Retirement Planning Basics: A Step-by-Step Guide to Securing Your Future

Retirement. The word itself conjures images of freedom, relaxation, and pursuing passions without the daily grind. But for many, it also brings a knot of anxiety: How will I afford it? Where do I even begin?

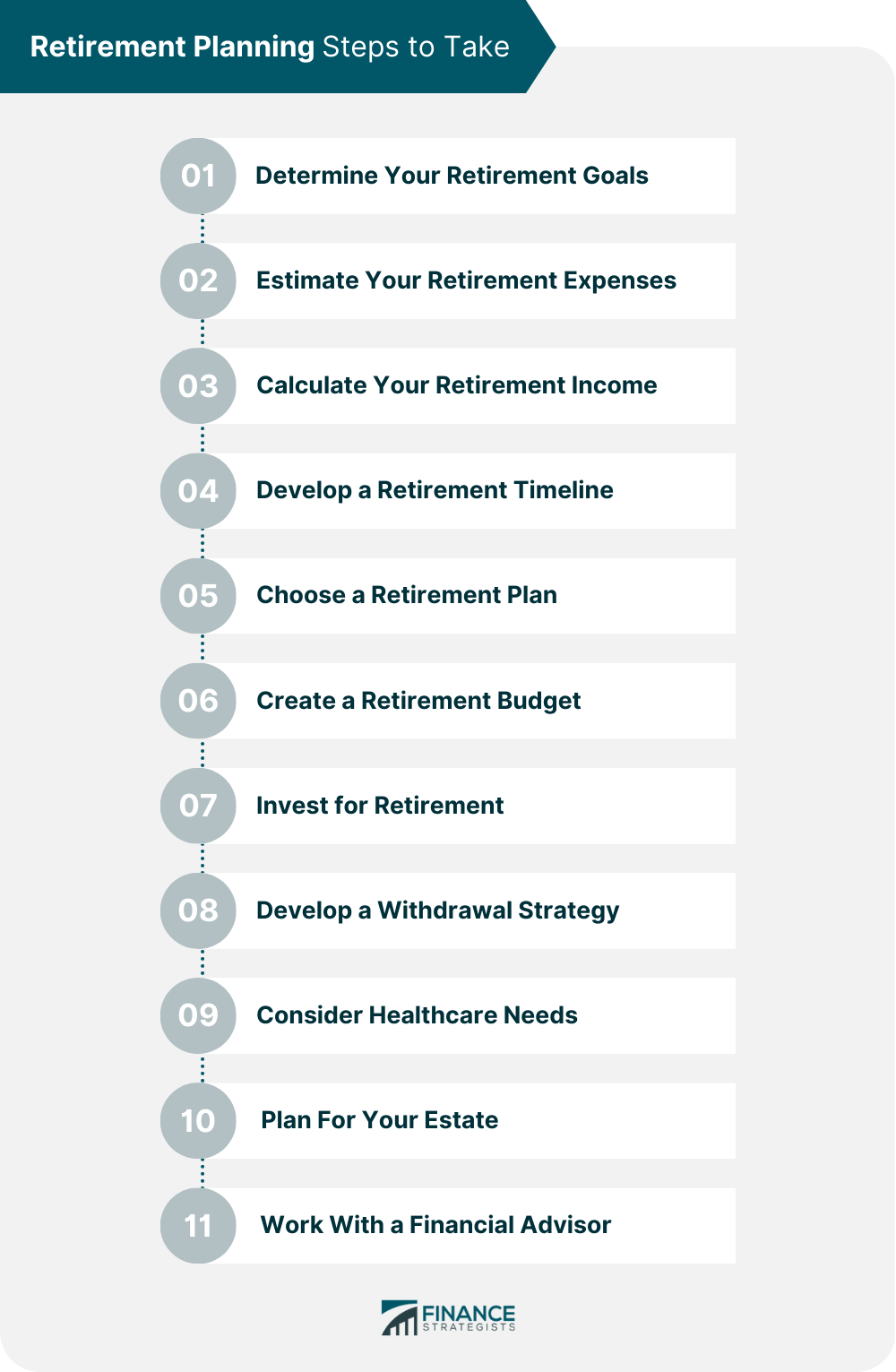

You’re not alone. Retirement planning can seem like a monumental task, especially if you’re just starting out or feel like you’ve fallen behind. The good news? It doesn’t have to be overwhelming. This guide breaks down the basics into simple, actionable steps, making the path to a secure and fulfilling retirement clear and manageable.

