Lagging Economic Indicators: Confirming a Downturn – Understanding the Economy’s Rearview Mirror

The economy is a vast, complex system, constantly moving and evolving. For businesses, investors, policymakers, and even everyday individuals, understanding its direction is crucial. While some economic signals try to predict the future (leading indicators) and others tell us what’s happening right now (coincident indicators), there’s a third, equally vital category: lagging economic indicators.

These indicators are like the rearview mirror of the economy. They don’t tell us what’s coming next, nor do they show us what’s happening at this very instant. Instead, they confirm what has already occurred, often solidifying the understanding that a shift, like an economic downturn, is indeed underway. For beginners, it’s essential to grasp why these "late" signals are so important. They provide the official confirmation, the undeniable proof, that a recession or slowdown has taken hold.

What Are Economic Indicators, Anyway?

Before we dive deep into the "lagging" part, let’s quickly define what economic indicators are in general.

Think of economic indicators as data points or statistics that give us clues about the health and direction of the economy. They’re like vital signs for a patient – a doctor looks at temperature, heart rate, and blood pressure to understand what’s going on. Economists and analysts look at things like job numbers, prices, and factory output.

These indicators are broadly categorized into three types based on their timing relative to economic cycles:

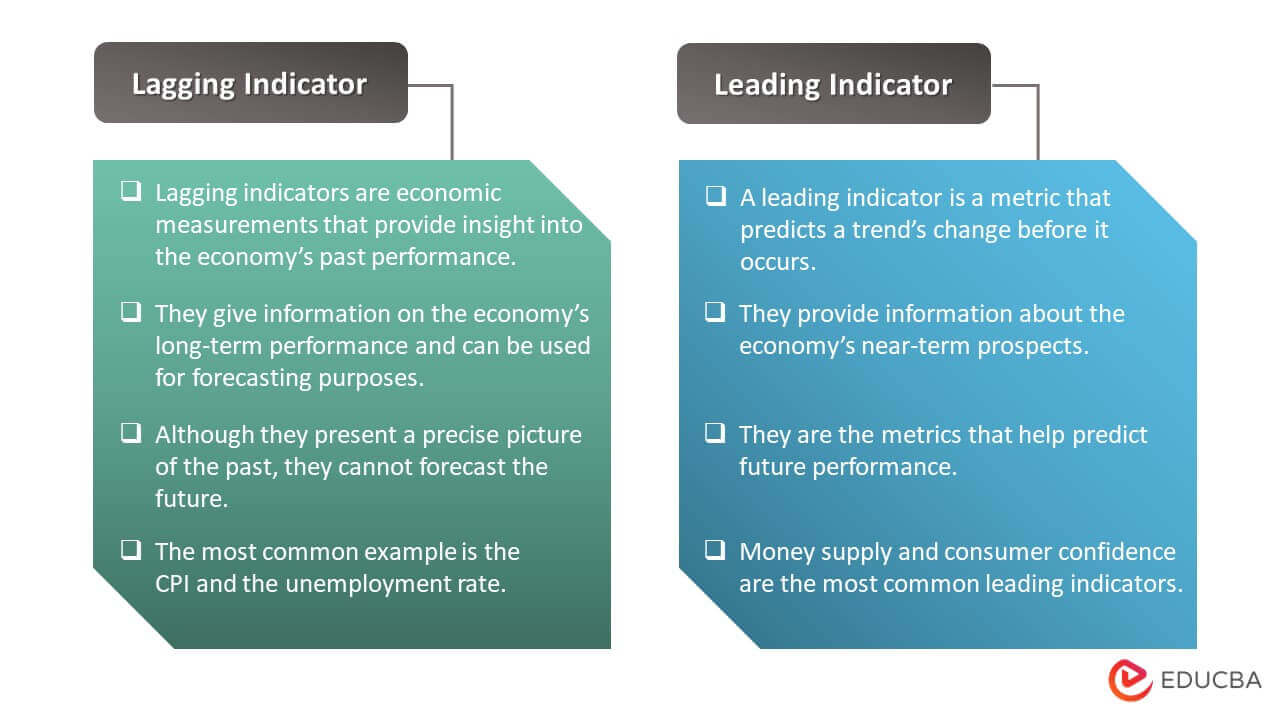

- Leading Indicators: These signals usually change before the economy as a whole changes. They try to predict future economic activity. Examples include new building permits, consumer confidence, or stock market performance.

