Fee-Only vs. Commission-Based Financial Advisors: Understanding How Your Advisor Gets Paid (And Why It Matters!)

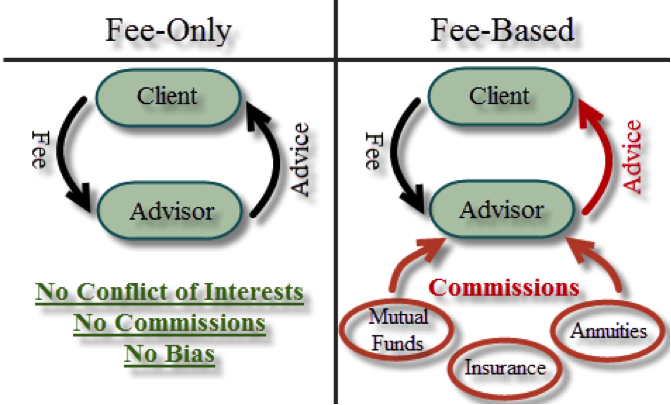

Navigating the world of financial advice can feel overwhelming, especially when you’re just starting out. One of the most confusing, yet crucial, aspects to understand is how your financial advisor gets paid. It might seem like a minor detail, but the way an advisor earns their income can significantly influence the advice they provide, the products they recommend, and ultimately, your financial future.

In this comprehensive guide, we’ll break down the two primary compensation models: Fee-Only and Commission-Based advisors. We’ll explain the differences in plain language, highlight the pros and cons of each, and empower you with the knowledge to choose the right financial partner for your unique needs.

Why Does Advisor Compensation Matter So Much?

Imagine hiring a professional to help you with a critical decision – perhaps a doctor for your health, or a lawyer for a legal matter. You’d want to know they have your best interests at heart, right? The same principle applies to your finances.

How an advisor is paid can create what’s known as a "conflict of interest." This means their personal financial gain might, in some situations, compete with what’s truly best for your financial situation. Understanding these potential conflicts is the first step toward making an informed decision.

Let’s dive into the details.

Understanding Commission-Based Financial Advisors

Commission-based advisors earn their income through commissions generated by selling specific financial products to their clients. Think of it like a salesperson earning a percentage of what they sell.

How They Get Paid:

- Selling Products: Their primary source of income comes from commissions on products like:

- Mutual Funds: They might earn a "load" (sales charge) when you buy or sell certain funds.

- Annuities: Often carry significant commissions for the advisor.

- Life Insurance Policies: High commissions are typical for certain types of policies.

- Stocks and Bonds: Commissions on trades.

- Other Investment Products: Any product with a sales charge or ongoing trail commission.

- "Free" Initial Consultations: Many commission-based advisors offer free initial meetings. While this sounds appealing, remember that their goal is to ultimately sell you a product that generates a commission.

Potential Pros of Commission-Based Advisors:

- Lower Upfront Cost (Potentially): You might not write a check directly to the advisor for their advice. The cost is embedded within the products you buy.

- Accessibility: This model can make financial advice seem more accessible to those who are hesitant to pay a direct fee.

- Transaction-Focused: If you primarily need help with specific transactions (e.g., buying a certain type of insurance), this model might seem straightforward.

Potential Cons of Commission-Based Advisors:

- Conflict of Interest: This is the biggest concern. An advisor might be incentivized to recommend products that pay them higher commissions, even if a less commission-heavy or different product would be better for you.

- Lack of Transparency: The exact commission structure can be complex and difficult for clients to understand. You might not always know how much the advisor is truly earning from your investments.

- Limited Product Selection: They might only offer products from specific companies or a limited range that provide them with commissions, rather than a truly open-architecture selection.

- Suitability Standard (Often): While they must recommend products that are "suitable" for you (meaning they generally fit your age, risk tolerance, and goals), this is a lower legal bar than the "fiduciary" standard (which we’ll discuss next). "Suitable" does not necessarily mean "best."

- Less Holistic Advice: The focus can sometimes be more on selling products than on comprehensive financial planning that covers all aspects of your financial life (budgeting, debt, estate planning, etc.).

Analogy: Think of a commission-based advisor like a car salesperson. They get paid when you buy a car, and they might earn more commission on certain models or add-ons. While they want you to be happy with your purchase, their primary incentive is to make the sale.

Understanding Fee-Only Financial Advisors

Fee-Only financial advisors are compensated directly by their clients for the advice and services they provide, and do not earn commissions from selling financial products. This means their advice is, in theory, free from the conflict of interest associated with product sales.

How They Get Paid:

Fee-Only advisors use several common compensation structures:

- Percentage of Assets Under Management (AUM): This is the most common model. The advisor charges a percentage (e.g., 0.5% to 1.5%) of the investment assets they manage for you each year. If your portfolio grows, their fee grows; if it shrinks, their fee shrinks.

- Example: If you have $100,000 under management and the fee is 1%, you pay $1,000 per year.

- Hourly Rate: You pay for the time spent on your financial plan, similar to how you’d pay a lawyer or accountant. This can be good for specific projects or one-time advice.

- Example: An advisor charges $150-$300 per hour.

- Flat Fee / Project-Based Fee: A fixed fee for a specific service or project, such as creating a comprehensive financial plan, a retirement plan, or a college savings plan.

- Example: A financial plan might cost a flat fee of $2,000 – $7,000, depending on complexity.

- Retainer Fee: A recurring fixed fee (monthly, quarterly, or annually) for ongoing advice and access to the advisor, regardless of your asset size or specific transactions. This is becoming more popular for younger clients who don’t have large investment portfolios but need comprehensive planning.