Let’s demystify retirement planning and empower you to take control of your financial future, one step at a time.

Why Retirement Planning Matters (Even if It Feels Far Away)

Before we dive into the "how," let’s understand the "why." Retirement planning isn’t just about accumulating a giant sum of money; it’s about ensuring your peace of mind and preserving your lifestyle when you’re no longer working.

Here’s why starting early and planning strategically is crucial:

- The Power of Compound Interest: This is your best friend! The longer your money has to grow, the more it earns on itself. Even small, consistent contributions made early can snowball into a significant nest egg over decades.

- Increased Longevity: People are living longer than ever before. A 65-year-old today can reasonably expect to live into their late 80s or even 90s. This means your retirement savings need to last for 20, 30, or even more years.

- Rising Healthcare Costs: Healthcare expenses tend to increase with age and can be a significant drain on retirement funds. Planning ahead for these costs is vital.

- Inflation: The cost of living consistently rises over time. What costs $100 today might cost $200 in 20-30 years. Your savings need to outpace inflation to maintain your purchasing power.

- Social Security May Not Be Enough: While Social Security provides a foundation, it’s generally designed to replace only about 40% of an average earner’s pre-retirement income. You’ll need other sources to cover your expenses and desired lifestyle.

Step 1: Envision Your Retirement Lifestyle (The Dream Phase)

Before you start crunching numbers, take some time to dream. What does your ideal retirement look like? This vision will be your motivation and help you set realistic financial goals.

Ask yourself:

- Where will you live? Will you stay in your current home, downsize, move closer to family, or relocate to a warmer climate?

- What will you do? Travel the world, pursue hobbies, volunteer, start a small business, spend more time with grandkids, or simply relax?

- What’s your daily routine? Will you wake up early for golf, enjoy leisurely mornings, or stay active with exercise and social groups?

- How active will you be? Will you need funds for expensive trips and activities, or are you envisioning a more relaxed, home-based retirement?

- Will you work part-time? Many retirees choose to work a few hours a week to supplement income or stay engaged.

Action Item: Grab a pen and paper or open a document and start jotting down your retirement dreams. Be as specific as possible!

Step 2: Calculate Your Retirement Needs (The Numbers Game)

Now that you have a vision, let’s put some numbers to it. This step can feel daunting, but remember, it’s an estimate, and you can always adjust it later.

A. Estimate Your Retirement Expenses:

A common rule of thumb suggests you’ll need 70-80% of your pre-retirement income to maintain your lifestyle. However, this is just a starting point. Your actual needs might be higher or lower depending on your Step 1 vision.

Consider these categories:

- Housing: Mortgage/rent, property taxes, insurance, maintenance.

- Utilities: Electricity, gas, water, internet, phone.

- Food: Groceries, dining out.

- Transportation: Car payments, gas, insurance, public transport, travel.

- Healthcare: Insurance premiums, deductibles, co-pays, prescriptions, long-term care. (This is often a higher expense in retirement.)

- Leisure & Hobbies: Travel, entertainment, dining, gym memberships, golf, art supplies, etc.

- Personal Care: Haircuts, toiletries, clothing.

- Miscellaneous: Gifts, charitable donations, unexpected expenses.

Tip: Look at your current monthly spending. Some expenses might decrease (commuting, work clothes), while others might increase (travel, hobbies, healthcare).

B. Account for Inflation:

Remember that $100 today? It will buy less in 20-30 years. When estimating your future expenses, assume a conservative inflation rate (e.g., 2-3% per year). Online retirement calculators automatically factor this in.

