What is Owner’s Equity and How Does It Grow? Your Guide to Building Business Wealth

Ever wondered what truly belongs to the owners of a business after all debts are paid? That, in essence, is Owner’s Equity. It’s a fundamental concept in business finance, representing the residual claim on assets after liabilities are settled. For aspiring entrepreneurs, small business owners, and anyone curious about how businesses build wealth, understanding owner’s equity is not just important – it’s crucial.

This comprehensive guide will demystify owner’s equity, explain its core components, reveal the primary ways it grows, and offer actionable tips for increasing this vital measure of business health.

Table of Contents

- What Exactly is Owner’s Equity? (The Foundation)

- The Accounting Equation: The Heart of Equity

- Different Names for Equity

- Why is Owner’s Equity So Important?

- Key Components of Owner’s Equity

- Capital Contributions (Initial & Additional Investments)

- Retained Earnings (The Power of Profit)

- Other Equity Accounts (Briefly)

- How Does Owner’s Equity Grow? (The Growth Engines)

- Method 1: Injecting More Capital

- Method 2: Earning and Retaining Profits (The Most Common Way)

- Indirect Growth Factors

- What Can Decrease Owner’s Equity?

- Owner Withdrawals/Dividends

- Business Losses

- Owner’s Equity on the Balance Sheet

- Practical Tips for Growing Your Owner’s Equity

- Common Misconceptions About Owner’s Equity

- Conclusion: Empowering Your Business Journey

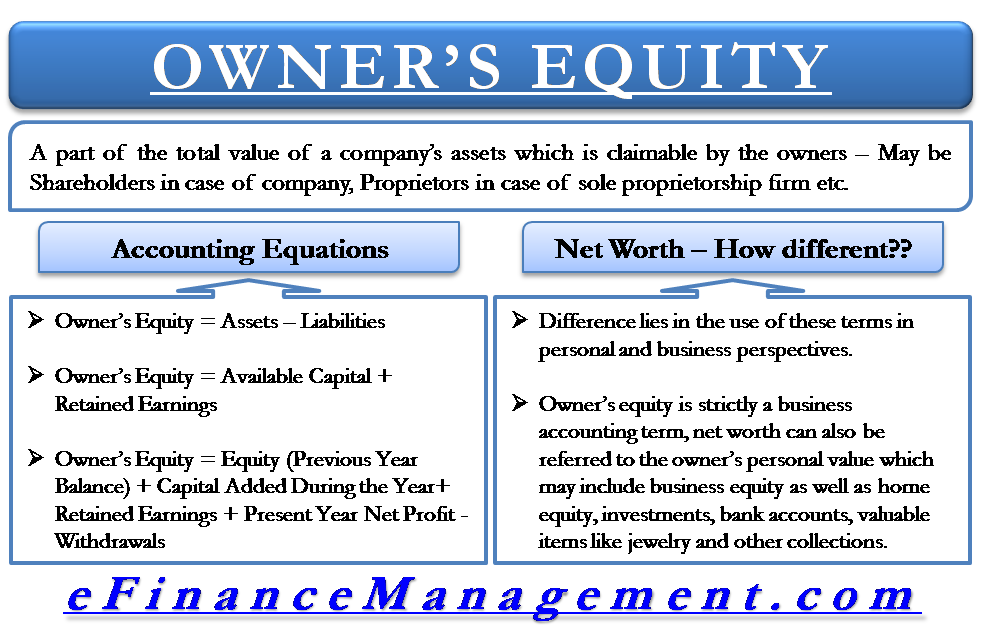

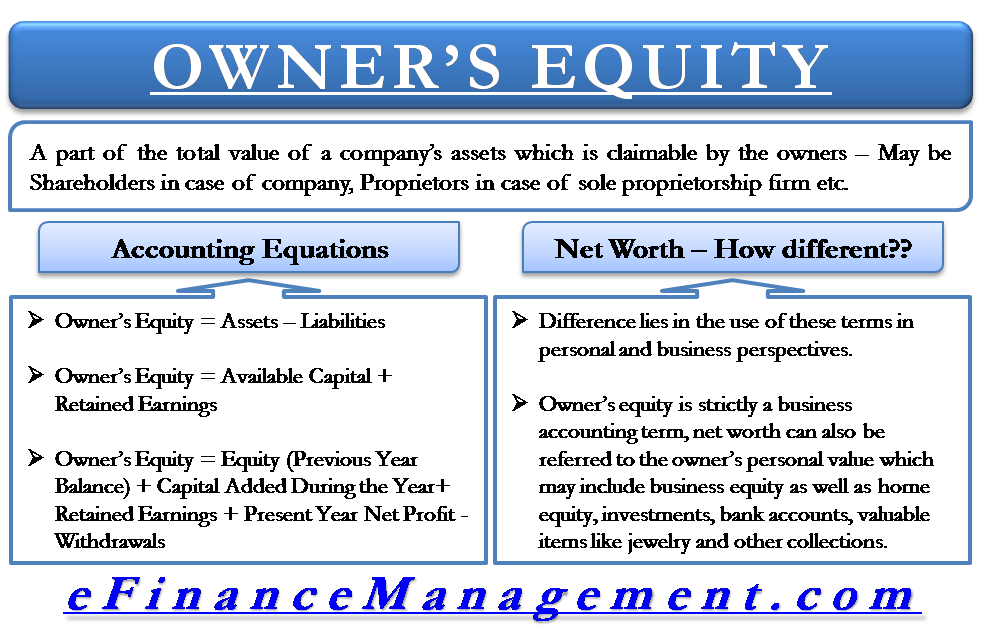

1. What Exactly is Owner’s Equity? (The Foundation)

Let’s start with a simple analogy. Imagine you own a house. Your house has a certain value (its assets). You probably have a mortgage (your liabilities). The difference between what your house is worth and what you still owe on it is your home equity. If you sell your house today and pay off the mortgage, the money left over is your equity.

In the business world, owner’s equity works the same way. It’s the owners’ stake in the company. It represents the portion of the company’s assets that are financed by the owners, rather than by external creditors (like banks or suppliers).

The Accounting Equation: The Heart of Equity