- Coincident Indicators: These indicators change at the same time as the overall economy. They show us what’s happening right now. Examples include industrial production, personal income, or retail sales.

- Lagging Indicators: These are the focus of our article. They change after the economy has already begun to shift. They confirm a trend that is already in motion or has concluded.

Lagging Economic Indicators: The Economy’s Rearview Mirror

Imagine you’re driving a car. You look ahead to see where you’re going (leading indicators), and you glance at your speedometer to see how fast you’re going right now (coincident indicators). But you also check your rearview mirror to see what’s behind you – traffic that has already passed, or obstacles you’ve just cleared. That’s exactly what lagging indicators do for the economy.

Lagging economic indicators confirm a trend that has already happened or is well underway. They don’t predict recessions; they officially confirm them. While this might seem less useful than a crystal ball, their value lies in providing undeniable proof and giving policymakers and businesses the data they need to make informed decisions for the next phase.

Why are they "lagging"? Because the data takes time to collect, verify, and report. Or, the economic effects they measure simply take time to materialize and become widespread. For example, businesses don’t lay off workers the moment sales dip; they try other measures first. Only after a sustained downturn do the unemployment numbers officially rise.

Key Lagging Indicators That Confirm a Downturn

When an economy is heading into or is already in a downturn, these are the lagging indicators that will eventually rise, fall, or change in a way that confirms the challenging times:

1. Unemployment Rate

- What it is: The percentage of the total labor force that is actively looking for work but cannot find a job.

- Why it’s lagging: Companies don’t immediately fire employees when sales slow down. They might first reduce hours, halt hiring, or offer voluntary buyouts. Layoffs are often a last resort after a downturn has already begun to bite into profits and demand. Therefore, the official unemployment rate typically rises after a recession has started and falls after a recovery is underway.

- Confirming a Downturn: A sustained and significant increase in the official unemployment rate, reported month after month, is a strong confirmation that the economy is contracting and businesses are struggling.

2. Consumer Price Index (CPI) / Inflation Rate

- What it is: The CPI measures the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. The inflation rate is the percentage increase in prices over a period.

- Why it’s lagging: While changes in prices can be a leading or coincident indicator, the official, sustained rate of inflation or deflation that impacts consumer behavior and policy decisions often becomes clear only after the fact. For instance, if a central bank raises interest rates to combat inflation, the full effect of those rate hikes on price levels takes time to filter through the economy.

- Confirming a Downturn: In some downturns, we might see disinflation (prices rising more slowly) or even deflation (prices falling) as demand collapses. In other downturns, particularly those following periods of high inflation (like the 1970s or recently), high inflation might persist for a while even as the economy slows, making the "stagflation" scenario. The confirmed trend in CPI helps confirm the economic environment.

3. Corporate Profits

- What it is: The total earnings of companies after all expenses (like wages, rent, and taxes) have been paid.

- Why it’s lagging: Companies report their profits quarterly (every three months) or annually. These reports reflect performance from the past period. When a downturn begins, sales might drop, but companies might initially try to maintain profit margins by cutting costs in other areas. However, as the downturn deepens, profits inevitably fall. This decline is then reported after the quarter has ended.

- Confirming a Downturn: A consistent trend of declining corporate profits across a wide range of industries over several quarters is a clear lagging signal that the economy is weakening. This often leads to further cuts, including layoffs, which then feed into the unemployment rate.

4. Gross Domestic Product (GDP) – Final Confirmed Figures

- What it is: The total value of all goods and services produced within a country’s borders in a specific period. It’s the broadest measure of economic activity.

- Why it’s lagging: GDP figures are released in stages: an "advance" estimate, a "second" estimate, and then a "third" or "final" estimate. These final figures, which are the most accurate, are released well after the quarter has ended. A recession is officially defined as two consecutive quarters of negative GDP growth. By the time this is confirmed, the recession is already underway or even nearing its end.

- Confirming a Downturn: When the final GDP numbers show two consecutive quarters of contraction (negative growth), it serves as the official, lagging confirmation of a recession.

5. Interest Rates (Specifically, the Average Prime Rate)

- What it is: The prime rate is the interest rate commercial banks charge their most creditworthy corporate customers. It’s heavily influenced by the federal funds rate set by the central bank (like the Federal Reserve in the US).