C. How Long Will Your Retirement Last?

It’s uncomfortable to think about, but estimating your lifespan is crucial for planning. Most financial planners use an age like 90 or 95 to ensure your money lasts.

D. Use Retirement Calculators:

Don’t try to do complex math by hand! Many free online retirement calculators can help:

- Employer-sponsored plan websites (401(k), 403(b))

- Financial institution websites (Fidelity, Vanguard, Charles Schwab)

- Government sites (Social Security Administration)

These calculators will ask for your current age, desired retirement age, current savings, and desired income in retirement, then tell you how much you need to save per month.

Step 3: Assess Your Current Financial Snapshot (Where You Are Now)

Before you map out your journey, you need to know your starting point. This involves taking a clear-eyed look at your current assets and liabilities.

- Current Savings:

- How much do you currently have in your 401(k), 403(b), IRA, Roth IRA, or other investment accounts?

- Do you have a pension from a previous job? (Less common now, but worth checking).

- What’s in your regular savings accounts?

- Social Security Estimate:

- Create an account at SSA.gov/myaccount. You can view your earnings record and get personalized estimates of your future Social Security benefits at different claiming ages.

- Net Worth:

- List all your assets (what you own): Home equity, savings, investments, valuable possessions.

- List all your liabilities (what you owe): Mortgage, car loans, student loans, credit card debt.

- Assets – Liabilities = Your Net Worth. This gives you a snapshot of your financial health.

- Budgeting:

- Understand where your money is going now. Are there areas where you can cut back to free up more for savings? Even small reductions can add up significantly over time.

Action Item: Gather statements for all your accounts. Visit the SSA website. If you don’t budget, now is a great time to start!

Step 4: Choose the Right Retirement Savings Vehicles

Once you know how much you need to save, the next step is deciding where to put your money. These are the "vehicles" that will help your money grow tax-efficiently.

A. Employer-Sponsored Plans (The Best Place to Start!)

- 401(k) / 403(b) / TSP (Thrift Savings Plan for federal employees): These are workplace retirement plans that allow you to contribute a portion of your paycheck pre-tax.

- Employer Match: This is FREE MONEY! If your employer offers a match (e.g., they contribute 50 cents for every dollar you contribute up to 6% of your salary), always contribute enough to get the full match. It’s an immediate, guaranteed return on your investment.

- High Contribution Limits: You can contribute a significant amount each year.

- Tax-Deferred Growth: You don’t pay taxes on the money or its growth until you withdraw it in retirement.

- Investment Options: Usually offers a selection of mutual funds, index funds, and target-date funds.

B. Individual Retirement Accounts (IRAs)

- Traditional IRA:

- Contributions may be tax-deductible (reducing your taxable income now).

- Money grows tax-deferred until retirement.

- Withdrawals in retirement are taxed as ordinary income.

- Ideal if you expect to be in a lower tax bracket in retirement.

- Roth IRA:

- Contributions are made with after-tax money (not tax-deductible).

- Money grows tax-free, and qualified withdrawals in retirement are completely tax-free.

- Ideal if you expect to be in a higher tax bracket in retirement or want tax-free income in retirement.

- Has income limitations for contributions.

Tip: If your employer offers a 401(k) match, contribute enough to get the full match first. Then, consider contributing to a Roth IRA (if you qualify) or maxing out your 401(k).

C. Health Savings Accounts (HSAs)

If you have a high-deductible health plan (HDHP), you might be eligible for an HSA. These are triple-tax advantaged:

- Tax-deductible contributions.

- Tax-free growth.

- Tax-free withdrawals for qualified medical expenses.

- After age 65, you can withdraw funds for any purpose (taxed as ordinary income if not for medical expenses), essentially acting like an additional retirement account.

D. Taxable Brokerage Accounts

These are general investment accounts (like opening an account with Fidelity or Vanguard) where you can invest in stocks, bonds, mutual funds, etc.