At the core of understanding owner’s equity is the fundamental accounting equation:

Assets = Liabilities + Owner’s Equity

Let’s break down each part:

- Assets: These are everything the business owns that has economic value. This includes cash, accounts receivable (money owed to the business), inventory, equipment, buildings, land, and intellectual property.

- Liabilities: These are what the business owes to others. This includes accounts payable (money the business owes to suppliers), loans, mortgages, and unearned revenue.

- Owner’s Equity: This is the residual claim on the assets after all liabilities have been paid. It represents the owners’ investment in the company plus any accumulated profits that have been reinvested in the business.

Think of it this way: If you were to liquidate (sell off) all of a company’s assets and then pay off all its debts (liabilities), the money left over would be the owner’s equity.

Different Names for Equity

You might encounter owner’s equity referred to by several other names, depending on the type of business structure:

- Shareholder Equity / Stockholder Equity: Commonly used for corporations, where owners are shareholders who own shares of stock.

- Partners’ Capital: Used for partnerships, where owners are partners.

- Owner’s Capital / Proprietor’s Equity: Often used for sole proprietorships.

- Net Worth: A broader term, but in a business context, it’s often synonymous with owner’s equity.

Regardless of the name, the underlying concept remains the same: it’s the owners’ piece of the pie.

Why is Owner’s Equity So Important?

Understanding owner’s equity is vital for several reasons:

- Indicator of Financial Health: A growing and positive owner’s equity generally indicates a healthy and financially stable business. It shows that the business is building wealth for its owners.

- Attracting Investors and Lenders: A strong equity position makes your business more attractive to potential investors and lenders. It signals that the owners have a significant stake in the business and that the company has a solid financial foundation. Lenders see lower risk when there’s more owner investment.

- Capacity for Growth: Higher equity means the business has more internal capital to fund expansion, research and development, or new initiatives without relying heavily on debt.

