

Take your time, do your homework, and when you’re ready, embark on your exciting franchise journey with confidence!

Post Comment