Potential Pros of Fee-Only Advisors:

- Fiduciary Duty: This is perhaps the most significant advantage. Fee-Only advisors are almost always held to a fiduciary standard, meaning they are legally and ethically bound to act in your absolute best interest, putting your needs above their own compensation.

- Reduced Conflict of Interest: Since they don’t earn commissions from products, their recommendations are theoretically unbiased. They can choose from the entire universe of investment products, selecting what’s truly best for you.

- Transparency: Their fees are typically very clear and upfront. You know exactly what you’re paying for and how it’s calculated.

- Holistic Financial Planning: Fee-Only advisors often focus on comprehensive financial planning, addressing all aspects of your financial life – budgeting, debt, insurance, taxes, estate planning, retirement, and more – not just investments.

- Objective Advice: Their incentive is to provide the best possible advice so you remain a satisfied client, not to sell you a product.

Potential Cons of Fee-Only Advisors:

- Direct Cost: You write a check directly for their services, which can feel like a significant upfront cost, especially for flat fees or hourly rates.

- Potentially Higher Cost for Small Portfolios: If paying a percentage of AUM, a small portfolio might incur a higher percentage fee than a very large one (though the total dollar amount will be less). For very small portfolios, a flat fee or hourly rate might be more cost-effective.

- May Require Minimum Assets: Some Fee-Only advisors who charge based on AUM may have minimum asset requirements, making them less accessible to those just starting to build wealth. However, many are adopting hourly or flat-fee models to serve a broader clientele.

Analogy: Think of a Fee-Only advisor like a doctor or a lawyer. You pay them directly for their professional expertise, and they are ethically bound to act in your best interest, regardless of which medication or legal strategy they recommend.

The Crucial Distinction: Fiduciary vs. Suitability Standard

Understanding these two legal standards is paramount when choosing an advisor:

-

Fiduciary Standard:

- Definition: An advisor acting as a fiduciary must always put their client’s best interests first, ahead of their own or their firm’s interests. This is the highest legal standard of care.

- Who Follows It: Registered Investment Advisors (RIAs) and advisors with the Certified Financial Planner (CFP®) designation typically operate under a fiduciary standard. Fee-Only advisors are almost always fiduciaries.

- Implication: They must disclose any potential conflicts of interest and choose the most appropriate and cost-effective solutions for you.

-

Suitability Standard:

- Definition: An advisor operating under the suitability standard must only recommend products that are "suitable" for their client based on their financial situation, goals, and risk tolerance. However, they are not required to recommend the best or most cost-effective option, only one that is appropriate.

- Who Follows It: Broker-dealers and advisors who are primarily compensated by commissions typically operate under this standard.

- Implication: They can recommend a product that pays them a higher commission, even if a similar, lower-cost option exists, as long as the recommended product is "suitable" for you.

Key Takeaway: Always ask an advisor if they act as a fiduciary 100% of the time. If they hesitate or say "sometimes," they are likely operating under the suitability standard at least part of the time.

Making Your Choice: Which Advisor is Right for You?

There’s no single "best" answer that fits everyone. Your ideal choice depends on your financial situation, your goals, your comfort level with different payment structures, and the type of relationship you seek.

Here’s a quick comparison to help you decide:

| Feature | Commission-Based Advisor | Fee-Only Advisor |

|---|---|---|

| How They Get Paid | Commissions from selling financial products | Direct fees from clients (AUM, hourly, flat, retainer) |

| Primary Incentive | Sell specific products that generate commissions | Provide unbiased advice and grow your wealth/achieve your goals |

| Conflict of Interest | Higher potential for conflict of interest | Significantly reduced conflict of interest |

| Fiduciary Duty | Typically operates under the "suitability" standard | Almost always operates under the "fiduciary" standard |

| Transparency of Fees | Often less transparent, embedded in product costs | Generally very clear and upfront |

| Advice Focus | Can be product-focused | Often comprehensive, holistic financial planning |

| Best For | Those needing a specific product (e.g., specific insurance) | Those seeking comprehensive, unbiased, long-term financial planning |

Questions to Ask Any Potential Financial Advisor:

Before committing to any advisor, regardless of their compensation model, ask these crucial questions:

- "Are you a fiduciary 100% of the time when advising me?" (Look for a clear "Yes.")

- "How are you compensated?" (Listen for a clear explanation of Fee-Only, Commission-Based, or Fee-Based – which is a hybrid and can be confusing).

- "What are all the fees I will pay, both directly to you and indirectly through investments?" (Ask for a clear breakdown in dollar amounts and percentages.)

- "What services do you provide?" (Beyond investments, do they cover budgeting, debt, taxes, estate planning, etc.?)

- "What are your qualifications and certifications?" (Look for CFP®, CFA, etc.)

- "Do you have any disciplinary history or conflicts of interest I should be aware of?" (They are legally required to disclose this.)

- "What is your investment philosophy?"

- "How often will we meet or communicate?"

- "Can you provide references from current clients?"

Conclusion: Empowering Your Financial Journey

Understanding the difference between Fee-Only and Commission-Based financial advisors is a powerful step toward taking control of your financial future. While commission-based advisors might seem "free" initially, the hidden costs and potential conflicts of interest can be significant. Fee-Only advisors, though they charge a direct fee, offer a transparent, unbiased relationship built on a fiduciary commitment to your best interests.

By asking the right questions and prioritizing transparency and fiduciary duty, you can find a financial advisor who truly serves as a trusted partner, helping you achieve your financial goals with confidence and peace of mind. Your money deserves the best advice, and now you’re better equipped to find it.

Post Comment