- Owner’s Return: Ultimately, owner’s equity represents the owners’ investment and their accumulated share of the business’s success. It’s a key measure of how much value the business has created for its owners.

- Legal Compliance: For corporations, maintaining a certain level of shareholder equity might be required by law or specific covenants.

2. Key Components of Owner’s Equity

While the overall concept is straightforward, owner’s equity is typically made up of a few key accounts. For beginners, the two most important are:

Capital Contributions (Initial & Additional Investments)

This component represents the money or other assets (like equipment or property) that the owner(s) directly invest into the business.

- Initial Investment: This is the capital an owner puts in to start the business. For a sole proprietor, it might be cash from their personal savings. For a corporation, it’s the money shareholders pay to buy shares.

- Additional Investments: As the business grows, owners might inject more capital to fund expansion, cover operational gaps, or strengthen the balance sheet. This also increases capital contributions.

Example: Sarah starts a graphic design business and invests $10,000 of her personal savings. This $10,000 is her initial capital contribution, directly increasing the owner’s equity of her business. If a year later she puts in another $5,000 to buy new software, that’s an additional capital contribution.

Retained Earnings (The Power of Profit)

This is often the largest and most dynamic component of owner’s equity, especially for established businesses. Retained earnings represent the cumulative total of a company’s net income (profits) that have not been distributed to owners as dividends or withdrawals, but instead have been reinvested back into the business.

Think of it as the "savings account" of the business, where profits are kept and used to fuel future growth.

- How it works: When a business makes a profit, that profit can either be:

- Distributed: Paid out to owners (e.g., as owner withdrawals in a sole proprietorship, or dividends in a corporation).

- Retained: Kept within the business to buy new assets, pay down debt, fund operations, or expand.

- Impact on Equity: When profits are retained, they increase the retained earnings account, which in turn increases the overall owner’s equity.

Example: If Sarah’s graphic design business makes a net profit of $20,000 in its first year, and she decides to take out $5,000 for personal use, the remaining $15,000 is retained earnings. This $15,000 adds to her owner’s equity, demonstrating that the business has generated wealth that is now "owned" by her.

Other Equity Accounts (Briefly)

For corporations, there might be other equity accounts, such as:

- Preferred Stock: A type of stock with different rights than common stock.

- Treasury Stock: Shares of the company’s own stock that it has repurchased from the open market. This actually decreases total equity.

- Accumulated Other Comprehensive Income (AOCI): Accounts for certain gains and losses that aren’t reported on the income statement (e.g., unrealized gains/losses on certain investments).

For beginners, focusing on Capital Contributions and Retained Earnings is sufficient as they are the primary drivers of equity growth for most small and medium-sized businesses.

3. How Does Owner’s Equity Grow? (The Growth Engines)

Now that we know what owner’s equity is made of, let’s dive into the two main ways it expands:

Method 1: Injecting More Capital

This is the most direct way to increase owner’s equity. When owners contribute more money or assets to the business, the owner’s equity account increases immediately.

- Scenario: A sole proprietor puts an additional $5,000 from their personal savings into the business checking account.

- Impact: Cash (an asset) increases by $5,000, and Owner’s Capital (an equity account) increases by $5,000. The accounting equation remains balanced.

- Scenario: A corporation issues new shares of stock to investors for cash.

- Impact: Cash (an asset) increases, and Shareholder Equity (specifically the "Common Stock" or "Paid-in Capital" account) increases.

When is this useful?

- Startup Phase: Essential for getting the business off the ground.

- Expansion: Funding a new product line, opening a new location, or acquiring another business.

- Financial Distress: Providing a lifeline during tough times to avoid taking on more debt.

- Strengthening the Balance Sheet: Improving the company’s debt-to-equity ratio to make it more attractive to lenders.

Method 2: Earning and Retaining Profits (The Most Common Way)

This is the bread and butter of sustainable equity growth. When a business generates net income (profit) and chooses to keep a portion or all of that profit within the business, it directly increases retained earnings, and thus owner’s equity.