- Why it’s lagging: While central banks change interest rates in an attempt to influence the future (making them somewhat leading in policy action), the average prime rate and its effects on the broader economy often lag. Banks don’t immediately adjust all their lending rates in lockstep, and it takes time for higher rates to filter through consumer borrowing, business investment, and ultimately, economic activity. The central bank often raises rates after inflation has become a problem, and may only cut them after a recession is confirmed.

- Confirming a Downturn: A sustained period of higher interest rates, reflecting a central bank’s efforts to cool an overheated economy, can eventually lead to a downturn. The persistence of these higher rates and their impact on borrowing and spending are confirmed over time.

6. Consumer Credit Defaults

- What it is: The rate at which consumers fail to make required payments on their loans (credit cards, mortgages, auto loans, etc.).

- Why it’s lagging: People generally try to keep up with their debt payments as long as possible. Defaults typically rise after unemployment has gone up, incomes have shrunk, or economic uncertainty has become severe. It’s a sign of financial distress that follows a deteriorating economic situation.

- Confirming a Downturn: A significant and widespread increase in consumer loan defaults signals that individuals are struggling financially, which is a strong confirmation of a broader economic downturn affecting households.

How Lagging Indicators Confirm a Downturn: The Sequence of Events

Think of it as a domino effect, or a story unfolding over time:

- Chapter 1: The Warning Signs (Leading Indicators): Stock markets start to dip, consumer confidence wavers, new business orders decline. These are the early whispers of trouble.

- Chapter 2: The Current Reality (Coincident Indicators): Industrial production slows, retail sales start to stagnate, and personal income growth flattens. You can feel the slowdown happening.

- Chapter 3: The Official Confirmation (Lagging Indicators): After months of slowing, companies start significant layoffs, causing the unemployment rate to jump. Corporate profits plummet. The final GDP figures show two consecutive quarters of contraction. Consumer credit defaults begin to surge. These are the definitive proofs that a downturn has not only begun but is also officially recognized.

By the time lagging indicators fully confirm a downturn, the economy may already be in the midst of it, or even approaching the bottom. This is why they are not useful for predicting, but indispensable for confirming and understanding the severity and duration of the economic phase.

Why Are Lagging Indicators Important, Even if They’re "Late"?

Their "lateness" doesn’t diminish their value. Here’s why lagging indicators are crucial:

- Validation and Confidence: They provide concrete evidence that earlier signals (leading and coincident) were accurate. This helps policymakers, businesses, and the public gain confidence in the economic assessment.

- Policy Adjustments: Governments and central banks often use lagging indicators to confirm the need for significant policy changes. For instance, once a recession is confirmed by GDP and unemployment, the central bank might feel more justified in cutting interest rates aggressively, or the government might implement stimulus packages.

- Historical Context and Analysis: Lagging indicators are vital for economists to study past economic cycles, understand the causes and effects of recessions, and build better models for the future.

- Business Planning: For businesses, confirmed data about a downturn helps in long-term strategic planning. They can adjust investment plans, hiring strategies, and production levels based on concrete evidence, rather than just predictions.

- Investor Strategies: While investors might react to leading indicators, lagging indicators help them understand the confirmed economic environment, which influences longer-term portfolio adjustments and sector allocations. For example, once a recession is confirmed, defensive stocks or bonds might become more attractive.

- Understanding Severity: Lagging indicators, especially unemployment and corporate profits, help quantify the depth and impact of a downturn on real people and businesses.

Limitations of Lagging Indicators

While invaluable for confirmation, relying solely on lagging indicators has its downsides:

- No Predictive Power: They cannot tell you what’s going to happen next. If you wait for lagging indicators to confirm a downturn before acting, you’ve already missed the initial phases of the shift.

- Delayed Response: For quick decision-making, especially in fast-moving markets, lagging indicators are too slow. Reacting only to confirmed past data can lead to missed opportunities or delayed necessary adjustments.

Conclusion: A Full Picture of the Economy

Understanding lagging economic indicators is like understanding the final chapter of a complex story. They provide the definitive proof, the official confirmation, that an economic downturn has taken hold. While they don’t offer foresight, their value lies in their ability to validate earlier signals, inform crucial policy decisions, and help us fully grasp the historical context and severity of economic shifts.

To truly navigate the economic landscape, it’s essential to look at all three types of indicators – leading, coincident, and lagging – together. Each offers a unique piece of the puzzle, providing a comprehensive view that helps us understand where the economy has been, where it is now, and where it might be headed next. By understanding the "rearview mirror" of the economy, we become better equipped to make informed decisions for our financial future.

Post Comment