- No specific tax benefits for contributions.

- Gains are taxed annually or when you sell investments.

- Offers flexibility as there are no withdrawal restrictions like retirement accounts.

Step 5: Develop a Savings Strategy & Stay Consistent

Knowing where to save is great, but how much and how consistently is key.

- Automate Your Savings: Set up automatic transfers from your checking account to your retirement accounts immediately after you get paid. "Pay yourself first" ensures you save before you spend.

- Increase Contributions Over Time: Aim to increase your savings rate by 1% or 2% each year, especially when you get a raise or bonus. You’ll barely notice the difference, but your retirement account will!

- Catch-Up Contributions: If you’re 50 or older, the IRS allows you to make additional "catch-up" contributions to 401(k)s and IRAs. Take advantage of these if you can.

- Prioritize High-Interest Debt: While saving for retirement is crucial, aggressively paying down high-interest debt (like credit card debt) can be a better "return" on your money, as the interest you save can be significant.

- Invest Wisely (Don’t Overthink It!):

- Diversification: Don’t put all your eggs in one basket. Invest across different asset classes (stocks, bonds) and geographies.

- Target-Date Funds: These are popular for beginners. You pick a fund based on your approximate retirement year (e.g., "2050 Fund"), and the fund automatically adjusts its asset allocation to become more conservative as you get closer to retirement.

- Low Fees: High investment fees can eat into your returns over time. Opt for low-cost index funds or ETFs.

Step 6: Consider Healthcare & Long-Term Care in Retirement

Healthcare costs are one of the biggest unknowns and potential expenses in retirement. Don’t overlook them!

- Medicare: This is federal health insurance for people 65 or older. However, it doesn’t cover everything.

- Part A (Hospital Insurance): Generally premium-free.

- Part B (Medical Insurance): Has a monthly premium.

- Part D (Prescription Drug Coverage): Has a monthly premium.

- Medicare Advantage (Part C): All-in-one plans offered by private companies.

- Supplemental Insurance (Medigap): Private insurance plans that help cover costs not paid by original Medicare (e.g., deductibles, co-pays).

- Long-Term Care: This refers to assistance with daily living activities (bathing, dressing, eating) due to chronic illness or disability. Medicare generally does not cover long-term care.

- Long-Term Care Insurance: Can be expensive, but provides coverage.

- Self-Funding: Using your own savings.

- Hybrid Policies: Life insurance policies with long-term care riders.

- This is a complex area, and it’s wise to discuss it with a financial advisor.

Action Item: Research Medicare basics. If you’re nearing retirement, consider attending a Medicare seminar.

Step 7: Review and Adjust Regularly (Stay on Track)

Retirement planning isn’t a "set it and forget it" task. Life changes, markets fluctuate, and your goals might evolve.

- Annual Check-Up: At least once a year, review:

- Your savings progress against your goals.

- Your investment performance.

- Your budget.

- Your retirement vision (Has it changed?).

- Life Changes: Significant life events warrant a review of your plan:

- Marriage or divorce

- Birth of children/grandchildren

- Job change or loss

- Inheritance

- Major health changes

- Market Fluctuations: Don’t panic during market downturns. Stay invested and remember that retirement planning is a long-term game. Avoid making emotional decisions.

- Seek Professional Guidance: If you feel overwhelmed, have complex financial situations, or simply want a second opinion, consider consulting a qualified financial advisor.

- Look for a fee-only fiduciary advisor who is legally obligated to act in your best interest.

Conclusion: Your Retirement Journey Starts Today!

Retirement planning is a marathon, not a sprint. It requires consistent effort, patience, and adaptability. But by taking these basic steps, you’re not just saving money; you’re building confidence, reducing future stress, and actively designing the retirement lifestyle you’ve always dreamed of.

Don’t wait for "someday." Start today, even if it’s with a small step. Every dollar saved and every smart decision made brings you closer to a secure, fulfilling, and worry-free retirement. You have the power to shape your financial future – embrace it!

Post Comment