Let’s trace the journey of a profit:

- Revenue: The business sells goods or services (e.g., $100,000).

- Expenses: The business incurs costs to generate that revenue (e.g., $60,000).

- Net Income (Profit): Revenue minus expenses (e.g., $40,000). This profit is initially reflected on the Income Statement.

- Decision Point: The owners decide what to do with the $40,000 profit.

- Option A: Distribute as Dividends/Withdrawals: If the owners take out $10,000, that $10,000 decreases equity (specifically retained earnings) as it leaves the business.

- Option B: Retain in the Business: If the remaining $30,000 is kept in the business, it moves from the Income Statement (as net income) to the Balance Sheet as an increase in the "Retained Earnings" component of owner’s equity.

Why is this so powerful?

- Organic Growth: It’s growth funded by the business’s own success, not by new money from outside or additional owner contributions.

- Compounding Effect: Over time, consistent profitability and retention of earnings can lead to significant equity growth, allowing the business to self-fund its expansion.

- Financial Stability: A business that can grow through retained earnings is less reliant on external financing, making it more resilient.

Example: A software company earns a net profit of $500,000 in a year. The founders decide to reinvest $400,000 back into developing a new product and marketing, distributing only $100,000 as dividends. The $400,000 directly increases the company’s retained earnings, significantly boosting its owner’s equity. This equity can then be used to pay for new developers, servers, and marketing campaigns – all assets that help the business grow further.

Indirect Growth Factors

While not direct additions to equity accounts, these factors can positively impact owner’s equity over time:

- Asset Appreciation: If a business owns assets like real estate or valuable intellectual property, an increase in their market value (even if not realized by sale) can indirectly strengthen the underlying value of the assets, and thus the potential equity, though usually not immediately reflected in the accounting equation until sold or revalued.

- Debt Reduction: While paying down liabilities doesn’t directly increase equity in the accounting equation, it strengthens the balance sheet. By reducing liabilities, the proportion of assets financed by owners (equity) becomes larger relative to the assets financed by debt. This improves financial ratios and the perceived stability of the business.

4. What Can Decrease Owner’s Equity?

Just as owner’s equity can grow, it can also decrease. Understanding these factors is equally important for managing your business’s financial health.

Owner Withdrawals / Dividends

When owners take money or assets out of the business for personal use, this directly reduces owner’s equity.

- Sole Proprietorship/Partnership: Often called "owner’s draws" or "withdrawals."

- Corporation: Called "dividends" paid to shareholders.

While perfectly normal and often necessary for owners to live, excessive withdrawals can stunt growth and weaken the business’s financial position.

Business Losses

If a business operates at a net loss (expenses exceed revenue), this loss directly reduces retained earnings, and thus owner’s equity.

- Impact: A loss for the period effectively subtracts from the accumulated profits (retained earnings) of previous periods. If losses continue, they can eventually erode all retained earnings and even capital contributions, leading to negative equity.

Example: Sarah’s graphic design business has a tough quarter and incurs a net loss of $2,000. This $2,000 loss will reduce her accumulated retained earnings by that amount, lowering her overall owner’s equity.

5. Owner’s Equity on the Balance Sheet

The Balance Sheet is one of the three core financial statements (along with the Income Statement and Cash Flow Statement). It provides a snapshot of a company’s financial position at a specific point in time.

Owner’s Equity is always found on the Balance Sheet, typically in the bottom section, after Assets and Liabilities. It will be broken down into its components, such as:

[Your Company Name]

Balance Sheet

As of [Date]

ASSETS

Current Assets

Cash …………………….. $X,XXX

Accounts Receivable ………. $X,XXX

Inventory ………………. $X,XXX

Non-Current Assets

Property, Plant, Equipment .. $X,XXX

Total Assets …………… $XX,XXX

LIABILITIES

Current Liabilities

Accounts Payable ………… $X,XXX

Short-Term Loans ………… $X,XXX

Non-Current Liabilities

Long-Term Debt ………….. $X,XXX

Total Liabilities ………. $XX,XXX

OWNER’S EQUITY

Capital Contributions ……. $X,XXX

Retained Earnings ……….. $X,XXX

Total Owner’s Equity ……. $XX,XXX

Total Liabilities & Owner’s Equity . $XX,XXX

Note: The "Total Assets" figure will always equal the "Total Liabilities & Owner’s Equity" figure. This is the fundamental balancing act of the accounting equation!

Monitoring your owner’s equity on the balance sheet over time gives you a clear picture of whether your business is growing its wealth or facing challenges.

6. Practical Tips for Growing Your Owner’s Equity

Understanding owner’s equity is one thing; actively working to increase it is another. Here are actionable strategies for entrepreneurs and business owners:

- Focus on Profitability: This is paramount. A business must generate more revenue than its expenses to create net income.

- Increase Sales: Implement effective marketing, expand your customer base, introduce new products/services.

- Optimize Pricing: Ensure your prices cover costs and provide a healthy margin.

- Manage Costs: Regularly review and reduce unnecessary expenses without sacrificing quality or efficiency.

- Reinvest Profits Wisely: Don’t just accumulate cash; put retained earnings to work.

- Invest in new equipment, technology, or facilities that boost productivity or capacity.

- Fund research and development for new products or services.

- Expand into new markets.

- Pay down high-interest debt (this indirectly strengthens equity by reducing liabilities).

- Control Owner Withdrawals/Dividends: While taking money out is necessary, be disciplined.

- Develop a clear policy for owner compensation that balances personal needs with business growth.

- Prioritize reinvestment, especially in the early stages or during growth phases.

- Consider Strategic Capital Injections: If there’s a clear opportunity for significant growth that requires more capital than current profits can provide, consider injecting more personal funds or bringing in new investors. This should be a calculated decision, not a regular habit for operational costs.

- Monitor Your Financials Regularly:

- Review your Income Statement to track profitability.

- Regularly check your Balance Sheet to see the growth (or decline) in your owner’s equity.

- Analyze key financial ratios related to equity (e.g., Debt-to-Equity Ratio).

- Build a Strong Brand and Customer Loyalty: These intangible assets can indirectly contribute to long-term profitability and therefore equity growth. A strong brand can command higher prices and attract more sales.

7. Common Misconceptions About Owner’s Equity

It’s easy to confuse owner’s equity with other financial concepts. Let’s clarify some common misunderstandings:

- Misconception 1: Owner’s Equity = Cash in the Bank.

- Reality: While cash is an asset, owner’s equity is a claim on all assets (cash, equipment, inventory, etc.) after liabilities. A business can have high equity but low cash if most of its assets are tied up in inventory or accounts receivable. Equity represents the value of the owners’ stake, not necessarily liquid funds.

- Misconception 2: Owner’s Equity = Revenue.

- Reality: Revenue is the total income generated from sales over a period. Owner’s equity is a cumulative figure representing invested capital plus retained profits (which are derived from revenue minus expenses). They are distinctly different financial measures.

- Misconception 3: Positive Equity Means the Business is Always Doing Well.

- Reality: While positive equity is generally good, a business can still have cash flow problems or declining profitability even with positive equity. It’s a snapshot in time. You need to look at all three financial statements (Balance Sheet, Income Statement, Cash Flow Statement) together for a complete picture.

- Misconception 4: Equity is Just for Large Corporations.

- Reality: Every business, regardless of size or structure (sole proprietorship, partnership, LLC, corporation), has owner’s equity. It might be called "Owner’s Capital" or "Partners’ Equity," but the concept is the same.

Conclusion: Empowering Your Business Journey

Owner’s equity is more than just a number on a balance sheet; it’s a powerful indicator of your business’s financial strength, its accumulated wealth, and its potential for future growth. By understanding what owner’s equity is, how its components interact, and the key drivers of its growth (and decline), you gain invaluable insight into your business’s true financial health.

Remember, consistent profitability and disciplined reinvestment of those profits are the most sustainable ways to build owner’s equity over the long term. Start tracking your equity, make informed decisions, and empower your business to build lasting wealth.

Post Comment